2025 BZZ Price Prediction: Expert Analysis and Market Forecast for Swarm's Native Token

Introduction: BZZ's Market Position and Investment Value

Swarm (BZZ) serves as a distributed storage platform and content distribution service protocol, functioning as a native service layer for Ethereum Web3.0. Since its inception in 2021, BZZ has established itself as a functional token powering decentralized storage and bandwidth services within the Ethereum ecosystem. As of December 2025, Swarm's market capitalization has reached approximately $10.02 million, with a circulating supply of around 63.15 million BZZ tokens, trading at approximately $0.1586 per unit. This asset, recognized as essential infrastructure for Web3.0 data storage and content distribution, plays an increasingly critical role in supporting Ethereum's decentralized ecosystem.

This article provides a comprehensive analysis of BZZ's price trajectory and market dynamics, incorporating historical performance data, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for the years ahead.

BZZ Market Analysis Report

I. BZZ Price History Review and Current Market Status

BZZ Historical Price Movement Trajectory

-

June 2021: BZZ reached its all-time high (ATH) of $21.11, marking the peak of its initial market cycle following the token's launch in May 2021 at $1.92.

-

2021-2024: Following the peak, BZZ experienced a sustained downtrend as the broader cryptocurrency market faced headwinds and investor sentiment shifted away from decentralized storage platforms.

-

November 2025: BZZ touched its all-time low (ATL) of $0.110009 on November 14, 2025, representing a decline of approximately 99.48% from its historical high.

BZZ Current Market Status

As of December 22, 2025, BZZ is trading at $0.1586, showing resilience with a 24-hour price increase of 2.11% and a 7-day gain of 4.32%. The 24-hour trading volume stands at approximately $63,884.99, indicating moderate market activity.

Key Market Metrics:

- Market Capitalization: $10,015,500.84

- Circulating Supply: 63,149,437.84 BZZ tokens (100% of total supply)

- Market Ranking: #1,172 by market cap

- Market Dominance: 0.00031%

- Total Holders: 24,457 addresses

- 1-Hour Change: -0.5%

- 1-Year Change: -58.41%

The token has recovered significantly from its November 2025 low, gaining approximately 44.17% from that level, though it remains vastly below its historical peak. The relatively stable circulating supply and fully diluted valuation being equivalent indicate mature tokenomics with no significant future dilution expected.

Click to view current BZZ market price

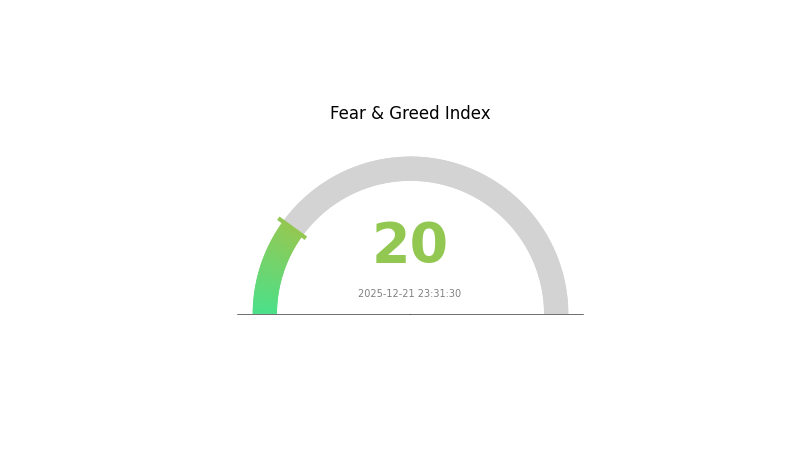

BZZ Market Sentiment Indicator

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This indicates significant market pessimism and heightened investor anxiety. During such periods, assets often become oversold, presenting potential buying opportunities for contrarian investors. However, extreme fear can persist, requiring careful risk management. Monitor market fundamentals and consider your investment strategy on Gate.com to navigate this volatile environment effectively.

BZZ Holdings Distribution

The address holdings distribution chart illustrates the concentration of BZZ tokens across different wallet addresses on the blockchain. By analyzing the top holders and their respective stake percentages, this metric provides critical insights into the decentralization level, market structure, and potential risks associated with token concentration and price manipulation.

