Post content & earn content mining yield

placeholder

ALinShuyan

Beware of Double Risks: Washout and Deep Drop! Gold Trading Guide for Next Week

In recent days, the gold market has been destined to be recorded in the history of precious metal trading. Many people feel that this plunge came suddenly, but from the perspective of market logic and policy trends, this sharp decline was foreshadowed long ago and is not an accidental black swan event. Starting from a unilateral rally around the 4620 level, reaching a high near the 5600 mark before quickly plunging, and then falling back to around 4682 within just two days.

Next week's market will continue the core

In recent days, the gold market has been destined to be recorded in the history of precious metal trading. Many people feel that this plunge came suddenly, but from the perspective of market logic and policy trends, this sharp decline was foreshadowed long ago and is not an accidental black swan event. Starting from a unilateral rally around the 4620 level, reaching a high near the 5600 mark before quickly plunging, and then falling back to around 4682 within just two days.

Next week's market will continue the core

BTC0,98%

- Reward

- 1

- Comment

- Repost

- Share

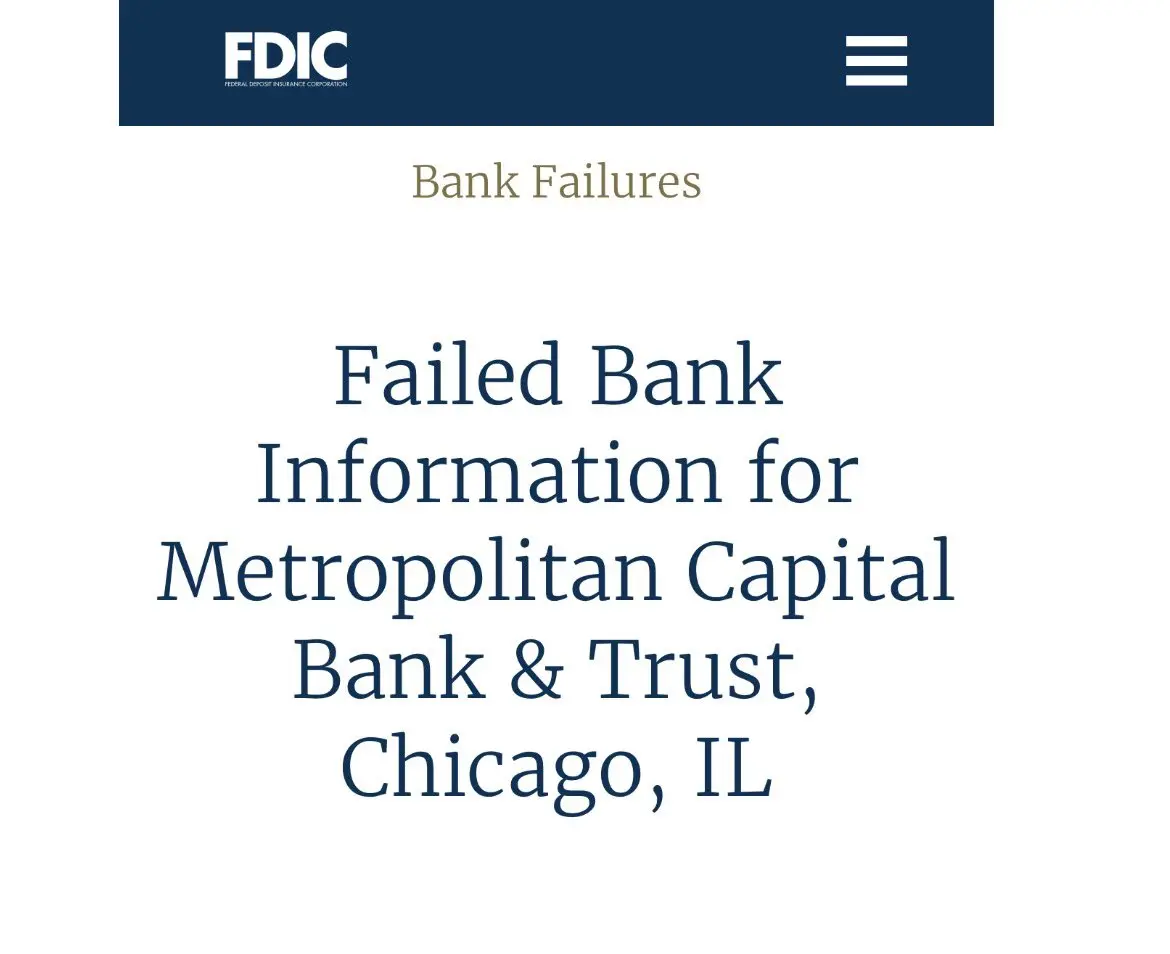

BREAKING: 🇺🇸 Chicago's Metropolitan Capital Bank & Trust becomes first bank of 2026 to COLLAPSE.

