# MiddleEastTensionsEscalate

33.07K

Rising U.S.–Iran tensions have driven gold above the $5,000 milestone, while Bitcoin has pulled back and market sentiment turns cautious. Would you allocate to gold now, or look for a BTC dip?

HanssiMazak

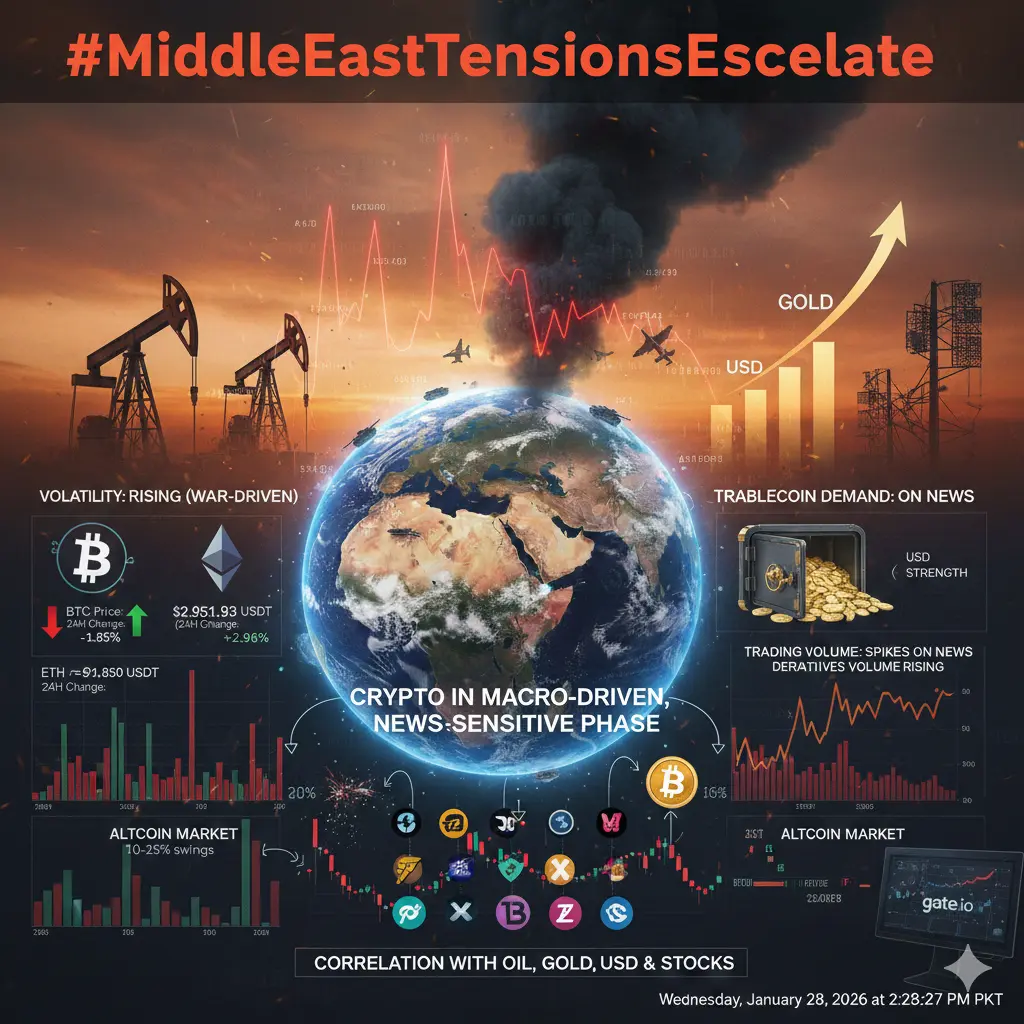

#MiddleEastTensionsEscalate The escalating situation in the Middle East is increasingly reshaping global financial behavior, and the cryptocurrency market is now responding as part of the broader macro system rather than operating in isolation. What was once primarily driven by technical patterns and on-chain cycles has shifted into a news-sensitive, geopolitically reactive environment.

As regional tensions rise, global capital flows are becoming defensive. Investors across traditional and digital markets are prioritizing capital preservation, liquidity access, and downside protection. This sh

As regional tensions rise, global capital flows are becoming defensive. Investors across traditional and digital markets are prioritizing capital preservation, liquidity access, and downside protection. This sh

- Reward

- 7

- 1

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊#MiddleEastTensionsEscalate #🌍 #MiddleEastTensionsEscalate Future Market Outlook

Crypto Enters a High-Volatility Macro Era (Forward View 2026)

As geopolitical pressure across the Middle East continues to reshape global risk sentiment, the crypto market is transitioning into a macro-dominated phasewhere headlines move price faster than charts.

