Pengenalan pada Dana Kuantitatif Arbitrase Tingkat Pendanaan

Sebelum masuk ke cara kerja dana kuantitatif ini dan mendiskusikan kelebihan dan kekurangannya, mari kita terlebih dahulu memahami apa itu funding rate.

Apa Itu Tingkat Pendanaan?

Funding rate adalah mekanisme kunci dalam pasar cryptocurrency untuk kontrak perpetual, digunakan untuk menyesuaikan kesenjangan harga antara harga kontrak dan harga aset yang mendasarinya. Ini adalah pertukaran arus kas periodik antara trader long dan short. Bergantung pada kondisi pasar, funding rate bisa bersifat positif atau negatif:

- Funding Positif: Pedagang posisi panjang membayar biaya pendanaan kepada pedagang posisi pendek. Ini biasanya terjadi ketika pasar sedang bullish, dan harga kontrak perpetual lebih tinggi dari harga pasar spot.

- Negative Funding Rate: Pedagang posisi pendek membayar biaya pendanaan kepada pedagang posisi panjang. Ini umumnya terjadi saat pasar sedang bearish, dan harga kontrak perpetual lebih rendah dari harga pasar spot.

Tujuan utama dari funding rate adalah untuk menyelaraskan harga kontrak perpetual dengan harga pasar spot, sehingga menjaga keseimbangan pasar.

Pentingnya Tingkat Pendanaan

Perbedaan kunci antara kontrak perpetual dan kontrak berjangka tradisional adalah bahwa kontrak perpetual tidak memiliki tanggal jatuh tempo, sehingga memungkinkan para trader untuk memegang posisi tanpa batas waktu. Bursa kripto menerapkan mekanisme funding rate untuk mencegah harga dari mengalami deviasi yang signifikan dari harga aset yang mendasarinya. Peran dari funding rate termasuk:

- Price Anchoring: Memastikan bahwa harga kontrak perpetual tetap sejalan dengan aset dasar (harga spot atau harga indeks).

- Keseimbangan Pasar: Dengan membebankan biaya pendanaan, tingkat pendanaan mendorong para pedagang untuk mengambil posisi berlawanan ketika harga menyimpang, mengurangi besarnya penyimpangan.

- Meningkatkan Likuiditas: Ketika mekanisme tingkat pendanaan beroperasi lancar, pengalaman perdagangan kontrak perpetual menjadi mirip dengan pasar spot, menarik lebih banyak investor untuk berpartisipasi.

Funding Rate vs. Contango dan Backwardation di Pasar Futures Tradisional

Contango dan Backwardation

Di pasar berjangka tradisional:

- Contango: Harga kontrak berjangka lebih tinggi dari harga spot, biasanya mencerminkan biaya modal dan penyimpanan.

- Backwardation: Harga berjangka lebih rendah dari harga spot, biasanya mencerminkan kelangkaan aset yang mendasarinya atau permintaan jangka pendek yang kuat.

Hubungan Antara Tingkat Pendanaan dan Contango/Backwardation

Funding rate berfungsi sebagai mekanisme penyesuaian dinamis di pasar kontrak perpetual, mirip dengan peran contango dan backwardation di pasar futures tradisional:

- Contango sesuai dengan tingkat pendanaan positif

Ketika harga kontrak perpepetual melebihi harga spot, para pedagang posisi panjang membayar tingkat pendanaan kepada pengguna posisi pendek, mendorong pedagang pendek untuk masuk dan mengurangi harga kontrak. Ini mirip dengan perbedaan harga positif yang diamati di pasar berjangka tradisional, di mana investor membayar biaya memegang kontrak berjangka.

- Backwardation sesuai dengan tingkat pendanaan negatif

Ketika harga kontrak perpetual lebih rendah dari harga spot, para trader posisi pendek membayar tingkat pendanaan kepada pengguna posisi panjang, mendorong para trader panjang untuk masuk dan mendorong harga kontrak naik. Hal ini mencerminkan skenario backwardation dalam pasar berjangka tradisional, di mana harga berjangka lebih rendah karena pasokan aset yang mendasarinya sedikit.