Based on the current data, BZZ demonstrates a relatively healthy distribution pattern with moderate concentration characteristics. The top five addresses collectively hold 22.86% of the total supply, with the largest holder possessing 7.17% and the second-largest holding 6.58%. This distribution indicates that while significant holdings exist among major addresses, no single entity commands an overwhelming majority of the token supply. Notably, the "Others" category accounts for 77.14% of total holdings, representing a substantial portion of tokens distributed across numerous addresses, which suggests a reasonably decentralized token base.

The current address distribution pattern reflects a balanced market structure with limited concentration risks. The gradual decline in individual holdings from top addresses indicates organic token distribution rather than extreme wealth concentration. This composition supports greater price stability and reduces the likelihood of sudden market manipulation through coordinated large-scale sales. The substantial participation of smaller holders in the "Others" category strengthens the overall decentralization profile of the BZZ ecosystem, promoting more resilient on-chain governance and community-driven decision-making mechanisms.

Click to view current BZZ holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8d0e...e3a620 | 4528.15K | 7.17% |

| 2 | 0x91d4...c8debe | 4157.93K | 6.58% |

| 3 | 0x0d07...b492fe | 2283.73K | 3.61% |

| 4 | 0x5b74...2bace1 | 1999.77K | 3.16% |

| 5 | 0x06c9...8ae55f | 1478.06K | 2.34% |

| - | Others | 48701.79K | 77.14% |

II. Core Factors Affecting BZZ's Future Price

Supply Mechanism

-

Dynamic Emission Model: BZZ follows a mechanism where buying BZZ increases the total circulating supply, while selling BZZ decreases the circulating quantity. The buy and sell prices are directly correlated with BZZ's issuance volume—the larger the circulating supply, the higher the BZZ price relative to its underlying value denominated in xDAI (US Dollar equivalent).

-

Current Impact: The supply dynamics create a direct relationship between market demand and token economics. As market participation increases through Gate.com and other trading venues, the supply adjustment mechanism will influence price discovery and market equilibrium.

Market Recognition and Capital Inflows

-

Market Acceptance: BZZ price momentum is primarily driven by increasing market recognition, successful project development progress, positive industry trends, growing capital inflows, and strengthening partnership relationships. These factors collectively determine investor confidence and willingness to accumulate positions.

-

Exchange Listings: Expansion of BZZ's trading availability on major platforms is expected to enhance liquidity and accessibility, potentially attracting institutional and retail participants seeking exposure to the Swarm ecosystem.

Policy and Regulatory Environment

- Regulatory Impact: BZZ's price volatility has been influenced by regulatory developments affecting the broader cryptocurrency market. Policy uncertainty can trigger panic selling among domestic investors, as evidenced by market reactions to regulatory announcements, which created downward pressure on token valuations.

III. 2025-2030 BZZ Price Forecast

2025 Outlook

- Conservative Forecast: $0.116 - $0.1589

- Neutral Forecast: $0.1589

- Optimistic Forecast: $0.2161 (requires sustained network adoption and ecosystem expansion)

2026-2028 Medium-Term Outlook

- Market Phase Expectation: Consolidation with gradual growth trajectory as the Swarm ecosystem matures and developer adoption increases

- Price Range Prediction:

- 2026: $0.17813 - $0.21375

- 2027: $0.11436 - $0.24677

- 2028: $0.12751 - $0.28857

- Key Catalysts: Expansion of decentralized storage infrastructure, increased enterprise adoption, protocol upgrades, and growing demand for censorship-resistant data storage solutions

2029-2030 Long-Term Outlook

- Base Case Scenario: $0.24589 - $0.30224 (assuming moderate adoption of Swarm network and incremental improvements in throughput and efficiency)

- Optimistic Scenario: $0.27919 - $0.30224 (assuming accelerated ecosystem development and mainstream adoption of Web3 storage solutions)

- Transformation Scenario: $0.29036 (breakthrough in decentralized storage market penetration and significant institutional participation in the Swarm network)

