2025 POLYX Price Prediction: Expert Analysis and Market Forecast for Polymesh Token

Introduction: Market Position and Investment Value of POLYX

Polymesh (POLYX) serves as an institutional-grade, public-permissioned blockchain specifically designed for regulated assets. Since its launch in 2021, Polymesh has established itself as a specialized infrastructure solution for the digital securities sector. As of December 2025, POLYX has achieved a market capitalization of approximately $61.27 million, with a circulating supply of around 1.23 billion tokens, currently trading at $0.04989 per token. This blockchain infrastructure, recognized for its focus on solving governance, identity, compliance, confidentiality, and settlement challenges, is playing an increasingly crucial role in streamlining traditional financial processes and enabling new financial instruments in the regulated asset space.

This article will provide a comprehensive analysis of POLYX's price trajectory through 2030, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors considering positions in this institutional-focused digital asset.

I. POLYX Price History Review and Current Market Status

POLYX Historical Price Evolution Trajectory

Based on available data, POLYX reached its all-time high (ATH) of $0.748771 on April 1, 2024. Since that peak, the token has experienced a significant downtrend. Over the past year, POLYX has declined by 84.46%, reflecting substantial price pressure and market headwinds. The token recently reached its all-time low (ATL) of $0.04997283 on December 18, 2025.

POLYX Current Market Status

As of December 18, 2025, POLYX is trading at $0.04989, down 4.98% over the last 24 hours. The token's 24-hour trading range spans from $0.04987 to $0.05343. Over the past week, POLYX has declined 15.47%, while the 30-day performance shows a steeper drop of 25.77%.

Market Capitalization and Supply Metrics:

- Total Market Cap: $61,267,370.45

- Circulating Supply: 1,228,049,117.11 POLYX

- Total Supply: 1,228,049,117.11 POLYX

- Market Dominance: 0.0019%

- 24-Hour Trading Volume: $25,527.85

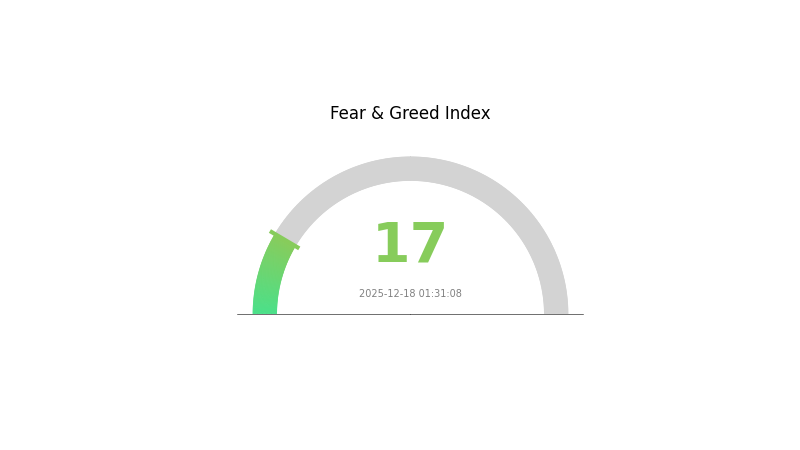

The token maintains a market ranking of 446 among digital assets and is currently listed on 17 exchanges. Token holders number approximately 6,039, indicating a relatively concentrated holder base. The market sentiment indicator currently reflects "Extreme Fear," with a VIX score of 17, suggesting heightened risk aversion in the broader market environment.

Visit current POLYX market price on Gate.com

POLYX Market Sentiment Indicator

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The POLYX market is currently experiencing extreme fear, with the Fear and Greed Index at 17. This historically low reading indicates severe market pessimism and capitulation among investors. Such extreme fear conditions often present contrarian opportunities, as markets tend to recover from excessive negative sentiment. However, extreme caution remains warranted, as further downside risks may persist. Investors should carefully assess their risk tolerance and consider dollar-cost averaging strategies. Monitor market developments closely on Gate.com for real-time updates and analysis.

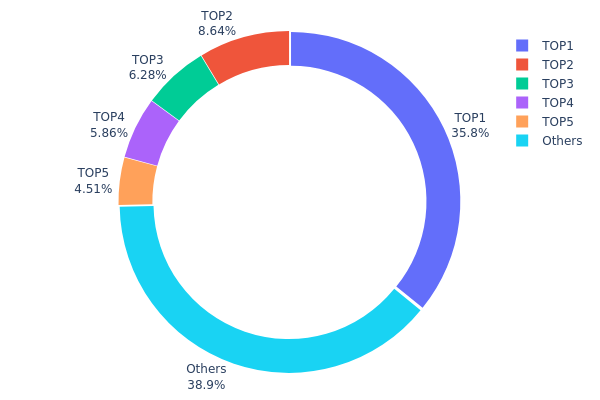

POLYX Holdings Distribution

The holdings distribution chart illustrates the concentration pattern of POLYX tokens across blockchain addresses, revealing how token supply is allocated among top holders and the broader investor base. This metric serves as a critical indicator of decentralization levels and potential market structure risks within the Polymesh ecosystem.

