# Cryptoanalysis

17.76K

YemenBit

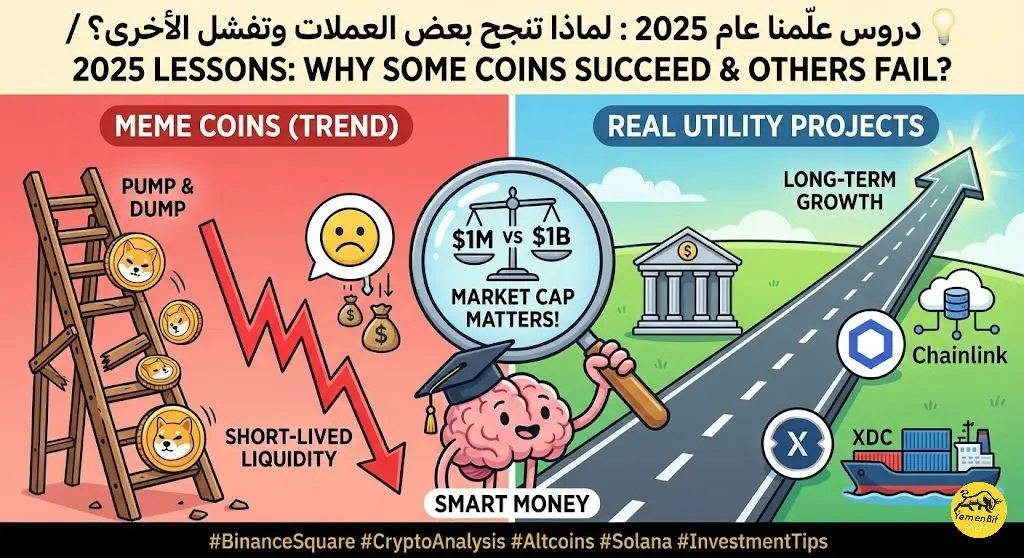

💡 Lessons taught to us in 2025: Why do some coins succeed and others fail?

Have you ever wondered why some profits vanished in 2025 while others' portfolios doubled? The secret isn't luck, but in choosing the right 'foundation'.

In the cryptocurrency market, a strong rally isn't always an indicator of ongoing success. 2025 has taught us clear lessons that survival belongs to projects with "real value".

🔍 Summary of the strategy to distinguish projects

📍 1. "Meme" coins versus real utility

We have seen coins that rely mainly on "trends" and social media, but their liquidity faded within week

View OriginalHave you ever wondered why some profits vanished in 2025 while others' portfolios doubled? The secret isn't luck, but in choosing the right 'foundation'.

In the cryptocurrency market, a strong rally isn't always an indicator of ongoing success. 2025 has taught us clear lessons that survival belongs to projects with "real value".

🔍 Summary of the strategy to distinguish projects

📍 1. "Meme" coins versus real utility

We have seen coins that rely mainly on "trends" and social media, but their liquidity faded within week

- Reward

- 2

- 1

- Repost

- Share

mared_007 :

:

Bullish market at its peak 🐂#TrumpWithdrawsEUTariffThreats #TrumpWithdrawsEUTariffThreats – What This Means for Markets and Crypto Going Forward

In a development that has caught many investors by surprise, former President Trump has officially withdrawn planned tariffs on several European nations that were set to take effect on February 1. This move comes after months of uncertainty around global trade, which has been creating volatility across equities, commodities, and risk-sensitive assets, including cryptocurrencies.

Immediate Market Implications:

The withdrawal of EU tariffs provides a clear boost to market sentimen

In a development that has caught many investors by surprise, former President Trump has officially withdrawn planned tariffs on several European nations that were set to take effect on February 1. This move comes after months of uncertainty around global trade, which has been creating volatility across equities, commodities, and risk-sensitive assets, including cryptocurrencies.

Immediate Market Implications:

The withdrawal of EU tariffs provides a clear boost to market sentimen

BTC-0.82%

- Reward

- 4

- 3

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

ETH Technical Outlook | Structured Recovery Within a Broader Correction

Ethereum ($ETH) is showing signs of stabilization after a deep corrective move that followed a strong rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection confirmed a distribution top and pushed price into the $2,620 macro demand area, where buyers stepped in decisively.

From this long-term demand, ETH is now attempting a rounded, structured recovery, printing higher lows—more consistent with early accumulation than panic-driven selling. While short-term momentum is improving, the higher-timefra

Ethereum ($ETH) is showing signs of stabilization after a deep corrective move that followed a strong rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection confirmed a distribution top and pushed price into the $2,620 macro demand area, where buyers stepped in decisively.

