# ETHEREUM

604.77K

DragonFlyOfficial

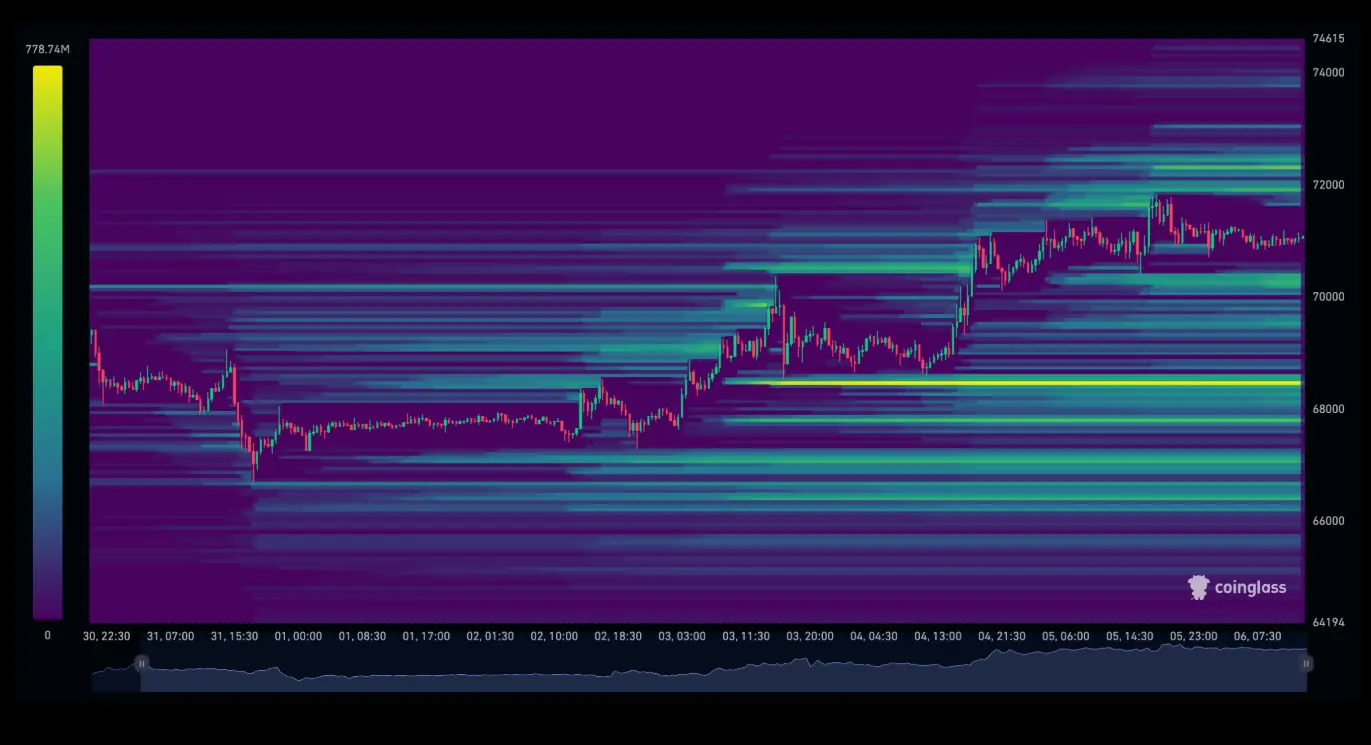

🚨 $60M Short Liquidated Amid Market Spike

According to BlockBeats News (Jan 24) and EmberCN monitoring, crypto market volatility struck again:

At around 1:00 a.m., Bitcoin briefly surged above $91,000 and Ethereum climbed past $3,000, triggering the liquidation of a massive short position held by “Rolling Trader 0xD83…Fd7”.

🔻 Key Details:

• Liquidation size: ~$60 million

• Total short position reduced from $300M → $238M

• Unrealized gains fell from $24M (2 days ago) to ~$4M

⚠️ This move once again highlights how high leverage + sudden volatility can quickly wipe out even large positions.

💬

According to BlockBeats News (Jan 24) and EmberCN monitoring, crypto market volatility struck again:

At around 1:00 a.m., Bitcoin briefly surged above $91,000 and Ethereum climbed past $3,000, triggering the liquidation of a massive short position held by “Rolling Trader 0xD83…Fd7”.

