瑞波币价格预测:市场表现与展望

XRP 项目概述

XRP 是 XRP Ledger(XRPL)的原生数字货币,由 Ripple Labs 于 2012 年推出。XRPL 是一个去中心化的开源区块链平台,支持多种资产的交易与结算,专为实现快速、高效的跨境支付而设计。

与比特币依赖工作量证明(PoW)机制不同,XRPL 采用瑞波共识协议(Ripple Consensus Protocol),由独立验证者组成的网络在 3 至 5 秒内达成共识,从而大幅提高交易确认速度。这一机制使 XRPL 能够为银行和金融机构提供更快速、成本更低的跨境支付解决方案,优化全球资金流转效率。

值得注意的是,XRP 在发布时已全部预挖,总供应量固定为 1000 亿枚,无额外挖矿增发。此外,Ripple Labs 定期出售所持 XRP,以增强市场流动性并支持生态系统发展,赋能跨境支付场景。

XRP 代币标识(图源:https://wallstreetpit.com)

相关链接:

- 官网入口:https://ripple.com/

- 白皮书:https://xrpl.org/docs

- Github:https://github.com/XRPLF/

- X (Twitter):https://x.com/Ripple

- Telegram:https://t.me/Ripple

- Xrpscan:https://xrpscan.com/

- 交易入口:https://www.Gate.com/zh/trade/XRP_USDT

XRP 团队介绍

Brad Garlinghouse

Ripple 首席执行官,也是董事会成员。在加入 Ripple 之前,他曾担任文件协作服务 Hightail 的首席执行官、美国在线 AOL 消费者应用总裁,以及在雅虎担任过多个行政职位。

David Schwartz

现任 Ripple 首席技术官,XRP Ledger 原始架构师之一,常被称为「JoelKatz」,在数字货币社区中受人尊敬。此前,他曾是 Santa Clara 软件开发商 WebMaster Incorporated 的首席技术官,也为 CNN、国家安全局 NSA 等组织开发了加密的云存储和企业消息传递系统。

Monica Long

现任 Ripple 总裁,2013 年加入 Ripple,曾任总经理、市场与设计高级副总裁,是公司最早的市场传播负责人之一,目前主要负责 Ripple Payments 和 RippleX 两大业务板块。她在金融科技领域具备深厚经验,曾获评 2020 年旧金山湾区最具影响力商业女性之一,拥有加州大学伯克利分校学士学位。

Ripple 项目领导者(图源:https://ripple.com/company/leadership/)

XRP 应用场景

在 Ripple 生态系统中,XRP 作为促进网络流动性的实用型代币,被广泛用于价值转移,比如在跨境交易中,XRP 可用于充当不同货币之间的中介资产,简化全球汇款流程。传统金融体系下,美国银行向欧盟银行汇款,通常需要经过多个第三方验证系统,手续费高昂,资金结算需要耗费较多时间。不过,借助 Ripple 生态系统,银行可以直接将资金转换为 XRP,并迅速完成跨境支付,使整个交易过程更为便捷、高效。

此外,传统银行系统在处理金额较高的跨境支付时,通常需要满足额外的监管合规要求,导致资金到账时间延迟多达 3 天,而 XRP 作为去中心化、实时结算的资产,能够有效规避这些延迟,即使是巨额交易,也能在数秒内完成,这一不受交易金额上限限制的特性,为金融机构提供了更大的市场灵活性。

Ripple 跨境支付流程示意(图源:Ripple Documentation)

XRP 最新动态

2025 年 3 月 2 日,美国总统唐纳德·特朗普正式宣布建立美国加密战略储备,其中明确将比特币、瑞波币等加密资产纳入储备资产范畴。这一决策在 2025 年 3 月 7 日即将召开的首届白宫加密峰会之前发布,会议将重点探讨加密货币监管与创新发展,预计为美国数字市场提供更明确的监管框架。

此次公告被市场解读为美国政府对加密货币持积极态度,尤其是对于瑞波币(XRP)而言,被纳入美国的国家级战略储备,是进一步强化了其在加密生态系统中的地位和市场认可度,不仅有利于加速 XRP 的机构级采用,推动更广泛的区块链基础设施建设,使其在全球金融体系中的重要性进一步提升。

