Bagaimana Cara Kerja Polymarket

Pengenalan Platform

Polymarket adalah platform pasar prediksi online yang diluncurkan pada tahun 2020, yang bertujuan untuk memberi pengguna kesempatan untuk bertaruh dan memprediksi peristiwa di masa depan. Platform ini mencakup berbagai topik prediksi, termasuk indikator ekonomi, upacara penghargaan, pemilihan presiden, dll., Dan keuntungan pengguna bergantung pada keakuratan prediksi. Model prediksi terdesentralisasi yang inovatif ini dengan cepat menarik perhatian publik sejak diluncurkan dan telah diakui oleh para pemimpin industri seperti pendiri Ethereum Vitalik Buterin. Aktivitas pasarnya telah sepenuhnya divalidasi, dengan volume perdagangan beberapa peristiwa populer melampaui $ 1 juta pada tahun peluncurannya, menunjukkan potensi pertumbuhan yang besar dan nilai komersial dari pasar prediksi.

Logo platform Polymarket (sumber:https://polymarket.com/)

Kinerja ekspansi pasar

Data menunjukkan bahwa volume perdagangan Polymarket mengalami peningkatan signifikan di paruh kedua tahun 2024. Dari April hingga Oktober, volume perdagangan bulanan melonjak dari $40 juta menjadi $2,5 miliar, dan minat terbuka naik dari $20 juta menjadi $400 juta. Hanya di bulan Oktober, menarik lebih dari 300.000 pengguna baru untuk mendaftar dan memiliki tingkat kunjungan tinggi sebanyak 35 juta kali. Selain pasar pemilihan, olahraga dan acara non-pemilihan lainnya juga menarik banyak aktivitas perdagangan. Saat ini, jumlah kunci platform setara dengan nilai total yang dikunci dari jaringan seperti TON, bahkan mendekati skala lalu lintas dari situs web perjudian teratas.

Tren pertumbuhan Polymarket 2024 (Sumber gambar: https://www.bitget.com)

Apa itu prediksi terdesentralisasi?

Pasar prediksi terdesentralisasi bergantung pada teknologi blockchain untuk beroperasi. Setelah pengguna membuat acara prediksi, mereka memasang taruhan mereka dengan mempertaruhkan token sebagai jaminan. Semua taruhan dan hadiah secara otomatis dieksekusi oleh kontrak cerdas, memastikan transparansi, keamanan, dan efisiensi di seluruh proses.

Peluang dan alokasi dana untuk setiap acara prediksi disesuaikan secara dinamis berdasarkan taruhan yang ditempatkan oleh peserta pasar pada hasil yang berbeda, mirip dengan mekanisme operasi dari kolam likuiditas. Pengguna menyetor dana ke dalam kolam likuiditas dan menerima token hasil yang sesuai. Token-token ini dapat diperdagangkan secara bebas di pasar terbuka, dan harganya akan berubah secara real time berdasarkan penawaran dan permintaan, mencerminkan probabilitas yang diharapkan pasar untuk hasil-hasil tertentu.

Selain itu, pencetakan lebih banyak token memerlukan pengguna untuk mendepositkan lebih banyak dana ke dalam kolam likuiditas untuk menjaga keseimbangan pasar. Begitu hasil akhir ditentukan, kontrak cerdas akan secara otomatis melikuidasi kolam likuiditas dan mengalokasikan dana kepada pengguna yang telah memprediksi dengan benar, mencapai mekanisme imbalan terdesentralisasi dan tanpa kepercayaan.

Mekanisme operasi pasar prediksi terdesentralisasi (sumber: https://www.horizen.io/akademi/desentralisasi)

Prinsip Operasi Polymarket

Inti dari operasi Polymarket adalah buku pesanan limit pusat on-chain dan off-chain yang digabungkan, yang mengadopsi model terdesentralisasi hybrid: pelaksanaan dan penyelesaian transaksi diselesaikan oleh kontrak pintar, dan operator bertanggung jawab untuk mencocokkan dan mengurutkan pesanan serta mengirimkan hasil pencocokan ke jaringan blockchain.

