# markets

6.43M

dragon_fly2

#BTC #Polymarket #Bitcoin #Markets

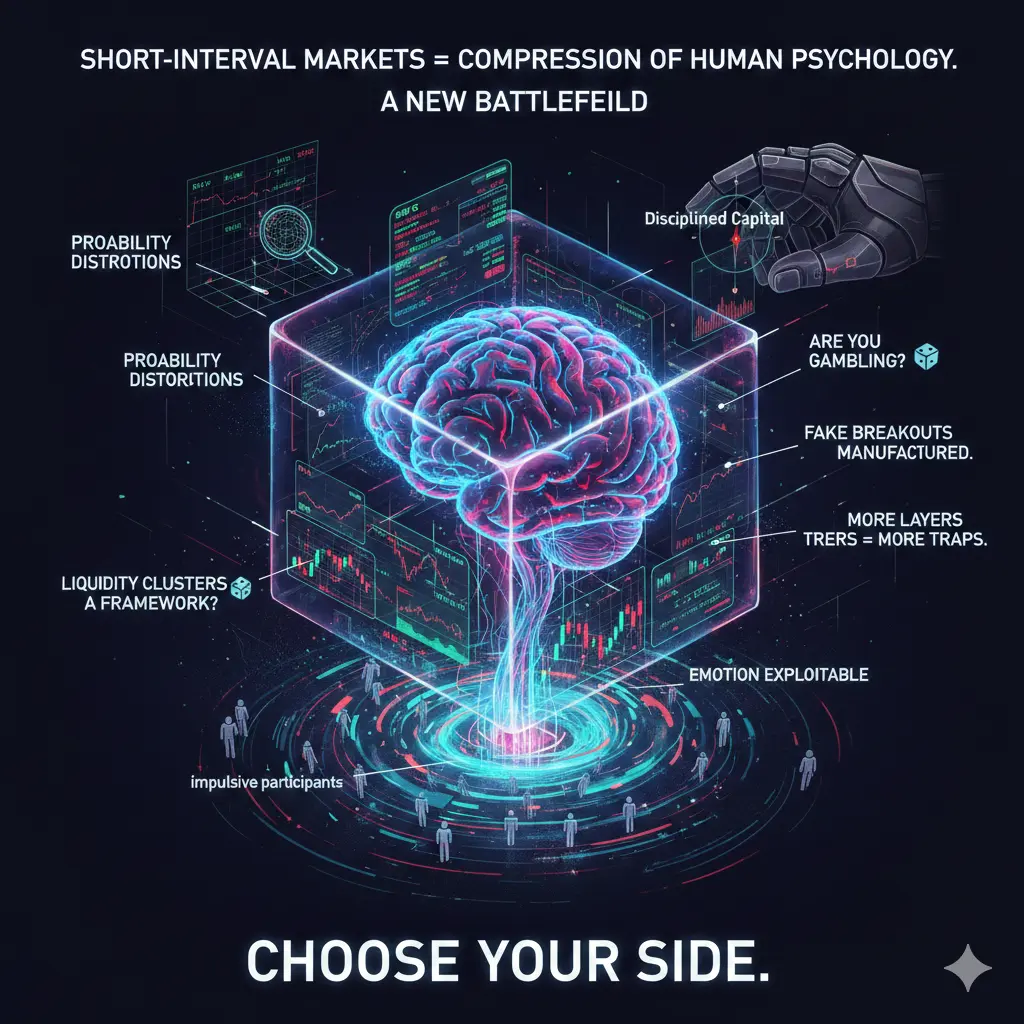

Ketika pasar prediksi terbesar di dunia, Polymarket, meluncurkan penetapan harga interval pendek pada Bitcoin, kebanyakan orang melihat inovasi.

Saya melihat kompresi psikologi manusia.

Ini bukan sekadar produk baru.

Ini adalah medan perang baru.

Pasar interval pendek memperkecil rentang perhatian.

Mereka memperkuat perdagangan emosional.

Mereka mengubah setiap gerakan mikro menjadi keputusan yang dimonetisasi.

Dan jika Anda tidak memahami apa arti itu secara struktural, Anda akan menjadi likuiditas.

Ini pandangan dewasa:

Pasar prediksi tidak menciptakan vola

Ketika pasar prediksi terbesar di dunia, Polymarket, meluncurkan penetapan harga interval pendek pada Bitcoin, kebanyakan orang melihat inovasi.

Saya melihat kompresi psikologi manusia.

Ini bukan sekadar produk baru.

Ini adalah medan perang baru.

Pasar interval pendek memperkecil rentang perhatian.

Mereka memperkuat perdagangan emosional.

Mereka mengubah setiap gerakan mikro menjadi keputusan yang dimonetisasi.

Dan jika Anda tidak memahami apa arti itu secara struktural, Anda akan menjadi likuiditas.

