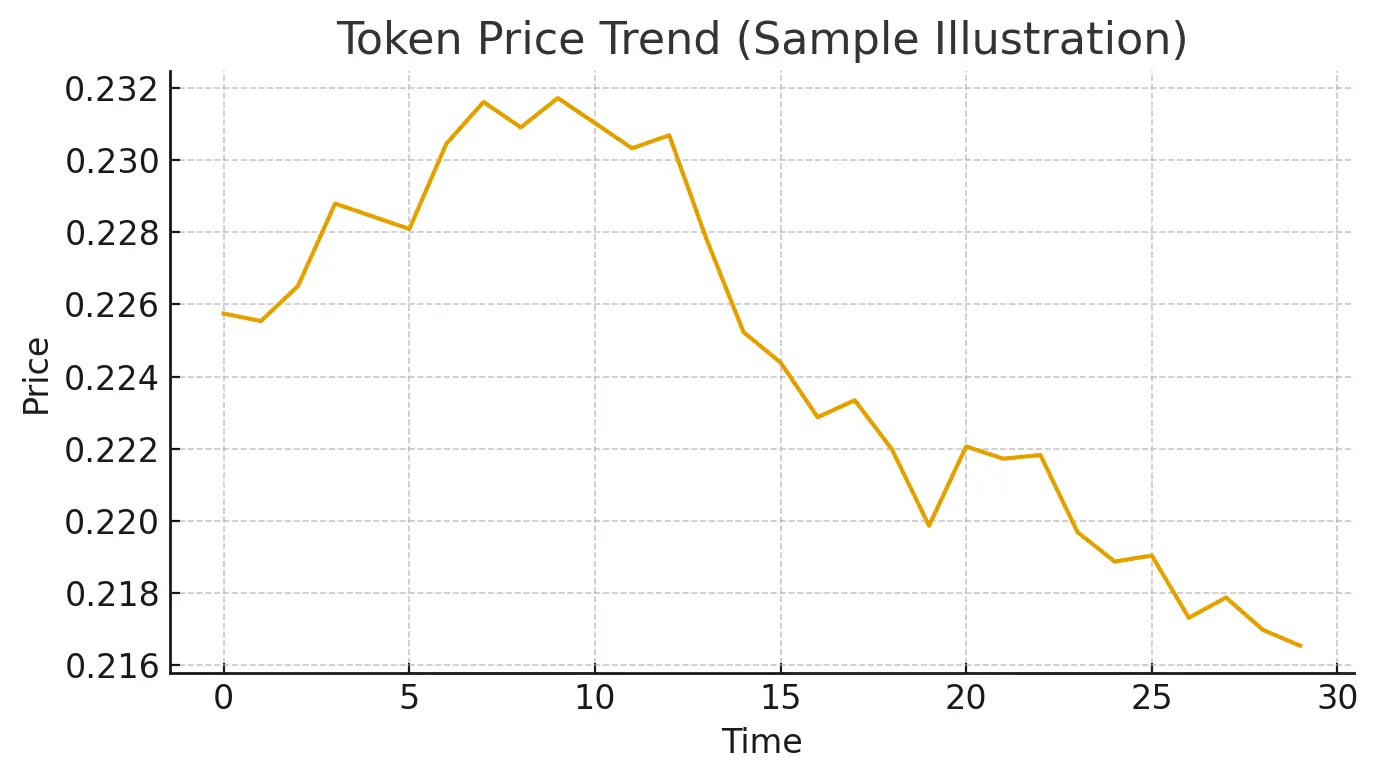

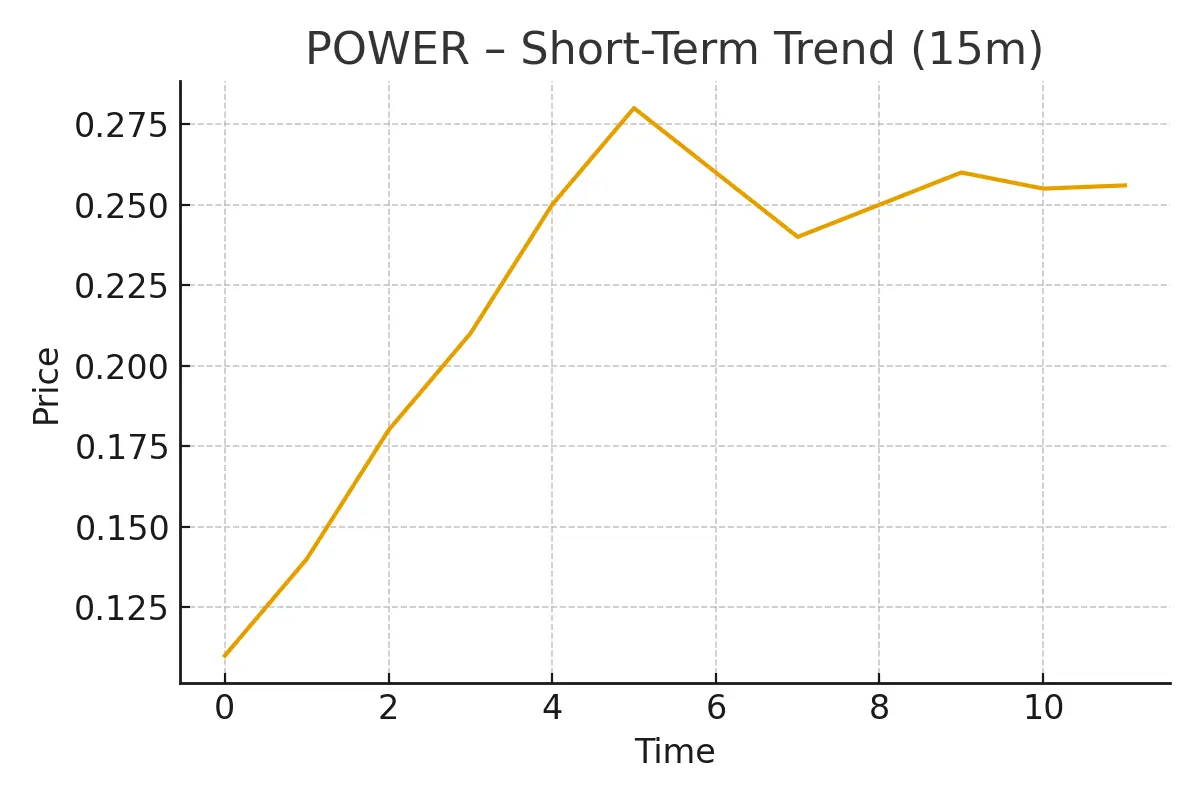