As of 2025-12-22, BZZ trading is available on Gate.com for real-time price monitoring and market analysis.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.2161 | 0.1589 | 0.116 | 0 |

| 2026 | 0.21375 | 0.1875 | 0.17813 | 18 |

| 2027 | 0.24677 | 0.20063 | 0.11436 | 26 |

| 2028 | 0.28857 | 0.2237 | 0.12751 | 41 |

| 2029 | 0.30224 | 0.25614 | 0.24589 | 61 |

| 2030 | 0.29036 | 0.27919 | 0.18706 | 76 |

BZZ Investment Strategy and Risk Management Report

I. BZZ Market Overview

Current Market Status

- Current Price: $0.1586 (as of December 22, 2025)

- 24-Hour Change: +2.11%

- Market Capitalization: $10,015,500.84

- Circulating Supply: 63,149,437.84 BZZ

- Market Rank: #1,172

- 24-Hour Trading Volume: $63,884.99

Historical Price Performance

- All-Time High: $21.11 (June 22, 2021)

- All-Time Low: $0.110009 (November 14, 2025)

- 1-Year Performance: -58.41%

- 7-Day Performance: +4.32%

- 30-Day Performance: +1.08%

II. BZZ Project Fundamentals

Project Overview

Swarm is a distributed storage platform and content distribution service protocol functioning as a native service layer of Ethereum Web3.0. It is primarily responsible for storing data on the Ethereum blockchain and providing bandwidth services. Swarm, along with smart contracts and Whisper (data encryption communication), constitutes the three pillars of Ethereum Web3.0 infrastructure.

BZZ Token Utility

BZZ is a functional token issued by Swarm that serves as fuel for utilizing decentralized storage and bandwidth services within the Swarm network. Token holders require BZZ to access network services.

Network Participants

- Total Token Holders: 24,457

- Active Exchanges: 5 major platforms

- Circulating Ratio: 100%

III. BZZ Technical and Network Analysis

Token Economics

- Total Supply: 63,149,437 BZZ

- Maximum Supply: 63,149,437 BZZ

- Fully Diluted Valuation: $10,015,500.84

- Market Dominance: 0.00031%

Network Infrastructure

- Primary Blockchain: Ethereum (ETH)

- Contract Address: 0x19062190b1925b5b6689d7073fdfc8c2976ef8cb

- Etherscan Link: https://etherscan.io/token/0x19062190b1925b5b6689d7073fdfc8c2976ef8cb

IV. BZZ Professional Investment Strategy and Risk Management

BZZ Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Individuals seeking to participate in decentralized storage infrastructure development; users who believe in Ethereum's Web3.0 ecosystem expansion

- Operational Recommendations:

- Accumulate BZZ during market downturns when prices fall below historical averages

- Hold tokens for long-term exposure to Swarm network adoption and storage demand growth

- Participate in staking or network contribution activities when available to generate additional returns

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages (MA): Use 20-day and 50-day moving averages to identify trend reversals and support/resistance levels

- Relative Strength Index (RSI): Monitor overbought (>70) and oversold (<30) conditions to identify entry and exit opportunities

- Wave Trading Key Points:

- Execute buy orders during confirmed oversold signals combined with positive market sentiment

- Take partial profits when RSI reaches overbought conditions or after 15-25% gains

BZZ Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total portfolio allocation

- Active Investors: 3-5% of total portfolio allocation

- Professional Investors: 5-10% of total portfolio allocation

(2) Risk Hedging Solutions

- Diversification Strategy: Maintain BZZ holdings alongside established Layer-1 and Layer-2 blockchain assets to reduce concentration risk

- Position Sizing: Never allocate more than 10% of investable capital to any single altcoin position; use stop-loss orders at 20-30% below entry price

(3) Secure Storage Solutions

- Hot wallet Option: Gate Web3 Wallet for frequent trading and active participation in Swarm network activities

- Cold Storage Approach: Transfer large BZZ holdings to hardware wallets or secure offline storage for long-term security

- Security Considerations: Enable two-factor authentication on all exchange accounts, use unique passwords, regularly verify contract addresses before transactions, and never share private keys or seed phrases

V. BZZ Potential Risks and Challenges

BZZ Market Risks

- High Volatility: BZZ has experienced significant price fluctuations, declining 58.41% year-over-year, indicating extreme market volatility unsuitable for risk-averse investors

- Low Liquidity: With only 5 active exchanges and a 24-hour trading volume of approximately $63,885, the token exhibits limited liquidity that may result in slippage during large trades

- Speculative Nature: The project's relatively small market cap ($10M) and limited adoption expose the token to sudden price crashes based on sentiment shifts

