2025 LYX Price Prediction: Expert Analysis and Market Forecast for Lukso Token's Future Growth

Introduction: Market Position and Investment Value of LYX

LYX (LUKSO) serves as a next-generation EVM blockchain based on Casper PoS, designed to revolutionize how brands, creators, and users interact with blockchain technology in the New Creative Economies. Since its launch in May 2023, LUKSO has established itself as an innovative layer-1 blockchain introducing a set of groundbreaking standards. As of December 2025, LYX boasts a market capitalization of approximately $18.76 million, with a circulating supply of about 30.54 million tokens, currently trading around $0.4467. This asset, recognized for its innovative LUKSO Standards Proposals (LSPs) and Universal Profiles framework, is increasingly playing a pivotal role in enabling verifiable digital identities and simplifying Web3 onboarding for users, brands, and creators.

This article will provide a comprehensive analysis of LYX's price trajectory and market dynamics, combining historical performance patterns, market supply-demand fundamentals, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for the period through 2030.

I. LYX Price History Review and Current Market Status

LYX Historical Price Trajectory

LUKSO (LYX) reached its all-time high of $11.6 on January 17, 2024, representing a significant peak in the asset's trading history. Since this peak, the token has experienced substantial depreciation, declining approximately 82.1% over the past year. Most recently, LYX touched its all-time low of $0.427764 on December 18, 2025, reflecting considerable downward pressure in the market.

LYX Current Market Situation

As of December 21, 2025, LYX is trading at $0.4467, with a 24-hour trading volume of $286,042.94. The token exhibits mixed short-term price action: it declined 0.69% in the past hour and 9.2% over the past seven days, though it marginally gained 0.02% in the last 24 hours. The 30-day performance shows a steeper decline of 26.22%, underscoring continued bearish sentiment.

LYX maintains a market capitalization of approximately $13.64 million against a fully diluted valuation of $18.76 million, representing a circulating supply of 30,535,906.59 tokens out of a total maximum supply of 42,000,000 tokens (72.7% circulating). The token is ranked #1,029 by market capitalization and currently trades on three exchanges. With 24,910,155 token holders, the asset demonstrates a distributed holder base.

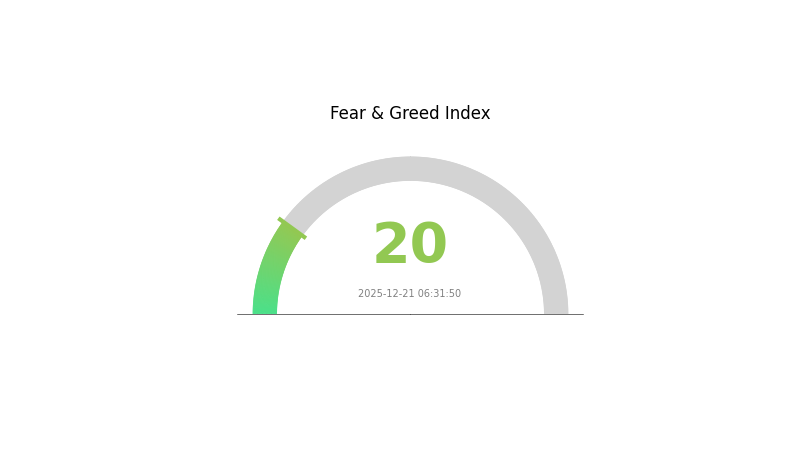

Current market sentiment reflects extreme fear conditions (VIX level: 20), which typically characterizes depressed market conditions across the broader cryptocurrency ecosystem.

Click to view current LYX market price

LYX Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index hitting 20. This indicates severe market pessimism and significant risk aversion among investors. During such extreme fear periods, market volatility typically increases, and asset prices often reach local lows. Savvy investors view this as a potential buying opportunity, as historical data suggests that extreme fear often precedes market recoveries. However, careful risk assessment and position management remain essential. Monitor market developments closely before making investment decisions on Gate.com.