🔻 Key Details:

• Liquidation size: ~$60 million

• Total short position reduced from $300M → $238M

• Unrealized gains fell from $24M (2 days ago) to ~$4M

⚠️ This move once again highlights how high leverage + sudden volatility can quickly wipe out even large positions.

💬

- Reward

- 7

- 9

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🚀 “Next-level energy here — can feel the momentum building!”View More

🔥 Nasdaq Moves to Lift Position Limits on BTC & ETH ETF Options 🔥

Big signal from traditional finance 👀

Nasdaq has officially applied to remove the 25,000-contract position limit on spot Bitcoin & Ethereum ETF options, submitting a rule change to the U.S. SEC.

📌 What’s changing?

• ❌ Removes the 25,000 contract cap

• ⚖️ Treats crypto ETF options the same as commodity ETF options

• 🏦 Eliminates what Nasdaq calls “unfair restrictions”

• 🗣️ SEC comment period is now open

• ⏰ Final decision expected by end of February

💡 Why this matters:

This could unlock larger institutional participation,

Big signal from traditional finance 👀

Nasdaq has officially applied to remove the 25,000-contract position limit on spot Bitcoin & Ethereum ETF options, submitting a rule change to the U.S. SEC.

📌 What’s changing?

• ❌ Removes the 25,000 contract cap

• ⚖️ Treats crypto ETF options the same as commodity ETF options

• 🏦 Eliminates what Nasdaq calls “unfair restrictions”

• 🗣️ SEC comment period is now open

• ⏰ Final decision expected by end of February

💡 Why this matters:

This could unlock larger institutional participation,

- Reward

- 14

- 15

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

#CryptoETFDivergence

Day by day, still here. Still observing the market.

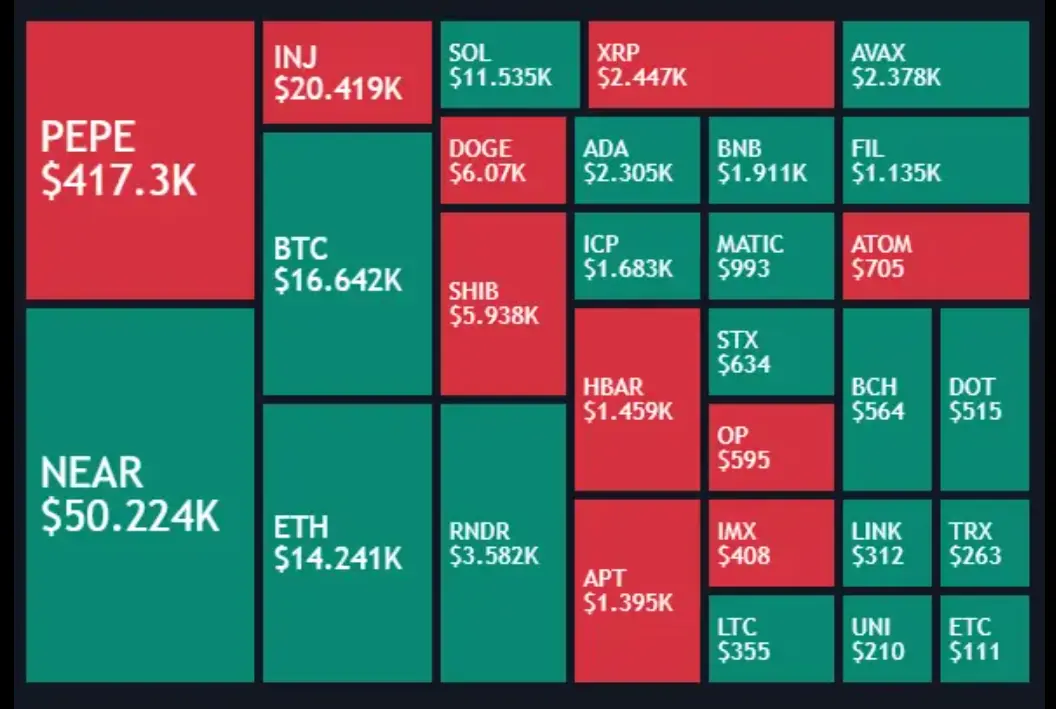

The crypto market is showing divergent signals between spot price movements and ETF flows. While Bitcoin and Ethereum are attempting short-term rebounds, ETF inflows are not fully aligned, creating a temporary disconnect in momentum.