Desain hibrid ini memungkinkan taruhan dan pencocokan pesanan diselesaikan dengan cepat di luar rantai, hanya operasi penyelesaian akhir yang memerlukan pemrosesan di rantai. Mode pertukaran terdesentralisasi unik platform menyediakan pengalaman perdagangan non-kustodial yang kuat bagi pengguna. Ini terdiri dari komponen-komponen kunci berikut:

Sistem perdagangan Polymarket didasarkan pada kontrak cerdas yang dirancang khusus untuk pasar biner, memfasilitasi pertukaran atom antara token hasil (USDC, aset ERC1155, dan aset ERC20 PToken) dan aset jaminan (ERC20) sesuai dengan limit order yang ditandatangani, tanpa perlu mempercayai pihak ketiga, sehingga membentuk buku pesanan 'terpadu' dalam kontrak, sambil mencocokkan posisi dan pesanan pelengkap mereka.

● Pesanan diwakili dalam bentuk data terstruktur yang ditandatangani dengan EIP712, memastikan keamanan dan standardisasi. Ketika pesanan dicocokkan, kedua pihak transaksi memainkan peran pembuat (yang menempatkan pesanan) dan pengambil (yang mengisi pesanan), dan transaksi dapat berupa pertandingan satu-ke-satu atau pertandingan banyak-ke-satu.

Mekanisme Penentuan Harga

Semua perdagangan di Polymarket adalah peer-to-peer. Saat membuat pasar, platform tidak menetapkan saham, atau harga atau peluang yang telah ditentukan sebelumnya, memungkinkan peserta untuk secara bebas membeli dan menjual saham tentang apakah suatu peristiwa akan terjadi. Awalnya, pembuat pasar tertarik untuk membeli saham YA atau NO menempatkan limit order pada harga yang bersedia mereka bayar. Ketika kutipan kedua belah pihak sama dengan $ 1,00, urutannya 'cocok'. Harga saham YES mencerminkan konsensus pasar tentang probabilitas peristiwa yang terjadi, setelah itu $ 1,00 akan dikonversi menjadi 1 saham YA dan 1 saham NO, masing-masing saham milik pembeli masing-masing.

Harga yang ditampilkan di Polymarket adalah titik tengah dari spread beli-jual dalam order book (kecuali spread melebihi $0.10, dalam hal ini harga terakhir yang diperdagangkan digunakan). Seperti pasar saham, harga di Polymarket juga merupakan fungsi dari pasokan dan permintaan real-time, dan harga itu sendiri mewakili probabilitas terjadinya acara pada waktu tertentu. Sebagai contoh, di pasar yang ditunjukkan dalam gambar di bawah ini, ada probabilitas 37% dari titik tengah antara harga beli $0.34 dan harga jual $0.40; jika spread beli-jual lebih besar dari $0.10, probabilitas ditampilkan sebagai harga terakhir yang diperdagangkan.

Harga = Probabilitas (sumber: https://learn.polymarket.com/docs/guides)

Bagaimana cara menghitung keuntungan?

Pengguna Polymarket dapat membeli sejumlah saham dalam hasil potensial apa pun dan menguangkan saham pemenang dengan harga $ 1 per saham setelah pasar mengendap. Oleh karena itu, sangat penting untuk melacak untung dan rugi taruhan secara real time. Sebelum pasar tutup, pengguna juga dapat mengunci keuntungan atau mengurangi kerugian dengan menjual saham pada harga pasar saat ini atau menetapkan limit order untuk mengoptimalkan pengembalian.

Karena Polymarket tidak langsung mengenakan biaya perdagangan, pengguna dapat dengan bebas membeli dan menjual saham di platform tanpa biaya tambahan. Namun, ketika pengguna mentransfer USDC masuk atau keluar dari dompet mereka melalui jaringan Polygon, mungkin ada biaya gas tertentu yang timbul.