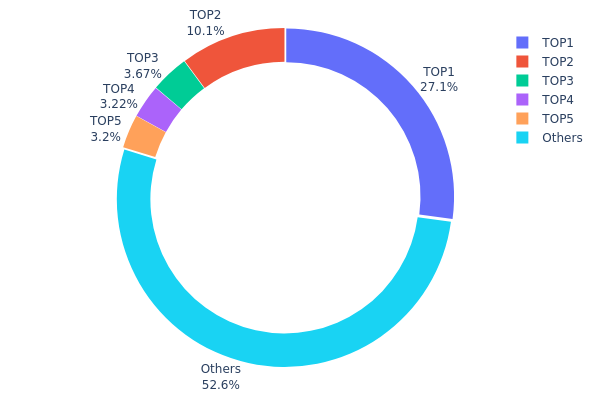

LYX Holdings Distribution

The address holdings distribution represents the allocation of LYX tokens across different wallet addresses, reflecting how token ownership is concentrated among individual holders. This metric is crucial for assessing market structure, potential concentration risks, and the overall decentralization characteristics of the network.

Current analysis of LYX's holdings distribution reveals a moderate concentration pattern with notable implications for market dynamics. The top holder commands 27.14% of total tokens, while the combined top five addresses account for 47.34% of circulating supply. This concentration level suggests that a relatively small number of significant stakeholders maintain considerable influence over token distribution. However, the fact that the "Others" category represents 52.66% of holdings indicates that slightly more than half of LYX tokens are dispersed among a larger, more fragmented holder base, which provides some balance to the overall structure.

The current distribution pattern presents both risks and stabilizing factors for price dynamics. While the dominant position held by the top address could theoretically enable substantial market impact through large token movements, the secondary distribution among numerous smaller holders creates natural resistance to extreme volatility. The 52.66% allocation to dispersed addresses demonstrates meaningful participation from retail and smaller institutional holders, reducing the probability of coordinated whale manipulation. Nevertheless, investors should remain cognizant that concentrated holdings in the top positions retain the capacity to significantly influence short-term price movements and market sentiment, particularly during periods of elevated trading volume or market stress.

Click to view current LYX holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xCAfe...00CAfe | 10271.26K | 27.14% |

| 2 | 0x2933...fA4625 | 3831.33K | 10.12% |

| 3 | 0xe1A8...1193f1 | 1387.42K | 3.66% |

| 4 | 0xB67e...D9eCaF | 1219.40K | 3.22% |

| 5 | 0x4D28...3C6A66 | 1211.34K | 3.20% |

| - | Others | 19920.90K | 52.66% |

II. Core Factors Affecting LYX's Future Price

Supply Mechanism

- Circulating Supply: LYX currently has a circulating supply of approximately 30.536 million tokens.

- Market Impact: Limited supply information may intensify market uncertainty and impact price stability.

Institutional and Major Holder Dynamics

- Institutional Investment: Institutional participation levels represent a key factor influencing LYX's investment value.

- Mainstream Adoption: Widespread adoption of LYX contributes to long-term value drivers.

Macroeconomic Environment

Overall economic conditions play a significant role in shaping cryptocurrency market cycles and investor sentiment toward digital assets.

Technology Development and Ecosystem Construction

- LUKSO Ecosystem Upgrades: Technical developments and improvements within the LUKSO ecosystem are crucial for the platform's progression and long-term sustainability.

- Ecosystem Applications: Growth in decentralized applications and ecosystem projects built on LUKSO supports increased utility and adoption of LYX tokens.

