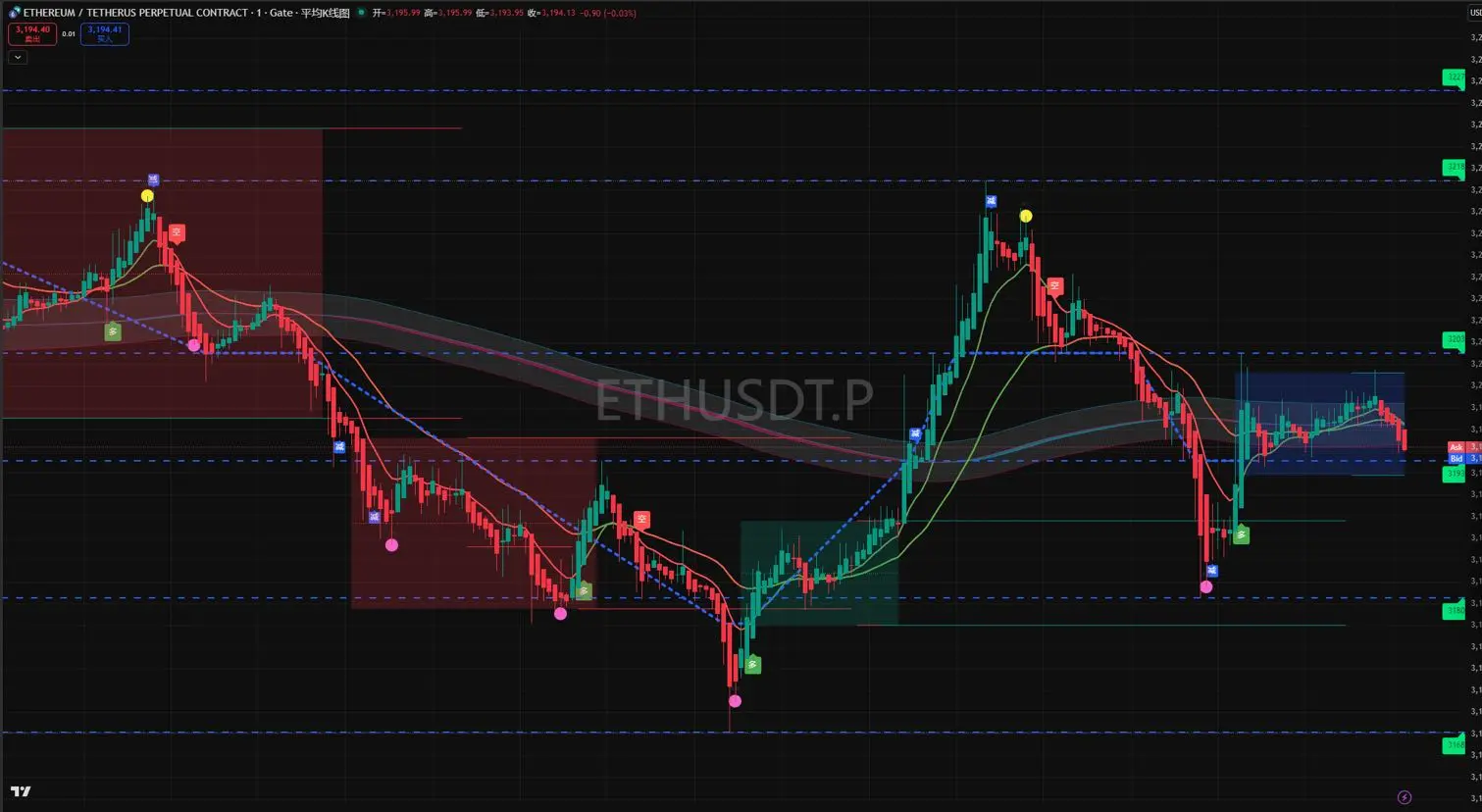

Comprehensive ETH

$ETH Trading Recommendations for Today (December 7)

