2025 AVAAI Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of AVAAI

AVAAI (AVA) stands as the first flagship AI agent launched through Holoworld AI, a launchpad platform designed to create audiovisual AI agents that come to life over video. Since its launch in November 2024, AVAAI has established itself as an innovative player in the AI agent ecosystem. As of December 2025, AVAAI's market capitalization has reached approximately $9.99 million, with a circulating supply of about 999.21 million tokens, maintaining a price around $0.009994. This asset, which bridges artificial intelligence with creative digital avatars, is playing an increasingly important role in the Web3 and AI convergence sector, supported by notable backers including Polychain and Nascent.

This article will provide a comprehensive analysis of AVAAI's price trends and market dynamics through 2030, integrating historical price patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

I. AVAAI Price History Review and Current Market Status

AVAAI Historical Price Evolution Trajectory

- January 15, 2025: AVAAI reached its all-time high of $0.338, marking the peak of its price performance since launch.

- October 10, 2025: The token hit its all-time low of $0.00339, representing a significant correction from previous highs.

- December 22, 2025: Current trading price stands at $0.009994, showing a recovery trend from the year-low but still down 29.54% on a one-year basis.

AVAAI Current Market Conditions

AVAAI is currently trading at $0.009994, with a 24-hour trading volume of $651,224.21. The token has experienced a 5.87% decline over the last 24 hours, though it has demonstrated stronger performance on a weekly basis with a 20.9% gain over the past 7 days and a 3.93% increase over the past 30 days.

The token maintains a market capitalization of approximately $9.99 million with a fully diluted valuation matching this figure, indicating that 99.92% of the maximum supply of 1 billion tokens is already in circulation. With 48,687 unique holders and presence on the Solana blockchain, AVAAI maintains a market dominance of 0.00031%.

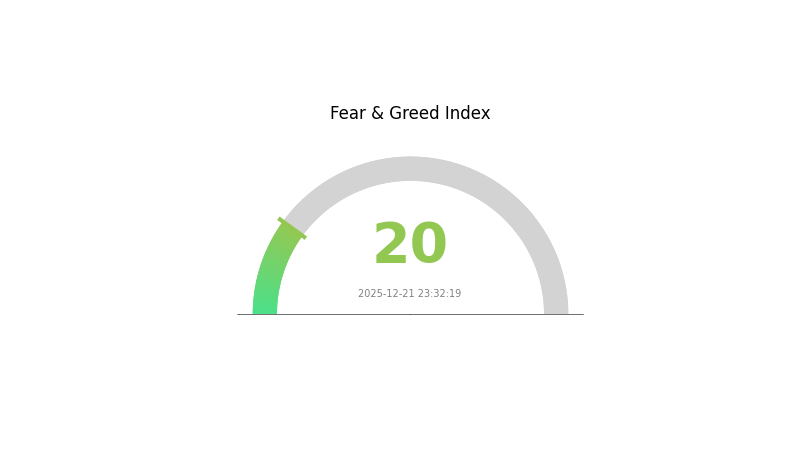

The market sentiment indicator shows extreme fear conditions as of December 21, 2025, reflecting broader market uncertainty. Despite this, the token has shown resilience with a notable recovery from its October lows, demonstrating some positive momentum in recent weeks.

Visit AVAAI Market Price on Gate.com for real-time price updates

AVAAI Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear with the Fear and Greed Index dropping to 20. This indicates heightened market anxiety and pessimistic sentiment among investors. During such periods of extreme fear, opportunities often emerge for long-term investors who maintain a rational approach. Market downturns can present favorable entry points for those with conviction in blockchain technology fundamentals. However, traders should exercise caution, manage risk prudently, and avoid making emotional decisions. Monitor market conditions closely on Gate.com for real-time data and insights to navigate this volatile environment effectively.

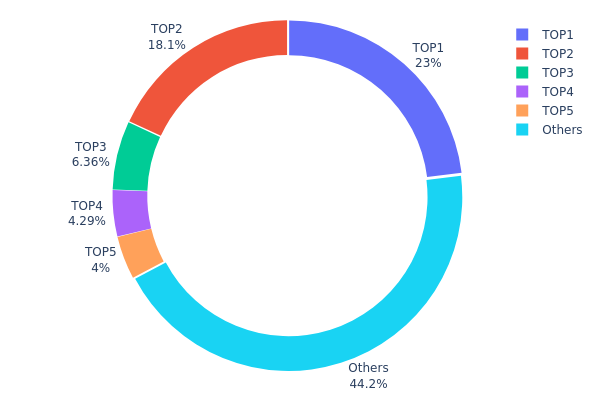

AVAAI Holdings Distribution

Address holdings distribution maps represent the concentration of token ownership across different wallet addresses on the blockchain. This metric provides critical insights into the tokenomics structure, ownership concentration, and potential market manipulation risks. By analyzing how AVAAI tokens are distributed among top holders versus the broader market participants, we can assess the degree of decentralization and the stability of the asset's on-chain ecosystem.