The current distribution of POLYX demonstrates a pronounced concentration among major stakeholders. The top holder commands 35.83% of total supply with 440,019.45K tokens, while the top five addresses collectively control 61.10% of circulating tokens. This concentration level presents notable considerations for market dynamics, as such centralization can amplify volatility and create dependencies on the actions of principal token holders. The second-largest holder maintains an 8.64% position, followed by progressively smaller allocations among the third through fifth positions, indicating a steep decline in holdings beyond the primary stakeholder.

The "Others" category, representing addresses outside the top five, accounts for 38.90% of total supply (477,453.87K tokens). While this seemingly distributed portion provides some degree of decentralization, the dominance of the top position substantially outweighs this diversification. The current structure suggests moderate concentration risk, particularly given that the leading address alone exceeds one-third of total supply. Such distribution patterns typically correlate with increased potential for price volatility triggered by large transactions, and warrant close monitoring of holder behavior for indicators of capital flight or strategic accumulation. The ecosystem's governance and market resilience may be materially influenced by how these concentrated holdings are managed and deployed.

Visit POLYX Holdings Distribution for real-time data

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 2DzB6L...QLFUkb | 440019.45K | 35.83% |

| 2 | 2Fd1UG...wfuU83 | 106139.89K | 8.64% |

| 3 | 2H2F5a...N42L3i | 77071.90K | 6.27% |

| 4 | 2DbjUi...JePw6Y | 71949.11K | 5.85% |

| 5 | 2HexZQ...BX7HMq | 55414.90K | 4.51% |

| - | Others | 477453.87K | 38.9% |

II. Core Factors Influencing POLYX's Future Price

Institutional and Whale Dynamics

- Institutional Adoption: BlackRock's launch of Security Token Offering (STO) funds has brought significant attention to the real-world assets (RWA) sector. Polymesh, as an institutional-grade permissioned blockchain specifically designed for security tokens, directly connects with this STO infrastructure, representing a major tailwind for price appreciation.

Macroeconomic Environment

- RWA Sector Growth: The emergence of institutional interest in tokenized real-world assets has created favorable market conditions for blockchain platforms facilitating securities tokenization. Polymesh's positioning as the infrastructure layer for STO transactions positions it to benefit from this macroeconomic trend toward asset tokenization.

Technology Development and Ecosystem Building

-

Institutional-Grade Infrastructure: Polymesh is purpose-built as a blockchain specifically for security tokens, integrating governance, identity, compliance, confidentiality, and certainty into the blockchain's core. This specialized architecture differentiates it from general-purpose blockchains and strengthens its competitive moat in the RWA sector.

-

Market Sentiment and Capital Flows: Investor sentiment and capital allocation from institutional players directly impact POLYX's price movements. The technology's innovation level and market recognition are key determinants of long-term value appreciation and overall market demand for the token.

III. 2025-2030 POLYX Price Forecast

2025 Outlook

- Conservative Forecast: $0.0379 - $0.04987

- Base Case Forecast: $0.04987

- Optimistic Forecast: $0.05336

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual consolidation and accumulation phase with moderate growth trajectory as adoption expands within the Polymesh ecosystem.

- Price Range Forecast:

- 2026: $0.04387 - $0.05523

- 2027: $0.02778 - $0.07105

- 2028: $0.03361 - $0.07531

- Key Catalysts: Increased institutional participation in the Polymesh protocol, expansion of tokenized securities use cases, regulatory clarity in digital asset markets, and ecosystem development milestones.

2029-2030 Long-term Outlook

- Base Scenario: $0.03851 - $0.07496 (sustained regulatory support and moderate institutional adoption)

- Optimistic Scenario: $0.05534 - $0.09486 (strong mainstream adoption of tokenized securities and broader blockchain integration)

- Transformative Scenario: $0.09486+ (revolutionary shift toward widespread institutional use of Polymesh for regulated digital assets, major regulatory framework advancement, and significant market expansion)

- 2030-12-18: POLYX at $0.09486 (potential peak valuation reflecting substantial ecosystem maturation and institutional acceptance)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.05336 | 0.04987 | 0.0379 | 0 |

| 2026 | 0.05523 | 0.05162 | 0.04387 | 3 |

| 2027 | 0.07105 | 0.05342 | 0.02778 | 7 |

| 2028 | 0.07531 | 0.06224 | 0.03361 | 24 |

| 2029 | 0.07496 | 0.06877 | 0.03851 | 37 |

| 2030 | 0.09486 | 0.07187 | 0.05534 | 44 |

POLYX Professional Investment Strategy and Risk Management Report

IV. POLYX Professional Investment Strategy and Risk Management

POLYX Investment Methodology

(1) Long-term Holding Strategy

- Target Audience: Institutional investors and compliance-focused participants seeking exposure to regulated asset tokenization

- Operational Recommendations:

- Accumulate POLYX during market downturns to benefit from the long-term adoption of regulated asset infrastructure