Tabel di bawah ini menunjukkan logika perhitungan keuntungan spesifik dari 4 skenario contoh dan hasil perhitungan Polymarket:

Langkah-langkah operasi perdagangan

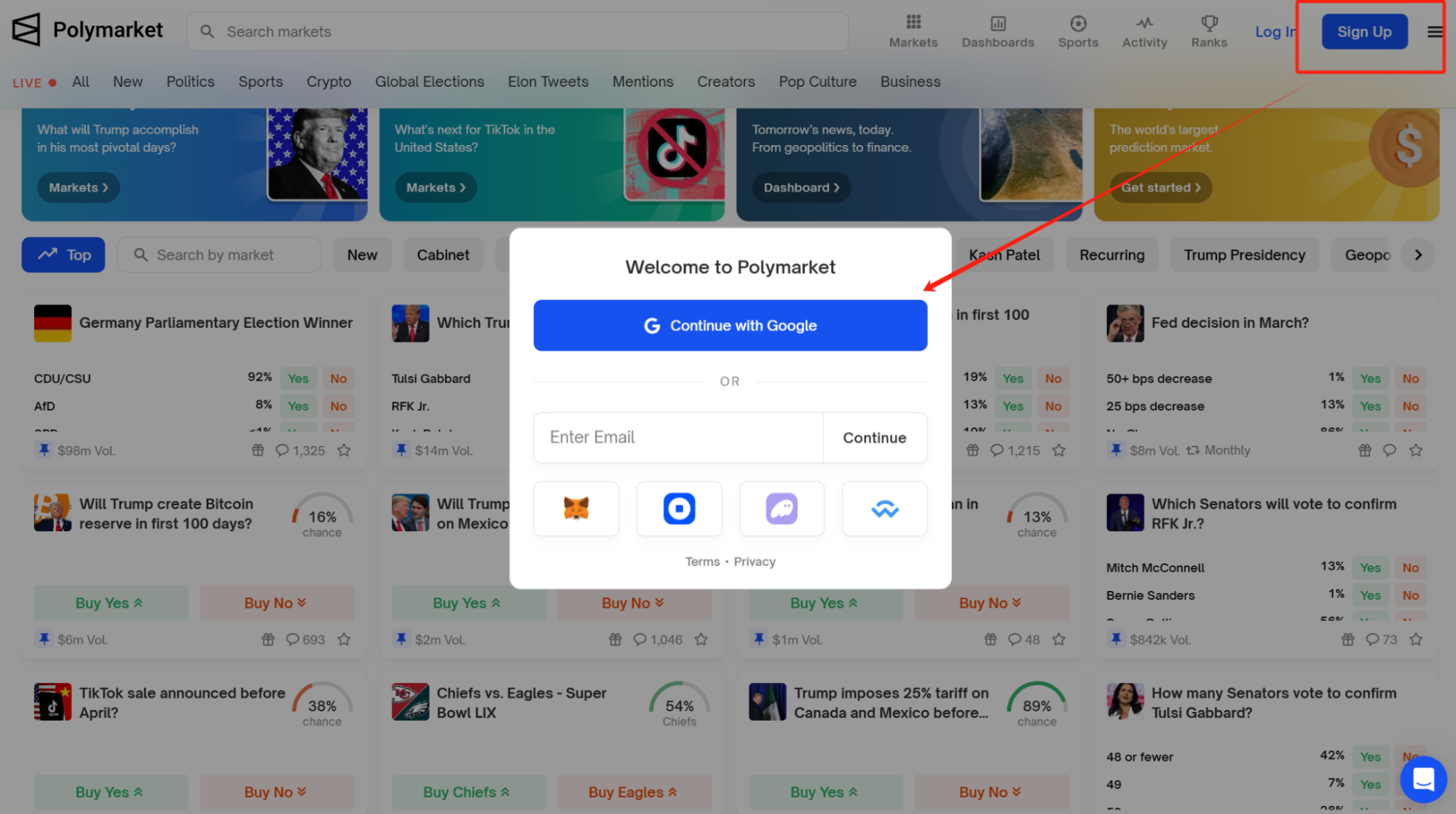

- Daftar akun

Pengguna perlu menggunakan alamat email untuk menyelesaikan pendaftaran, dan Polymarket kemudian akan secara otomatis membuat dompet terdesentralisasi untuk pengguna berdasarkan Ethereum. Kunci pribadi dompet ini dikelola oleh pengguna sendiri, memastikan kontrol penuh atas dana tanpa bergantung pada layanan penitipan pihak ketiga.