The current AVAAI holdings distribution exhibits moderate concentration characteristics. The top five addresses collectively control 55.8% of the total token supply, with the leading address holding 23.03% and the second-largest holder maintaining 18.12%. This bipolar concentration pattern indicates that significant decision-making power is concentrated among a limited number of entities. However, the "Others" category accounts for 44.2% of holdings, suggesting that nearly half of AVAAI's circulating supply is distributed across numerous smaller addresses, which partially mitigates concerns about extreme centralization.

The concentration dynamics present a nuanced risk profile for market participants. While the top holders' combined stake exceeds 55%, the absence of a single dominant address holding more than 25% reduces the immediate risk of unilateral price manipulation through coordinated large-scale liquidations. The distribution pattern suggests a market structure where institutional or early-stage stakeholders maintain significant influence, yet sufficient token fragmentation exists among retail participants to create meaningful price discovery mechanisms. This composition reflects a transitional phase typical of mid-cap digital assets, where the market has achieved partial decentralization but remains vulnerable to coordinated actions by the largest holders.

Access current AVAAI Holdings Distribution on Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | u6PJ8D...ynXq2w | 230119.25K | 23.03% |

| 2 | 2iwfzt...VLtRhr | 181127.47K | 18.12% |

| 3 | 5Q544f...pge4j1 | 63570.60K | 6.36% |

| 4 | 9ZPsRW...ZgE4Y4 | 42885.89K | 4.29% |

| 5 | AGVhmr...gHAk8N | 40000.00K | 4.00% |

| - | Others | 441503.83K | 44.2% |

II. Core Factors Affecting AVAAI's Future Price

Market Sentiment and Trading Volume

-

Market Sentiment Impact: AVAAI's price is significantly influenced by overall market sentiment and trading volume. Short-term price volatility can be substantial, with the market experiencing sharp fluctuations driven by buyer and seller dynamics.

-

Price Volatility Patterns: Recent market data indicates significant price swings, reflecting strong market competition and the speculative nature of emerging AI tokens.

Macroeconomic Environment

-

Monetary Policy Impact: Broader macroeconomic conditions, including interest rate changes and liquidity cycles, play a crucial role in determining AVAAI's price trajectory. Shifts in global monetary policy can influence investor risk appetite and cryptocurrency valuations.

-

Supply and Demand Dynamics: Price movements are fundamentally driven by supply and demand relationships, with trading volume and price momentum serving as key indicators for understanding market direction.

Technology Development and Ecosystem Expansion

-

User Adoption Trends: AVAAI's price is sensitive to technology development progress and user adoption rates within its ecosystem. Growth in the number of active users and expanding use cases support positive price momentum.

-

Ecosystem Expansion: Market competition and ecosystem development are critical factors influencing long-term value. As the platform expands its applications and attracts more participants, this directly impacts price expectations and market capitalization growth.

III. 2025-2030 AVAAI Price Forecast

2025 Outlook

- Conservative Forecast: $0.00507 - $0.00994

- Base Case Forecast: $0.00994

- Optimistic Forecast: $0.01113 (requires positive market sentiment and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Consolidation and gradual accumulation phase with moderate growth trajectory

- Price Range Predictions:

- 2026: $0.00642 - $0.01453

- 2027: $0.00702 - $0.01491

- 2028: $0.01139 - $0.01880

- Key Catalysts: Ecosystem development maturation, institutional interest, technological upgrades, and integration with major platforms including Gate.com

2029-2030 Long-term Outlook

- Base Case Scenario: $0.01122 - $0.02000 (assuming steady market development and stable macroeconomic conditions)

- Optimistic Scenario: $0.01269 - $0.02122 (assumes accelerated adoption, successful protocol upgrades, and positive regulatory environment)

- Transformational Scenario: Above $0.02122 (requires breakthrough technological innovation, mainstream institutional adoption, and favorable global crypto market dynamics)

- 2030-12-31: AVAAI approaches $0.02122 as projected (cumulative appreciation of approximately 81% from 2025 levels, reflecting sustained growth momentum)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01113 | 0.00994 | 0.00507 | 0 |

| 2026 | 0.01453 | 0.01053 | 0.00642 | 5 |

| 2027 | 0.01491 | 0.01253 | 0.00702 | 25 |

| 2028 | 0.0188 | 0.01372 | 0.01139 | 37 |

| 2029 | 0.02 | 0.01626 | 0.01122 | 62 |

| 2030 | 0.02122 | 0.01813 | 0.01269 | 81 |

AVA (AVAAI) Investment Strategy and Risk Management Report

Overview

AVA is the flagship AI agent launched through Holoworld AI, a launchpad platform for creating audiovisual AI agents. As of December 22, 2025, AVA trades at $0.009994 with a market capitalization of approximately $9.99 million, ranking 1,176 in the cryptocurrency market.