- Penyesuaian Dinamis Tingkat Pendanaan

Berbeda dengan perbedaan harga statis dalam kontrak berjangka tradisional, tingkat pendanaan kontrak perpetual dihitung ulang secara berkala (biasanya setiap 8 jam), menyesuaikan secara dinamis berdasarkan kondisi pasar untuk mencegah deviasi harga yang berkepanjangan.

Perhitungan Biaya Pendanaan

Biaya pendanaan dihitung sebagai berikut:

Biaya Pendanaan = Nilai Kontrak Nominal × Tingkat Pendanaan

Dimana:

- Nilai Kontrak Nominal: Nilai posisi yang terkait dengan harga mark, digunakan untuk menghindari dampak fluktuasi harga ekstrem.

- Funding Rate: Berdasarkan kekuatan panjang dan pendek pasar serta penyimpangan harga aset yang mendasarinya, biasanya berasal dari perbedaan tingkat bunga dan dasar harga.

Sebagai contoh, dalam kontrak perpetual Gate.com, biaya pendanaan sebagian besar aset dihitung ulang setiap 8 jam. Beberapa aset, seperti PNUTUSDT, memiliki biaya pendanaan yang dihitung setiap 4 jam untuk menyesuaikan lebih cepat dengan kondisi pasar.

Arbitrase Tingkat Pendanaan: Strategi Investasi Cryptocurrency yang Stabil

Arbitrase tingkat pendanaan adalah strategi netral pasar yang dirancang khusus untuk pasar cryptocurrency, bertujuan untuk menghasilkan pengembalian yang stabil dengan memanfaatkan mekanisme tingkat pendanaan kontrak perpetual. Prinsip intinya adalah untuk mendirikan posisi lindung nilainya di pasar spot dan pasar kontrak perpetual, sehingga seimbang efek fluktuasi pasar untuk mencapai pembangkitan keuntungan yang stabil.

Operasi spesifik berfungsi sebagai berikut: investor membeli aset spot dengan nilai yang setara dengan kontrak perpetuanya, sambil secara bersamaan membentuk posisi pendek bernilai sama di pasar kontrak. Konfigurasi posisi ini memastikan bahwa pergerakan harga pasar memiliki sedikit atau tidak ada dampak pada nilai portofolio secara keseluruhan. Misalnya, ketika harga naik, nilai posisi spot meningkat, sementara nilai posisi pendek menurun, dan kedua efek tersebut saling membatalkan. Sumber utama pengembalian adalah tingkat pendanaan kontrak perpetuanya. Ketika pasar bullish, pedagang long membayar biaya pendanaan kepada pedagang pendek, dan arbitrer mendapatkan keuntungan dari keuntungan yang stabil.

Selain itu, dengan menggunakan sistem marjin lintas bursa, marjin untuk posisi spot dan kontrak dapat digabungkan. Ini memungkinkan untuk meningkatkan daya ungkit dan penempatan modal lebih banyak. Hal ini memperbesar potensi keuntungan dan memungkinkan strategi untuk mencapai keuntungan lebih tinggi seiring dengan perluasan skala modal, sehingga membuat strategi lebih menarik.

Stabilitas dan Risiko Rendah: Keuntungan dari Arbitrase Tingkat Pendanaan

Keuntungan utama dari arbitrase funding rate terletak pada stabilitasnya dan risiko yang relatif rendah. Lindung nilai antara posisi spot dan kontrak membantu meminimalkan efek volatilitas pasar terhadap nilai portofolio. Bagi investor, strategi ini sebagian besar tidak terpengaruh oleh fluktuasi harga, dengan keuntungan utamanya berasal dari funding rate itu sendiri.