BZZ Regulatory Risks

- Regulatory Uncertainty: Decentralized storage and Web3.0 infrastructure projects face evolving regulatory frameworks across jurisdictions that could impact network operations

- Compliance Challenges: Changes in cryptocurrency regulations, particularly regarding how utility tokens are classified, could affect BZZ's legal status and trading availability

- Geographic Restrictions: Certain countries may impose restrictions on storage and decentralized network technologies, potentially limiting Swarm's addressable market

BZZ Technology Risks

- Network Adoption Risk: Limited mainstream adoption of Swarm storage services compared to centralized cloud storage alternatives reduces immediate revenue generation

- Technical Development Risk: Critical bugs, security vulnerabilities, or architectural flaws in the Swarm protocol could compromise network integrity and token value

- Competition from Established Solutions: Competition from both centralized cloud providers and other decentralized storage platforms poses a threat to Swarm's market position

VI. Conclusion and Action Recommendations

BZZ Investment Value Assessment

Swarm represents a fundamental infrastructure play within the Ethereum Web3.0 ecosystem, addressing critical decentralized storage and bandwidth distribution needs. However, the project faces significant challenges including limited adoption, high volatility, and execution risks. BZZ's current price of $0.1586, down 92.5% from its all-time high, may represent either a significant opportunity for believers in Web3.0 infrastructure or a value trap reflecting persistent adoption challenges. The token's viability depends on Swarm's ability to attract substantial user adoption and demonstrate clear technical advantages over competing solutions.

BZZ Investment Recommendations

✅ Beginners: Limit BZZ allocation to 1-2% of total portfolio; focus on understanding Swarm's technology and use cases before investing; consider starting with positions during extreme oversold conditions (RSI <20)

✅ Experienced Investors: Employ technical analysis combined with fundamental research on Swarm adoption metrics; use wave trading strategies during identified support and resistance levels; maintain discipline with predetermined stop-loss levels

✅ Institutional Investors: Evaluate BZZ alongside broader Web3.0 infrastructure exposure; assess correlation with Ethereum's performance; consider strategic positions aligned with long-term Ethereum ecosystem development thesis

BZZ Trading Participation Methods

- Gate.com Spot Trading: Purchase BZZ directly using major trading pairs (USDT, ETH) on Gate.com's spot trading platform

- Dollar-Cost Averaging: Execute periodic BZZ purchases on a fixed schedule to reduce timing risk and benefit from long-term price appreciation

- Limit Orders: Utilize Gate.com's advanced order types to establish disciplined entry points at predetermined price levels rather than market orders

Cryptocurrency investment carries extreme risk and volatility. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial situation. It is strongly recommended to consult with a qualified financial advisor before making investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

What is a BZZ coin?

BZZ is the native token of the Swarm network, rewarding node operators for providing bandwidth and storage services. It incentivizes constructive participation within the decentralized network ecosystem.

Can Bluzelle hit 1 dollar?

Bluzelle is unlikely to reach $1. Current market analysis and algorithms predict a maximum price around $0.01502, based on existing trends and market fundamentals.

Does Bluzelle have a future?

Yes, Bluzelle has potential future growth. As a decentralized database platform, it serves real use cases in Web3. With ongoing development and increasing adoption of blockchain solutions, BLZ could see significant appreciation. Market dynamics and crypto adoption will be key drivers for its long-term success.

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Sui Price Market Analysis and Long-term Investment Potential in 2025

America Party: A Fundamental Analysis of Its White Paper Logic and Future Impact

Lark Davis Vs ZachXBT

2025 TIA Price Prediction: Analyzing Market Trends and Growth Potential for the Celestia Token

Elon Musk's Birthday And It's Astrology

Is FreeStyle Classic Token (FST) a good investment?: A Comprehensive Analysis of Risks, Returns, and Market Potential

Understanding Polymarket: A Guide to Decentralized Prediction Markets

Is Arena-Z (A2Z) a good investment?: A Comprehensive Analysis of Risks, Opportunities, and Market Potential

Is Turtle (TURTLE) a good investment?: A Comprehensive Analysis of Risks, Opportunities, and Market Potential in 2024

Is TCOM (TCOM) a good investment?: A comprehensive analysis of China's leading online travel platform's growth potential and market outlook