美国总统特朗普确认 XRP 为加密战略储备(图源:Truth Details | Truth Social)

$XRP 链上数据

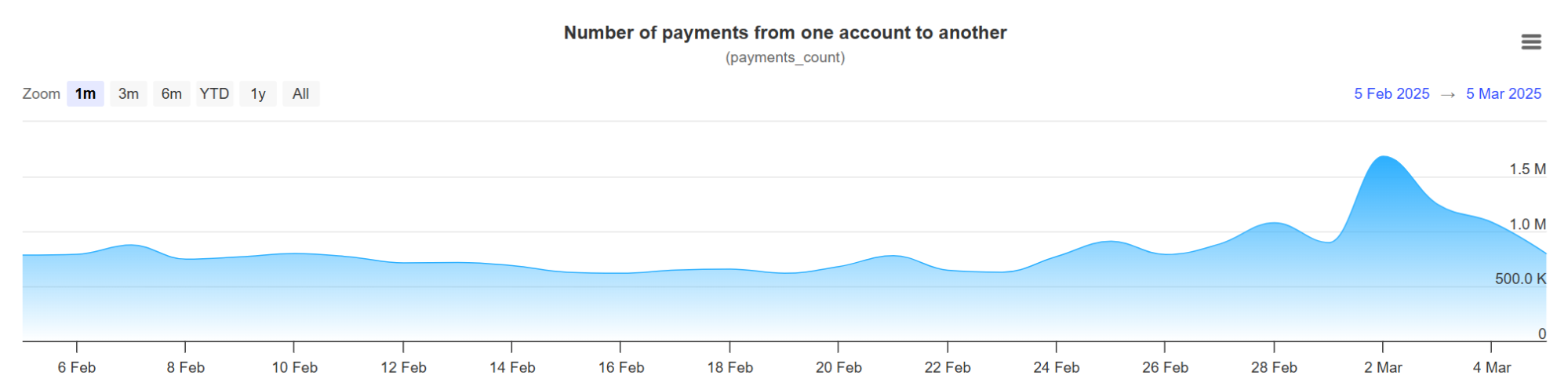

过去一个月,XRPL 链上支付交易量呈现显著波动,整体维持在 50 万至 150 万笔 之间。3 月初,交易活跃度明显提升,并于 3 月 2 日 附近攀升至阶段性高点,峰值突破 150 万笔,或受到最新政策利好信号的推动。此后,交易量虽有所回落,但仍高于此前平均水平,显示出市场买方情绪的持续释放。

过去三个月 XRPL 链上执行的交易数量(图源:https://xrpscan.com/metrics)

过去一周,$XRP 经历了显著的价格波动。三月前,整体处于低位震荡整理阶段,市场交投情绪较谨慎,缺乏明显的方向性突破;3 月 2 日起,市场出现剧烈拉升,可能受到政策利好的推动,$XRP 价格在短时间内快速突破,并伴随显著放量;3 月 4 日至 5 日,$XRP 价格进入横盘震荡阶段,尽管整体价格有所回调,但仍保持在相对高位,显示出市场开始整理修复,短期支撑与买盘力量仍然存在。

截至3月5日(UTC+0)撰文时,$XRP最新价格为 2.47 美元,全流通市值 2479.0 亿美元,持币地址数量623.7万,后续走势将取决于市场买盘意愿、宏观环境及 Ripple 生态系统的进一步发展。

(马上交易:https://www.Gate.com/zh/trade/XRP_USDT)

02/26 - 03/5 期间 $XRP 走势(图源:https://coinmarketcap.com/dexscan/bsc)