From this long-term demand, ETH is now attempting a rounded, structured recovery, printing higher lows—more consistent with early accumulation than panic-driven selling. While short-term momentum is improving, the higher-timefra

ETH-0.7%

- Reward

- 1

- 2

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

$ADA 📈 Cardano (ADA) Market Outlook: Breaking the Consolidation?

Hello Gate.io Community! 👋

Today, let’s take a look at Cardano ($ADA). After a period of sideways movement, ADA is showing signs of a potential trend reversal on the 4-hour time frame. The price action is currently hovering near a multi-week resistance zone, and the RSI (Relative Strength Index) suggests that momentum is gradually building up.

Key Technical Levels to Monitor:

📍 Major Support: $0.65 - $0.70. This level has acted as a strong floor during recent pullbacks. As long as ADA stays above $0.70, the bullish structure

Hello Gate.io Community! 👋

Today, let’s take a look at Cardano ($ADA). After a period of sideways movement, ADA is showing signs of a potential trend reversal on the 4-hour time frame. The price action is currently hovering near a multi-week resistance zone, and the RSI (Relative Strength Index) suggests that momentum is gradually building up.

Key Technical Levels to Monitor:

📍 Major Support: $0.65 - $0.70. This level has acted as a strong floor during recent pullbacks. As long as ADA stays above $0.70, the bullish structure

ADA-1.13%

- Reward

- 1

- 1

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊🚀 $CYBER Spot Analysis: Identifying the Reversal Floor for a Long-Term Move

Market Context:

As we move into the second quarter of 2026, the decentralized social layer narrative is regaining traction۔ CyberConnect ($CYBER), a leader in the Web3 social space, is currently exhibiting a classic "Bottoming Out" pattern after a prolonged correction phase۔

The Reversal Zone:

Technical indicators suggest that $CYBER is entering a high-probability "Reversal Zone" between $0.60 and $0.82۔

• Support Base: This range has acted as a significant psychological floor.

• Technical Setup: We are seeing bull

Market Context:

As we move into the second quarter of 2026, the decentralized social layer narrative is regaining traction۔ CyberConnect ($CYBER), a leader in the Web3 social space, is currently exhibiting a classic "Bottoming Out" pattern after a prolonged correction phase۔

The Reversal Zone:

Technical indicators suggest that $CYBER is entering a high-probability "Reversal Zone" between $0.60 and $0.82۔

• Support Base: This range has acted as a significant psychological floor.

• Technical Setup: We are seeing bull

CYBER2.06%

- Reward

- like

- Comment

- Repost

- Share

⚖️ Bitcoin vs Gold — A Shift Toward Safety in Uncertain Markets

Bitcoin is currently trading around $88,762, consolidating near a critical psychological level after a strong bull run.

While BTC remains a powerful long-term digital asset, short-term momentum is slowing due to:

Reduced liquidity

Slower ETF inflows

Profit-taking

Persistently high global interest rates

Volatility remains elevated — opportunities exist for skilled traders, but downside risks increase if key support levels fail.

🏆 Gold: The Classic Safe Haven

Gold is trading near 5,033, maintaining strength as investors rotate towa

Bitcoin is currently trading around $88,762, consolidating near a critical psychological level after a strong bull run.

While BTC remains a powerful long-term digital asset, short-term momentum is slowing due to:

Reduced liquidity

Slower ETF inflows

Profit-taking

Persistently high global interest rates

Volatility remains elevated — opportunities exist for skilled traders, but downside risks increase if key support levels fail.

🏆 Gold: The Classic Safe Haven

Gold is trading near 5,033, maintaining strength as investors rotate towa

BTC-0.82%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin vs Gold: A Shift Toward Safety in Uncertain Markets

Bitcoin is currently trading around $88,762, consolidating near a critical psychological level after a strong bull run. While BTC remains a powerful long-term digital asset, short-term momentum is weakening due to reduced liquidity, slower ETF inflows, profit-taking, and persistently high global interest rates. Price volatility remains elevated, creating opportunities for skilled traders—but also increasing downside risk if key support levels fail.

In contrast, Gold is trading near 5033, showing sustained strength as investors rotate

Bitcoin is currently trading around $88,762, consolidating near a critical psychological level after a strong bull run. While BTC remains a powerful long-term digital asset, short-term momentum is weakening due to reduced liquidity, slower ETF inflows, profit-taking, and persistently high global interest rates. Price volatility remains elevated, creating opportunities for skilled traders—but also increasing downside risk if key support levels fail.