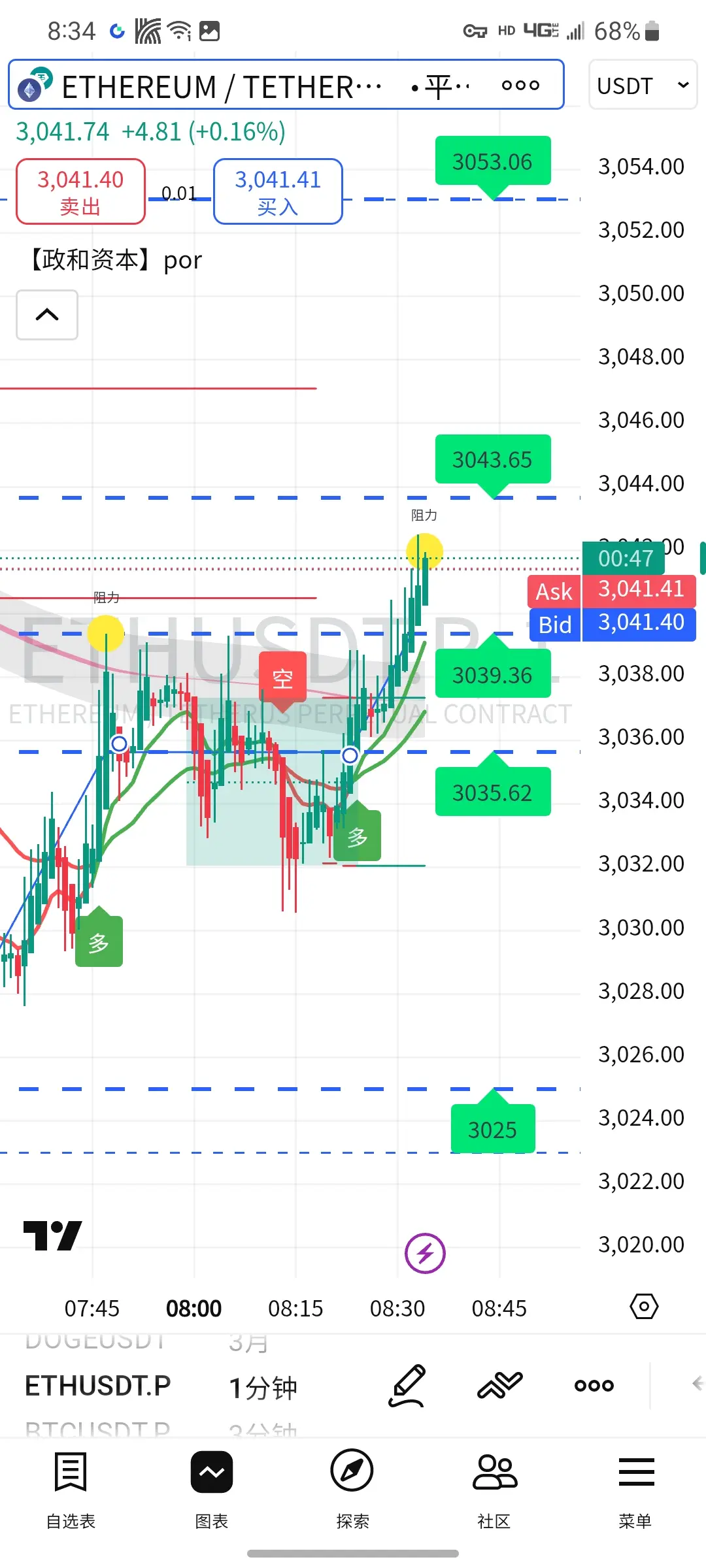

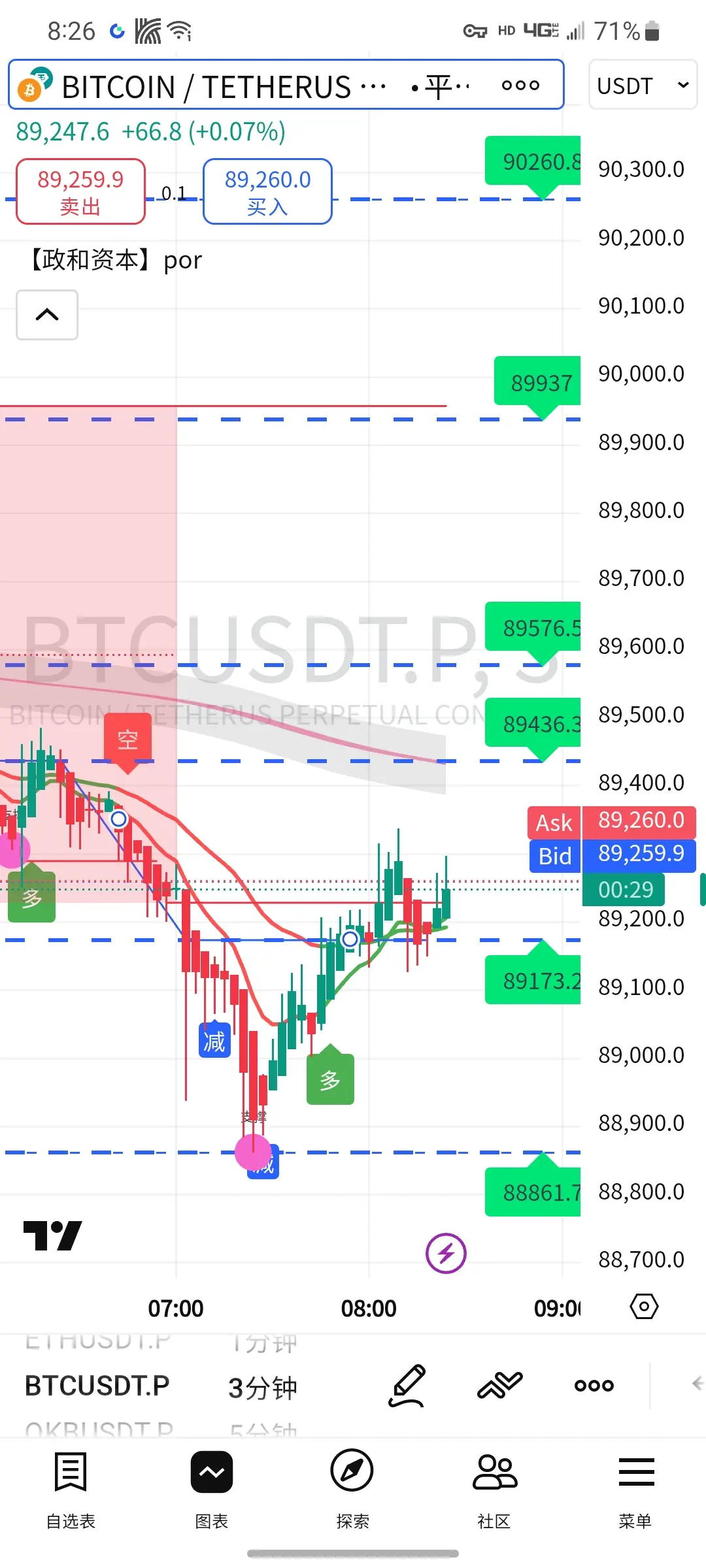

Current Core Dispute: The $3,000 Level

· Current Status: As of December 6/7, Ethereum’s price is fluctuating around $3,020–$3,050, testing this key support.