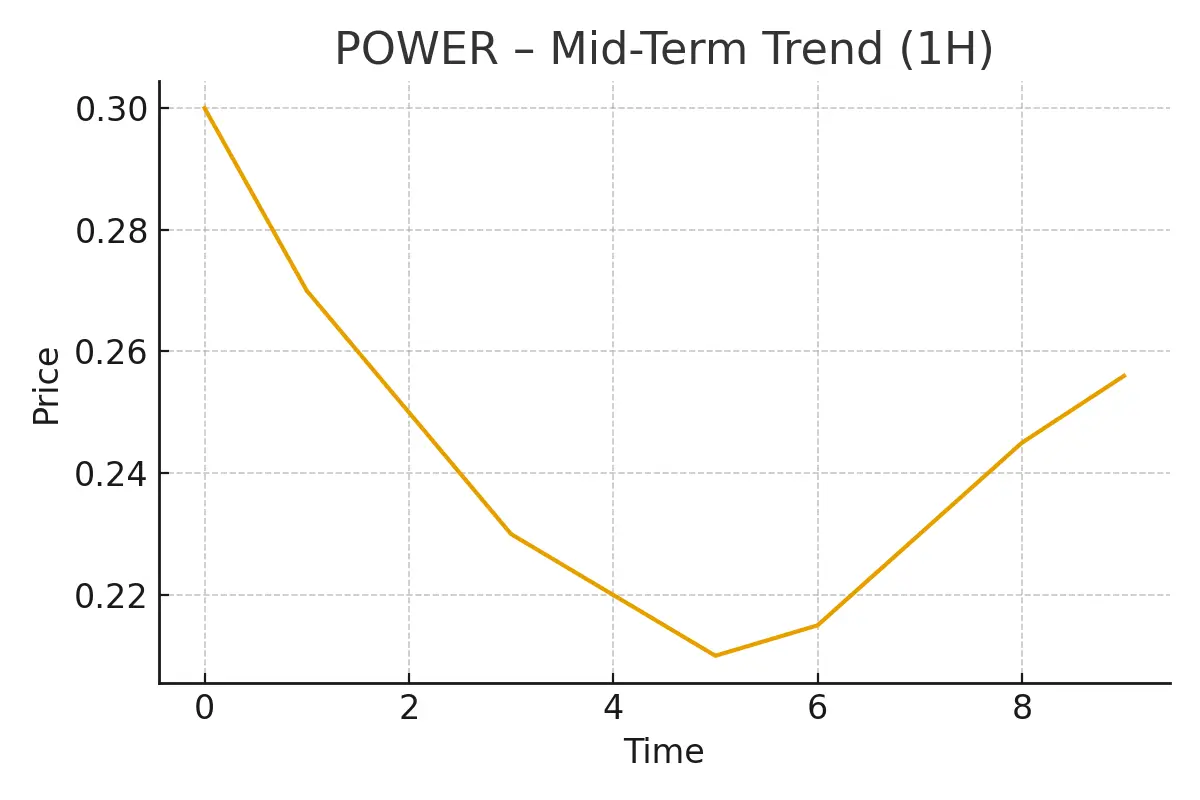

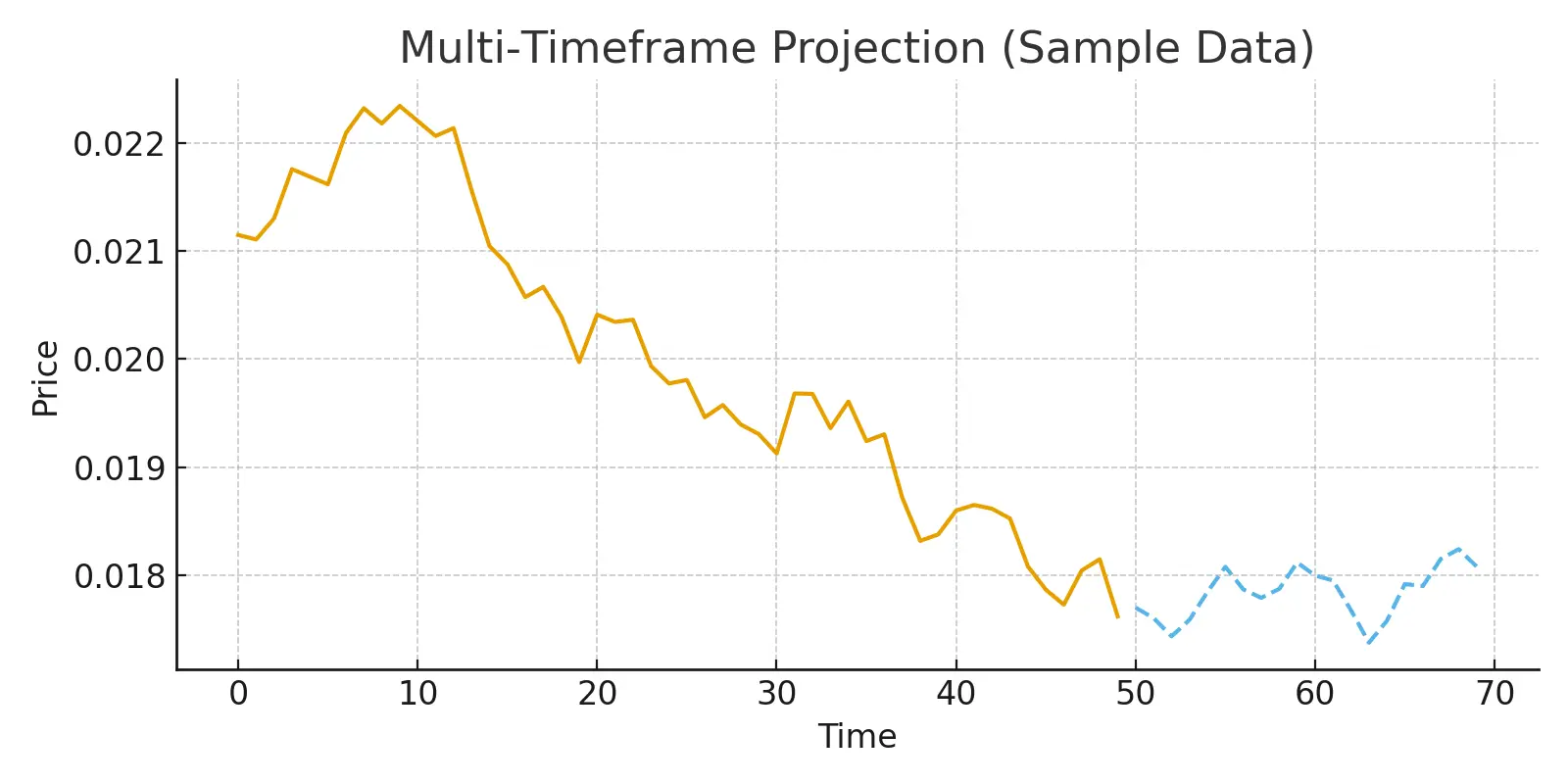

$PI Price dipped to ~0.218 after the last pullback, bounced to ~0.234 and is now trading near 0.222.

