Guia de Negociação de Futuros

Prefácio

Com o rápido desenvolvimento do mercado de criptomoedas, a negociação de futuros tornou-se uma forma importante para muitos investidores lucrarem. A negociação de futuros permite aos usuários comprar e vender sem possuir ativos reais e lucrar com as flutuações do mercado. Para os iniciantes, é crucial compreender os conceitos básicos, o processo de operação e a gestão de riscos da negociação de futuros.

Conceitos Básicos

1. Long e Short

- Posição longa: Prever um aumento de preço, comprar primeiro e depois vender para obter lucro.

- Shorting: Prever uma queda de preço, vender primeiro e depois comprar para lucrar.

2. Margem e Alavancagem

- Margem: Os fundos mínimos necessários para abrir um contrato.

- Alavancagem: Permite aos usuários controlar contratos de maior valor com uma pequena quantidade de capital. Por exemplo, uma alavancagem de 10x significa que um contrato no valor de 1000 USDT pode ser controlado com 100 USDT.

3. Taxa de Negociação

- Cada operação de abertura e encerramento incorrerá em uma taxa de manuseio, e os padrões de taxa podem variar de plataforma para plataforma. Compreender a estrutura de taxas é crucial para calcular os retornos reais.

Como negociar?

1. Selecionar contrato perpétuo e par de negociação

- Faça login no site oficial da Gate.com.

- Clique na opção 'Negociação de Futuros' na barra de navegação superior e selecione 'Contrato Perpétuo' ou 'Contrato de Entrega' para entrar na página de Negociação de Futuros.

- Clique no botão do par de negociação no canto superior esquerdo da página e selecione o par de negociação da moeda que deseja negociar.

2. Transferência de Fundos

No modo de conta clássica, clique no botão 'Transferir' no canto inferior direito para transferir ativos da conta à vista para a conta de futuros.

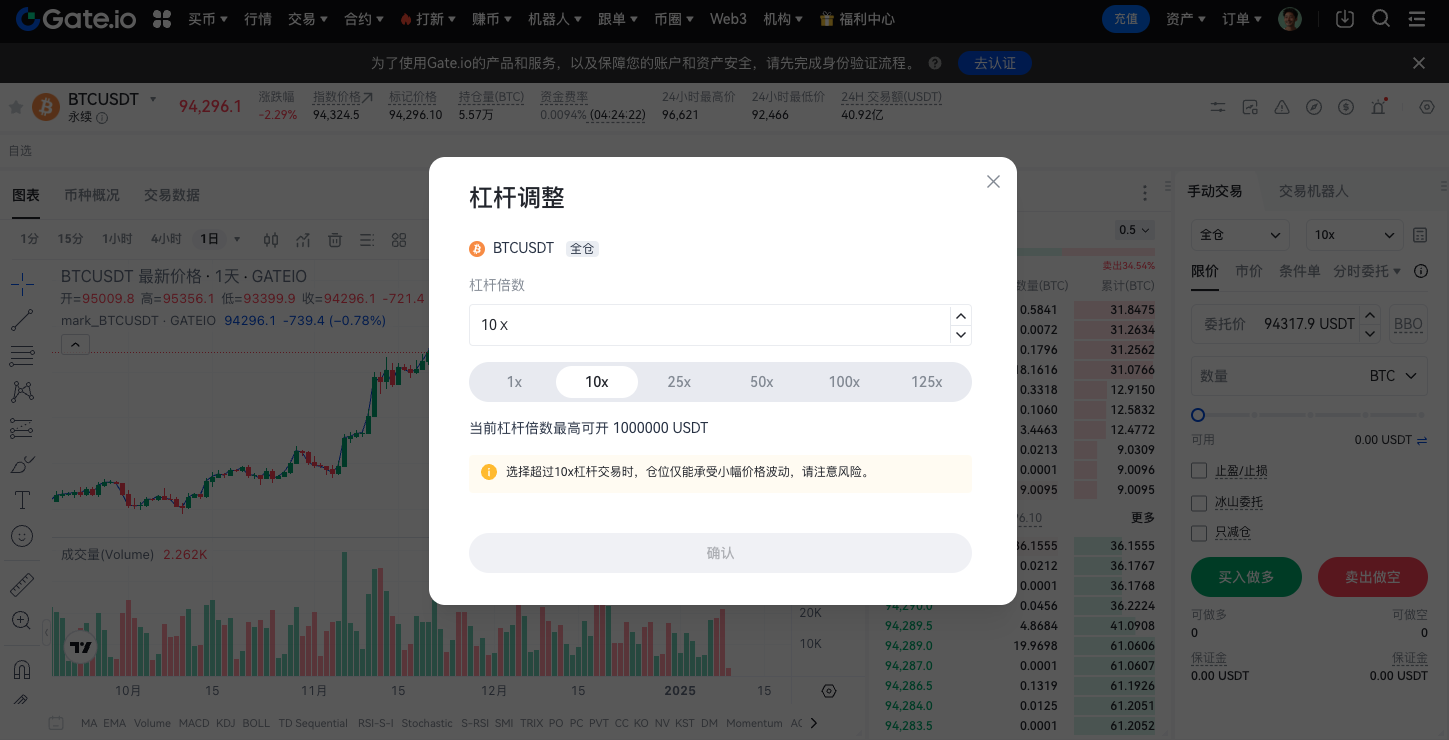

3. Selecione o modo de posição e ajuste o multiplicador de alavancagem

- Escolha entre modo de margem total ou modo de margem isolada.

