2025 LRC Price Prediction: Expert Analysis and Future Outlook for Loopring Token

Introduction: Market Position and Investment Value of LRC

Loopring (LRC) is an open multi-token transaction protocol based on ERC-20 and smart contracts that enables the establishment of decentralized exchange applications without asset custody and capital freezing. Since its inception in 2017, Loopring has pioneered decentralized trading infrastructure by allowing multiple exchanges to compete in off-chain order matching and on-chain settlement. As of December 2025, LRC has achieved a market capitalization of approximately $72.69 million USD, with a circulating supply of approximately 1.25 billion tokens, currently trading at $0.05291 per token. This innovative protocol, recognized for its "zero-risk token exchange model," is playing an increasingly critical role in decentralized finance and Ethereum-based trading applications.

This article provides a comprehensive analysis of LRC's price trajectory and market dynamics, integrating historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for the period through 2030.

I. LRC Price History Review and Market Current Status

LRC Historical Price Evolution

- 2021: LRC reached its all-time high of $3.75 on November 10, 2021, reflecting peak market sentiment during the bull market cycle.

- 2019 to Present: LRC hit its all-time low of $0.01963893 on December 18, 2019, marking the lowest point in its trading history.

LRC Current Market Situation

As of December 18, 2025, LRC is trading at $0.05291, reflecting a significant decline of -79.38% from its all-time high. The token shows mixed short-term momentum with a -6.88% decline over the past 24 hours, a -18.75% drop over the past 7 days, and a -8.62% decrease over the past 30 days. In the last hour, LRC experienced a minor -0.38% change.

The 24-hour trading range for LRC spans from a low of $0.05263 to a high of $0.05687, indicating moderate price volatility within the short-term trading window. Trading volume in the past 24 hours reached $369,712.49, demonstrating active market participation.

LRC's market capitalization currently stands at approximately $65.93 million, with a fully diluted valuation of $72.69 million. The token maintains a circulating supply of 1.25 billion LRC tokens out of a total supply of 1.37 billion tokens, representing a circulation ratio of 90.65%. With 168,714 token holders, LRC maintains a distributed holder base across the market. The token ranks 432nd by market capitalization and holds a market dominance of 0.0023%, indicating a relatively modest position within the broader cryptocurrency ecosystem.

Click to view the current LRC market price

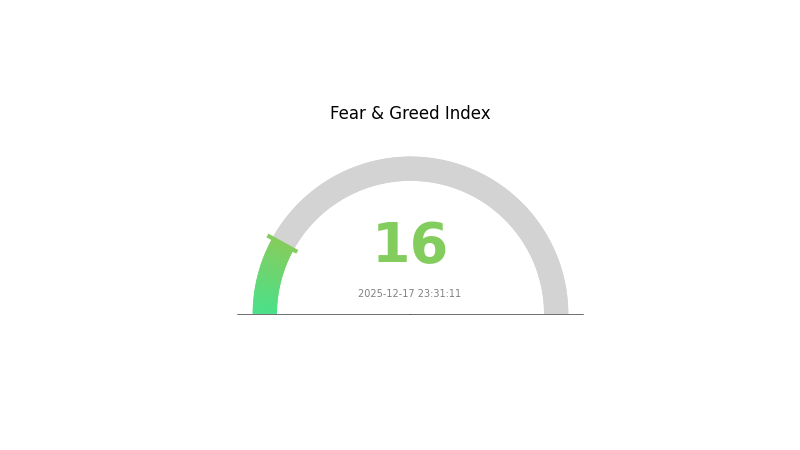

LRC Market Sentiment Index

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The market is currently experiencing extreme fear with an index reading of 16. This represents one of the most pessimistic sentiment levels in the market, indicating heightened anxiety among investors. During periods of extreme fear, market participants often become overly cautious, leading to potential capitulation selling. However, such extreme readings historically present contrarian opportunities for patient investors. Those with strong conviction and adequate risk management may consider this a time to accumulate quality assets at depressed valuations on Gate.com.

