# BitcoinFallsBehindGold

9.56K

MrFlower_XingChen

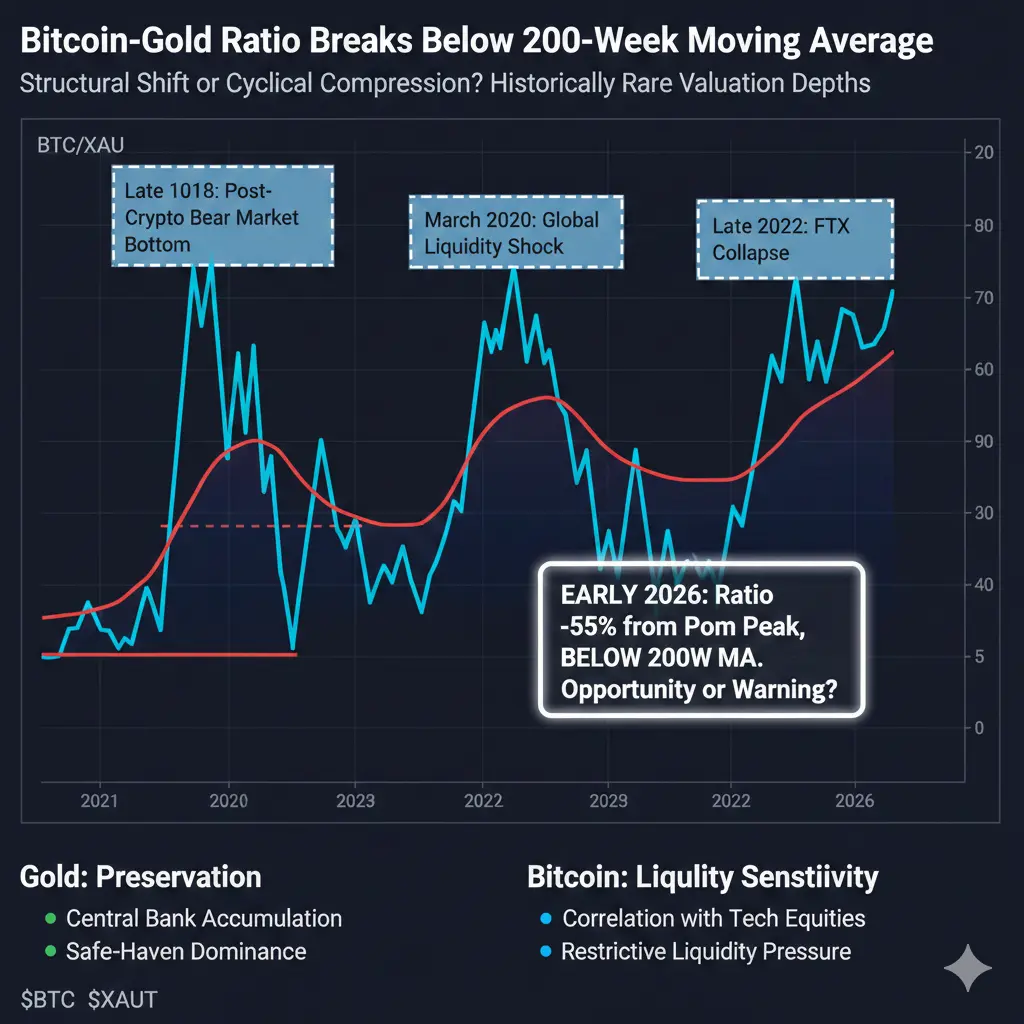

#BitcoinFallsBehindGold Bitcoin–Gold Ratio Breaks Below 200-Week Moving Average — Opportunity or Structural Warning?

In the global macro-financial environment of early 2026, a highly important long-term indicator has once again sent a powerful signal. The Bitcoin-to-Gold ratio has retraced approximately 55% from its previous peak and has now decisively fallen below the 200-week moving average, a level widely regarded as the long-term equilibrium threshold.

Within crypto market structure, the 200-week moving average is often described as the final line of defense. Historically, only a handful o

In the global macro-financial environment of early 2026, a highly important long-term indicator has once again sent a powerful signal. The Bitcoin-to-Gold ratio has retraced approximately 55% from its previous peak and has now decisively fallen below the 200-week moving average, a level widely regarded as the long-term equilibrium threshold.