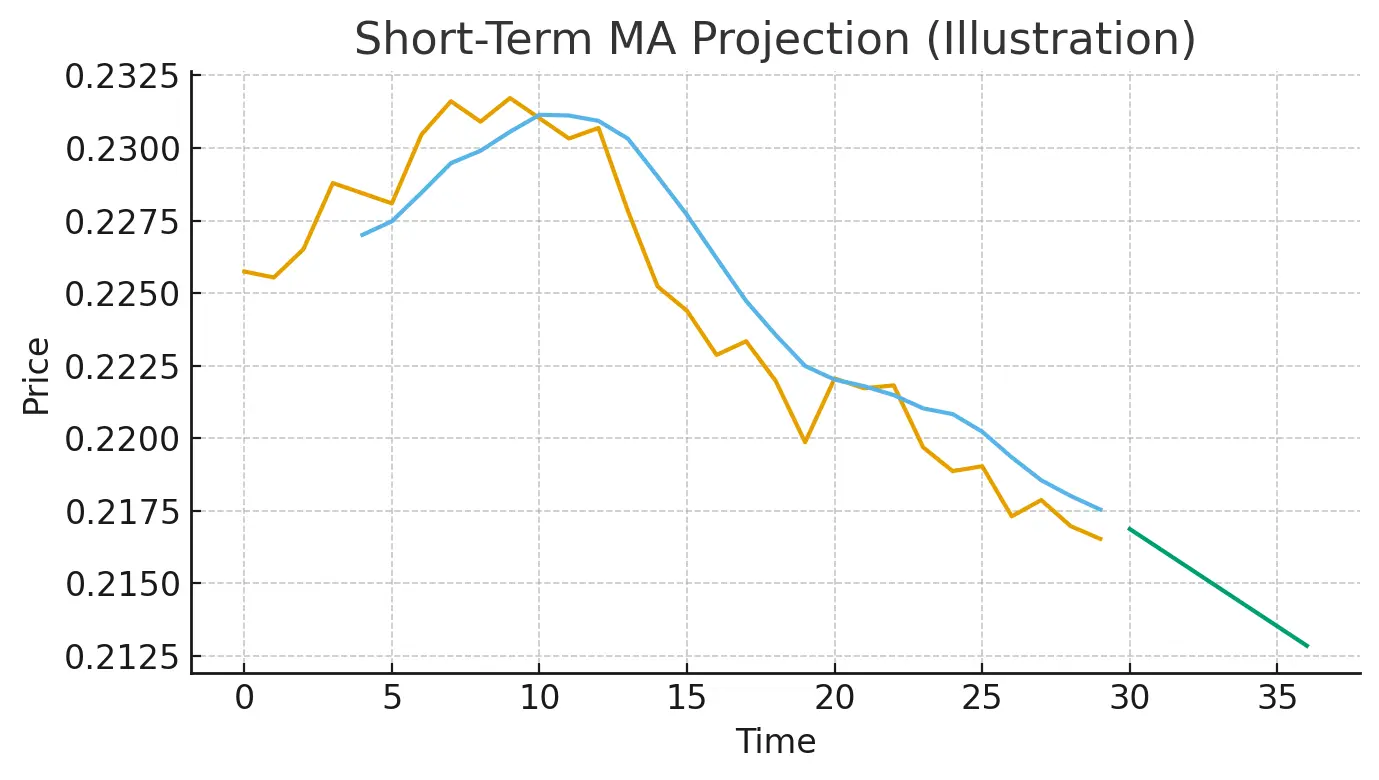

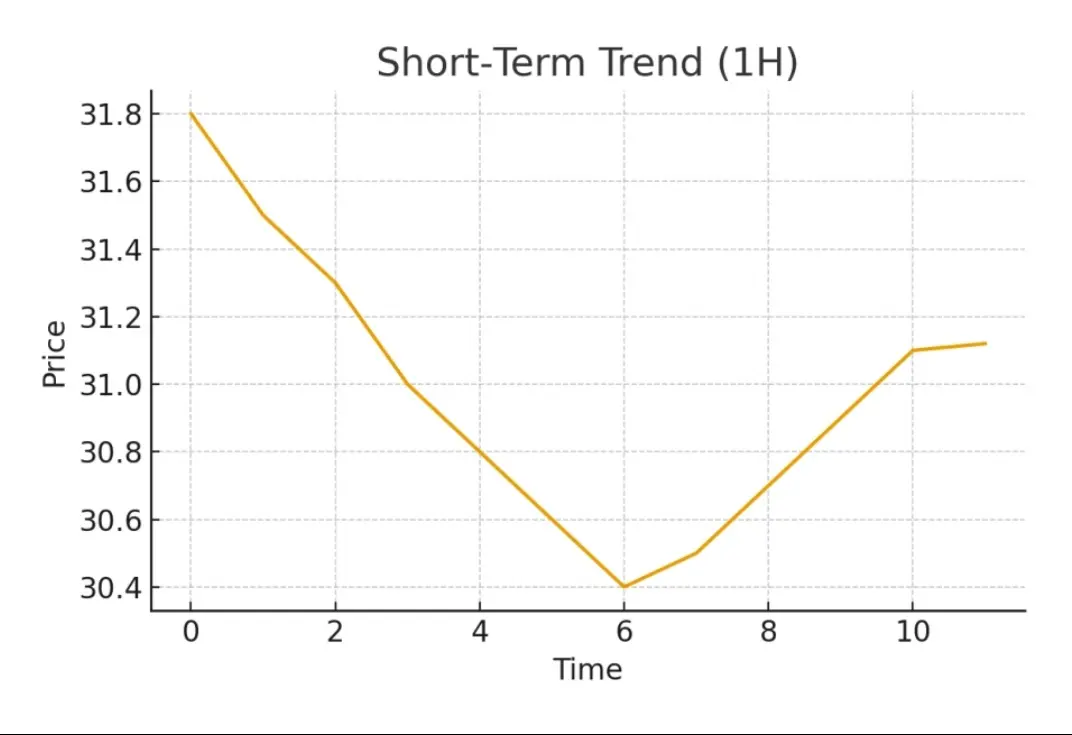

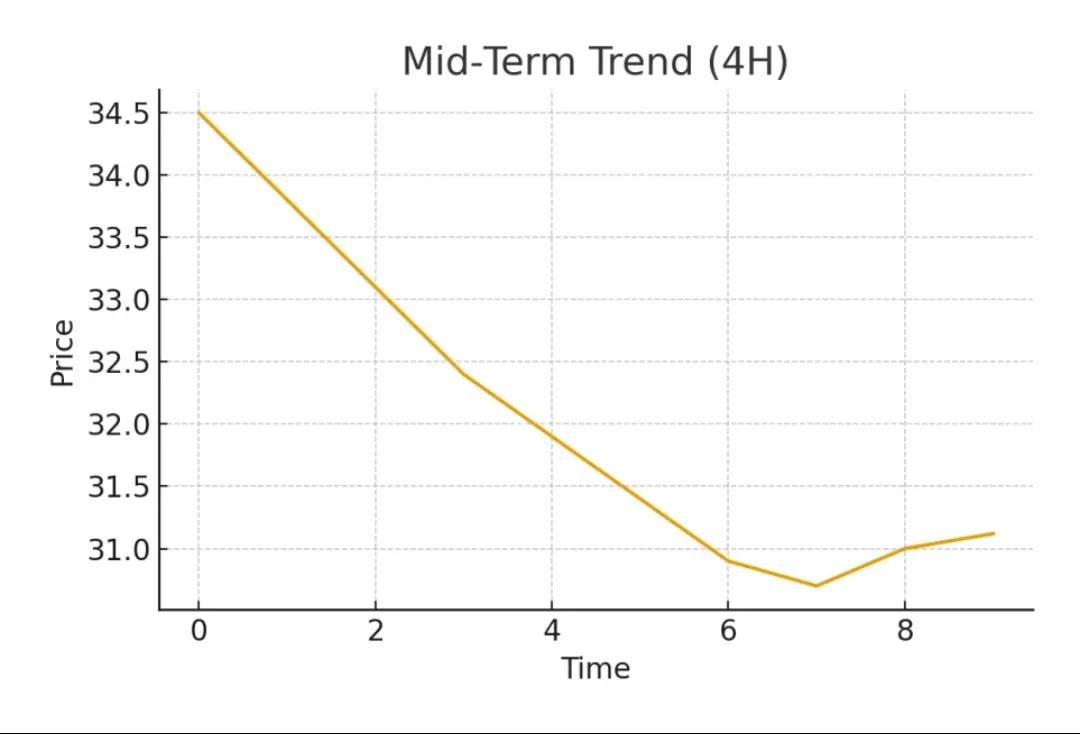

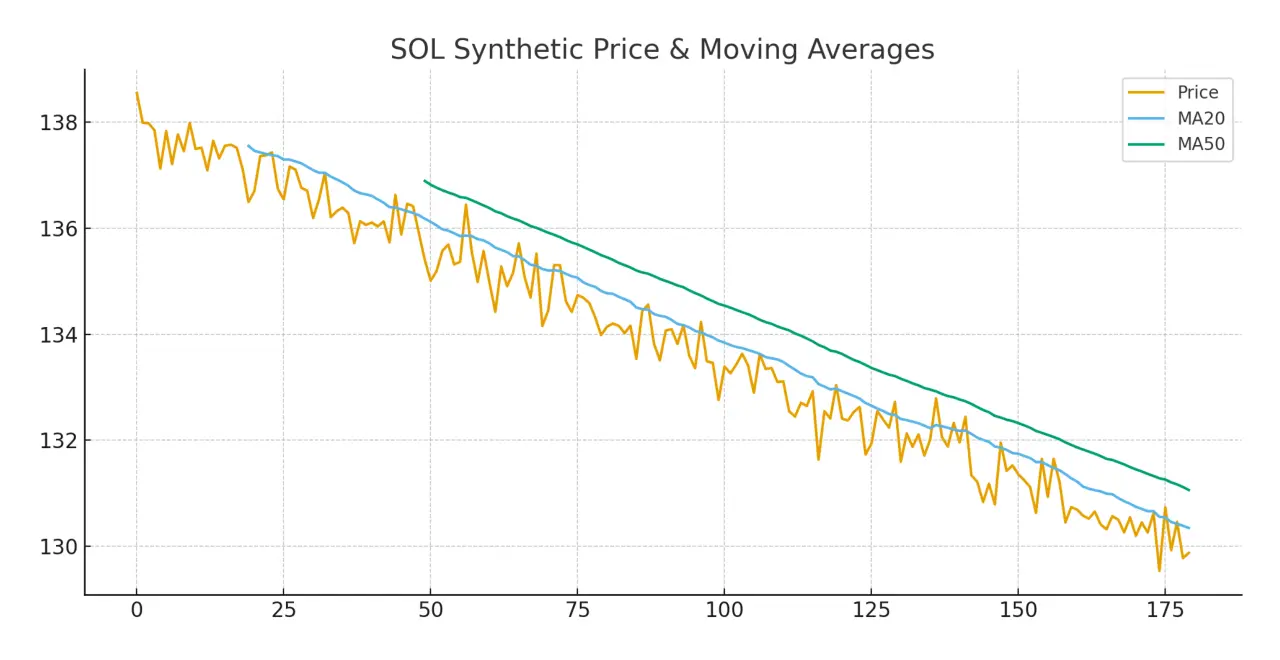

Short view: momentum is weak — watch the EMAs. If price holds above the EMA10 → small recovery likely to 0.226–0.230. If it closes below the 0.218 area again, another leg down is possible.

My view: small position, wait for clear confirmation or a clean retest. Not financial advice.

Short view: momentum is weak — watch the EMAs. If price holds above the EMA10 → small recovery likely to 0.226–0.230. If it closes below the 0.218 area again, another leg down is possible.

My view: small position, wait for clear confirmation or a clean retest. Not financial advice.