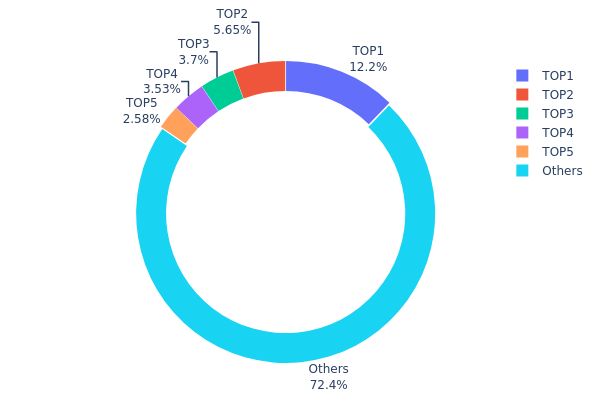

LRC Holdings Distribution

The address holdings distribution map illustrates the concentration of LRC tokens across the top wallet addresses and remaining holders on the blockchain. This metric serves as a critical indicator of token ownership structure, revealing potential centralization risks and the overall health of the token's ecosystem decentralization.

LRC's current holdings distribution exhibits moderate concentration characteristics. The top five addresses collectively hold approximately 27.58% of total supply, with the largest single address (0xf977...41acec) commanding 12.15% of all LRC tokens. While this concentration level is noteworthy, it remains within acceptable parameters for established blockchain projects. The remaining 72.42% dispersed among other addresses demonstrates a relatively healthy distribution pattern, suggesting that no single entity maintains overwhelming control over token supply and market dynamics.

The current address distribution structure presents mixed implications for market dynamics. The significant holdings by top addresses create potential liquidity concentration, which could theoretically facilitate large-scale transactions but also introduces risks of sudden market movement through coordinated actions. However, the substantial portion held by decentralized address networks substantially mitigates systemic concentration risk. This distribution pattern reflects moderate decentralization, indicating that while LRC maintains reasonable governance resilience and market stability, continued monitoring of the top holders' activity remains important for assessing potential price volatility and market manipulation scenarios.

Visit LRC Holdings Distribution on Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 166983.89K | 12.15% |

| 2 | 0x76ec...78fbd3 | 77656.50K | 5.65% |

| 3 | 0x674b...66bd3f | 50774.21K | 3.69% |

| 4 | 0xc368...816880 | 48475.79K | 3.52% |

| 5 | 0x9b0c...ba8d46 | 35391.52K | 2.57% |

| - | Others | 994591.49K | 72.42% |

II. Core Factors Affecting LRC's Future Price

Supply Mechanism

-

Token Burn Model: LRC implements a deflationary mechanism where transaction fees paid in LRC are burned, artificially reducing the circulating supply. This design aims to make LRC more attractive to the community as a scarce resource.

-

Historical Impact: Since Loopring 2.0's launch in December 2018, the burn mechanism has created new incentives for long-term LRC holders. The introduction of the ability to lock LRC for lower transaction fees and higher fee retention ratios has generated accumulation effects within the network.

-

Current Impact: As network activity increases, the burn mechanism directly reduces token supply, providing potential value storage appeal. Users paying fees with LRC receive the lowest rates, creating ongoing demand for the token.

Technology Development and Ecosystem Building

-

Loopring 2.0 Protocol Enhancement: The protocol allows traders to pay transaction fees not only in LRC but also in ERC-20 tokens and WETH. Users utilizing LRC for fees enjoy preferential rates and minimal token burn, incentivizing LRC adoption.

-

UDOM Model and Ring-Based Matching System: Loopring features innovative matching technology that can execute unmatched trading pairs, providing enhanced liquidity and smoother pricing through relay nodes finding optimal exchange rates.

-

Cross-Blockchain Integration: Loopring's design philosophy is blockchain-agnostic, enabling integration with non-Ethereum networks. The project has released Loopring NEO and LRN tokens to enhance trading systems on the NEO network.