This is no longer just a technical market.

It’s a news-reactive, liquidity-sensitive, institution-driven battlefield.

Let’s break down what comes next.

📊 Forward Crypto Market Projection (Next Phase)

Bitcoin (BTC)

Expected Range: $88K – $102K

Projecte

Crypto Enters a High-Volatility Macro Era (Forward View 2026)

As geopolitical pressure across the Middle East continues to reshape global risk sentiment, the crypto market is transitioning into a macro-dominated phasewhere headlines move price faster than charts.

This is no longer just a technical market.

It’s a news-reactive, liquidity-sensitive, institution-driven battlefield.

Let’s break down what comes next.

📊 Forward Crypto Market Projection (Next Phase)

Bitcoin (BTC)

Expected Range: $88K – $102K

Projecte

- Reward

- 10

- 7

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

🧭 Gold Breaks $5,000 as Geopolitical Risk Spikes — Is This the Moment to Hedge or Hunt a BTC Dip?

Escalating U.S.–Iran tensions have flipped global markets into risk-off mode. Capital is rotating fast — and the divergence between gold and Bitcoin is getting louder.

🥇 Gold: Fear Trade in Full Control

Gold pushing above the $5,000 level is not a normal technical breakout — it’s a macro statement.

What’s driving it right now:

Heightened geopolitical risk → classic safe-haven demand

Weak confidence in fiat stability during conflict escalation

Central banks & institutions prioritizing capital pre

Escalating U.S.–Iran tensions have flipped global markets into risk-off mode. Capital is rotating fast — and the divergence between gold and Bitcoin is getting louder.

🥇 Gold: Fear Trade in Full Control

Gold pushing above the $5,000 level is not a normal technical breakout — it’s a macro statement.

What’s driving it right now:

Heightened geopolitical risk → classic safe-haven demand

Weak confidence in fiat stability during conflict escalation

Central banks & institutions prioritizing capital pre

BTC1,26%

- Reward

- 13

- 6

- Repost

- Share

BeautifulDay :

:

2026 GOGOGO 👊View More

#MiddleEastTensionsEscalate MiddleEastTensionsEscalate

Rising geopolitical tensions in the Middle East are now a major macro force shaping global financial markets, and crypto is firmly inside this equation. As conflict risk increases, capital behavior is shifting rapidly, pushing the crypto market into a volatility-driven, macro-sensitive phase. Liquidity is tightening, sentiment is fragile, and price action is increasingly reactive to headlines tied to oil prices, the US dollar, and global risk appetite. This environment marks a clear transition from purely narrative-driven crypto cycles to

Rising geopolitical tensions in the Middle East are now a major macro force shaping global financial markets, and crypto is firmly inside this equation. As conflict risk increases, capital behavior is shifting rapidly, pushing the crypto market into a volatility-driven, macro-sensitive phase. Liquidity is tightening, sentiment is fragile, and price action is increasingly reactive to headlines tied to oil prices, the US dollar, and global risk appetite. This environment marks a clear transition from purely narrative-driven crypto cycles to