📊 Market Overview

Ethereum (ETH):

Price stabilized near 3000 after failing to hold resistance around 3170–3180.

Recent rebound near 3130 is weak; a retest below 3100, potentially toward 3070, is likely.

Volatility remains high, and ETF flows are cautious, limiting strong upward moves.

Bitcoi

Day by day, still here. Still observing the market.

The crypto market is showing divergent signals between spot price movements and ETF flows. While Bitcoin and Ethereum are attempting short-term rebounds, ETF inflows are not fully aligned, creating a temporary disconnect in momentum.

📊 Market Overview

Ethereum (ETH):

Price stabilized near 3000 after failing to hold resistance around 3170–3180.

Recent rebound near 3130 is weak; a retest below 3100, potentially toward 3070, is likely.

Volatility remains high, and ETF flows are cautious, limiting strong upward moves.

Bitcoi

ETH0,54%

MC:$3.55KHolders:1

0.00%

- Reward

- 5

- 6

- Repost

- Share

Vortex_King :

:

2026 GOGOGO 👊View More

#CryptoMarketOutlook2026 🚀

Beyond the Noise: Positioning for the Next Expansion Phase

As we move deeper into 2026, the crypto market is entering a phase that separates speculators from strategists.

This is not the end of the bull cycle, but a necessary recalibration before the next leg higher. Markets rarely move in straight lines—the strongest trends are forged during periods of doubt.

Bitcoin consolidating below major psychological levels and altcoins cooling off is structural strength in action, not weakness. Volatility is no longer driven by retail emotion alone—it’s now shaped by ETF flo

Beyond the Noise: Positioning for the Next Expansion Phase

As we move deeper into 2026, the crypto market is entering a phase that separates speculators from strategists.

This is not the end of the bull cycle, but a necessary recalibration before the next leg higher. Markets rarely move in straight lines—the strongest trends are forged during periods of doubt.

Bitcoin consolidating below major psychological levels and altcoins cooling off is structural strength in action, not weakness. Volatility is no longer driven by retail emotion alone—it’s now shaped by ETF flo