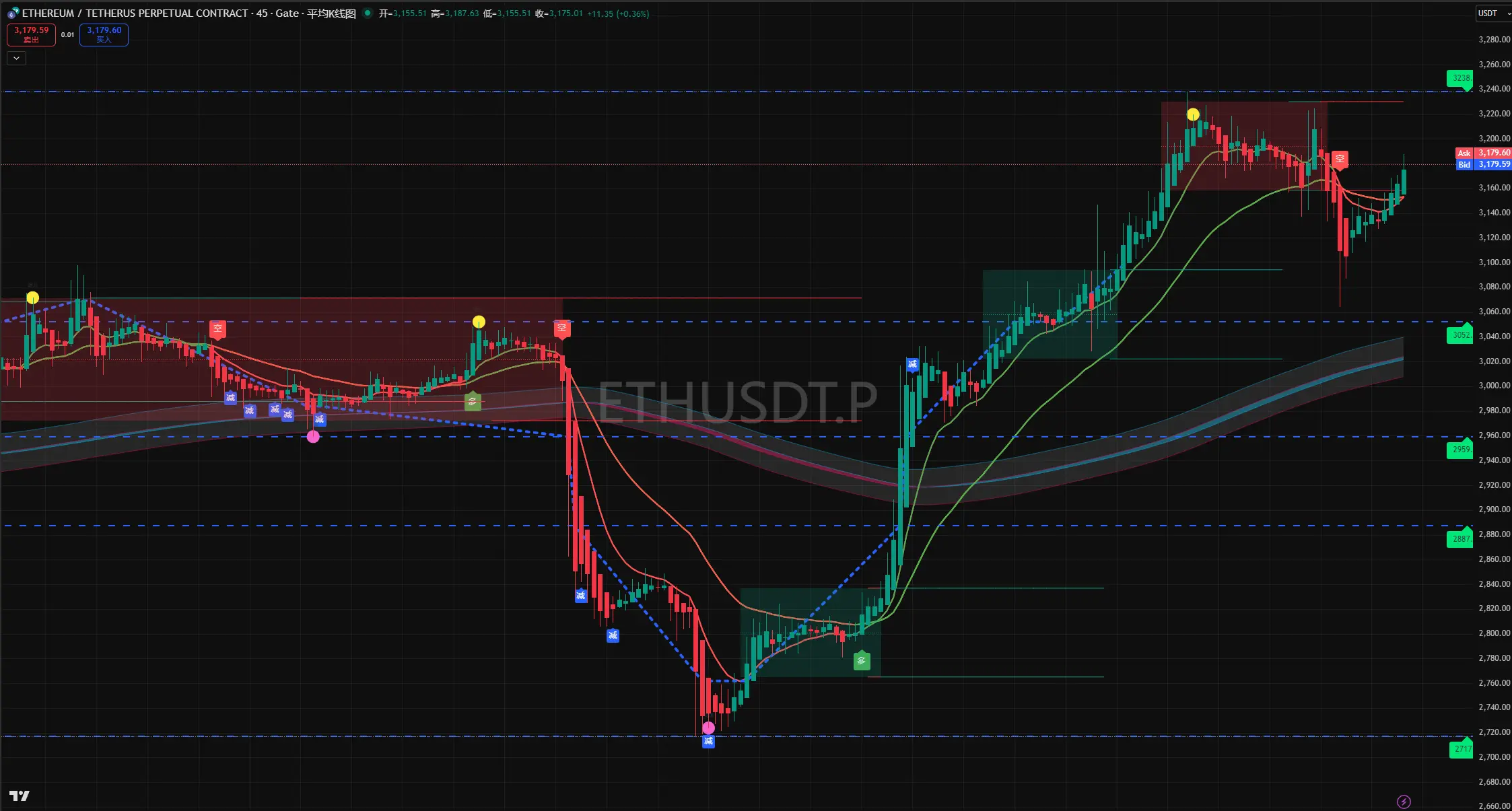

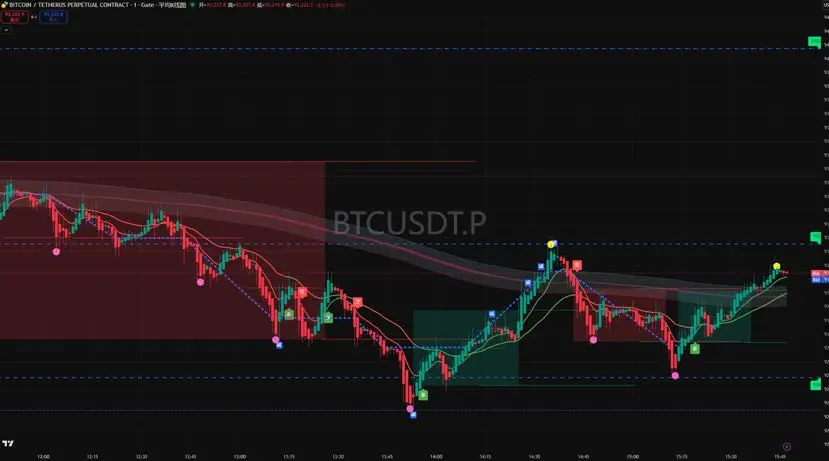

Main Reasons for Bullish (Long) Viewpoints

· Core Logic: Key support is holding, offering potential for a technical rebound and structural opportunities.

· Key Support: Institutional buying is providing support near $3,000.

· Technical Pattern: The ETH/BTC ratio has broken above a descending trendline, indicating market risk appetite may be returning; if it breaks above