-

Ecosystem Partnerships: Notable integrations include Loopring's integration into Morpheus and Mytoken blockchain wallets. The project has also developed internal trading solutions such as Loopr and Circulr.

III. 2025-2030 LRC Price Forecast

2025 Outlook

- Conservative Forecast: $0.02972 - $0.05307

- Base Case Forecast: $0.05307

- Optimistic Forecast: $0.06846 (requires sustained ecosystem adoption and positive market sentiment)

2026-2027 Medium-term Outlook

- Market Stage Expectations: Recovery and gradual accumulation phase with emerging positive catalysts

- Price Range Predictions:

- 2026: $0.05469 - $0.07839 (14% upside potential)

- 2027: $0.05288 - $0.10297 (31% upside potential)

- Key Catalysts: Layer 2 scaling solution improvements, increased institutional interest, enhanced DeFi protocol integration, and expanding use cases within the Loopring ecosystem

2028-2030 Long-term Outlook

- Base Case Scenario: $0.0742 - $0.09059 (63% cumulative growth, assuming moderate ecosystem expansion and market recovery)

- Optimistic Scenario: $0.08450 - $0.11235 (75% cumulative growth, assuming strong protocol adoption and broader cryptocurrency market recovery)

- Transformational Scenario: $0.11235+ (assumes breakthrough in Layer 2 adoption rates, institutional partnerships, and major DeFi protocol integrations)

- 2025-12-18: LRC trading within predicted ranges, positioned for multi-year appreciation cycle

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.06846 | 0.05307 | 0.02972 | 0 |

| 2026 | 0.07839 | 0.06077 | 0.05469 | 14 |

| 2027 | 0.10297 | 0.06958 | 0.05288 | 31 |

| 2028 | 0.09059 | 0.08627 | 0.0742 | 63 |

| 2029 | 0.09727 | 0.08843 | 0.05394 | 67 |

| 2030 | 0.11235 | 0.09285 | 0.0845 | 75 |

Loopring (LRC) Professional Investment Strategy and Risk Management Report

IV. LRC Professional Investment Strategy and Risk Management

LRC Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Protocol technology believers, decentralized exchange advocates, Ethereum ecosystem participants

- Operational Recommendations:

- Accumulate LRC during market downturns when price volatility is high, taking advantage of the current 79.38% year-over-year decline

- Maintain a 2-3 year holding horizon to benefit from potential network adoption growth and protocol upgrades

- Reinvest any transaction fee rewards generated from network activity into additional LRC holdings

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 24-hour range of $0.05263 to $0.05687 for short-term trading signals

- Volume Analysis: Track the 24-hour trading volume of $369,712.49 to identify momentum shifts and breakout opportunities

- Wave Operation Key Points:

- Use the historical low of $0.01963893 and all-time high of $3.75 as long-term reference points for risk-reward assessment

- Focus on intraday volatility patterns, considering the -0.38% hourly decline suggests consolidation phases

LRC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total portfolio allocation

- Active Investors: 2-5% of total portfolio allocation

- Professional Investors: 5-10% of total portfolio allocation

(2) Risk Hedging Solutions

- Diversification Strategy: Balance LRC holdings with other Layer 2 protocol tokens and mainstream cryptocurrencies to reduce concentration risk

- Dollar-Cost Averaging (DCA): Execute regular periodic purchases to mitigate timing risk and reduce the impact of price volatility

(3) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate Web3 Wallet provides integrated security features for managing LRC tokens with access to Gate.com's trading ecosystem

- Hardware Security Option: For large LRC holdings, consider using hardware wallets for enhanced security and offline storage

- Security Precautions: Never share private keys or seed phrases; enable two-factor authentication on all exchange and wallet accounts; regularly verify contract addresses when transferring LRC tokens

V. LRC Potential Risks and Challenges

LRC Market Risks

- Severe Price Volatility: LRC has experienced a 79.38% decline over the past year, reflecting extreme market sentiment and liquidity challenges in the token

- Limited Liquidity Depth: With 24-hour trading volume of only $369,712.49 and a market cap of $65.9 million, LRC exhibits limited trading depth that could amplify price swings