Key Metrics:

- Current Price: $0.009994

- 24H Change: -5.87%

- 7D Change: +20.9%

- All-Time High: $0.338 (January 15, 2025)

- All-Time Low: $0.00339 (October 10, 2025)

- Circulating Supply: 999,207,048 AVA

- Total Supply: 999,943,931 AVA

- Holders: 48,687

IV. AVA Professional Investment Strategy and Risk Management

AVA Investment Methodology

(1) Long-Term Holding Strategy

-

Target Investors: Believers in AI agent technology, supporters of the Holoworld ecosystem, and investors with extended investment horizons.

-

Operational Recommendations:

- Accumulate during market downturns, particularly when 24-hour volatility exceeds 10% in the negative direction.

- Dollar-cost averaging (DCA) approach: allocate fixed amounts at regular intervals to reduce timing risk.

- Hold through market cycles, particularly given AVA's position as a flagship AI agent with institutional backing from Polychain and Nascent.

-

Storage Approach:

- Utilize Gate.com Web3 Wallet for secure non-custodial storage with built-in security features.

- For significant holdings, implement cold storage solutions with hardware security protocols.

- Enable two-factor authentication and withdrawal whitelisting on all exchange accounts.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Relative Strength Index (RSI): Monitor overbought conditions above 70 and oversold conditions below 30; current price action shows moderate conditions.

- Moving Averages: Track 20-day and 50-day moving averages to identify trend reversal signals; recent 7-day +20.9% gain suggests bullish momentum.

-

Wave Trading Key Points:

- Capitalize on the observed volatility pattern: 24-hour decline of -5.87% presents potential entry opportunities.

- Set profit-taking targets at resistance levels near recent highs of $0.011045.

- Implement stop-loss orders at 2% below entry points to manage downside risk.

AVA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total portfolio allocation; focus on long-term position building with minimal active trading.

- Aggressive Investors: 3-8% of total portfolio allocation; participate in both long-term holding and tactical trading opportunities.

- Professional Investors: 5-15% of total portfolio allocation; implement sophisticated hedging strategies and advanced trading tactics.

(2) Risk Hedging Solutions

- Volatility Hedging: Monitor the significant price history (from $0.00339 to $0.338) indicating extreme volatility; maintain diversified holdings across multiple AI-related projects to distribute exposure.

- Correlation Management: Given AVA's Solana-based architecture, balance SOL exposure to prevent concentration risk; consider uncorrelated asset classes in your broader portfolio.

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate.com Web3 Wallet provides secure, user-friendly management with integrated exchange connectivity for seamless trading.

- Cold Storage Approach: For significant holdings exceeding your monthly trading volume, transfer to offline storage with multi-signature security protocols.

- Security Considerations: Never share private keys or seed phrases; verify contract addresses before token transfers (verified AVA contract: DKu9kykSfbN5LBfFXtNNDPaX35o4Fv6vJ9FKk7pZpump on Solana); regularly update security protocols and monitor wallet activity.

V. AVA Potential Risks and Challenges

AVA Market Risks

- High Volatility: AVA exhibits extreme price volatility with a range from $0.00339 to $0.338, representing a 99x fluctuation. This creates substantial liquidation risk for leveraged positions and significant drawdown potential for long-term holders.

- Liquidity Constraints: Current 24-hour trading volume of $651,224 is relatively modest for the market capitalization, potentially creating slippage during large orders and difficulty exiting positions during market stress.

- Market Sentiment Dependency: As an AI agent token with limited real-world utility metrics, AVA is highly susceptible to sentiment shifts, influencer commentary, and broader cryptocurrency market movements.

AVA Regulatory Risks

- Token Classification Uncertainty: Regulatory agencies globally have not provided definitive guidance on AI agent tokens; potential reclassification as securities could trigger significant legal and operational challenges.

- Compliance Evolution: Emerging regulations in major jurisdictions (EU, US, Singapore) may impose stricter requirements on AI-related token projects, potentially affecting trading availability on exchanges including Gate.com.