Within crypto market structure, the 200-week moving average is often described as the final line of defense. Historically, only a handful o

XAUT-0,25%

- Reward

- 12

- 149

- Repost

- Share

Yunna :

:

2026 gogoView More

#BitcoinFallsBehindGold #比特币相对黄金进入深度弱势 🔥

Global financial markets are quietly delivering a clear signal: the hierarchy of safe-haven assets is shifting once again. Recent price behavior across major asset classes points to a growing divergence between Bitcoin and Gold — one that reflects a decisive change in investor priorities. As geopolitical tension, monetary uncertainty, and macro instability intensify, capital is no longer chasing innovation. It is seeking protection.

Gold’s advance is neither emotional nor accidental. Its move toward the $4,900–$5,000 per ounce region reflects deliberat

Global financial markets are quietly delivering a clear signal: the hierarchy of safe-haven assets is shifting once again. Recent price behavior across major asset classes points to a growing divergence between Bitcoin and Gold — one that reflects a decisive change in investor priorities. As geopolitical tension, monetary uncertainty, and macro instability intensify, capital is no longer chasing innovation. It is seeking protection.

Gold’s advance is neither emotional nor accidental. Its move toward the $4,900–$5,000 per ounce region reflects deliberat

BTC-0,13%

- Reward

- 15

- 112

- Repost

- Share

GateUser-72338806 :

:

Happy New Year! 🤑View More

#BitcoinFallsBehindGold

The Traditional Victor of the Digital Age

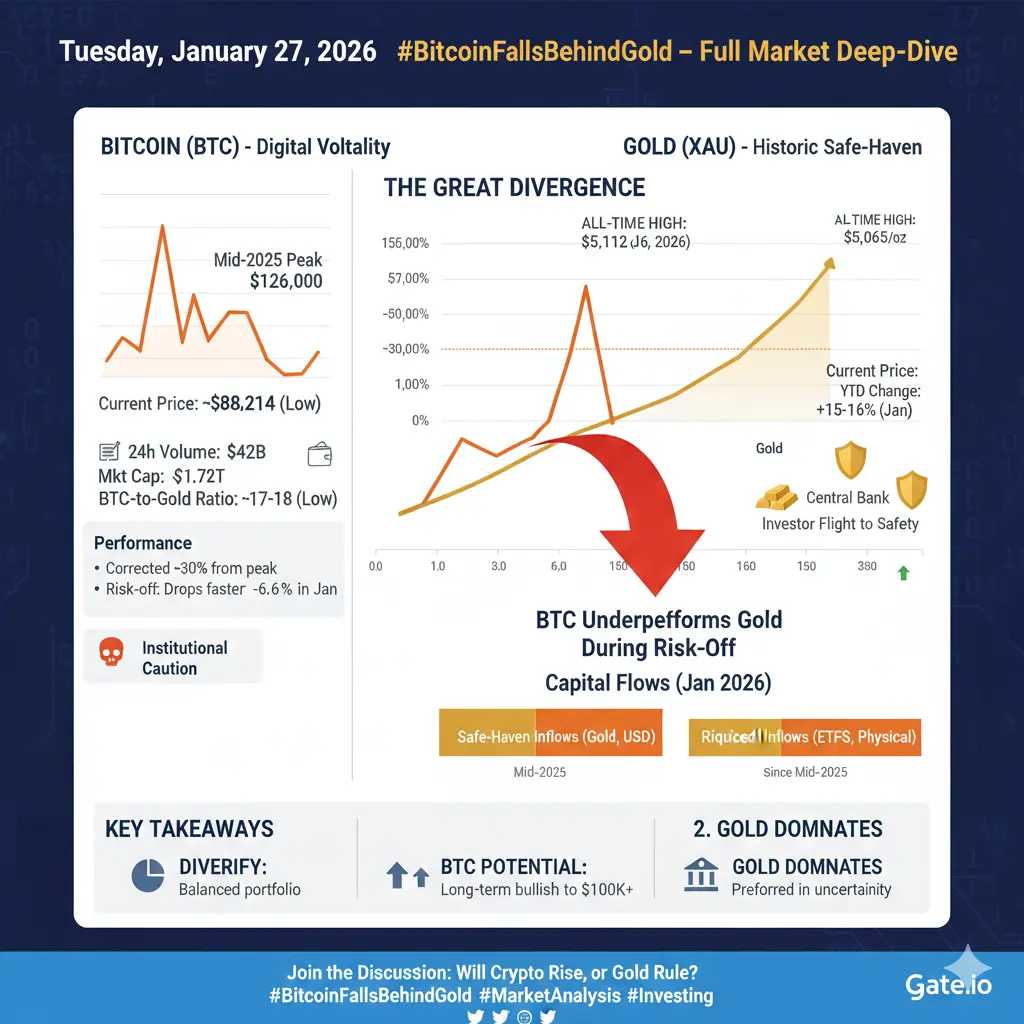

As of January 2026, the gap between "digital gold" and "physical gold" in global financial markets has widened more than ever before. While Bitcoin struggles to break through the psychological barrier of $100,000, traditional gold continues to shatter records, proving itself as the true sovereign of the stage.