Dibandingkan dengan produk keuangan tradisional seperti deposito berjangka atau produk pendapatan tetap, arbitrase tingkat pendanaan biasanya menawarkan tingkat pengembalian yang lebih tinggi, terutama ketika sentimen pasar sedang bullish. Hal ini membuatnya menjadi pilihan investasi yang lebih menarik daripada deposito berjangka. Sebagai contoh, pada tahun 2024, tingkat bunga acuan AS sekitar 5% per tahun, sementara strategi arbitrase tingkat pendanaan dalam dana kuantitatif Gate.com dapat menghasilkan pengembalian lebih dari 15%.

Risiko dan Batasan: Tantangan Arbitrase Tingkat Pendanaan

Meskipun arbitrase tingkat pendanaan terlihat stabil, itu tidaklah tanpa risiko. Selama kondisi pasar bearish, tingkat pendanaan dapat berubah menjadi negatif, sehingga memerlukan arbitrase untuk menyesuaikan strategi mereka secara dinamis. Perubahan seperti itu meningkatkan kompleksitas operasional dan menimbulkan biaya transaksi tambahan, yang dapat mengurangi manfaat bersih dari tingkat pendanaan dan bahkan mengakibatkan kerugian potensial.

Selain itu, profitabilitas strategi bergantung sepenuhnya pada tingkat funding rate. Ketika aktivitas pasar rendah, atau tingkat funding mendekati nol, potensi profit sangat berkurang. Kondisi pasar ekstrim, seperti kekurangan likuiditas atau perubahan kebijakan pertukaran, juga dapat membuat strategi kurang efektif dan mengganggu eksekusinya.

Apa itu Dana Kuantitatif Tingkat Pendanaan?

Sebuah dana kuantitatif tingkat pendanaan adalah portofolio investasi yang beroperasi di pasar kontrak permanen cryptocurrency. Ini menggunakan strategi arbitrase tingkat pendanaan yang dijelaskan di atas. Keunggulan inti dari dana kuantitatif ini terletak pada sistem perdagangannya, yang menggunakan model matematis dan algoritma yang tepat untuk menangkap ketidaksesuaian tingkat pendanaan di pasar. Ini secara otomatis mengidentifikasi peluang tingkat pendanaan yang paling menarik, melakukan penilaian risiko, dan mengelola posisi. Perdagangan otomatis meningkatkan efisiensi eksekusi dan meminimalkan kesalahan yang mungkin timbul dari penilaian manusia.

Di tim kuantitatif profesional, masalah yang dihadapi investor biasa dapat diselesaikan secara sistematis. Pertama, tim membentuk sistem pemantauan risiko komprehensif yang terus melacak indikator sentimen pasar, volatilitas, volume perdagangan, dan data multi-dimensi lainnya. Hal ini memungkinkan mereka untuk mengeluarkan peringatan dini sebelum tingkat pendanaan berubah menjadi negatif. Ketika kondisi pasar memburuk, sistem secara otomatis mengurangi posisi atau bahkan keluar sementara, daripada menderita kerugian secara pasif seperti yang mungkin dilakukan trader eceran.

Di sisi teknis, tim dana kuantitatif memiliki kemampuan penelitian dan pengembangan yang kuat. Mereka telah mengembangkan sistem perdagangan berfrekuensi tinggi yang memantau pasar dan mengeksekusi pesanan dalam milidetik, secara signifikan mengurangi risiko perbedaan harga spot-futures. Selain itu, mereka terus melakukan analisis data untuk mengevaluasi rasio manfaat biaya dari setiap perdagangan dengan tepat, memastikan profitabilitas yang stabil bahkan di lingkungan perdagangan berfrekuensi tinggi.

Untuk mengatasi kekhawatiran likuiditas, dana menggunakan algoritma dan model keuangan untuk memutar aset. Sistem dapat beralih antara pasangan pada waktu yang optimal dengan menganalisis indikator likuiditas dan kinerja funding rate di berbagai pasangan perdagangan. Ketika likuiditas untuk pasangan tertentu menurun atau funding ratenya memburuk, sistem segera mengalokasikan dana ke pasangan yang performanya lebih baik, sehingga menjaga stabilitas strategi secara keseluruhan.