It was CLOSED by Illinois regulators due to unsafe conditions and weak capital cited.

Assets: $261 million

Deposits: $212 million

Hit to the FDIC fund: $19.7 million

It was CLOSED by Illinois regulators due to unsafe conditions and weak capital cited.

Assets: $261 million

Deposits: $212 million

Hit to the FDIC fund: $19.7 million

- Reward

- 1

- 1

- Repost

- Share

BuiHaiDuong :

:

hdhdj【$SOL Signal】Long + Volume and Price Breakout Confirmation

$SOL After volume expansion and upward push, the price action shows a healthy breakout, with open interest rising in sync, indicating institutional entry rather than mere short covering. The market structure has shifted to a bullish dominance.

🎯 Direction: Long

🎯 Entry: 117.50 - 119.00

🛑 Stop Loss: 114.80 ( Rigid stop loss, invalidating the breakout if broken )

🚀 Target 1: 125.00

🚀 Target 2: 130.00

$SOL Consolidation above a key psychological level, with a 4-hour bullish candle confirming strong buying pressure. The current pri

$SOL After volume expansion and upward push, the price action shows a healthy breakout, with open interest rising in sync, indicating institutional entry rather than mere short covering. The market structure has shifted to a bullish dominance.

🎯 Direction: Long

🎯 Entry: 117.50 - 119.00

🛑 Stop Loss: 114.80 ( Rigid stop loss, invalidating the breakout if broken )

🚀 Target 1: 125.00

🚀 Target 2: 130.00

$SOL Consolidation above a key psychological level, with a 4-hour bullish candle confirming strong buying pressure. The current pri

SOL1,59%

- Reward

- like

- 1

- Repost

- Share

GrayGoat :

:

Currently, the market trend is bearish. You say to go long, but are you trapped at the top?中国心

中国心

Created By@YanyanAngelPromoterYanyanAngel

Listing Progress

0.00%

MC:

$3.23K

Create My Token

Privacy: The Future's Most Core "Moat" of Cryptocurrency【Plain Language Guide】Will privacy be the ultimate moat for cryptocurrencies? A16Z partner Ali Yahya pointed out in an interview that as performance gradually becomes commoditized, the "lock-in effect" brought by privacy will reshape the competitive landscape. Since the risk of migrating secrets is much higher than that of assets, privacy chains will generate strong network effects, leading to a few winners taking all. This is an inevitable path for finance to go mainstream and a necessity in the AI era. For more details, please see:

View Original

- Reward

- like

- Comment

- Repost

- Share

This guy bought 180 million yuan in financial products at the bank. After maturity, only 440,000 yuan remains and cannot be redeemed. What's the difference between this and a scam rug pull?

View Original- Reward

- like

- Comment

- Repost

- Share

Bought silver for 1 million on the 29th; can it grow to 1.5 million after the new year?

View Original- Reward

- like

- Comment

- Repost

- Share

Anyone from Finland can confirm this?

- Reward

- 1

- 7

- Repost

- Share

EagleEye :

:

"This post is truly impressive! I really appreciate the effort and creativity behind it."View More

I think I finally learned how to play with technical coins. Thanks to October's new listings for the transformation they brought me😭. I used to think that playing with technical coins required understanding underlying technology. I'm not an engineering major and had no technical background, so I thought it was very difficult. Recently, my perspective has opened up, and I realize that technical coins and meme coins are fundamentally the same.

MEME-4,16%

- Reward

- 1

- Comment

- Repost

- Share

#PreciousMetalsPullBack 🏦 The "Wall Street" Effect

For many institutional funds, the barrier to entry isn't lack of interest—it's compliance. A Spot ETF removes the hurdles of private key management and unregulated exchanges.

Pension Funds & IRAs: Can now allocate a portion of their portfolios to AVAX through standard brokerage accounts.

Reduced Friction: No need for "wrapped" tokens or complex DeFi bridges to get exposure.

Legitimacy: VanEck’s backing acts as a seal of approval for risk-averse investors.🚀 What’s Next for the Ecosystem?