Three, 2025-2030 LYX Price Forecast

2025 Outlook

- Conservative Forecast: $0.3482 - $0.4464

- Neutral Forecast: $0.4464 - $0.5273

- Optimistic Forecast: $0.5273 - $0.6071 (requires sustained ecosystem development and increased institutional adoption)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with strengthening fundamentals and expanding use cases within the Lukso ecosystem

- Price Range Forecast:

- 2026: $0.4214 - $0.6742

- 2027: $0.5465 - $0.8407

- Key Catalysts: Ecosystem maturation, increased digital fashion and lifestyle brand partnerships, growing developer adoption on the Lukso blockchain, and broader market recovery sentiment

2028-2030 Long-term Outlook

- Base Case: $0.6630 - $0.7494 (assuming moderate ecosystem growth and stable market conditions)

- Optimistic Case: $0.7429 - $0.9555 (assuming significant enterprise adoption and mainstream integration of digital identities and assets)

- Transformative Case: $0.9551 - $0.9555 (extreme favorable conditions including universal adoption of Lukso's Universal Profile standard and dominant position in digital lifestyle ecosystems)

- 2030-12-31: LYX at $0.8453 average price (sustained bullish trajectory with 88% cumulative appreciation potential from 2025 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.6071 | 0.4464 | 0.34819 | 0 |

| 2026 | 0.67424 | 0.52675 | 0.4214 | 17 |

| 2027 | 0.8407 | 0.6005 | 0.54645 | 33 |

| 2028 | 0.74942 | 0.7206 | 0.66295 | 60 |

| 2029 | 0.95551 | 0.73501 | 0.41895 | 63 |

| 2030 | 0.95514 | 0.84526 | 0.72692 | 88 |

LYX Professional Investment Strategy and Risk Management Report

IV. LYX Professional Investment Strategy and Risk Management

LYX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Web3 enthusiasts and creative economy participants seeking exposure to blockchain infrastructure

- Operational Recommendations:

- Accumulate LYX during market downturns to build long-term positions, leveraging the -82.1% year-over-year decline as a potential entry opportunity

- Hold positions through ecosystem development cycles, as LUKSO's Universal Profiles and LSP standards mature

- Reinvest any staking rewards to compound gains over extended periods

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the all-time high of $11.60 (January 17, 2024) and recent low of $0.427764 (December 18, 2025) as key reference points for range-bound trading

- Volume Analysis: Track the 24-hour trading volume of approximately 286,042.94 LYX to identify liquidity conditions and potential breakout opportunities

- Range Trading Considerations:

- Current price of $0.4467 sits near recent support levels, suggesting potential reversal zones

- 24-hour price range between $0.4406 and $0.4533 indicates consolidation patterns suitable for mean reversion strategies

LYX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation

- Active Investors: 3-8% of portfolio allocation

- Professional Investors: 8-15% of portfolio allocation

(2) Risk Hedging Approaches

- Portfolio Diversification: Combine LYX exposure with established Layer-1 blockchain assets to reduce concentration risk

- Position Sizing: Implement strict position limits based on account size and risk tolerance to prevent catastrophic losses

(3) Secure Storage Solutions

- Self-Custody Solution: Gate Web3 Wallet for users prioritizing security and asset control

- Exchange Storage: Gate.com custodial wallets for active traders requiring frequent liquidity access

- Security Best Practices: Enable multi-factor authentication, utilize hardware wallet backups, maintain offline seed phrase copies in secure locations, and never share private keys or recovery phrases

V. LYX Potential Risks and Challenges

LYX Market Risk

- High Volatility: LYX has experienced severe drawdowns, with a year-over-year decline of 82.1% demonstrating significant price instability that can lead to substantial losses

- Low Market Capitalization: With a total market cap of approximately $18.76 million and daily volume of $286,042.93, the token exhibits limited liquidity and susceptibility to price manipulation

- Market Sentiment Sensitivity: As an emerging ecosystem token, LYX is highly reactive to sentiment shifts, regulatory announcements, and competitive developments in the Layer-1 blockchain space

LYX Regulatory Risk

- Evolving Compliance Landscape: Blockchain standards and creative economy applications face uncertain regulatory frameworks across different jurisdictions