Kombinasi dari beberapa aset dan strategi membuat portofolio stabil bahkan jika satu pasangan perdagangan atau strategi menghadapi kondisi pasar yang merugikan. Kemampuan manajemen portofolio profesional ini, dukungan teknis yang canggih, dan kontrol risiko yang ketat memungkinkan dana kuantitatif menawarkan layanan manajemen aset yang lebih stabil dan profesional—keuntungan yang biasanya tidak dimiliki oleh investor ritel.

Ini menjelaskan mengapa, di pasar cryptocurrency, memilih tim kuantitatif profesional untuk manajemen investasi seringkali menghasilkan rasio risiko-imbal hasil yang lebih baik dibandingkan dengan berinvestasi secara individu. Tim secara sistematis menghindari berbagai risiko dan menggunakan keunggulan teknisnya untuk menangkap lebih banyak peluang pasar, akhirnya mencapai keuntungan yang stabil.

Backtest Sederhana dari Arbitrase Tingkat Pendanaan

Gambar 1: Jumlah tingkat pendanaan untuk kontrak perpetual BTC_USDT, dengan rolling_90 dan rolling_30 mewakili tingkat pendanaan rata-rata selama 90 dan 30 periode, masing-masing.

Gambar 1 menunjukkan tingkat pendanaan untuk pasangan perdagangan kontrak perpetual BTC_USDT di Gate.com pada tahun 2024. Tingkat pendanaan rata-rata per periode adalah 0,0081%, yang menunjukkan bahwa, dalam jangka panjang, biaya pendanaan positif dikumpulkan. Menjual kontrak perpetual BTC_USDT akan menghasilkan sekitar 0,0081% per periode.

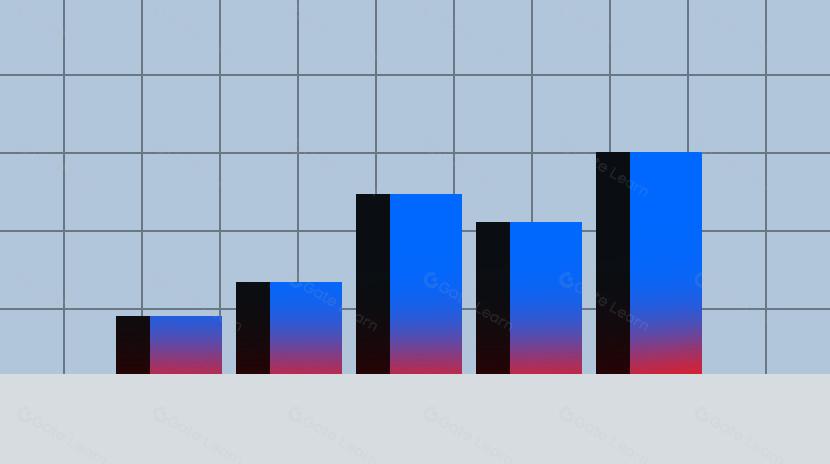

Gambar 2: Uji coba arbitrase tingkat pendanaan untuk kontrak perpetual BTC_USDT. Garis biru mewakili leverage 1x, sementara garis merah mewakili leverage 2x, menunjukkan pengembalian kumulatif setelah mengumpulkan tingkat pendanaan.

Gambar 2 menyajikan uji coba mundur sederhana untuk arbitrase tingkat pendanaan kontrak berjangka BTC_USDT. Dengan asumsi kita membeli $5,000 nilai BTC di pasar spot dan melakukan short $5,000 kontrak berjangka BTC, untuk total nilai $10,000, pada tanggal 1 Januari 2024, dan menutup posisi pada tanggal 31 Desember 2024, kita dapat memperoleh nilai pendanaan yang ditunjukkan dalam gambar. Garis biru mewakili return kumulatif dengan leverage 1x, sedangkan garis merah mewakili return kumulatif dengan leverage 2x dalam sistem margin silang.

