Что движет цену ADA криптовалюты?

Роль токеномики ADA в движении цен

Токеномика играет решающую роль в динамике цены ADA. Ее структура предложения и механизмы стейкинга напрямую влияют на ее рыночное поведение.

Фиксированный Предложение и Циркуляция

Общее количество: 45 миллиардов ADA

Оборотный оборот: ~35 миллиардов ADA

Дефляционные аспекты: фиксированный объем предотвращает инфляционные риски, в отличие от фиатных валют или криптовалют с неограниченным предложением.

Модель предложения ADA обеспечивает предсказуемость, что может помочь инвесторам и разработчикам планировать долгосрочное взаимодействие с сетью.

Стратегическое распределение токенов

Распределение ADA Cardano было тщательно спланировано для поддержки роста экосистемы:

Публичные и частные продажи: Раннее распространение позволило широкому кругу участников приобрести ADA.

Фонд Cardano: Часть токенов зарезервирована для продвижения принятия блокчейна и соблюдения регулирования.

IOHK & Emurgo: Этим организациям были выделены средства для поддержки развития, исследований и коммерциализации.

Эта сбалансированная стратегия распределения обеспечивает, что ключевые заинтересованные стороны остаются инвестированными в долгосрочный успех ADA, сохраняя децентрализацию.

Рыночные факторы цены криптовалюты ADA

Цена ADA подвержена влиянию различных внешних и внутренних рыночных сил, включая:

1. Обновления сети и прогресс разработки

Cardano имеет структурированную дорожную карту развития, следующую фазы как Byron, Shelley, Goguen, Basho и Voltaire. Крупные обновления часто влияют на цену ADA:

Хардфорк Алонзо (2021 год): Внедрение возможностей смарт-контрактов, что способствовало росту цены ADA до исторического максимума около $3.10.

Обновление Vasil (2022): Улучшена скорость и эффективность транзакций, способствуя возобновлению интереса инвесторов.

Предстоящие улучшения управления: будущие улучшения в децентрализованном управлении и совместимости могут дополнительно повлиять на стоимость ADA.

2. Институциональное принятие и партнерства

Институциональный интерес к ADA увеличивается:

Рост DeFi и активность NFT на Cardano могут привлечь крупных игроков.

Партнерства с правительствами и предприятиями (например, сотрудничество Cardano с Министерством образования Эфиопии) добавляют практические случаи использования в реальном мире.

Если увеличится принятие, цена криптовалюты ADA может сохранить восходящий импульс.

3. Настроения на рынке и тренды криптовалют

Как и большинство криптовалют, ADA подвержена влиянию движения цены биткойна, общих тенденций на рынке и настроений инвесторов.

Бычьи циклы часто видят, как ADA следует за восходящим трендом BTC.

Медвежьи условия приводят к снижению цен из-за снижения спроса и увеличения продаж.

4. Регулятивные изменения

Регулирование криптовалют во всем мире может повлиять на цену ADA.

Позитивная ясность SEC или правительства в отношении стейкинга и блокчейн-проектов может укрепить доверие.

Более строгие правила могут ограничить рост экосистемы DeFi Cardano и негативно повлиять на цену.

Сравнение токеномики ADA с другими криптовалютами

ADA конкурирует с другими блокчейн-проектами, такими как Solana (SOL) и Binance Coin (BNB). Вот краткое сравнение их моделей токеномики:

Основные моменты по позиции ADA

Более децентрализованный, чем Solana и BNB, что делает его привлекательным для инвесторов, ориентированных на управление.

Более низкая скорость транзакций по сравнению с Solana замедляет расширение DeFi.

Фиксированный запас гарантирует дефицит, в отличие от инфляционной модели Соланы.

Если Cardano сможет улучшить скорость транзакций и принятие DeFi, цена криптовалюты ADA может стать более конкурентоспособной на рынке.

ADA Крипто Прогнозы Цен

Учитывая текущие тенденции на рынке, каково будущее цены ADA?

Прогнозы цен на короткий срок (6-12 месяцев)

Ожидаемый диапазон: $0.40 - $1.00

Потенциальные катализаторы: восстановление рынка, предстоящие обновления управления или увеличение принятия DeFi.

Риски: регуляторные проблемы, конкуренция со скоростными блокчейнами, такими как Солана.

Среднесрочный (1-3 года)

Ожидаемый диапазон: $1.50 - $3.00

Потенциальные катализаторы: институциональное принятие, рост NFT и DeFi на Cardano, и расширение экосистемы.

Риски: Медленная скорость принятия по сравнению с Ethereum или Solana, проблемы сетевой перегрузки.

Долгосрочный (3+ года)

Ожидаемый диапазон: $5.00+ (если Cardano достигнет широкого распространения в финансах, управлении и DeFi).

Потенциальные катализаторы: Правительства, использующие ADA для реальных приложений, Cardano становится доминирующей платформой смарт-контрактов.

Риски: Конкуренты по технологиям обгоняют Cardano, регулятивные изменения, ограничивающие блокчейны PoS.