The year 2026 began as a "reality check" for the financial world. While there has been talk for years about Bitcoin claiming its crown as digital gold, data from January presents a starkly different picture. Gold (XAU)

The Traditional Victor of the Digital Age

As of January 2026, the gap between "digital gold" and "physical gold" in global financial markets has widened more than ever before. While Bitcoin struggles to break through the psychological barrier of $100,000, traditional gold continues to shatter records, proving itself as the true sovereign of the stage.

The year 2026 began as a "reality check" for the financial world. While there has been talk for years about Bitcoin claiming its crown as digital gold, data from January presents a starkly different picture. Gold (XAU)

BTC-0,13%

- Reward

- 40

- 37

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

Why the “Safe Haven” Narrative Is Being Repriced

In an environment of rising global uncertainty, markets are sending a clear signal:

capital is prioritizing stability over growth.

While gold and silver continue to print new highs, Bitcoin is lagging both in price action and investor confidence.

📊 Crypto Fear & Greed Index: 20 — Extreme Fear

This level reflects a market driven more by defensive positioning than risk-taking.

🔍 Key Market Signals

Bitcoin price: ~88,150 USDT

BTC YTD performance: -6.25%

Gold: +65–70% over the past year

Volatility: Elevated across BTC & ETH

Capital flow: Risk-off

In an environment of rising global uncertainty, markets are sending a clear signal:

capital is prioritizing stability over growth.

While gold and silver continue to print new highs, Bitcoin is lagging both in price action and investor confidence.

📊 Crypto Fear & Greed Index: 20 — Extreme Fear

This level reflects a market driven more by defensive positioning than risk-taking.

🔍 Key Market Signals

Bitcoin price: ~88,150 USDT

BTC YTD performance: -6.25%

Gold: +65–70% over the past year

Volatility: Elevated across BTC & ETH

Capital flow: Risk-off

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 14

- 14

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

#BitcoinFallsBehindGold

Bitcoin’s Gold Ratio Down 55% Is This a Dip-Buying Opportunity or a Warning Signal?

Bitcoin has recently fallen behind gold in terms of relative strength, with the BTC-to-gold ratio down approximately 55% from its peak. Additionally, BTC has slipped below its 200-week moving average, a long-term technical benchmark that has historically acted as a strong support level during major corrections. These movements have left investors and traders asking: Is this the ideal moment to accumulate, or is the downside risk still too high?

Bitcoin’s recent underperformance relativ

Bitcoin’s Gold Ratio Down 55% Is This a Dip-Buying Opportunity or a Warning Signal?

Bitcoin has recently fallen behind gold in terms of relative strength, with the BTC-to-gold ratio down approximately 55% from its peak. Additionally, BTC has slipped below its 200-week moving average, a long-term technical benchmark that has historically acted as a strong support level during major corrections. These movements have left investors and traders asking: Is this the ideal moment to accumulate, or is the downside risk still too high?