Ini pandangan dewasa:

Pasar prediksi tidak menciptakan vola

BTC-2,06%

- Hadiah

- 7

- 9

- Posting ulang

- Bagikan

Yunna :

:

Ke BulanLihat Lebih Banyak

🚨 Trump Meningkatkan Tarif atas Kontroversi Greenland — Pasar Waspada

• Trump mengumumkan tarif baru pada negara-negara UE terkait sengketa Greenland

• Ketegangan perdagangan meningkat di luar sengketa kebijakan normal ⚠️

• Rantai pasokan global mungkin menghadapi tekanan baru

• Sentimen risiko bisa beralih ke aset safe-haven

• Saham dan kripto mungkin mengalami volatilitas yang meningkat

• Pertanyaan sebenarnya: Apakah ini hanya peringatan atau awal dari spiral perdagangan?

✨ Tetap siaga — geopolitik kembali memegang kendali

#Markets #Geopolitics #Tariffs #Crypto #RiskOnRiskOff#WeekendMarket

• Trump mengumumkan tarif baru pada negara-negara UE terkait sengketa Greenland

• Ketegangan perdagangan meningkat di luar sengketa kebijakan normal ⚠️

• Rantai pasokan global mungkin menghadapi tekanan baru

• Sentimen risiko bisa beralih ke aset safe-haven

• Saham dan kripto mungkin mengalami volatilitas yang meningkat

• Pertanyaan sebenarnya: Apakah ini hanya peringatan atau awal dari spiral perdagangan?

✨ Tetap siaga — geopolitik kembali memegang kendali

#Markets #Geopolitics #Tariffs #Crypto #RiskOnRiskOff#WeekendMarket

BTC-2,06%

- Hadiah

- 2

- Komentar

- Posting ulang

- Bagikan

📊 #NonfarmPayrollsComing — Pasar Bersiap untuk Pembaruan Makro Besar

Laporan Nonfarm Payrolls bulanan (NFP) segera hadir, dan sekali lagi, pasar global beralih ke mode “menunggu dan melihat”.

Rilis data ini adalah salah satu indikator paling berpengaruh untuk memahami kesehatan pasar tenaga kerja AS — dan dampaknya sering merembet ke saham, forex, obligasi, dan bahkan kripto.

Dengan tekanan inflasi, ekspektasi pemotongan suku bunga, dan kekhawatiran resesi yang membentuk narasi 2026, cetakan NFP ini bisa menentukan arah pasar jangka pendek.

Trader akan memantau dengan cermat:

🔹 Kekuatan atau

Lihat AsliLaporan Nonfarm Payrolls bulanan (NFP) segera hadir, dan sekali lagi, pasar global beralih ke mode “menunggu dan melihat”.

Rilis data ini adalah salah satu indikator paling berpengaruh untuk memahami kesehatan pasar tenaga kerja AS — dan dampaknya sering merembet ke saham, forex, obligasi, dan bahkan kripto.

Dengan tekanan inflasi, ekspektasi pemotongan suku bunga, dan kekhawatiran resesi yang membentuk narasi 2026, cetakan NFP ini bisa menentukan arah pasar jangka pendek.

Trader akan memantau dengan cermat:

🔹 Kekuatan atau

- Hadiah

- 10

- 13

- Posting ulang

- Bagikan

MoonGirl :

:

GOGOGO 2026 👊Lihat Lebih Banyak

rypto #markets #doakan kami #ECBroulette

Minggu ini menjanjikan volatilitas di pasar keuangan dengan rilis data ekonomi kunci seperti revisi Non-Farm Payrolls AS, Indeks Harga Produsen, dan CPI AS. Para trader harus mempersiapkan kemungkinan pergeseran dalam portofolio karena ECB juga membuat keputusan penting.

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Muat Lebih Banyak

Bergabung dengan 40M pengguna dalam komunitas yang terus berkembang

⚡️ Bergabung dengan 40M pengguna dalam diskusi tren kripto yang sedang ramai

💬 Berinteraksi dengan kreator top favorit Anda

👍 Lihat apa yang menarik minat Anda

Topik Trending

118.87K Popularitas

19.46K Popularitas

17.58K Popularitas

62.8K Popularitas

8.52K Popularitas

267.68K Popularitas

293.73K Popularitas

20.55K Popularitas

10.12K Popularitas

8.29K Popularitas

8.69K Popularitas

8.56K Popularitas

7.8K Popularitas

36.35K Popularitas

Berita

Lihat Lebih BanyakData: 500 BTC dipindahkan dari alamat anonim, bernilai sekitar 34,2 juta dolar AS

15 men

Data: 141.38 juta TON dipindahkan dari Kiln, kemudian mengalir masuk ke TON setelah transit

1 jam

Data: 318.24 BTC dipindahkan dari alamat anonim, setelah melalui perantara mengalir ke Duelbits

1 jam

Data: Dalam 24 jam terakhir, total likuidasi di seluruh jaringan mencapai 342 juta dolar AS, likuidasi posisi long sebesar 246 juta dolar AS, dan likuidasi posisi short sebesar 96,206,3 juta dolar AS

1 jam

Data: 5.1686 juta TON dipindahkan dari alamat anonim ke Kiln, senilai sekitar 7.5461 juta dolar AS

1 jam

Sematkan