- No modo cruzado, todos os pares de negociação de margem cruzada compartilham a margem de posição; no modo isolado, cada par de negociação tem uma posição independente, e a posição define a taxa de alavancagem (1-125 vezes). Quanto maior a taxa de alavancagem, menor a margem exigida, mas maior o risco de liquidação.

4. Selecione o tipo de ordem e confirme a direção de abertura.

- Coloque ordens com preço limite, preço de mercado, ordem condicional ou ordem limite avançada.

- As negociações de ordem limite são realizadas ao preço e quantidade especificados por você; as ordens de mercado são executadas rapidamente ao melhor preço de mercado; as ordens de paragem e de limite avançado são executadas quando o preço de disparo é alcançado.

- Digite o preço e a quantidade, confirme a direção de abertura e clique em 'Comprar Longo' ou 'Vender Curto' para fazer o pedido.

5. Fechar posição

- Clique em 'Posições' na parte inferior da página para visualizar as informações da sua posição, acompanhar o preço de liquidação ou definir o take profit e stop loss.

- Quando o lucro esperado for alcançado, escolha preço de mercado, preço limite ou liquidação com um clique para concluir a operação de encerramento.

O que é liquidação?

Na negociação de futuros, a liquidação ocorre quando a margem da conta do usuário é insuficiente para manter uma posição e atinge a linha de perigo, momento em que o sistema irá automaticamente lidar com a posição de risco para evitar perdas adicionais. Em resumo, a liquidação é uma medida de liquidação forçada tomada pelo sistema para evitar um saldo negativo na conta.

Qual é o motivo da liquidação?

- Alavancagem Elevada: A alavancagem elevada não só pode ampliar os lucros, mas também ampliar os riscos. Mesmo uma ligeira flutuação do mercado pode levar a uma margem de conta insuficiente e desencadear a liquidação.

- Volatilidade de mercado: O mercado de criptomoedas é altamente volátil, e os preços podem flutuar significativamente em um curto período de tempo. Se o mercado flutuar em uma direção desfavorável à posição, o risco de liquidação aumentará significativamente.

- Falha em adicionar margem a tempo: quando as flutuações do mercado resultam em margem insuficiente, se a margem não for adicionada de forma oportuna, o sistema forçará a liquidação para evitar maiores perdas.

Como evitar a liquidação?

Para reduzir o risco de liquidação, os usuários da Gate.com podem adotar as seguintes estratégias:

Escolha uma alavancagem razoável

Quanto maior a alavancagem, maior o risco. Os iniciantes são aconselhados a começar com uma alavancagem menor, para que, mesmo se o mercado flutuar muito, você tenha mais tempo para ajustar sua posição ou adicionar margem.Preste muita atenção ao preço de marcação

A negociação de futuros na Gate.com utiliza o preço de marcação para calcular lucros e perdas e a relação de margem. O preço de marcação é calculado com base no preço do índice spot e no índice de prêmio, sendo o preço justo atual no mercado de futuros. Preste muita atenção às alterações no preço de marcação, o que ajuda a determinar quando são necessários ajustes nas posições ou margem adicional.Definir ordens de stop-loss e take-profit

Definir ordens de stop loss e take profit antecipadamente durante a negociação pode executá-las automaticamente quando o mercado flutua repentinamente, evitando que as perdas se expandam ou garantindo os lucros existentes. Esta funcionalidade é especialmente adequada para usuários que não podem monitorar constantemente o mercado.Gestão Adequada de Posições

Evite colocar todos os seus fundos em um único contrato. Diversificar posições pode reduzir o impacto da volatilidade do mercado em sua conta e, assim, reduzir o risco de liquidação.Margem adicional oportuna

A Gate.com fornece uma função de alerta de aviso de liquidação de contrato, os utilizadores podem definir para receber notificações quando se aproximar do risco de liquidação. Isso ajuda os utilizadores a ajustar suas estratégias ou adicionar margem de forma oportuna antes que ocorram mudanças desfavoráveis no mercado, prevenindo efetivamente a liquidação.

Resumo

A negociação de futuros, como um importante método de investimento no mercado de criptomoedas, permite que os usuários lucrem com as flutuações de mercado por meio de posições longas e curtas, sem possuir ativos reais. Compreender os conceitos básicos, processos operacionais e gestão de riscos da negociação de futuros é a chave para o sucesso de todo investidor. Este artigo fornece uma introdução detalhada aos elementos principais da negociação de futuros, incluindo margem, alavancagem, taxas de transação, etc., e fornece etapas operacionais específicas, desde a seleção de pares de negociação até o fechamento de posições. Ao mesmo tempo, propõe estratégias eficazes de controle de risco para riscos de liquidação, como escolher alavancagem com sabedoria, monitorar de perto o preço marcado, definir ordens de stop-loss e take-profit, gerenciar posições de forma razoável e adicionar margem oportunamente.

Artigos relacionados

Analisando o Hack do Bybit Usando o Ataque de Assinatura Múltipla Radiant como Exemplo

A esplêndida bolha e a verdade perdida das tokens de celebridade

O que é FLock.io (FLOCK)?

Os mais recentes desenvolvimentos de Cardano (ADA)

Grok AI, GrokCoin & Grok: o Hype e a Realidade