- Reward

- 5

- 4

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

#MiddleEastTensionsEscalate

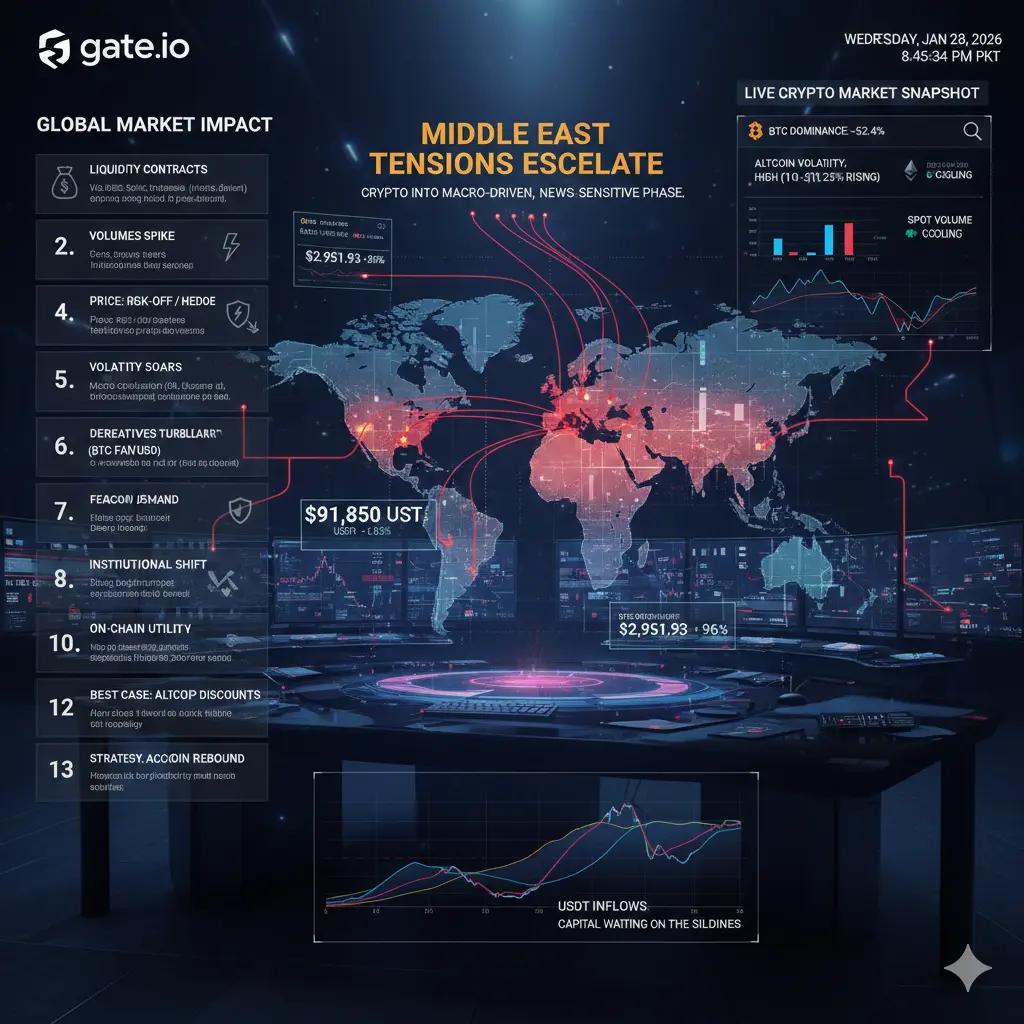

The escalating conflict in the Middle East is increasingly influencing global financial markets, and the cryptocurrency market is now directly feeling the impact across liquidity flows, trading volumes, volatility levels, price movements, derivatives positioning, and investor sentiment.

This geopolitical escalation is pushing crypto into a macro-driven, news-sensitive phase, where war risk, oil price shocks, and global risk appetite are shaping price direction more than pure technical trends.

📊 Live Crypto Market Snapshot (Gate.io Reference)

🔹 Bitcoin (BTC)

Price

The escalating conflict in the Middle East is increasingly influencing global financial markets, and the cryptocurrency market is now directly feeling the impact across liquidity flows, trading volumes, volatility levels, price movements, derivatives positioning, and investor sentiment.

This geopolitical escalation is pushing crypto into a macro-driven, news-sensitive phase, where war risk, oil price shocks, and global risk appetite are shaping price direction more than pure technical trends.

📊 Live Crypto Market Snapshot (Gate.io Reference)

🔹 Bitcoin (BTC)

Price

- Reward

- 28

- 57

- Repost

- Share

repanzal :

:

Happy New Year! 🤑View More

WHAT'S THE WAY FORWARD FOR BITCOIN?

PUMPING OR DUMPING SOON ? FIND OUT HERE:

As of January 27, 2026, Bitcoin ($BTC ) is trading around $87,700 - $88,600 (With a live price of $88,300 at the time of writing) showing signs of consolidation after recent volatility. The cryptocurrency has been under pressure from macroeconomic factors, geopolitical tensions (such as U.S.-Iran issues), and market rotations away from risk assets. This has led to a choppy trading environment, with BTC struggling to reclaim higher levels like $90,000 while defending key supports. Short-Term Price Movement (1-30 D

PUMPING OR DUMPING SOON ? FIND OUT HERE:

As of January 27, 2026, Bitcoin ($BTC ) is trading around $87,700 - $88,600 (With a live price of $88,300 at the time of writing) showing signs of consolidation after recent volatility. The cryptocurrency has been under pressure from macroeconomic factors, geopolitical tensions (such as U.S.-Iran issues), and market rotations away from risk assets. This has led to a choppy trading environment, with BTC struggling to reclaim higher levels like $90,000 while defending key supports. Short-Term Price Movement (1-30 D

BTC1,26%

- Reward

- 5

- 3

- Repost

- Share

Bitcoinworld90 :

:

$AXS This isn’t a pump. This is acceptance after expansion. Smart money already positioned. $AXS

View More

#MiddleEastTensionsEscalate 🌍⚠️

Global markets once again move into risk-sensitive mode as Middle East tensions intensify.

Geopolitical uncertainty is rising — and history shows markets never ignore this for long.

