2025 M Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: M's Market Position and Investment Value

MemeCore (M), as the first Layer 1 blockchain built for the Meme 2.0 era, has emerged as a transformative force in the cryptocurrency landscape since its inception. As of 2025, MemeCore's market capitalization has reached $2.94 billion, with a circulating supply of approximately 1.68 billion tokens, and a price hovering around $1.75. This asset, often referred to as the "viral economy pioneer," is playing an increasingly crucial role in reshaping the meme coin ecosystem and cultural asset creation.

This article will provide a comprehensive analysis of MemeCore's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. M Price History Review and Current Market Status

M Historical Price Evolution Trajectory

- 2025: MemeCore launched as the first Layer 1 blockchain for Meme 2.0, price reached an all-time high of $2.9647 on September 18

- 2025: Market correction phase, price dropped to an all-time low of $1.1954 on November 27

- 2025: Recent recovery, price rebounded to $1.7499 as of December 16

M Current Market Situation

As of December 16, 2025, MemeCore (M) is trading at $1.7499. The token has experienced a 6.19% decline in the past 24 hours, with a trading volume of $420,044.98. Despite the recent dip, M has shown significant growth over the past week, with a 37.5% increase. However, the 30-day performance indicates a 22.96% decrease, suggesting volatility in the medium term.

The current market capitalization of MemeCore stands at $2,935,065,650, ranking it 41st in the overall cryptocurrency market. With a circulating supply of 1,677,276,215 M tokens, representing 33.55% of the total supply, the project has a fully diluted valuation of $8,749,500,000.

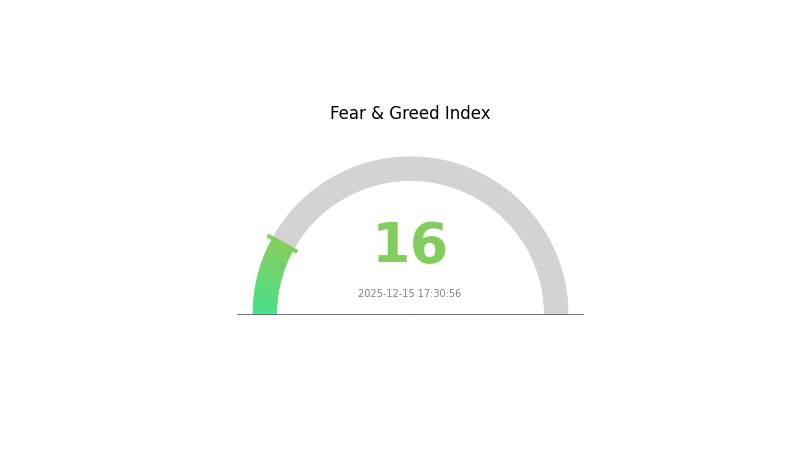

The market sentiment for cryptocurrencies is currently in a state of "Extreme Fear" with a VIX index of 16, indicating heightened investor caution. This sentiment may be influencing M's short-term price movements.

Click to view the current M market price

Market Sentiment Indicator

2025-12-15 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 16. This stark reading suggests investors are exceedingly cautious, potentially indicating oversold conditions. While fear often precedes market bottoms, it's crucial to approach with caution. Seasoned traders may view this as an opportunity to accumulate, adhering to the adage "be greedy when others are fearful." However, newcomers should tread carefully, conducting thorough research before making any moves in this volatile climate.

M Holdings Distribution

The address holdings distribution data for M reveals a relatively decentralized ownership structure. This distribution pattern indicates that no single address holds a disproportionate amount of M tokens, suggesting a healthier and more balanced market.

The absence of large concentrated holdings reduces the risk of market manipulation and sudden price fluctuations caused by the actions of a few major holders. This distribution pattern contributes to greater market stability and potentially reflects a wider adoption of M among various participants in the ecosystem.

Overall, the current address distribution of M suggests a favorable level of decentralization and structural stability in its on-chain dynamics. This characteristic may contribute to a more resilient and equitable market environment for M, potentially fostering long-term sustainability and growth.

Click to view the current M holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing Future M Price

Supply Mechanism

- Token Distribution: The current data shows no single address holds a large amount of M tokens, indicating a balanced distribution and high on-chain decentralization.

- Historical Pattern: The lack of dominant holders has effectively reduced market manipulation risks, providing a solid foundation for M token price stability.

- Current Impact: The distribution pattern demonstrates significant progress in M network decentralization, stable on-chain structure, and diverse user base, promoting organic ecosystem growth.

Institutional and Whale Dynamics

- Corporate Adoption: MemeCore (M) aims to lead the Meme coin ecosystem innovation by 2025, leveraging blockchain innovations.