- Reward

- 4

- 2

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

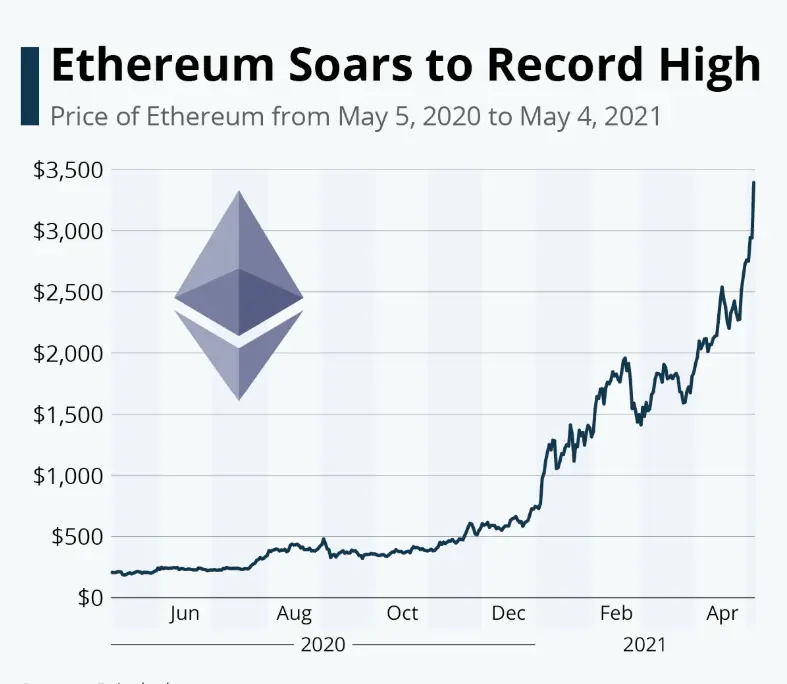

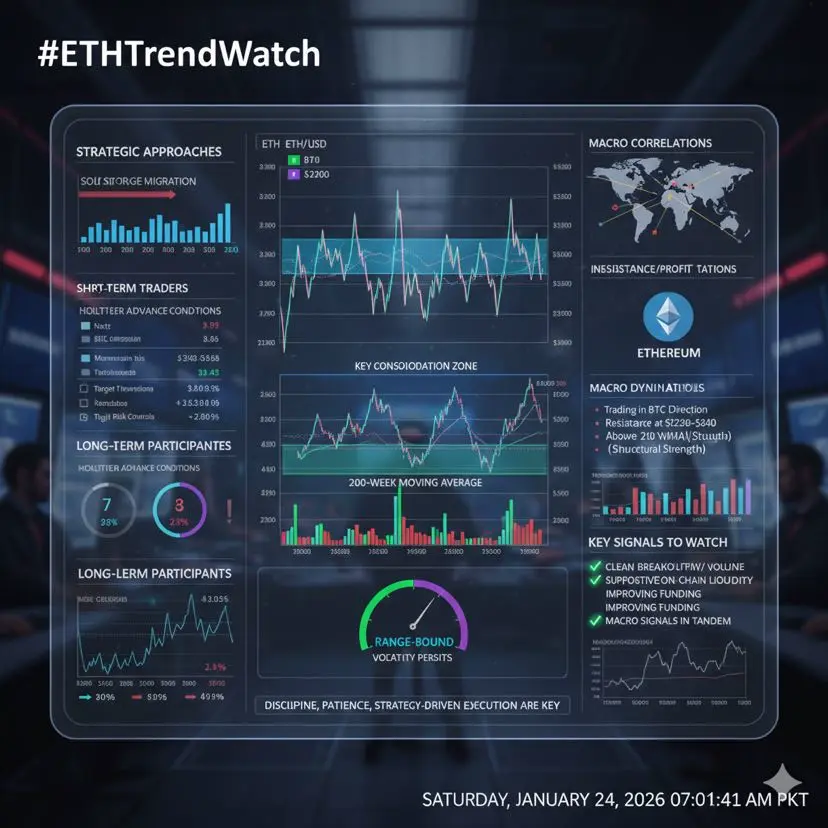

🔥 #ETHTrendWatch | Ethereum in Consolidation Mode

Ethereum (ETH) is currently navigating a range-bound consolidation, balancing technical structure with macro uncertainty. No panic—just calculated price discovery.

💹 Price Action Snapshot • Range: $2,970 – $3,200

• Choppy movement after recent highs

• Strong demand zone: $3,100–$3,200

• Key resistance: $3,250–$3,400 (profit-taking area)

📊 Technical Outlook • ETH holds above the 200-week MA → long-term strength intact

• A clean breakout above $3,400–$3,450 could unlock bullish momentum

• Accumulation at support, distribution near resistance

•

Ethereum (ETH) is currently navigating a range-bound consolidation, balancing technical structure with macro uncertainty. No panic—just calculated price discovery.

💹 Price Action Snapshot • Range: $2,970 – $3,200

• Choppy movement after recent highs

• Strong demand zone: $3,100–$3,200

• Key resistance: $3,250–$3,400 (profit-taking area)

📊 Technical Outlook • ETH holds above the 200-week MA → long-term strength intact

• A clean breakout above $3,400–$3,450 could unlock bullish momentum

• Accumulation at support, distribution near resistance

•

- Reward

- 1

- Comment

- Repost

- Share

🔥 Nasdaq Moves to Lift Position Limits on BTC & ETH ETF Options 🔥

A major signal from traditional finance 👀

Nasdaq has officially filed a proposal with the U.S. SEC to remove the 25,000-contract position limit on options for spot Bitcoin and Ethereum ETFs.

📌 What’s Changing?

• ❌ The 25,000 contract cap will be eliminated

• ⚖️ Crypto ETF options would be regulated the same way as commodity ETF options

• 🏦 Nasdaq calls the current limit an “unfair restriction”

• 🗣️ The SEC comment period is now open

• ⏰ A final decision is expected by the end of February

💡 Why This Matters:

If approved, t

A major signal from traditional finance 👀

Nasdaq has officially filed a proposal with the U.S. SEC to remove the 25,000-contract position limit on options for spot Bitcoin and Ethereum ETFs.

📌 What’s Changing?