Halaman registrasi perdagangan platform (sumber:https://polymarket.com/)

- Persiapkan dana perdagangan

Sebelum ikut serta dalam perdagangan, pengguna perlu membeli USDC melalui pertukaran terpusat (CEX) seperti Coinbase, Binance, atau pertukaran terdesentralisasi (DEX), dan kemudian mendeposit USDC ke dalam dompet Polymarket sebagai persiapan dana perdagangan. - Pilih Acara Perdagangan

Pengguna dapat menelusuri pasar prediksi yang berbeda di platform Polymarket dan memilih acara spekulatif yang sesuai dengan minat mereka, seperti olahraga atau politik. Pasar ini biasanya disajikan dalam bentuk biner, dan pengguna dapat menggunakan fungsi penyaringan untuk menemukan jenis pasar yang selaras dengan preferensi investasi mereka.

Misalnya, setelah memilih kategori olahraga, sub-acara yang lebih spesifik akan muncul (sumber gambar:https://polymarket.com/)

- Beli Saham Prediktif

Pengguna dapat menggunakan USDC untuk membeli 'saham hasil' di pasar tertentu, dengan harga mulai dari $ 0,01 hingga $ 1,00 per saham, yang mencerminkan ekspektasi pasar terhadap probabilitas peristiwa yang terjadi. Selain itu, pengguna dapat dengan bebas memperdagangkan saham yang dibeli kapan saja sebelum penyelesaian pasar. - Fase penyelesaian pasar

Ketika hasil akhir dari acara yang diprediksi jelas, pasar akan memasuki tahap penyelesaian. Pengguna yang memprediksi dengan benar dapat menukarkan saham mereka dengan nilai $1.00 per saham, sementara saham yang diprediksi dengan salah akan bernilai nol. Jika terjadi perselisihan atas hasilnya, Komite Integritas Pasar Polymarket akan membuat keputusan final.

Kesimpulan

Polymarket sedang mendefinisikan ulang cara analisis informasi dilakukan, membuat prediksi peristiwa masa depan lebih intuitif dan berkontribusi pada realisasi kesetaraan informasi sampai batas tertentu. Saat ini, semakin banyak lembaga perdagangan yang memperhatikan Polymarket, melihatnya sebagai sumber referensi informasi yang penting, bukan hanya sebagai alat untuk bertaruh dan mendapatkan keuntungan. Misalnya, saat mengevaluasi kemungkinan peristiwa besar, harga pasar prediksi sering menjadi dasar pengambilan keputusan yang paling intuitif dan dapat diandalkan. Dengan meningkatnya permintaan pasar, pasar prediksi diharapkan memainkan peran yang lebih besar di masa depan. Namun, peserta pasar tetap perlu berhati-hati terhadap risiko seperti fluktuasi pasar dan kepatuhan regulasi saat menggunakan platform Polymarket, dan mengadopsi strategi taruhan yang moderat.

Artikel Terkait

Apa Itu Fartcoin? Semua Hal yang Perlu Anda Ketahui Tentang FARTCOIN

Perkiraan Harga Emas Lima Tahun ke Depan: Outlook Tren 2026–2030 dan Implikasi Investasi, Apakah Dapat Mencapai $6.000?

Kalkulator Laba Masa Depan Kripto: Bagaimana Menghitung Potensi Keuntungan Anda

Koin Berikutnya yang Berpotensi Naik 100x? Analisis Crypto Gem Kapitalisasi Rendah

Apa Itu Opsi Kripto?