In contrast, Gold is trading near 5033, showing sustained strength as investors rotate

BTC-0.82%

- Reward

- 4

- 7

- Repost

- Share

Badarmo00 :

:

hı everbody how are you todayView More

📉 SOMIUSDT | Short scenario on the table

Price is struggling around the 0.29 – 0.30 range after a strong rise.

There are attempts to go higher, but no continuation.

This tells us: momentum is weakening, the market is at a decision point.

🔍 Technical side:

No persistence above 0.30

RSI has dropped below 50

Price is moving sideways–downward trend

This setup keeps the controlled short scenario on the table.

📌 Important levels

Close above 0.300 – 0.305 → Scenario invalidates

Below 0.285 → Movement may accelerate

0.26 – 0.24 range → Main support / profit zones

⚠️ It’s especially important to say

View OriginalPrice is struggling around the 0.29 – 0.30 range after a strong rise.

There are attempts to go higher, but no continuation.

This tells us: momentum is weakening, the market is at a decision point.

🔍 Technical side:

No persistence above 0.30

RSI has dropped below 50

Price is moving sideways–downward trend

This setup keeps the controlled short scenario on the table.

📌 Important levels

Close above 0.300 – 0.305 → Scenario invalidates

Below 0.285 → Movement may accelerate

0.26 – 0.24 range → Main support / profit zones

⚠️ It’s especially important to say

- Reward

- 5

- 6

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

ETHUSDT | 1s

Price responded with a V-shaped reaction after a sharp decline, but the upward movement is currently controlled and limited.

As long as it stays below the purple trend line, interpreting this rise as a main trend reversal is difficult.

📌 3,000 – 3,030 range is a clear supply / sell zone.

The reaction here is already weakening.

🔻 The first support zone below is 2,950 – 2,910.

If this area is lost, liquidity could drop back to around 2,865.

📈 In the bullish scenario:

Hourly close above 3,030

Followed by breaking the purple trend

beforehand, it’s premature to get excited.

The RSI

Price responded with a V-shaped reaction after a sharp decline, but the upward movement is currently controlled and limited.

As long as it stays below the purple trend line, interpreting this rise as a main trend reversal is difficult.

📌 3,000 – 3,030 range is a clear supply / sell zone.

The reaction here is already weakening.

🔻 The first support zone below is 2,950 – 2,910.

If this area is lost, liquidity could drop back to around 2,865.

📈 In the bullish scenario:

Hourly close above 3,030

Followed by breaking the purple trend

beforehand, it’s premature to get excited.

The RSI

ETH-0.7%

- Reward

- 6

- 4

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

🌐 Ethereum ($ETH) Roadmap: Why the $6,000–$8,000 Target is Within Reach

The Accumulation Thesis:

While the broader market experiences localized volatility, Ethereum ($ETH) remains in a textbook "Strategic Accumulation Zone". Currently trading between the $2,600 and $3,400 range, ETH is building a massive base of support. Historically, these consolidation phases in Ethereum lead to explosive parabolic moves once the supply on exchanges hits critical lows.

Institutional Catalysts for 2026:

The path to $6,000–$8,000 is not just driven by speculation but by solid fundamental shifts:

1. The Glamst

The Accumulation Thesis:

While the broader market experiences localized volatility, Ethereum ($ETH) remains in a textbook "Strategic Accumulation Zone". Currently trading between the $2,600 and $3,400 range, ETH is building a massive base of support. Historically, these consolidation phases in Ethereum lead to explosive parabolic moves once the supply on exchanges hits critical lows.

Institutional Catalysts for 2026:

The path to $6,000–$8,000 is not just driven by speculation but by solid fundamental shifts:

1. The Glamst

ETH-0.7%

- Reward

- like

- 1

- Repost

- Share

Crypt_Panda :

:

ETH is going down soonLoad More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

67.32K Popularity

42.01K Popularity

34.88K Popularity

13.47K Popularity

28.33K Popularity

19.97K Popularity

16.51K Popularity

85.57K Popularity

45.45K Popularity

26.61K Popularity

16.46K Popularity

5.27K Popularity

262K Popularity

26.33K Popularity

184.32K Popularity

News

View MoreOCC: The procedural review of WLFI's application for a banking license will remain non-political

16 m

Alchemy Pay obtains Nebraska MTL license, expanding the compliant map in the United States to 14 states

46 m

Data: In 2025, stablecoins on Ethereum generated approximately $5 billion in revenue, with the supply increasing by about $50 billion.

1 h

Solana's privacy coin GHOST surged 60% after announcing a new cross-chain swap solution.

1 h

Bloomberg Analyst: Silver ETF Returns Are "Exaggerated" but Limited Capital Inflows, IBIT Wind Resistance Attracts Funds, Sending Long-term Bullish Signals for BTC

1 h

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889