AVA Technology Risks

- Platform Dependency: AVA operates on the Solana blockchain; network congestion, technical failures, or blockchain-level issues could impact token transferability and trading functionality.

- Ecosystem Concentration: Heavy reliance on Holoworld AI ecosystem success means project challenges would directly impact AVA token utility and adoption.

VI. Conclusion and Action Recommendations

AVA Investment Value Assessment

AVA represents a speculative investment in the emerging AI agent technology sector. The project benefits from notable institutional backing (Polychain, Nascent) and partnerships with established brands (Milady, Pudgy Penguins, L'Oreal). However, the extreme volatility (-29.54% annually), significant price decline from all-time highs (97%), and limited trading liquidity present substantial risks. The token's value proposition depends heavily on Holoworld AI's successful execution in creating commercially viable audiovisual AI agents. Investors should approach this as a high-risk, speculative position requiring careful position sizing and risk management.

AVA Investment Recommendations

✅ Beginners: Start with micro-positions (0.5-1% of crypto portfolio) through Gate.com's user-friendly interface. Use dollar-cost averaging over 3-6 months to build familiarity with the project while minimizing timing risk. Monitor project developments on official channels (@AVA_holo Twitter) before increasing exposure.

✅ Experienced Investors: Implement tactical trading strategies exploiting the observed volatility patterns (current -5.87% 24H decline suggests potential reversal opportunities). Combine 70% long-term holding with 30% active trading allocation. Use technical indicators to time entry and exit points around resistance ($0.011045) and support levels.

✅ Institutional Investors: Conduct comprehensive due diligence on Holoworld AI's commercial partnerships and revenue generation models. Allocate appropriate portfolio exposure (5-15%) based on AI sector thesis. Establish direct communication with project teams regarding development roadmap, tokenomics sustainability, and long-term utility expansion plans.

AVA Trading Participation Methods

- Exchange Trading: Access AVA through Gate.com with professional-grade trading tools, advanced order types, and reliable liquidity. Utilize margin trading capabilities with strict risk management protocols.

- Direct Blockchain Interaction: Transfer AVA directly via Solana blockchain to personal wallets (contract: DKu9kykSfbN5LBfFXtNNDPaX35o4Fv6vJ9FKk7pZpump) for long-term holding with full custody control.

- Community Engagement: Participate in the Holoworld AI ecosystem through official Telegram channel (https://t.me/AvaAIonSol) and Twitter (@AVA_holo) to stay informed on developments, partnerships, and potential use case expansions.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose completely.

FAQ

What is the price prediction for Avaai coin in 2030?

Based on technical analysis and historical data, Avaai coin is predicted to reach approximately $423.73 by 2030, representing a significant increase from current levels.

What is the prediction of Avaai?

Ava AI (AVAAI) is predicted to reach approximately $0.076472 by 2028, representing a +15.76% growth based on current market assumptions and historical trends analysis.

What factors influence AVAAI price predictions?

AVAAI price predictions are influenced by market sentiment, investor confidence, trading volume, market volatility, and broader cryptocurrency trends. Positive developments and adoption metrics also impact price movements.

What is the current price of AVAAI and what is the price target?

AVAAI is predicted to average $0.0104 in 2025, with prices ranging between $0.00697 and $0.01498. The token shows potential growth within this price range throughout the year.

Is AVAAI a good investment based on price forecasts?

AVAAI shows promising growth potential with positive price forecasts driven by AI innovation and increasing market adoption. Strong technical indicators suggest upside opportunities, making it an attractive investment for those bullish on AI-powered cryptocurrencies.

2025 DWAIN Price Prediction: Analyzing Market Trends and Potential Growth Factors

What is ANON: Understanding the Decentralized Anonymous Network and Its Impact on Digital Privacy

2025 HAT Price Prediction: Will the Decentralized Storage Token Reach New Heights?

2025 ELIZAOS Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

What is GOAT: Understanding the Greatest of All Time Concept and Its Impact Across Sports and Culture

Laser Eyes Meme: The Bullish Signal Crypto Traders Still Watch

What Are Derivatives Market Signals and How Do Futures Open Interest, Funding Rates, and Liquidation Data Predict Crypto Price Movements?

Leading Decentralized Forecast Platforms You Should Explore

深入了解 Thetanuts Finance:创新期权策略平台解析

Is Saros (SAROS) a good investment? A Comprehensive Analysis of Price Potential, Tokenomics, and Market Viability in 2024

Is PinLink (PIN) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Expert Recommendations for 2024