Perhitungan sederhana menunjukkan bahwa dengan leverage 1x, pengembalian tahunan sekitar 4,4%. Memanfaatkan hingga 2x melalui sistem margin silang dapat meningkatkan pengembalian tahunan sebesar 8,8%. Menggunakan token yang lebih volatile dapat menghasilkan pengembalian yang lebih tinggi, dan dengan melakukan diversifikasi di berbagai pasangan perdagangan funding rate, sebuah dana kuantitatif multi-aset dapat diciptakan untuk lebih meningkatkan pengembalian.

Gambar 3: Pengembalian kumulatif dari arbitrase tingkat pendanaan dengan leverage 1x di berbagai pasangan perdagangan kontrak perpetual.

Gambar 4: Pengembalian akumulasi dari arbitrase tingkat pendanaan dengan leverage 2x di berbagai pasangan perdagangan kontrak berjangka tanpa tanggal jatuh tempo.

Gambar 3 menunjukkan pengujian kembali beberapa token dengan sejarah perdagangan yang lebih lama di pasar. Setelah melakukan arbitrase funding rate, tingkat pengembalian tahunan untuk kontrak-kontrak berbeda bervariasi. Tingkat pengembalian tahunan tertinggi adalah untuk DOGE_USDT sebesar 7,245%, diikuti oleh LINK_USDT sebesar 6,027%. Kontrak-kontrak lain memiliki tingkat pengembalian tahunan berkisar antara 4,5% hingga 6%. Kami melihat bahwa kontrak-kontrak BTC_USDT, dengan volatilitas lebih rendah daripada altcoin, cenderung memiliki tingkat pembiayaan yang lebih rendah dan, oleh karena itu, tingkat pengembalian tahunan yang lebih rendah. Sebaliknya, altcoin dengan volatilitas yang lebih tinggi memiliki tingkat pengembalian tahunan yang lebih tinggi.

Gambar 4 mengilustrasikan hasil kumulatif untuk pasangan yang sama yang ditunjukkan di Gambar 3, tetapi dengan leverage 2x dalam sistem cross-margin. Meskipun leverage yang meningkat, hasil tetap stabil, dengan sebagian besar kontrak menghasilkan hasil tahunan sekitar 10%. Strategi dana kuantitatif profesional dapat mengidentifikasi aset yang lebih menguntungkan dan memberikan hasil tahunan yang ditingkatkan melalui algoritma canggih dan manajemen portofolio.

Kesimpulan

Secara kesimpulan, Arbitrase tingkat pendanaan adalah strategi investasi yang stabil dan cocok untuk para investor yang mencari keuntungan konsisten di pasar yang volatile. Meskipun memiliki beberapa keterbatasan, selama likuiditas pasar memadai dan tingkat pendanaan tetap positif, strategi ini dapat menawarkan sumber keuntungan yang “near-risk-free” dalam kebanyakan kasus. Arbitrase tingkat pendanaan memberikan alternatif yang lebih menarik bagi investor yang akrab dengan produk keuangan tradisional seperti deposito berjangka atau obligasi. Namun, memilih bursa dengan hati-hati dan memperhitungkan risiko likuiditas sangat penting. Bursa dengan cadangan yang cukup lebih siap untuk menghindari risiko default atau kebangkrutan, dan dalam hal ini, Gate.com lebih siap daripada banyak bursa lain di industri ini.

Artikel Terkait

Cara Terbaik Membaca Grafik Mata Uang Kripto

Apa itu Bubblemaps?

Bagaimana Menggunakan API untuk Memulai Perdagangan Kuantitatif

5 Alat Riset Kripto Teratas Yang Harus Anda Ketahui Meminimalkan Keterlibatan Risiko dan Kerugian Perdagangan | Gerbang.io

Ulasan tentang Sepuluh Bot Meme Teratas