MinusTwoDegrees

最近、ライドシェアの車に乗った時、ドライバーが彼の経験について話しているのを聞きました。彼は漢口の漢正街で十年以上の間、衣料品の卸売業を営んでいたと言い、ピーク時には500平米以上の店舗を持っていましたが、今年倒産しました。借金を300w現金化し、期限が過ぎてしまったので、返済するつもりはないと言っていました。また、妻とも離婚手続きをしました。以前はずっと経営者として働いていましたが、今は働きに出ることができず、仕方なくライドシェアの運転手をしています。

タクシーを利用する人が以前より少なくなり、プラットフォームも多くの手数料を取っており、かろうじて生活を維持している。実体経済はすぐには立ち直らず、資本が押し寄せる場所では何も育たない。どの業界も非常に競争が激しい。今後数年から十数年は厳しい時代に入るだろう。底辺の人々が稼ぐことは難しく、生活も厳しい。

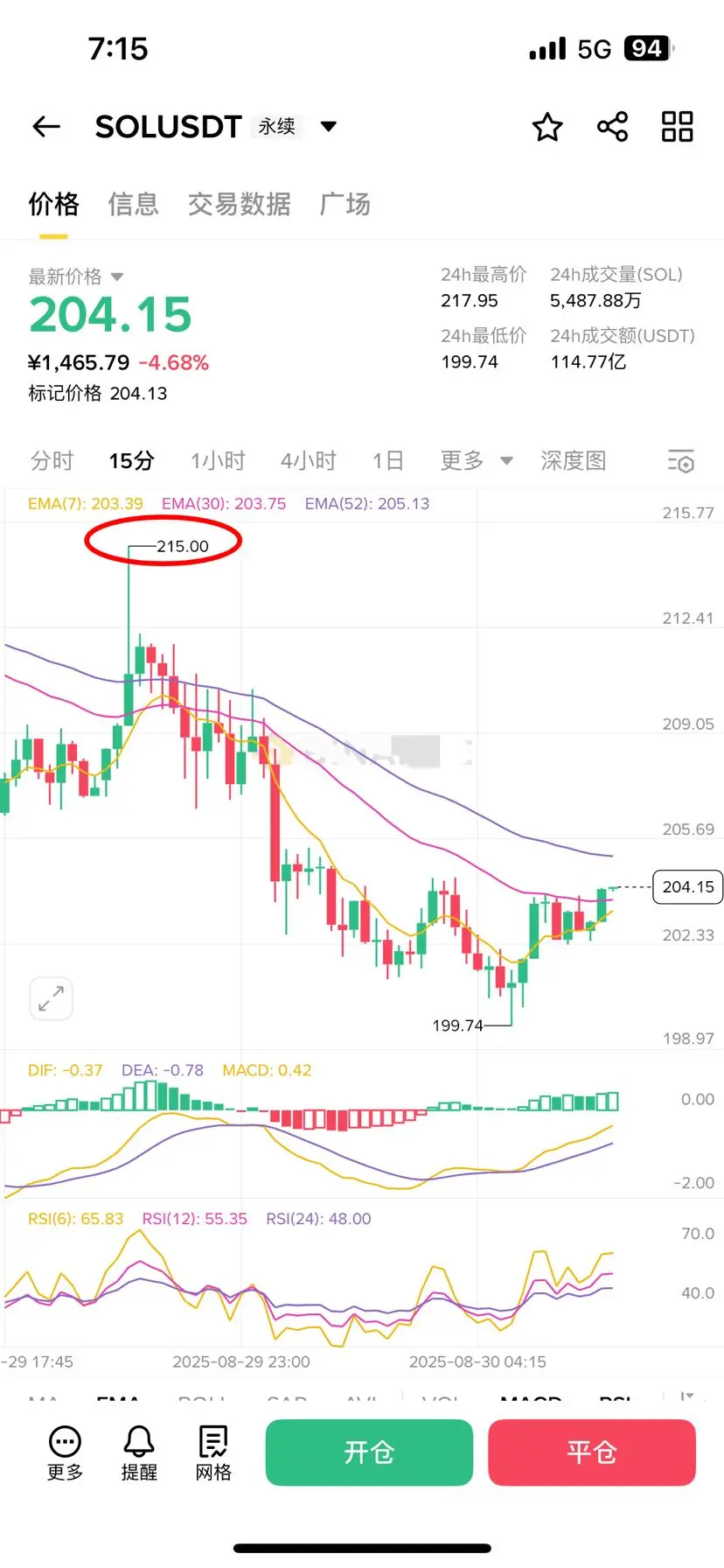

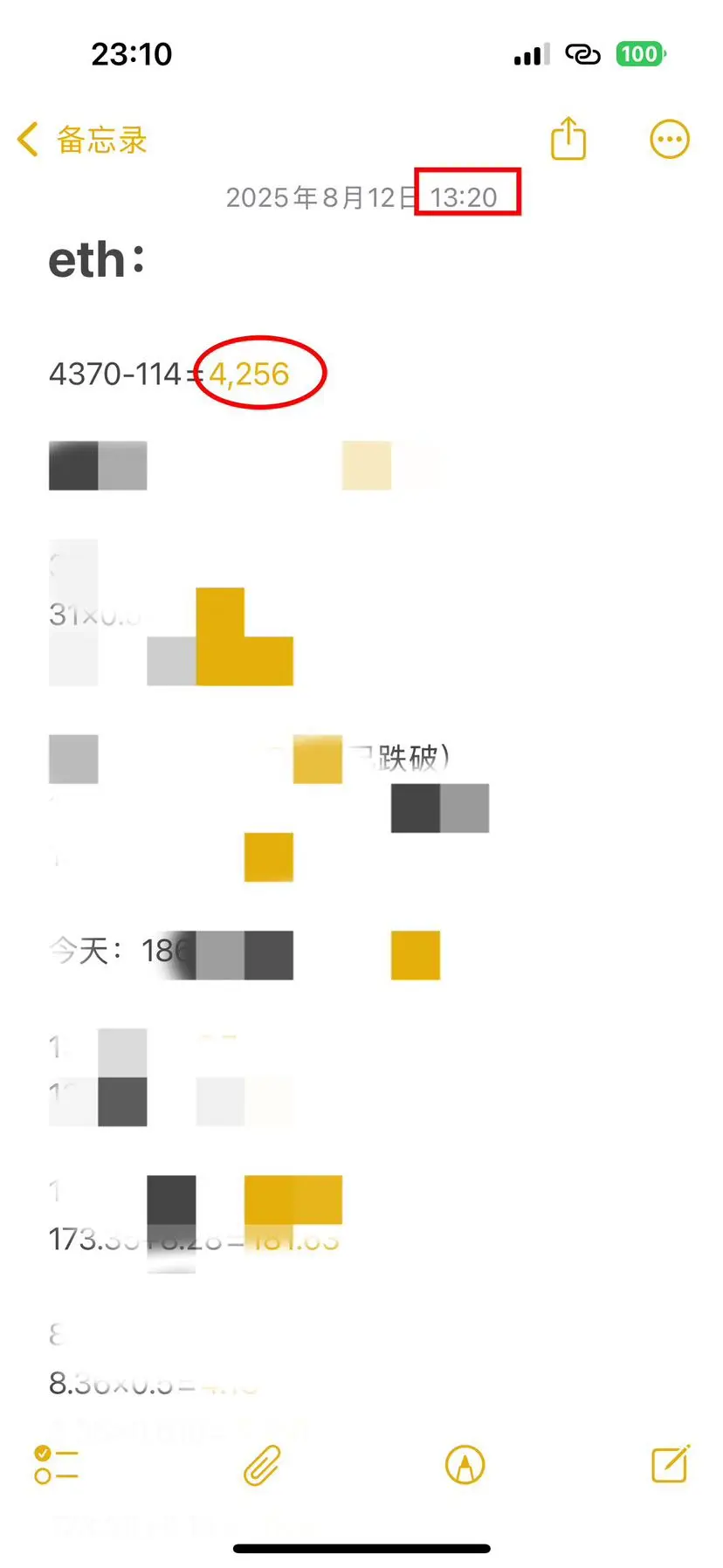

