2025 AFC Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: AFC's Market Position and Investment Value

Arsenal Fan Token (AFC) serves as the official fan token of Arsenal Football Club, designed to strengthen the relationship between fans and the club while providing unique advantages such as participation in club decision-making processes and access to special discounts and rewards. As of December 2025, AFC has achieved a market capitalization of approximately $13.37 million, with a circulating supply of around 15.06 million tokens, currently trading at $0.3343 per token. This digital asset, recognized as a "fan engagement token," is playing an increasingly important role in enhancing fan participation and loyalty within the sports ecosystem.

This article will provide a comprehensive analysis of AFC's price trends from 2025 to 2030, incorporating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

Arsenal Fan Token (AFC) Market Analysis Report

I. AFC Price History Review and Current Market Status

AFC Historical Price Evolution Trajectory

- October 2021: Arsenal Fan Token reached its all-time high of $8.13, marking a peak in market enthusiasm for football-related digital assets.

- December 2025: The token has experienced significant depreciation, trading at $0.3343, representing a decline of approximately 58.13% over the past year.

- October 2025: AFC touched its lowest price point of $0.297579, reflecting sustained downward pressure in the market.

AFC Current Market Position

As of December 23, 2025, Arsenal Fan Token demonstrates the following market characteristics:

Price Performance:

- Current price: $0.3343

- 24-hour trading range: $0.327 to $0.3448

- 1-hour change: +0.69%

- 24-hour change: +0.18%

- 7-day change: -4.3%

- 30-day change: -11.21%

- Year-to-date change: -58.13%

Market Metrics:

- Market capitalization: $5,034,480.77

- Fully diluted valuation: $13,372,000.00

- Circulating supply: 15,059,769 AFC (37.65% of total supply)

- Total supply: 40,000,000 AFC

- 24-hour trading volume: $933,824.92

- Market dominance: 0.00042%

- Current market ranking: #1,525

Token Economics:

- Circulating supply ratio: 37.6494225%

- Available on 5 exchanges

- Deployed on CHZ2 blockchain network

The token currently exhibits modest short-term recovery potential with the 1-hour positive movement of 0.69%, though longer-term trends show persistent weakness across the 7-day, 30-day, and 1-year periods. The market sentiment remains bearish, as reflected in the extreme fear indicator reading.

Visit Arsenal Fan Token current market price on Gate.com

AFC Market Sentiment Index

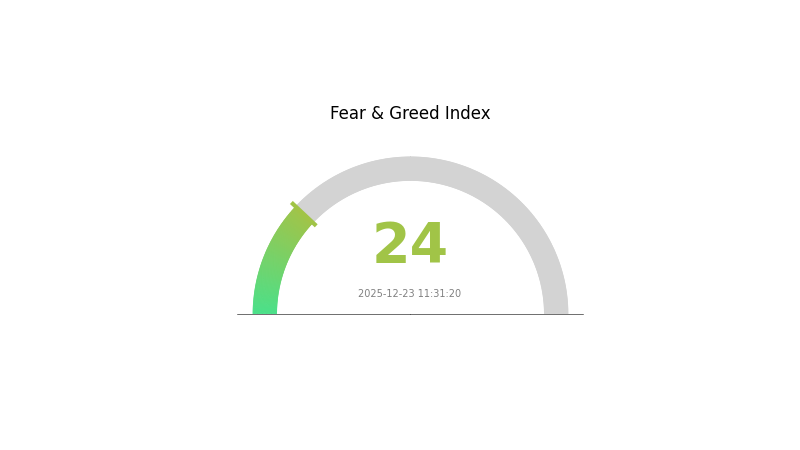

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the index dropping to 24. This indicates heightened market anxiety and pessimism among investors. During such extreme fear periods, many traders tend to panic sell, creating potential buying opportunities for contrarian investors. However, caution remains essential as market volatility typically increases in these conditions. Experienced investors often view extreme fear as a contrarian signal, though thorough analysis and risk management are crucial before making any trading decisions on Gate.com.

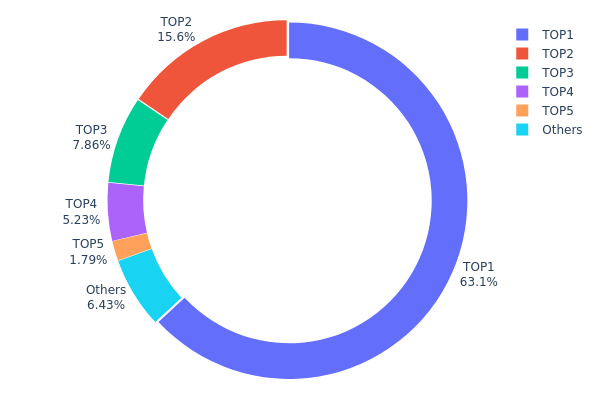

AFC Holdings Distribution

The address holdings distribution map illustrates the concentration of AFC tokens across different wallet addresses, providing critical insight into the token's decentralization status and potential market structure risks. By analyzing the top holders and their respective percentages, we can assess the degree of token concentration and evaluate whether the distribution presents systemic vulnerabilities to price manipulation or sudden liquidity events.