• ❌ The 25,000 contract cap will be eliminated

• ⚖️ Crypto ETF options would be regulated the same way as commodity ETF options

• 🏦 Nasdaq calls the current limit an “unfair restriction”

• 🗣️ The SEC comment period is now open

• ⏰ A final decision is expected by the end of February

💡 Why This Matters:

If approved, t

- Reward

- 4

- 4

- Repost

- Share

EagleEye :

:

Buy To Earn 💎View More

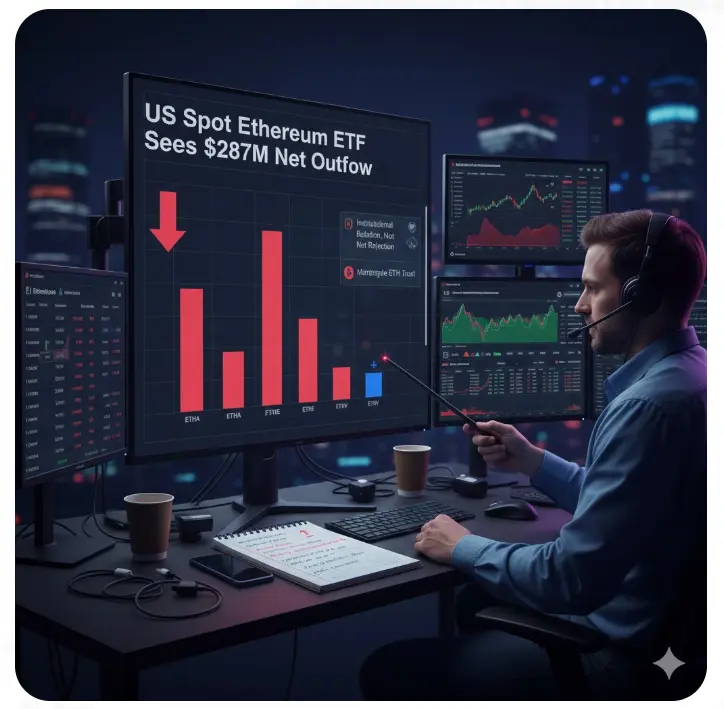

📉 US Spot Ethereum ETF Sees $287M Net Outflow — What’s Really Happening?

Market Update (Jan 22 | Farside data)

US spot Ethereum ETFs recorded $287 million in net outflows, marking two consecutive trading days of capital exits.

Breakdown:

• ETHA: –$250.3M

• FETH: –$30.9M

• ETHE: –$11.4M

• ETHV: –$4.4M

• Grayscale ETH Trust: + $10M inflow

This divergence is important — and tells a deeper story.

🧠 1️⃣ Institutional Behavior: Rotation, Not Rejection

The second day of outflows suggests short-term capital rotation, not abandonment of Ethereum.

Key observations:

Outflows are concentrated, not broad

Market Update (Jan 22 | Farside data)

US spot Ethereum ETFs recorded $287 million in net outflows, marking two consecutive trading days of capital exits.

Breakdown:

• ETHA: –$250.3M

• FETH: –$30.9M

• ETHE: –$11.4M

• ETHV: –$4.4M

• Grayscale ETH Trust: + $10M inflow

This divergence is important — and tells a deeper story.

🧠 1️⃣ Institutional Behavior: Rotation, Not Rejection

The second day of outflows suggests short-term capital rotation, not abandonment of Ethereum.

Key observations:

Outflows are concentrated, not broad

- Reward

- 3

- 2

- Repost

- Share

ybaser :

:

Bullish vibes 🔥🔥🔥View More

🔥 Nasdaq Moves to Lift Position Limits on BTC & ETH ETF Options! 🔥

Traditional finance is making a bold move 👀

Nasdaq has filed a proposal with the U.S. SEC to remove the 25,000-contract cap on options for spot Bitcoin and Ethereum ETFs.

📌 Key Changes:

• ❌ 25,000 contract limit removed

• ⚖️ Crypto ETF options treated like commodity ETF options

• 🏦 Nasdaq calls the current cap an “unfair restriction”

• 🗣️ SEC comment period now open

• ⏰ Final decision expected by end of February

💡 Why This Matters:

If approved, expect larger institutional participation, deeper liquidity, and more sophist

Traditional finance is making a bold move 👀

Nasdaq has filed a proposal with the U.S. SEC to remove the 25,000-contract cap on options for spot Bitcoin and Ethereum ETFs.