現在の仮想通貨市場では、米国株で利益を上げるのは比較的容易です。幸運なことに、私たちはまだこの仮想通貨市場の先駆者です。ですので、この市場でできるだけ多くの利益を上げ、貯蓄を増やす努力をしましょう。未来は未知に満ちていますので、今を生き、現在のチャンスを大切にし、心を込めて蓄積し、少しでも多くのお金を稼ぐことができれば、将来の計画を立て、より長期的な戦略を考えることができます。

原文表示タクシーを利用する人が以前より少なくなり、プラットフォームも多くの手数料を取っており、かろうじて生活を維持している。実体経済はすぐには立ち直らず、資本が押し寄せる場所では何も育たない。どの業界も非常に競争が激しい。今後数年から十数年は厳しい時代に入るだろう。底辺の人々が稼ぐことは難しく、生活も厳しい。

現在の仮想通貨市場では、米国株で利益を上げるのは比較的容易です。幸運なことに、私たちはまだこの仮想通貨市場の先駆者です。ですので、この市場でできるだけ多くの利益を上げ、貯蓄を増やす努力をしましょう。未来は未知に満ちていますので、今を生き、現在のチャンスを大切にし、心を込めて蓄積し、少しでも多くのお金を稼ぐことができれば、将来の計画を立て、より長期的な戦略を考えることができます。