Macroeconomic Environment

- Monetary Policy Impact: Major central bank interest rate trends are expected to be key short-term variables.

- Inflation Hedging Properties: Gold has shown outstanding performance as an inflation hedge, with inflation expectations rising.

- Geopolitical Factors: While existing geopolitical hotspots like the Middle East crisis and Russia-Ukraine conflict have weakened, tensions remain and new risk points may emerge.

Technical Development and Ecosystem Building

- PoM Consensus Mechanism: The application of the Proof of Meme (PoM) consensus mechanism is a potential price driver for M tokens.

- Ecosystem Applications: MemeCore is committed to revolutionizing the Meme coin ecosystem by 2025, focusing on blockchain innovations.

III. M Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $1.66 - $1.75

- Neutral prediction: $1.75 - $2.00

- Optimistic prediction: $2.00 - $2.22 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $1.35 - $2.85

- 2028: $2.58 - $2.87

- Key catalysts: Increasing adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $2.23 - $2.93 (assuming steady market growth)

- Optimistic scenario: $2.93 - $3.50 (assuming strong market performance)

- Transformative scenario: $3.50 - $3.98 (assuming extremely favorable conditions)

- 2030-12-31: M $2.93 (potential year-end target)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.21996 | 1.748 | 1.6606 | 0 |

| 2026 | 2.93629 | 1.98398 | 1.03167 | 13 |

| 2027 | 2.85376 | 2.46014 | 1.35307 | 40 |

| 2028 | 2.8695 | 2.65695 | 2.57724 | 51 |

| 2029 | 3.09481 | 2.76322 | 1.57504 | 57 |

| 2030 | 3.98346 | 2.92902 | 2.22605 | 67 |

IV. Professional Investment Strategies and Risk Management for M

M Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Accumulate M tokens during market dips

- Regularly review project developments and community growth

- Store tokens securely in non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought or oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Stay informed about MemeCore ecosystem updates and partnerships

M Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for M

M Market Risks

- High volatility: Meme coins are subject to extreme price fluctuations

- Sentiment-driven: Price movements often influenced by social media trends

- Market saturation: Increasing competition in the meme coin space

M Regulatory Risks

- Uncertain regulations: Potential for stricter oversight of meme coins

- Cross-border compliance: Varying legal status across different jurisdictions

- Tax implications: Evolving tax treatment of meme coin transactions

M Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Ability to handle increased network activity

- Centralization concerns: Dependence on core development team

VI. Conclusion and Action Recommendations

M Investment Value Assessment

MemeCore (M) presents a unique value proposition in the evolving meme coin landscape, with potential for long-term growth driven by its innovative viral economy model. However, short-term volatility and regulatory uncertainties pose significant risks.

M Investment Recommendations

✅ Newcomers: Start with small positions, focus on education and community engagement ✅ Experienced investors: Consider allocating a portion of high-risk portfolio to M, actively monitor market trends ✅ Institutional investors: Conduct thorough due diligence, potentially explore strategic partnerships within the MemeCore ecosystem

M Trading Participation Methods

- Spot trading: Purchase M tokens on Gate.com

- Futures trading: Engage in leveraged trading of M perpetual contracts on Gate.com

- Staking: Participate in any available staking programs to earn passive income

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for M crypto?

Based on long-term forecasts, M crypto is expected to reach a maximum price of $8.5 by the end of 2030.

Will magic coin reach $1?

Based on current forecasts, Magic coin may reach $0.66 by 2025, but reaching $1 remains uncertain. Its growth potential is significant.

Does memecoin have a future?

Yes, memecoins have a future. Their popularity and market interest persist, allowing them to thrive in various conditions. Ongoing investor enthusiasm suggests they'll remain a part of the crypto landscape.

How much is crypto worth in 2025?

In 2025, the crypto market is estimated to be worth over $3 trillion. Widespread adoption and significant infrastructure improvements have driven growth, with stablecoins becoming mainstream and blockchain technology nearly ready for prime time.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Is SuperFarm (SUPER) a good investment?: A Comprehensive Analysis of Tokenomics, Use Cases, and Market Potential

Is Brett (BRETT) a good investment?: A Comprehensive Analysis of Performance, Market Potential, and Risk Factors

CVX vs SOL: Which Cryptocurrency Offers Better Value for Long-Term Investors in 2024?

Is Toshi (TOSHI) a good investment?: A Comprehensive Analysis of the Cryptocurrency's Potential, Risks, and Market Outlook

SFP vs ADA: A Comprehensive Comparison of Two Leading Cardano-Based Tokens in the DeFi Ecosystem