- Classification Uncertainty: LUKSO's positioning within the creative economies sector may attract regulatory scrutiny regarding asset classification and compliance requirements

- Geopolitical Factors: International regulatory changes could impact the development and adoption of LUKSO's ecosystem, particularly regarding data privacy and digital identity standards

LYX Technical Risk

- Ecosystem Adoption: The success of LUKSO depends heavily on developer adoption of LSP standards and user uptake of Universal Profiles, which remain early-stage

- Competitive Pressure: Competing blockchain solutions and alternative identity standards may limit LUKSO's market penetration and network effects

- Smart Contract Vulnerabilities: As with all blockchain platforms, potential vulnerabilities in LSP implementations or ecosystem applications could pose security risks

VI. Conclusion and Action Recommendations

LYX Investment Value Assessment

LUKSO represents a specialized blockchain infrastructure play targeting the creative economy segment. The project introduces innovative standards (LSPs) and Universal Profiles aimed at simplifying Web3 onboarding and enabling verifiable digital identities. However, the severe 82.1% annual decline reflects significant market challenges, limited adoption metrics, and the speculative nature of early-stage blockchain infrastructure projects. While the underlying technology shows promise, current valuations present both opportunity and substantial downside risk.

LYX Investment Recommendations

✅ Beginners: Start with minimal allocations (0.5-1%) as a speculative position within a diversified portfolio. Focus on understanding LUKSO's technology before increasing exposure.

✅ Experienced Investors: Consider 3-5% portfolio allocation with disciplined entry points during significant price corrections. Implement strict stop-loss orders at predetermined support levels.

✅ Institutional Investors: Evaluate LYX as part of emerging blockchain infrastructure allocations, requiring thorough due diligence on ecosystem adoption metrics, developer activity, and competitive positioning.

LYX Trading Participation Methods

- Spot Trading: Purchase and hold LYX directly on Gate.com for immediate exposure to price movements

- Market Making: Provide liquidity in LYX trading pairs on Gate.com to earn trading fees while gaining market exposure

- Dollar-Cost Averaging: Execute regular purchases over extended periods to mitigate timing risk and reduce the impact of volatility

Cryptocurrency investments carry extreme risk and this report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and are encouraged to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Lukso a buy or sell?

Lukso is currently in a strong sell trend based on technical analysis. Market conditions may change. Consult updated sources for the latest information.

What is the price of LYX?

The current price of LYX is $0.445302 as of December 21, 2025. LYX, the native token of LUKSO, has a market cap of $13.62M. For real-time price updates, check current market data.

What factors influence LYX price movements?

LYX price movements are driven by institutional adoption, ETF demand, macroeconomic trends, market sentiment, and trading volume. Network development updates and broader cryptocurrency market conditions also significantly impact its price.

What is the price target for LYX in 2025?

Based on current forecasts, LYX is predicted to reach $0.4463 by the end of 2025, representing a 0% change from current levels. Upper price target predictions suggest potential gains of up to 103.72%, reaching $0.9033.

What are the risks of investing in LYX tokens?

LYX tokens face high volatility and potential significant losses. Regulatory uncertainty, market speculation, and liquidity risks also exist. Conduct thorough research before investing.

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Sui Price Market Analysis and Long-term Investment Potential in 2025

America Party: A Fundamental Analysis of Its White Paper Logic and Future Impact

Lark Davis Vs ZachXBT

2025 TIA Price Prediction: Analyzing Market Trends and Growth Potential for the Celestia Token

Elon Musk's Birthday And It's Astrology

Is doginme (DOGINME) a good investment?: A comprehensive analysis of risks, potential returns, and market fundamentals for crypto investors

Analyzing Profitability Trends Among Crypto Traders

Understanding Hardware Wallets: A Secure Solution for Crypto Storage

Is NFPrompt (NFP) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Future Outlook

Is OpenEden (EDEN) a good investment?: A comprehensive analysis of tokenomics, market potential, and risk factors in 2024