2025 STOC Price Prediction: Expert Analysis and Market Outlook for the Year Ahead

Introduction: STOC's Market Position and Investment Value

STO Chain (STOC), as a blockchain designed specifically for regulated assets, has made significant strides in bridging traditional finance with decentralized finance since its inception. As of 2025, STOC's market capitalization has reached $525,324,833, with a circulating supply of approximately 2,919,444,444 tokens, and a price hovering around $0.17994. This asset, often referred to as the "regulated asset bridge," is playing an increasingly crucial role in the seamless issuance, trading, and settlement of security tokens and Real-World Assets (RWAs).

This article will comprehensively analyze STOC's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to provide investors with professional price predictions and practical investment strategies.

I. STOC Price History Review and Current Market Status

STOC Historical Price Evolution Trajectory

- 2025: STOC reached its all-time high of $2.39999 on July 11, marking a significant milestone for the project

- 2025: Just three weeks later, on August 1, STOC experienced its all-time low of $0.02718, showcasing extreme volatility

- 2025: STOC has shown remarkable recovery, with a 897.45% increase over the past year

STOC Current Market Situation

As of December 16, 2025, STOC is trading at $0.17994, with a 24-hour trading volume of $155,700.20. The token has experienced a slight decrease of 0.79% in the last 24 hours. STOC's market capitalization stands at $525,324,833, ranking it 114th in the overall cryptocurrency market. The circulating supply is 2,919,444,444 STOC, which represents 29.19% of the total supply of 10,000,000,000 tokens. Despite the recent dip, STOC has shown strong performance over the past year, with a substantial increase in value.

Click to view the current STOC market price

STOC Market Sentiment Indicator

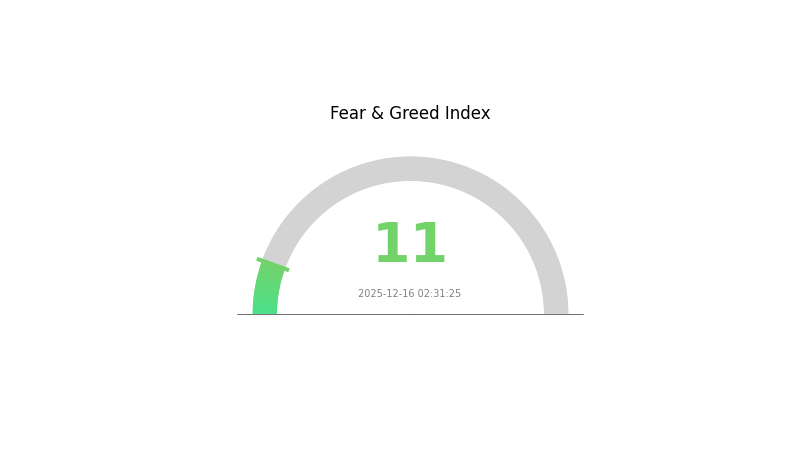

2025-12-16 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of extreme fear, with the sentiment index plummeting to 11. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research before making any investment decisions. Remember, market sentiment can shift rapidly, and while extreme fear may indicate oversold conditions, it doesn't guarantee an immediate market reversal. Stay informed and consider diversifying your portfolio to mitigate risks in these uncertain times.

STOC Holdings Distribution

The address holdings distribution chart provides insights into the concentration of STOC tokens among different wallet addresses. Based on the provided data, it appears that there is no significant concentration of STOC tokens in any particular address.

This relatively even distribution suggests a healthy level of decentralization within the STOC ecosystem. The absence of large token holders, often referred to as "whales," indicates a reduced risk of market manipulation and potential price volatility caused by sudden large-scale transactions. This distribution pattern is generally considered favorable for the overall stability and long-term sustainability of the token's ecosystem.

The current address distribution reflects a market structure that is resistant to centralized control and aligns well with the principles of decentralization. It suggests a diverse user base and potentially indicates widespread adoption of STOC across various stakeholders in the ecosystem.