Bitcoin’s recent underperformance relativ

- Reward

- 20

- 22

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold

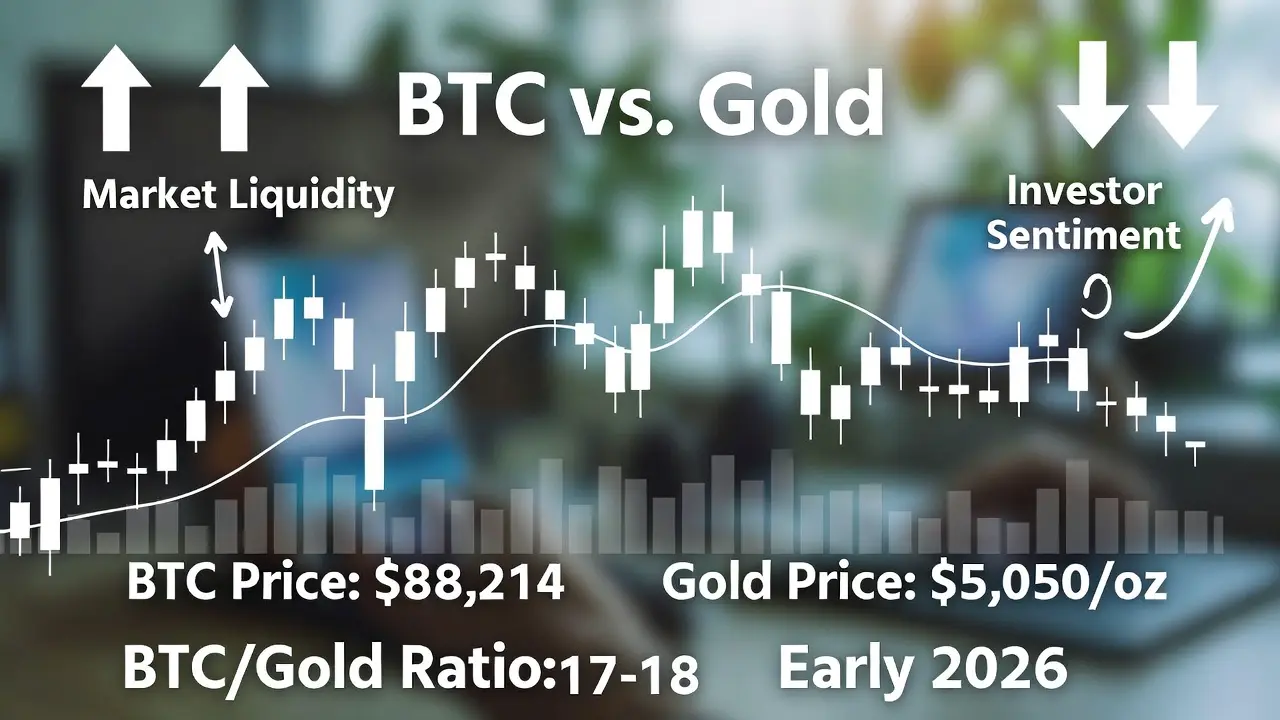

As 2026 progresses, Bitcoin’s claim as “digital gold” faces its toughest challenge yet. Gold continues its historic surge, hitting new all-time highs, while Bitcoin underperforms significantly, especially during risk-off phases. The divergence between these two supposed stores of value reveals deeper market dynamics, including liquidity flows, investor psychology, and macroeconomic pressures. This deep dive analyzes everything: price movements, percentage changes, volume trends, market liquidity, BTC-to-gold ratio, macro drivers, and forward outlooks.

Bitcoin – Detaile

As 2026 progresses, Bitcoin’s claim as “digital gold” faces its toughest challenge yet. Gold continues its historic surge, hitting new all-time highs, while Bitcoin underperforms significantly, especially during risk-off phases. The divergence between these two supposed stores of value reveals deeper market dynamics, including liquidity flows, investor psychology, and macroeconomic pressures. This deep dive analyzes everything: price movements, percentage changes, volume trends, market liquidity, BTC-to-gold ratio, macro drivers, and forward outlooks.

Bitcoin – Detaile

BTC-0,13%

- Reward

- 16

- 18

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

#BitcoinFallsBehindGold 📉 #BitcoinFallsBehindGold

The contrast is hard to miss right now. Gold is breaking records. Bitcoin is moving sideways.

But this isn’t a verdict — it’s a cycle snapshot.

🟡 Gold is reacting exactly as it should: • Rising geopolitical stress

• Central banks increasing reserves

• Capital seeking protection

₿ Bitcoin is doing something different: • Cooling after a leverage-heavy phase

• Rebuilding structure

• Letting speculative excess unwind

Two assets. Two purposes.

Gold absorbs fear. Bitcoin absorbs liquidity.

When markets go defensive, gold leads. When liquidity retur

The contrast is hard to miss right now. Gold is breaking records. Bitcoin is moving sideways.

But this isn’t a verdict — it’s a cycle snapshot.

🟡 Gold is reacting exactly as it should: • Rising geopolitical stress

• Central banks increasing reserves

• Capital seeking protection

₿ Bitcoin is doing something different: • Cooling after a leverage-heavy phase

• Rebuilding structure

• Letting speculative excess unwind

Two assets. Two purposes.

Gold absorbs fear. Bitcoin absorbs liquidity.

When markets go defensive, gold leads. When liquidity retur

- Reward

- 6

- 8

- Repost

- Share

AylaShinex :

:

1000x VIbes 🤑View More

#BitcoinFallsBehindGold #BitcoinFallsBehindGold

For the first time in months, the narrative is shifting.