$XRP 价格预测

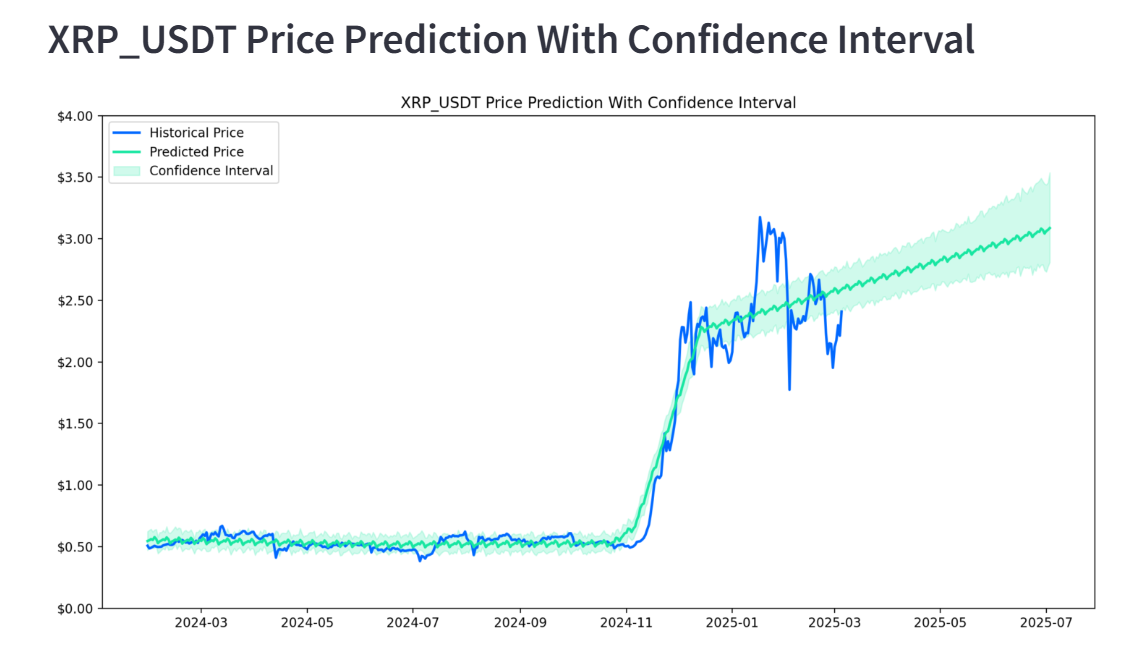

预计短期内,XRP 价格将在 $2.00 至 $2.50 区间内震荡整理,市场呈现低位盘整态势。随着时间推移,预计在 2025 年 4-5 月,XRP 可能迎来新一轮突破,价格有望升至 $3.00 附近,并测试新的阶段性高点。同时,从置信区间的走势来看,市场对 XRP 的长期前景仍然保持乐观,整体趋势仍指向上行。若加密市场行情回暖,或进入新一轮牛市周期,XRP 可能迎来更大幅度的上涨,突破此前的预测区间。

$XRP 价格走势 AI 模型预测(图源:https://cryptopriceperdiction-isshiliu.streamlit.app/)