Why this matters for financial markets & crypto:

🔺 Oil prices react first

Supply risk fears push energy markets higher, adding inflation pressure globally.

💰 Safe-haven assets gain attention

Gold strengthens, while capital becomes more selective across risk assets.

📉 Risk assets turn cautious

Equities and high-beta crypto assets face volatility as investors reduce exposure.

🪙 Cr

Global markets once again move into risk-sensitive mode as Middle East tensions intensify.

Geopolitical uncertainty is rising — and history shows markets never ignore this for long.

Why this matters for financial markets & crypto:

🔺 Oil prices react first

Supply risk fears push energy markets higher, adding inflation pressure globally.

💰 Safe-haven assets gain attention

Gold strengthens, while capital becomes more selective across risk assets.

📉 Risk assets turn cautious

Equities and high-beta crypto assets face volatility as investors reduce exposure.

🪙 Cr

BTC1,26%

- Reward

- 7

- 7

- Repost

- Share

AylaShinex :

:

2026 GOGOGO 👊View More

WHAT'S THE WAY FORWARD FOR BITCOIN?

PUMPING OR DUMPING SOON ? FIND OUT HERE:

As of January 27, 2026, Bitcoin ($BTC ) is trading around $87,700 - $88,600 (With a live price of $88,300 at the time of writing) showing signs of consolidation after recent volatility. The cryptocurrency has been under pressure from macroeconomic factors, geopolitical tensions (such as U.S.-Iran issues), and market rotations away from risk assets. This has led to a choppy trading environment, with BTC struggling to reclaim higher levels like $90,000 while defending key supports. Short-Term Price Movement (1-30 D

PUMPING OR DUMPING SOON ? FIND OUT HERE:

As of January 27, 2026, Bitcoin ($BTC ) is trading around $87,700 - $88,600 (With a live price of $88,300 at the time of writing) showing signs of consolidation after recent volatility. The cryptocurrency has been under pressure from macroeconomic factors, geopolitical tensions (such as U.S.-Iran issues), and market rotations away from risk assets. This has led to a choppy trading environment, with BTC struggling to reclaim higher levels like $90,000 while defending key supports. Short-Term Price Movement (1-30 D

BTC1,26%

- Reward

- 4

- 3

- Repost

- Share

Bitcoinworld90 :

:

Buy To Earn 💎View More

#MiddleEastTensionsEscalate #MiddleEastTensionsEscalate

Markets don’t collapse because of conflict. They collapse because of mispriced risk. Middle East tensions are not a headline event; they are a pressure test on energy flows, inflation expectations, and global liquidity. Traders who react emotionally will focus on explosions and statements. Professionals focus on transmission channels.

The first impact is not crypto. It is oil volatility. Higher energy risk feeds directly into shipping costs, insurance premiums, and import inflation. That inflation pressure limits central bank flexibility

Markets don’t collapse because of conflict. They collapse because of mispriced risk. Middle East tensions are not a headline event; they are a pressure test on energy flows, inflation expectations, and global liquidity. Traders who react emotionally will focus on explosions and statements. Professionals focus on transmission channels.

The first impact is not crypto. It is oil volatility. Higher energy risk feeds directly into shipping costs, insurance premiums, and import inflation. That inflation pressure limits central bank flexibility

BTC1,26%

- Reward

- 4

- 3

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

Update on stock #PAXGUSDT 📈

The price has increased by 20% since our forecast and is now heading toward the second target.

Momentum remains strong, and as long as geopolitical instability continues, the bullish outlook remains valid, opening the possibility of reaching the third target at $5476.

#MiddleEastTensionsEscalate

#PAXG

$PAXG

The price has increased by 20% since our forecast and is now heading toward the second target.

Momentum remains strong, and as long as geopolitical instability continues, the bullish outlook remains valid, opening the possibility of reaching the third target at $5476.

#MiddleEastTensionsEscalate

#PAXG

$PAXG

PAXG4,65%

- Reward

- 2

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

16.85K Popularity

80.11K Popularity

33.07K Popularity

11.16K Popularity

11.92K Popularity

10.46K Popularity

9.75K Popularity

9.71K Popularity

75.2K Popularity

22.5K Popularity

82.6K Popularity

23.96K Popularity

51.4K Popularity

44.49K Popularity

197.93K Popularity

News

View MoreData: In the past 24 hours, the entire network has liquidated 281 million USD, with long positions liquidated at 64.352 million USD and short positions at 216 million USD.

3 m

Powell: Labor demand decline slightly exceeds supply

3 m

Powell: Signs of improvement in the employment situation

4 m

Powell: Growth in labor supply has essentially stagnated

5 m

Powell: The US debt trajectory is unsustainable, and fiscal issues need to be addressed

8 m

Pin