The real magic happens when this capital trickles down.

For many institutional funds, the barrier to entry isn't lack of interest—it's compliance. A Spot ETF removes the hurdles of private key management and unregulated exchanges.

Pension Funds & IRAs: Can now allocate a portion of their portfolios to AVAX through standard brokerage accounts.

Reduced Friction: No need for "wrapped" tokens or complex DeFi bridges to get exposure.

Legitimacy: VanEck’s backing acts as a seal of approval for risk-averse investors.🚀 What’s Next for the Ecosystem?

The real magic happens when this capital trickles down.

- Reward

- 5

- 7

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Happy New Year! 🤑View More

market prediction 2026

- Reward

- like

- Comment

- Repost

- Share

$SOL $SOL SOL/USDT charts across multiple timeframes, here is the professional analysis and trade plan.

1. 4H Chart - Identify Direction & Higher Timeframe Structure

Trend: Bullish Consolidation. Price is holding well above the significant daily low of 113.01 and is consolidating near the 118.50 area after a strong move up.

· Key Level (Resistance): 119.12 (24h High). A sustained break above this level confirms bullish continuation.

· Key Level (Support): 115.85 - 116.12 (Recent 1H swing low & 4H Bollinger Lower Band from earlier chart).

· Market Structure: Higher highs and higher lows rem

1. 4H Chart - Identify Direction & Higher Timeframe Structure

Trend: Bullish Consolidation. Price is holding well above the significant daily low of 113.01 and is consolidating near the 118.50 area after a strong move up.

· Key Level (Resistance): 119.12 (24h High). A sustained break above this level confirms bullish continuation.

· Key Level (Support): 115.85 - 116.12 (Recent 1H swing low & 4H Bollinger Lower Band from earlier chart).

· Market Structure: Higher highs and higher lows rem

SOL1,59%

- Reward

- 3

- 2

- Repost

- Share

HighAmbition :

:

Watching Closely 🔍️View More

- Reward

- 1

- Comment

- Repost

- Share

zb

资本家

Created By@ForgottenMemories

Listing Progress

0.00%

MC:

$3.23K

Create My Token

Focus on the key threshold: The market is operationally balanced: the probability of short-term growth is estimated at 55%, and of decline — at 45%. The key battle is around 85,000 USDT: a breakout above will confirm a bullish scenario, while a pullback below 80,000 USDT will activate short positions. $BTC

Bullish scenario: Appointment of a crypto-friendly Fed chair, increasing institutional interest, and positive signals from elite accounts (long/short = 2.18) create potential for testing 85,000 USDT. ETH and XRP demonstrate volume stabilization, which boosts confidence in the sector.

Short-

Bullish scenario: Appointment of a crypto-friendly Fed chair, increasing institutional interest, and positive signals from elite accounts (long/short = 2.18) create potential for testing 85,000 USDT. ETH and XRP demonstrate volume stabilization, which boosts confidence in the sector.

Short-

BTC0,98%

- Reward

- 2

- 1

- Repost

- Share

NextGame :

:

Follow 🔍 closely【$SOL Signal】Empty Position + Observation of Position Changes

$SOL Price slightly declines but open interest remains high. Combined with market logic, this suggests caution for potential main force distribution or long liquidation risks. Currently, the market shows no clear price action support, indicating a high-uncertainty zone.

🎯 Direction: Empty Position

Price decline accompanied by extremely high open interest is a typical "bull-bear showdown" signal. Market logic clearly points to two possibilities: either the short-term main force is actively distributing to create panic, or the l

$SOL Price slightly declines but open interest remains high. Combined with market logic, this suggests caution for potential main force distribution or long liquidation risks. Currently, the market shows no clear price action support, indicating a high-uncertainty zone.

🎯 Direction: Empty Position

Price decline accompanied by extremely high open interest is a typical "bull-bear showdown" signal. Market logic clearly points to two possibilities: either the short-term main force is actively distributing to create panic, or the l

SOL1,59%

- Reward

- 2

- 1

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊🚨 HUGE — BREAKING 🇺🇸The U.S. government has officially entered a partial shutdown. Markets now brace for volatility as funding uncertainty hits Washington.Risk assets, USD, gold, and crypto all in focus. 📊

- Reward

- like

- Comment

- Repost

- Share

Gu Jingci: Near the key nodes of 1.31 Bitcoin/Ethereum, the bullish outlook remains unchanged.