- Hold tokens through market cycles to capture potential appreciation as Polymesh ecosystem matures

- Participate in network governance to influence protocol development and earn staking rewards

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages (MA 50/200): Use crossover signals to identify trend reversals in POLYX price action

- Relative Strength Index (RSI): Monitor overbought/oversold conditions to time entry and exit points

- Wave Trading Key Points:

- Enter positions during price support levels around the 24-hour low of $0.04987

- Exit partial positions at resistance levels or during 5-7% upside movements to secure profits

POLYX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation to POLYX

- Active Investors: 3-5% of portfolio allocation to POLYX

- Professional Investors: 5-10% of portfolio allocation considering institutional use cases

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance POLYX holdings with established cryptocurrencies and traditional assets to mitigate concentration risk

- Dollar-Cost Averaging (DCA): Implement systematic purchases over time to reduce exposure to price volatility

(3) Secure Storage Solutions

- Hot Wallet Solution: Gate.com Web3 Wallet for frequent trading and active participation in network governance

- Cold Storage Approach: Transfer long-term holdings to hardware wallets for enhanced security against digital threats

- Security Precautions: Enable multi-factor authentication, use hardware wallet signing for critical transactions, and maintain secure backup of recovery phrases offline

V. POLYX Potential Risks and Challenges

POLYX Market Risk

- Price Volatility: POLYX has experienced an 84.46% decline over the past year, indicating significant price exposure and potential for further downside movement

- Liquidity Risk: With 24-hour volume of $25,527.85 and market cap of $61.27 million, trading liquidity may be insufficient for large institutional positions

- Market Cap Concentration: As the 446th ranked cryptocurrency by market cap, POLYX remains relatively small and susceptible to market sentiment shifts

POLYX Regulatory Risk

- Compliance Framework Evolution: Changes in global securities regulations could impact the demand for regulated asset infrastructure

- Jurisdictional Uncertainty: Varying regulatory interpretations across markets may limit Polymesh's addressable market expansion

- Central Bank Digital Currency Competition: Development of CBDCs and competing blockchain solutions may cannibalize demand for Polymesh's services

POLYX Technical Risk

- Adoption Bottleneck: Success depends heavily on enterprise adoption of the Polymesh network for regulated asset issuance

- Protocol Updates: Smart contract vulnerabilities or inadequate security audits could compromise network integrity

- Competition Risk: Emergence of alternative institutional-grade blockchains may reduce Polymesh's competitive advantage in regulated asset settlement

VI. Conclusion and Action Recommendations

POLYX Investment Value Assessment

Polymesh operates in a compelling but early-stage market segment targeting institutional-grade regulated asset tokenization. While the long-term thesis around compliance-native blockchain infrastructure remains theoretically sound, current market conditions present significant headwinds. The project's 84.46% annual decline suggests either overvaluation at launch or fundamental challenges in market adoption. Investors must carefully weigh the transformative potential of regulated asset infrastructure against the substantial technical and commercial execution risks.

POLYX Investment Recommendations

✅ Beginners: Start with minimal exposure (0.5-1% of portfolio) through Gate.com to understand the project dynamics before scaling allocation ✅ Experienced Investors: Implement a DCA strategy during periods of significant drawdown, accumulating at lower price points while monitoring adoption metrics ✅ Institutional Investors: Evaluate Polymesh's technical specifications and governance model to assess alignment with institutional requirements for regulated asset settlement

POLYX Trading Participation Methods

- Spot Trading: Execute buy and hold positions directly on Gate.com to gain exposure to POLYX price appreciation

- Governance Participation: Hold POLYX tokens to vote on protocol proposals and influence network development direction

- Market Analysis: Monitor trading volume, price trends, and ecosystem developments on Gate.com to inform timing decisions

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on their risk tolerance and personal circumstances. Always consult with qualified financial advisors before making investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

Is polyx a good investment?

POLYX demonstrates strong potential driven by Polymesh's regulatory compliance framework and growing institutional adoption. Technical analysis suggests bullish momentum for 2025-2026. Strong fundamentals and increasing transaction volume support positive outlook for long-term investors.

Will polygon hit $10?

Yes, Polygon could potentially reach $10 with sustained growth and increased adoption. Market analysts suggest this milestone is plausible by 2031, driven by continued network expansion and ecosystem development.

Does Polymesh have a future?

Yes, Polymesh has strong future potential. Its innovative compliance-focused blockchain infrastructure addresses real regulatory needs in financial markets. Growing institutional adoption and expanding use cases in securities trading suggest significant growth opportunities ahead.

Can PolySwarm reach $10?

Yes, PolySwarm could potentially reach $10 if market conditions improve and adoption increases significantly. However, this requires substantial growth in trading volume and ecosystem development. Price predictions remain speculative.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Top NFT Success Stories to Watch in 2024

Prominent NFT Creators and Their Masterpieces

Efficient Crypto Payment Solutions: A Guide for Modern Businesses

Spur Protocol Daily Quiz Answer Today 19 december 2025

Dropee Question of the Day for 19 december 2025