Click to view the current STOC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing STOC's Future Price

Supply Mechanism

- Supply Adjustments: Historically, supply adjustments have significantly impacted price trends

- Current Impact: Expected supply changes are likely to continue influencing price dynamics

Institutional and Major Holder Dynamics

- Institutional Holdings: Institutional funds play a role in STOC's market dynamics

Macroeconomic Environment

- Inflation Hedging Properties: STOC's performance in inflationary environments is a consideration for investors

Technical Development and Ecosystem Building

- Ecosystem Applications: Development of key DApps and ecosystem projects impacts STOC's value proposition

III. STOC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.12426 - $0.15000

- Neutral prediction: $0.15000 - $0.18009

- Optimistic prediction: $0.18009 - $0.23952 (requires positive market sentiment)

2027 Mid-term Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2026: $0.14477 - $0.28953

- 2027: $0.21471 - $0.30709

- Key catalysts: Increased adoption and technological improvements

2030 Long-term Outlook

- Base scenario: $0.34306 - $0.36496 (assuming steady market growth)

- Optimistic scenario: $0.36496 - $0.37955 (assuming strong market performance)

- Transformative scenario: $0.37955 - $0.40977 (assuming breakthrough innovations)

- 2030-12-31: STOC $0.36496 (102% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.23952 | 0.18009 | 0.12426 | 0 |

| 2026 | 0.28953 | 0.2098 | 0.14477 | 16 |

| 2027 | 0.30709 | 0.24967 | 0.21471 | 38 |

| 2028 | 0.36189 | 0.27838 | 0.14476 | 54 |

| 2029 | 0.40977 | 0.32014 | 0.21129 | 77 |

| 2030 | 0.37955 | 0.36496 | 0.34306 | 102 |

IV. STOC Professional Investment Strategies and Risk Management

STOC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Institutional investors and long-term believers in security token offerings

- Operation suggestions:

- Accumulate STOC during market dips

- Set a target holding period of 3-5 years

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage downside risk

STOC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple blockchain projects

- Options trading: Use put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for STOC

STOC Market Risks

- Volatility: High price fluctuations common in crypto markets

- Liquidity: Limited trading volume may impact price stability

- Competition: Emergence of rival security token platforms

STOC Regulatory Risks

- Compliance: Changing regulations may affect STOC's operations

- Jurisdictional issues: Varying legal frameworks across countries

- Licensing: Potential need for additional licenses or registrations

STOC Technical Risks

- Smart contract vulnerabilities: Potential for code exploits

- Scalability: Challenges in handling increased transaction volumes

- Interoperability: Integration issues with traditional financial systems

VI. Conclusion and Action Recommendations

STOC Investment Value Assessment

STOC presents a unique opportunity in the regulated digital asset space, with potential for long-term growth. However, investors should be aware of short-term volatility and regulatory uncertainties.

STOC Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market ✅ Experienced investors: Consider a balanced approach with both long-term holdings and active trading ✅ Institutional investors: Explore strategic partnerships and large-scale adoption of the STO Chain platform

STOC Trading Participation Methods

- Spot trading: Buy and sell STOC on Gate.com

- Staking: Participate in staking programs if available

- OTC trading: For large volume transactions, consider over-the-counter options

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the 7% rule in stocks?

The 7% rule suggests selling a stock if it drops 7% below the purchase price to limit losses. It's a risk management strategy, but may cause early exits for volatile stocks.

Is it possible to predict stock prices?

Yes, advanced AI models can predict stock prices with increasing accuracy, using market data and trends.

Which stock to buy for the next 5 years?

Amazon, Shopify, and Eli Lilly are strong choices for the next 5 years, offering excellent growth potential and proven track records.

Should I pull my money out of the stock market?

It depends on your goals. Pulling out may avoid short-term losses but risks missing future gains. Consider your long-term strategy and consult a financial advisor for personalized advice.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

What is BNB's whitepaper core logic and how does it drive the BNB Chain ecosystem?

What is NUC Price Volatility: Understanding the 3.33% Fluctuation and 52-Week Trading Range?

What Is RLS Community Activity and Why Does DApp Ecosystem Growth Matter in 2025?

What Is Token Economics Model: Distribution Mechanisms, Inflation Design & Governance Utility Explained

What is DigiByte (DGB): Fundamentals, Technology Innovation, and Roadmap Progress in 2025?