Gold is pushing record highs.

Bitcoin is consolidating.

Does that mean Bitcoin is losing its edge?

Not exactly.

Here’s what’s happening:

🟡 Gold is benefiting from geopolitical tension, central bank accumulation, and safe-haven flows.

₿ Bitcoin, on the other hand, is moving through a structural reset phase after heavy leverage was flushed out.

Different cycles. Different drivers.

Gold thrives on fear.

Bitcoin thrives on liquidity.

Right now, capital is rotating defensively.

But history show

For the first time in months, the narrative is shifting.

Gold is pushing record highs.

Bitcoin is consolidating.

Does that mean Bitcoin is losing its edge?

Not exactly.

Here’s what’s happening:

🟡 Gold is benefiting from geopolitical tension, central bank accumulation, and safe-haven flows.

₿ Bitcoin, on the other hand, is moving through a structural reset phase after heavy leverage was flushed out.

Different cycles. Different drivers.

Gold thrives on fear.

Bitcoin thrives on liquidity.

Right now, capital is rotating defensively.

But history show

- Reward

- 10

- 11

- Repost

- Share

AYATTAC :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold

Today’s market conversation is increasingly shaped by a quiet but meaningful comparison: Bitcoin, often called “digital gold,” is currently falling behind actual gold in terms of performance and investor preference. While Bitcoin remains a dominant force in the crypto ecosystem, gold has taken the lead as capital seeks stability over speculation. This shift doesn’t signal the end of Bitcoin’s relevance, but it does highlight how market priorities change when uncertainty rises.

Gold’s recent strength reflects a classic flight-to-safety move. As macro pressures persist r

Today’s market conversation is increasingly shaped by a quiet but meaningful comparison: Bitcoin, often called “digital gold,” is currently falling behind actual gold in terms of performance and investor preference. While Bitcoin remains a dominant force in the crypto ecosystem, gold has taken the lead as capital seeks stability over speculation. This shift doesn’t signal the end of Bitcoin’s relevance, but it does highlight how market priorities change when uncertainty rises.

Gold’s recent strength reflects a classic flight-to-safety move. As macro pressures persist r

BTC-0,13%

- Reward

- 11

- 15

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

📉 Bitcoin Gold Ratio Hits Key Levels — Dip-Buy Opportunity?

The Bitcoin-to-Gold ratio has fallen roughly 55% from its peak and recently dipped below the 200-week moving average, signaling extended underperformance relative to gold. Historically, moves below this MA have often coincided with accumulation opportunities for long-term BTC holders.

Current Market Context

Bitcoin (BTC): $96,400 (approx.) | 200-week MA breached

Gold (XAU/USD): $5,020/oz | safe-haven demand remains elevated

Sentiment: Caution in equities and crypto; risk-off flows continue to support gold

Strategic Insights

Historica

The Bitcoin-to-Gold ratio has fallen roughly 55% from its peak and recently dipped below the 200-week moving average, signaling extended underperformance relative to gold. Historically, moves below this MA have often coincided with accumulation opportunities for long-term BTC holders.

Current Market Context

Bitcoin (BTC): $96,400 (approx.) | 200-week MA breached

Gold (XAU/USD): $5,020/oz | safe-haven demand remains elevated

Sentiment: Caution in equities and crypto; risk-off flows continue to support gold

Strategic Insights

Historica

BTC-0,13%

- Reward

- 7

- 5

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

39.87K Popularity

3.83K Popularity

3.04K Popularity

1.57K Popularity

1.48K Popularity

1.27K Popularity

1.27K Popularity

1.69K Popularity

68.33K Popularity

110.66K Popularity

77.59K Popularity

19.39K Popularity

44.04K Popularity

36.9K Popularity

175.13K Popularity

News

View MoreClawdBot Founder: The GitHub hijacking issue has been resolved, it only affected my personal account.

1 m

Stablecoin market cap loses $70 billion in one week? $155 billion retreat reveals the truth about crypto fund withdrawals

4 m

Data: A trader shorted 738.48 ETH at 25x leverage, with an average entry price of $2906.2.

5 m

PUMP token price surges 25% in a single day: Pump.fun faces class-action lawsuits, Solana ecosystem experiences intense polarization

9 m

Hong Kong Securities and Futures Commission signs Memorandum of Understanding with UAE to strengthen digital asset cooperation

11 m

Pin