ETH-2,13%

- Reward

- 2

- Comment

- Repost

- Share

LianKe Community; still can enter now. $river now around 33. Enter at around 31.5 with a small addition. Exit if it drops below 29.8. Target 40. Less than 10x.

View Original

- Reward

- 1

- Comment

- Repost

- Share

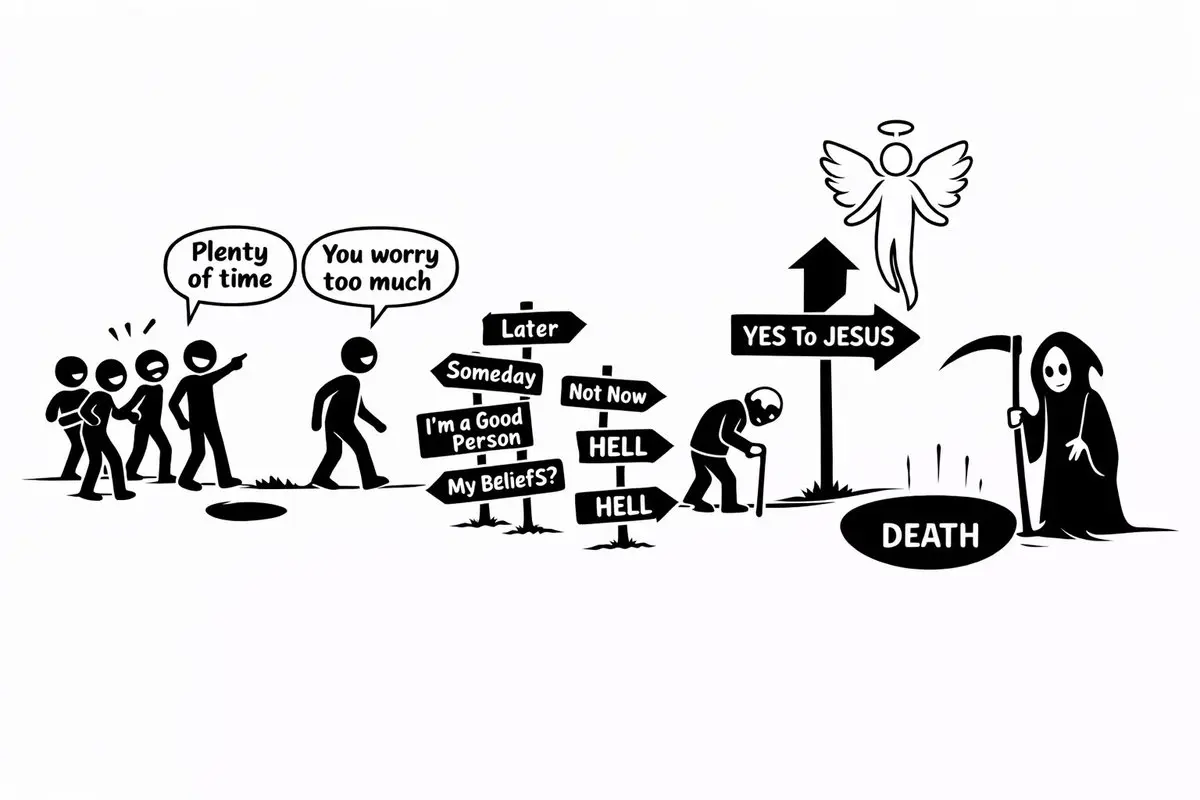

What are you waiting for?If something unexpected happened tomorrow, are you assured of where you’re going?

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More32.06K Popularity

43.09K Popularity

360.18K Popularity

37.11K Popularity

58.41K Popularity

Hot Gate Fun

View More- MC:$3.21KHolders:10.00%

- MC:$3.21KHolders:10.00%

- MC:$3.23KHolders:10.00%

- MC:$3.23KHolders:10.00%

- MC:$3.23KHolders:10.00%

News

View MoreCircle's USDC circulation decreased by 3.4 billion tokens within a week

1 h

Gate Research Institute: The market remains in defensive consolidation, with capital rotation shifting towards high-elasticity small-cap sectors

1 h

Huatai Macro: Wosh may promote the policy combination of "interest rate cuts + balance sheet reduction"

1 h

Santiment: The ongoing extreme panic in the crypto market is a "strong bullish" signal

1 h

Federal Reserve Chair Nominee Jerome Powell is revealed to have been involved in the Epstein case.

2 h

Pin