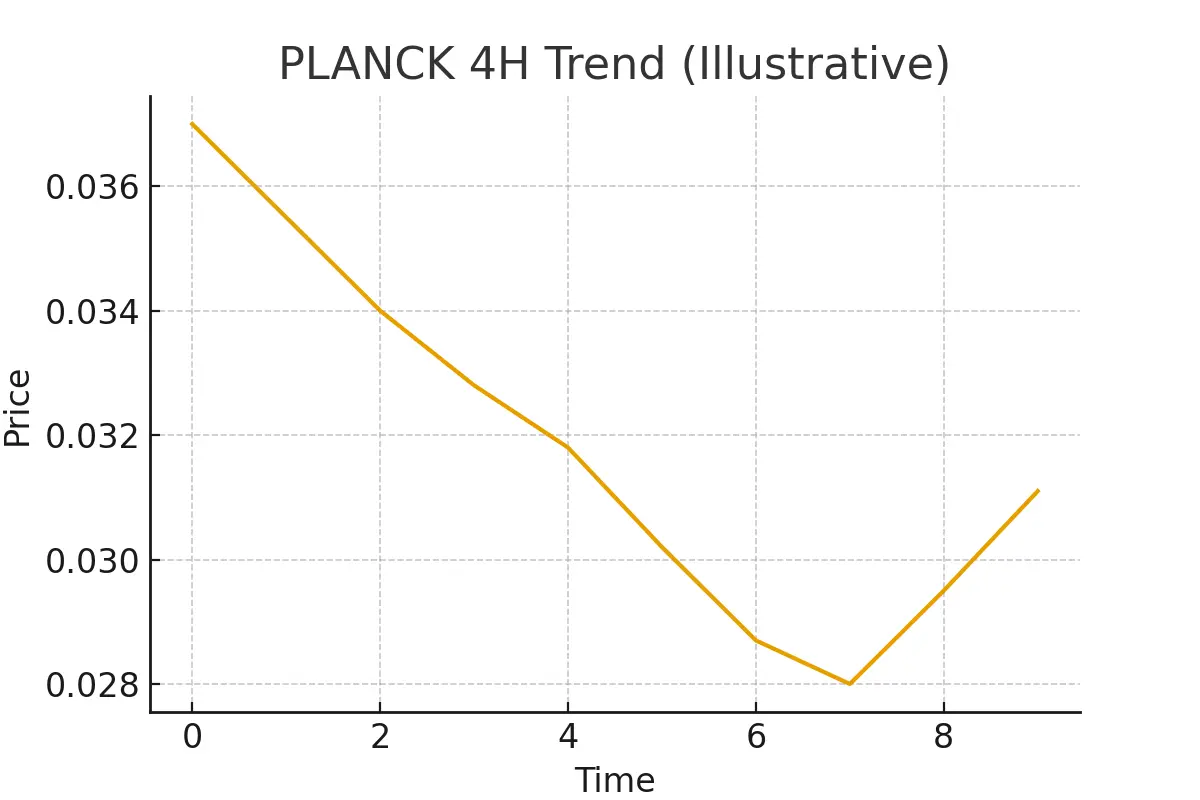