📌 Key Changes:

• ❌ 25,000 contract limit removed

• ⚖️ Crypto ETF options treated like commodity ETF options

• 🏦 Nasdaq calls the current cap an “unfair restriction”

• 🗣️ SEC comment period now open

• ⏰ Final decision expected by end of February

💡 Why This Matters:

If approved, expect larger institutional participation, deeper liquidity, and more sophist

- Reward

- 1

- 1

- Repost

- Share

Yusfirah :

:

Happy New Year! 🤑📊 🔥 Crypto Market Update – January 22, 2026 (Gate.io) 🔥

🔹 Market is volatile today! Bitcoin is hovering around $90,000, with major positions being liquidated.

📉 Bitcoin & Ethereum Update:

• BTC dropped nearly 3.8% in the last 24 hours

• ETH and major altcoins also under pressure

📊 Market Sentiment:

• Fear & Greed Index is low — fear dominates the market

• Institutional investors still active — hedge funds and big players are accumulating

⚠️ Special Note:

• Large BTC accumulation happening — big players buying in bulk

📌 Key Trading Tips for Gate.io Users:

✔️ Volatility is high — trade ca

🔹 Market is volatile today! Bitcoin is hovering around $90,000, with major positions being liquidated.

📉 Bitcoin & Ethereum Update:

• BTC dropped nearly 3.8% in the last 24 hours

• ETH and major altcoins also under pressure

📊 Market Sentiment:

• Fear & Greed Index is low — fear dominates the market

• Institutional investors still active — hedge funds and big players are accumulating

⚠️ Special Note:

• Large BTC accumulation happening — big players buying in bulk

📌 Key Trading Tips for Gate.io Users:

✔️ Volatility is high — trade ca

- Reward

- 4

- 8

- Repost

- Share

Discovery :

:

Watching Closely 🔍️View More

🔥 Dual-Currency Long Positions Continue to Surge

💰 Total Profit Exceeds 1,900 USDT | Returns Above 200%+

📊 Real-Time Position Performance

✅ BTC Long Position – Profits Expanding

Entry Avg Price: 88,150.0

Current Price: 89,943.3

Return Rate: +227.85%

Profit: 856.48 USDT

Status: Trend remains intact — continue holding

✅ ETH Long Position – Strong & Stable

Entry Avg Price: 2,905.00

Current Price: 2,980.00

Return Rate: +287.60%

Profit: 1,086.75 USDT

Status: Key resistance broken — next target 3,050

🔥 Total Dual-Currency Profit: 1,943.23 USDT

📈 Average Holding Return: 257.7%

---

🎯 Holding Log

💰 Total Profit Exceeds 1,900 USDT | Returns Above 200%+

📊 Real-Time Position Performance

✅ BTC Long Position – Profits Expanding

Entry Avg Price: 88,150.0

Current Price: 89,943.3

Return Rate: +227.85%

Profit: 856.48 USDT

Status: Trend remains intact — continue holding

✅ ETH Long Position – Strong & Stable

Entry Avg Price: 2,905.00

Current Price: 2,980.00

Return Rate: +287.60%

Profit: 1,086.75 USDT

Status: Key resistance broken — next target 3,050

🔥 Total Dual-Currency Profit: 1,943.23 USDT

📈 Average Holding Return: 257.7%

---

🎯 Holding Log

- Reward

- 4

- 4

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

38.64K Popularity

22.21K Popularity

16.19K Popularity

3.96K Popularity

11.74K Popularity

10.69K Popularity

9.14K Popularity

78.01K Popularity

36.95K Popularity

21.05K Popularity

8.07K Popularity

110.37K Popularity

255.19K Popularity

20.71K Popularity

180.21K Popularity

News

View More"Maqi" Ethereum long position currently has a floating profit of $60,000, with total holdings rising to 6,000 ETH.

12 m

The share of US dollar in global foreign exchange reserves drops below 60%

20 m

Gate BTC staking total surpasses 2,620 coins, reaching a new high, with an annualized yield of 9.99%

26 m

The Ethereum Foundation has assembled a quantum team to shift research into engineering practice.

47 m

Rainbow will launch the CCA auction on Uniswap on February 2nd.

53 m

Pin