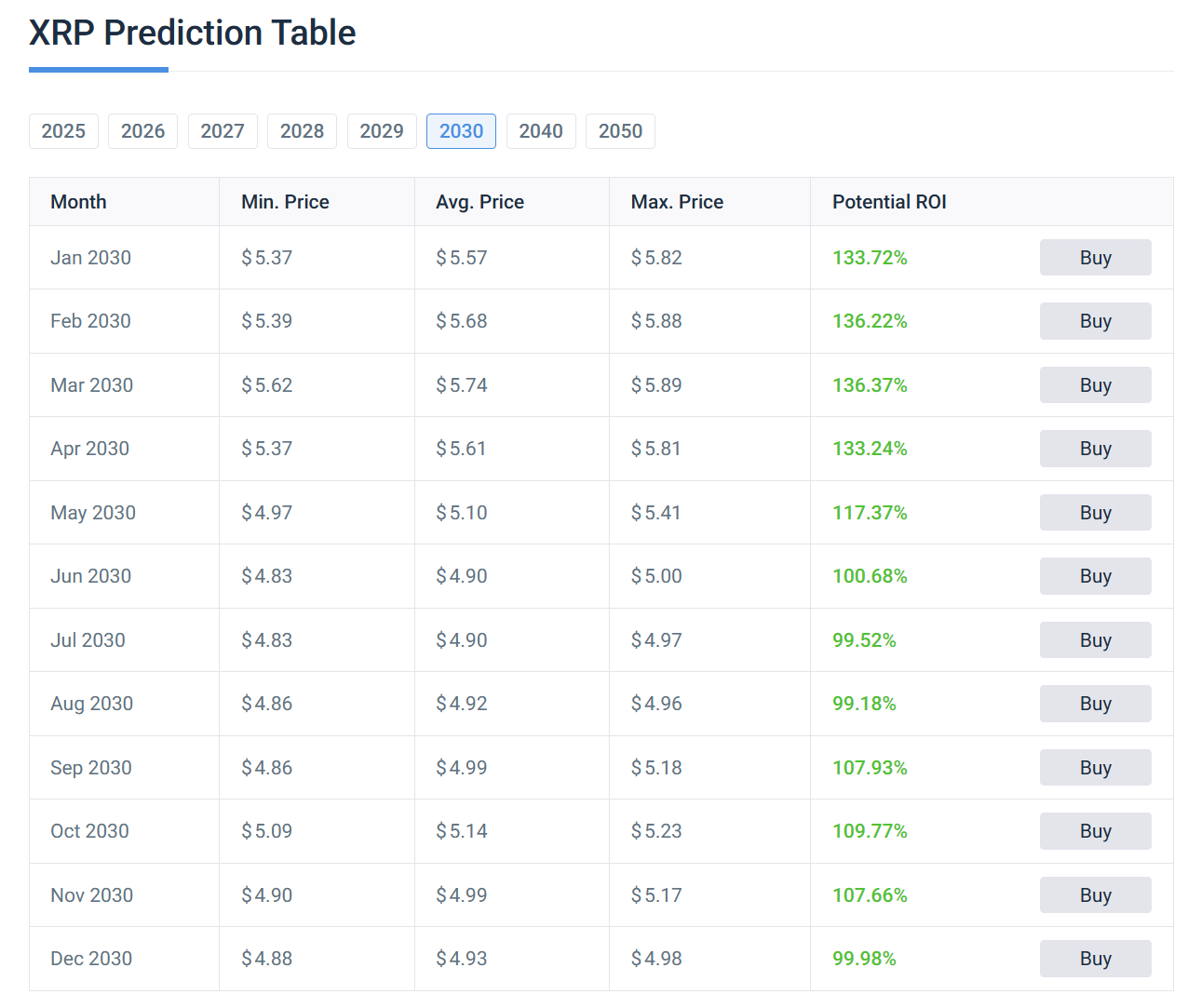

从 2030 年 XRP 价格预测表来看,随着加密市场的成熟,以及 XRP 在全球支付领域的应用扩大,$XRP 在未来长期走势上可能呈稳步上涨的趋势,整体价格预期维持在 $4.83 至 $5.89 之间,2030 年的平均价格稳定在 $4.90 以上,表明 XRP 具备较强的长期持有价值。此外,$XRP 投资回报率维持在 99% 以上,部分月份甚至超过 136%,凸显出其未来的增值潜力,以及市场对 XRP 未来的乐观态度。

$XRP未来价格长期展望(图源:https://coincodex.com/crypto/ripple/price-prediction/)

结语

近期市场走势表明,XRP 在政策利好、机构采用率提升的推动下,具备较强的增长潜力,长期来看,随着区块链技术的成熟及主流金融机构的逐步采纳,XRP 极有可能成为全球支付体系的重要组成部分。未来,建议投资者密切关注宏观政策及 Ripple 生态发展,把握 XRP 的长期价值和投资机会。

相关文章

Gate BTC 挖矿:质押 BTC,轻松每日赚取链上收益

ETF 助力 Nasdaq Turns Positive in 2025:捕捉科技浪潮红利

2025 年房屋税新政全面解析 — 政策变化与纳税人应对策略

纳斯达克 100 指数最新动态与投资策略