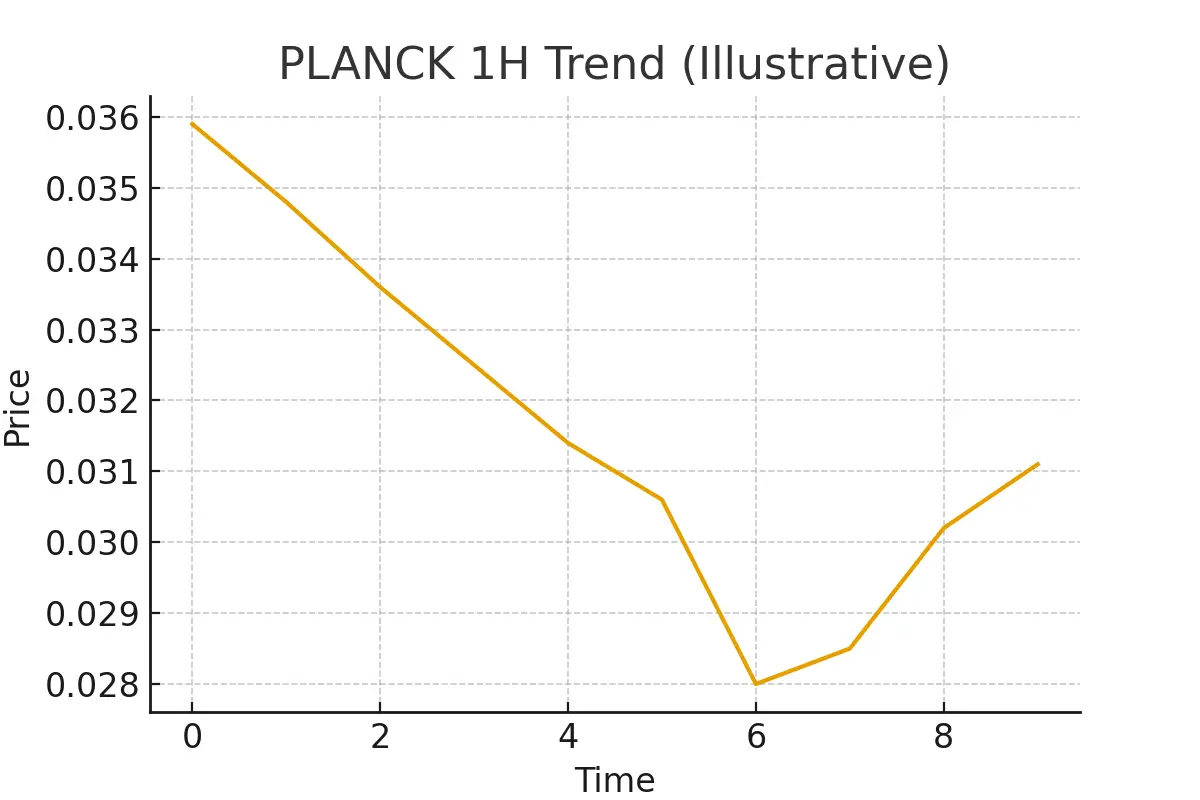

PI-4.06%