The current AFC holdings data reveals a highly concentrated distribution pattern, with the top holder commanding 63.10% of total supply. This level of concentration significantly exceeds healthy decentralization benchmarks. The top five addresses collectively control 93.57% of all tokens in circulation, leaving only 6.43% distributed among other holders. Such extreme concentration introduces substantial risk to market stability, as the actions of a small number of wallet addresses could potentially trigger significant price volatility. The second and third largest holders maintain positions of 15.59% and 7.86% respectively, further emphasizing the dominance of institutional or large individual stakeholders.

This distribution pattern reflects a market structure where price stability and token utility are heavily dependent on the behavior of a limited number of major stakeholders. The pronounced concentration suggests that AFC may still be in an early development phase or that significant token allocation remains concentrated among early investors or protocol developers. From a market microstructure perspective, such concentration elevates the risk of sudden sell-offs or strategic accumulation by dominant holders, potentially creating conditions for price manipulation. For long-term viability and ecosystem resilience, a gradual shift toward more equitable distribution would be beneficial for establishing genuine market-driven price discovery and reducing systemic vulnerability to single-actor decisions.

Click to view current AFC holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6F45...41a33D | 25240.23K | 63.10% |

| 2 | 0xc80A...e92416 | 6236.13K | 15.59% |

| 3 | 0xc368...816880 | 3142.45K | 7.86% |

| 4 | 0x76eC...78Fbd3 | 2092.50K | 5.23% |

| 5 | 0xb334...66e1eF | 717.66K | 1.79% |

| - | Others | 2571.03K | 6.43% |

II. Core Factors Affecting AFC's Future Price

Supply Mechanism

-

Supply and Demand Balance: Supply-demand equilibrium is the key factor determining AFC's price movements. Market balance directly influences pricing levels and volatility.

-

Cost Structure: Production and operational costs significantly impact AFC's market pricing. These costs form the foundation for determining market valuation and investment returns.

Macro Economic Environment

- Market Demand and Trends: Market demand and technology development serve as critical growth drivers. Investors need to monitor market trends and policy changes to assess future price movements.

III. AFC Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.2469-$0.2800

- Neutral Forecast: $0.3000-$0.3336

- Optimistic Forecast: $0.3400-$0.3636 (requires positive market sentiment and ecosystem development acceleration)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with emerging bullish momentum, characterized by increasing institutional interest and ecosystem expansion

- Price Range Forecasts:

- 2026: $0.2684-$0.5125 (4% upside potential)

- 2027: $0.2368-$0.5210 (28% upside potential)

- 2028: $0.4520-$0.7089 (42% upside potential)

- Key Catalysts: Ecosystem partnerships, technological upgrades, broader cryptocurrency market recovery, increased adoption in decentralized finance applications, and strategic integrations with major platforms like Gate.com

2029-2030 Long-term Outlook

- Base Case: $0.3139-$0.8292 by 2029 and $0.6255-$0.8529 by 2030 (assumes steady institutional adoption and market maturation)

- Optimistic Scenario: $0.8292-$0.9500 range by 2029 (presumes accelerated mainstream adoption and breakthrough partnerships)

- Transformational Scenario: $1.0000+ by 2030 (requires paradigm shift in cryptocurrency valuation, major enterprise adoption, and significant macroeconomic tailwinds)

- 2030-12-31: AFC reaching 112% cumulative gain from 2025 levels (reflecting sustained growth trajectory and market capitalization expansion)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.36362 | 0.3336 | 0.24686 | 0 |

| 2026 | 0.51246 | 0.34861 | 0.26843 | 4 |

| 2027 | 0.52095 | 0.43054 | 0.23679 | 28 |

| 2028 | 0.70886 | 0.47574 | 0.45195 | 42 |

| 2029 | 0.82922 | 0.5923 | 0.31392 | 77 |

| 2030 | 0.85291 | 0.71076 | 0.62547 | 112 |

Arsenal Fan Token (AFC) Professional Analysis Report

I. Arsenal Fan Token Overview

Basic Information

Arsenal Fan Token (AFC) is the official fan token of Arsenal Football Club, designed to strengthen the relationship between fans and the club. As a digital asset, AFC provides fans with unique advantages including participation in club decision-making processes and access to special discounts and exclusive rewards.