- Competitive Pressure: The decentralized exchange and Layer 2 protocol space has become increasingly competitive with newer technologies and solutions

LRC Regulatory Risks

- Evolving Regulatory Environment: Regulatory frameworks for decentralized protocols and DeFi applications remain uncertain and subject to rapid policy changes

- Exchange Listing Volatility: Changes in exchange policies or regulatory compliance requirements could impact LRC availability on trading platforms

- Protocol Classification Risk: Regulatory agencies may classify LRC or its associated protocols differently, affecting legal status and accessibility

LRC Technical Risks

- Protocol Obsolescence: As Ethereum scaling solutions and Layer 2 technologies evolve, Loopring's protocol may face competition from more efficient or feature-rich alternatives

- Smart Contract Vulnerabilities: Although the protocol has been operational since 2017, undiscovered vulnerabilities or exploits in the smart contracts could pose systemic risks

- Network Adoption Challenges: The protocol's utility depends on trader participation and exchange integration; lower adoption could reduce fee generation and token value

VI. Conclusion and Action Recommendations

LRC Investment Value Assessment

Loopring (LRC) represents a mature Layer 2 protocol with established infrastructure for decentralized token exchange. However, the token faces significant headwinds from the current bear market sentiment (79.38% annual decline) and competition from emerging scaling solutions. The protocol's current valuation reflects market skepticism about near-term adoption growth, making it suitable primarily for risk-tolerant investors with conviction in Layer 2 technology adoption over extended timeframes.

LRC Investment Recommendations

✅ Beginners: Start with minimal exposure (1% of crypto portfolio) through Gate.com's trading platform; use dollar-cost averaging over 6-12 months to establish a position while learning about Layer 2 protocols

✅ Experienced Investors: Consider accumulating during market downturns below $0.05; implement a 3-5 year holding strategy targeting 2-5% portfolio allocation; actively monitor protocol developments and competitive dynamics

✅ Institutional Investors: Evaluate LRC as part of broader Ethereum ecosystem exposure; conduct detailed technical and economic analysis of protocol adoption metrics; consider strategic positions with risk management frameworks aligned with institutional guidelines

LRC Trading Participation Methods

- Spot Trading: Purchase and hold LRC directly on Gate.com using multiple order types and market conditions

- Trading Pairs: Access LRC trading pairs against major cryptocurrencies and stablecoins on Gate.com to optimize entry and exit strategies

- DCA Programs: Implement automated recurring purchases through Gate.com to reduce timing risk and accumulate positions systematically

Cryptocurrency investment carries extremely high risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much will Terra Luna Classic coin price be in 2030?

Terra Luna Classic's predicted price in 2030 ranges between $0.000061 and $0.000091, based on current market analysis. However, price predictions are speculative and subject to significant market fluctuations.

How high will loaded lion crypto go?

Loaded Lion is projected to reach approximately $0.01874 by 2030, representing a potential increase of 173.55% from current levels. Price movements depend on market adoption, trading volume, and overall market conditions in the crypto space.

What are the risks of investing in LRC?

LRC faces market volatility, regulatory uncertainty, and technical risks. As a layer-2 scaling solution token, adoption rates and competition impact its value. Smart contract vulnerabilities and liquidity fluctuations also present challenges. Investors should conduct thorough research before committing capital.

Will Litentry go back up?

Yes, indicators suggest Litentry has upside potential. Technical analysis points towards recovery towards $0.505 in the near term, with continued growth expected over the coming months as market conditions stabilize.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

1011 Crypto Market Crash Analysis

What Is Regulatory and Compliance Risk in Cryptocurrency: SEC Legal Requirements and KYC/AML Policies Explained

What is AVNT: A Comprehensive Guide to Advanced Virtual Network Technology

What is OMI: A Comprehensive Guide to Open Metrics Initiative and Its Impact on Data Standardization

What is VVV: A Comprehensive Guide to Understanding Virtual Venture Value in Modern Business