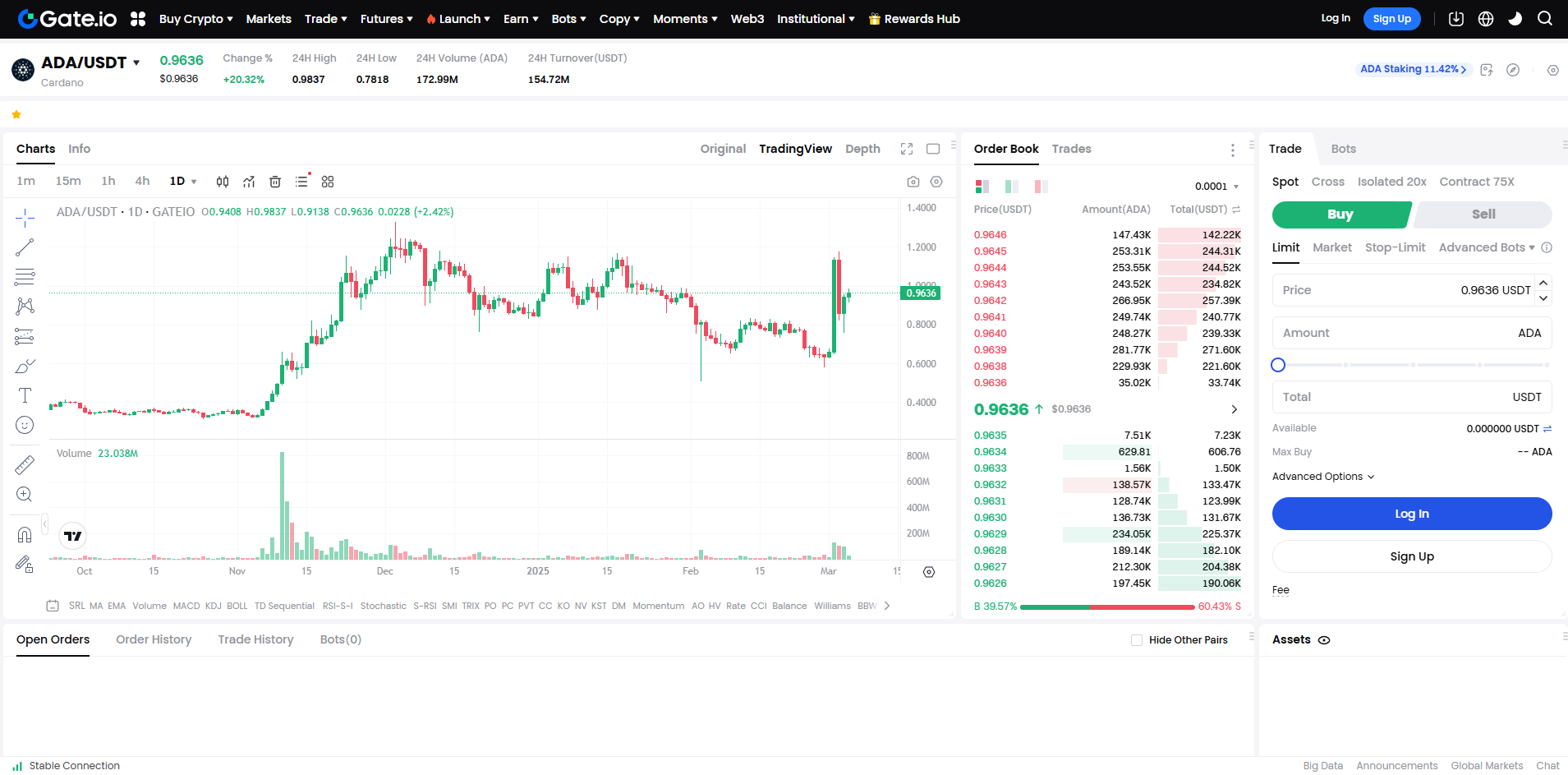

Время создания скриншота: 5 марта 2025 г.

Отказ от ответственности: Торговля криптовалютой включает значительные риски, включая потенциальные потери капитала, рыночную волатильность и регуляторные неопределенности. Торгуйте ответственно и проводите тщательное исследование перед инвестированием.

Вывод: Чего ожидать от цены криптовалюты ADA?

Цена ADA формируется сильной токеномикой, стимулами для стейкинга и постоянными обновлениями сети.

Несмотря на вызовы, такие как волатильность рынка и скорость принятия, приверженность Cardano к масштабируемости, децентрализации и безопасности позволяет ему занимать сильную позицию среди конкурентов в области блокчейна.

Если увеличится институциональное принятие и Cardano расширит свою экосистему DeFi и NFT, цена криптовалюты ADA может значительно вырасти в долгосрочной перспективе.

Хотели бы вы отслеживать тренды цен ADA или узнать больше о возможностях стейкинга? Дайте нам знать! 🚀

Торговля криптовалютой включает значительные риски, включая потенциальные потери капитала, рыночную волатильность и правовые неопределенности — торгуйте ответственно и проводите тщательное исследование перед инвестированием.

Похожие статьи

Как переводить средства с Binance безопасно и эффективно

Понимание токена TRUMP в одной статье: Комплексный анализ токена $TRUMP

Как отследить транзакцию USDT BEP20?

Сколько времени займет добыча 1 биткойна в 2025 году? Подробное руководство

Что такое MELANIA: мем-монета на миллиард долларов, запущенная первой леди США