Key Metrics (As of December 23, 2025):

| Metric | Value |

|---|---|

| Current Price | $0.3343 |

| 24H Change | +0.18% |

| Market Capitalization | $5,034,480.78 |

| Fully Diluted Valuation | $13,372,000.00 |

| Circulating Supply | 15,059,769 AFC |

| Total Supply | 40,000,000 AFC |

| 24H Trading Volume | $933,824.92 |

| Market Ranking | #1,525 |

Price Performance

Historical Price Metrics:

- All-Time High: $8.13 (October 27, 2021)

- All-Time Low: $0.297579 (October 11, 2025)

- Current Price vs. ATH: Down 95.88%

Price Trends:

- 1 Hour: +0.69%

- 24 Hours: +0.18%

- 7 Days: -4.3%

- 30 Days: -11.21%

- 1 Year: -58.13%

II. Market Analysis

Market Position

AFC currently ranks #1,525 among cryptocurrency assets with a market dominance of 0.00042%. The token maintains a market share of approximately 0.42% relative to the broader cryptocurrency market. With a circulating supply representing 37.65% of the total supply, the token shows moderate liquidity distribution.

Trading Activity

Trading is currently facilitated across 5 exchanges, with AFC available on Gate.com for trading pairs. The 24-hour trading volume of approximately $933,825 indicates moderate market activity relative to the token's market capitalization.

Supply Dynamics

The token operates under a fixed supply model with no additional inflation:

- Total Supply: 40,000,000 AFC (capped)

- Circulating Supply: 15,059,769 AFC (37.65% circulated)

- Remaining to Circulate: 24,940,231 AFC (62.35%)

This supply structure creates potential for future price impacts as additional tokens gradually enter circulation.

III. Utility and Use Cases

Fan Engagement Features

As an official fan token, AFC provides Arsenal supporters with:

-

Governance Participation: Fans holding AFC tokens can participate in club decision-making processes, enabling direct influence over certain club matters and initiatives.

-

Exclusive Benefits: Token holders gain access to special discounts, limited-edition merchandise, and exclusive rewards programs designed to reward loyal supporters.

-

Community Building: AFC facilitates stronger connections between fans and the club, creating a community-driven ecosystem around the Arsenal brand.

Platform Infrastructure

AFC operates on the CHZ2 blockchain network, utilizing the Chiliz ecosystem infrastructure designed specifically for sports fan tokens. The token's smart contract is verified and auditable on the blockchain explorer.

IV. AFC Professional Investment Strategy and Risk Management

AFC Investment Methodology

(1) Long-Term Investment Strategy

-

Suitable For: Retail investors with high risk tolerance and genuine interest in Arsenal Football Club; supporters seeking long-term exposure to the sports tokenization trend.

-

Operational Guidance:

- Accumulate tokens during price weakness periods, taking advantage of the significant discount from all-time highs to establish positions at favorable entry points.

- Maintain a multi-year holding horizon, recognizing that fan tokens represent an emerging asset class still in early adoption phases.

- Regularly review club performance and community engagement metrics as fundamental indicators supporting token value appreciation.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Monitor the current price zone around $0.33 as a near-term support level, with resistance potentially forming near recent highs.

- Volatility Indicators: Track 24-hour and 7-day price movements to identify short-term trading opportunities within the token's established trading range.

-

Wave Trading Key Points:

- Exploit the 95% discount from all-time highs, recognizing extreme valuation compression may present mean reversion opportunities.

- Scale positions gradually rather than all-at-once to manage position risk and capture multiple entry points.

AFC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of total cryptocurrency portfolio allocation to AFC, treating it as speculative exposure.

- Experienced Investors: 1-3% portfolio allocation, allowing for more active position management while maintaining risk discipline.

- Professional Investors: 2-5% allocation, with sophisticated hedging and rebalancing strategies to manage downside exposure.

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance AFC holdings with established cryptocurrencies and traditional assets to reduce overall portfolio concentration risk.

- Position Sizing: Limit individual AFC positions to a percentage of total capital that you can afford to lose completely without impacting financial stability.

(3) Secure Storage Solutions

- Custody Options: Use Gate.com's secure platform infrastructure for active trading positions, benefiting from professional-grade security protocols and insurance coverage.

- Security Best Practices: Enable all available security features including two-factor authentication, IP address whitelisting, and withdrawal address whitelists when storing tokens on exchange platforms.

- Critical Risk Alerts: Never share private keys or seed phrases; always verify website URLs before accessing exchange accounts; utilize hardware security keys when available for enhanced protection.

V. AFC Potential Risks and Challenges

Market Risks

- Extreme Valuation Compression: The token has declined 95.88% from its all-time high, reflecting significant loss of investor confidence and potential continued downward pressure if market sentiment doesn't recover.

- Liquidity Constraints: Daily trading volume of under $1 million relative to market capitalization indicates potential liquidity challenges when executing larger trades, with possible slippage on significant orders.

- Supply Overhang: With 62.35% of total supply still not circulating, future token releases could create significant downward price pressure as new supply enters the market.

Regulatory Risks

- Sports Token Regulatory Uncertainty: Fan tokens operate in an evolving regulatory landscape where regulators may implement new rules governing tokenization of sports intellectual property, potentially impacting token utility and value.

- Gambling and Youth Protection Concerns: Regulatory scrutiny focused on protecting minors from cryptocurrency exposure could limit fan token marketing and distribution in certain jurisdictions.

- Jurisdiction-Specific Restrictions: Different countries maintain varying regulatory frameworks for crypto assets, potentially restricting AFC trading access or utility in specific regions.

Technical Risks

- Smart Contract Vulnerabilities: Any undiscovered vulnerabilities in the AFC smart contract infrastructure could impact token functionality or user fund security.

- Blockchain Infrastructure Dependencies: AFC relies on the Chiliz ecosystem infrastructure; any issues with the CHZ2 network could disrupt token operations and trading.

- Adoption and Network Effects: Declining user engagement with the fan token ecosystem could undermine the value proposition if the community supporting AFC participation deteriorates.

VI. Conclusion and Action Recommendations

AFC Investment Value Assessment

Arsenal Fan Token represents an emerging asset class at a critical juncture following a severe valuation correction. While the 95%+ discount from all-time highs presents potential mean reversion opportunities for risk-tolerant investors, significant headwinds persist including supply dynamics, market sentiment deterioration, and regulatory uncertainty. AFC's primary value proposition depends on sustained fan engagement and successful integration of club governance mechanisms. Long-term viability remains uncertain, making this a high-risk, speculative investment requiring conviction in both Arsenal's brand strength and the broader sports tokenization trend.

AFC Investment Recommendations

✅ Beginners: Treat AFC as a small, speculative allocation (under 1% of crypto portfolio) only if you possess genuine interest in Arsenal Football Club and understand crypto volatility; prioritize education over accumulation.

✅ Experienced Investors: Consider tactical accumulation during significant weakness, implementing defined entry and exit strategies; maintain strict position sizing discipline and utilize stop-loss orders to manage downside risk on Gate.com.

✅ Institutional Investors: Conduct thorough due diligence on sports tokenization market dynamics and regulatory trends before considering AFC exposure; if allocating capital, implement formal risk governance frameworks and maintain diversification across multiple fan token projects.

AFC Trading Participation Methods

- Gate.com Direct Trading: Access AFC trading pairs directly on Gate.com's platform, benefiting from competitive fees and professional trading infrastructure; recommended for most investors.

- Limit Orders Strategy: Utilize Gate.com's advanced order types to establish positions at predetermined price levels without requiring real-time market monitoring.

- Portfolio Tracking: Monitor AFC holdings alongside other crypto assets using Gate.com's portfolio management tools to track allocation percentages and performance metrics.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial circumstances. Always consult with qualified financial advisors before making investment decisions. Never invest capital you cannot afford to lose completely.

FAQ

Is AFC Energy a good buy?

AFC Energy is rated as a Strong Buy by analysts, indicating strong growth potential. With positive market sentiment and development momentum, it presents a compelling investment opportunity for crypto enthusiasts.

What is the price forecast for AFC Energy?

The average 12-month price forecast for AFC Energy is 26.324, with estimates ranging from 22.647 to 30 based on analyst projections.

What is happening to AFC Energy?

AFC Energy reported FY 2024 financial results and continues advancing hydrogen power generation technologies. The company is actively developing fuel cell solutions for clean energy applications globally.

Aergo Price Analysis: 112% Surge in 90 Days - What's Next for 2025?

What Is Driving AIA's Price Volatility in 2025?

What Are the Key Market Metrics for Crypto in 2025?

What Are the Key Metrics Driving the Crypto Market in 2025?

How Has the Crypto Market Volatility Affected Price Movements in 2025?

Is Unizen (ZCX) a good investment?: Analyzing the potential and risks of this emerging hybrid exchange token

Ethereum Surges Past 4,300 USDT Amidst Impressive Daily Growth

Security Issues Highlighted in Cryptocurrency Hardware Wallets After Multi-Million Dollar Theft

Pi Network News: Potential Listing Model for Pi Coin

A Professional’s Guide to Purchasing Ondo (ONDO) in Brazil

What is DIAM: A Comprehensive Guide to Direct Imaging and Multiwavelength Analysis