NolanVincent

加密市场分析师与研究员

专注于链上数据、市场情绪和投资者行为在加密周期中的变化。

分析资本流动、流动性状况以及风险偏好/风险厌恶的状态,以评估市场结构和下行风险。

以数据为驱动,进行客观研究,优先考虑背景和风险管理,而非短期价格预测。

- 赞赏

- 点赞

- 1

- 转发

- 分享

蜜蜂之歌 :

:

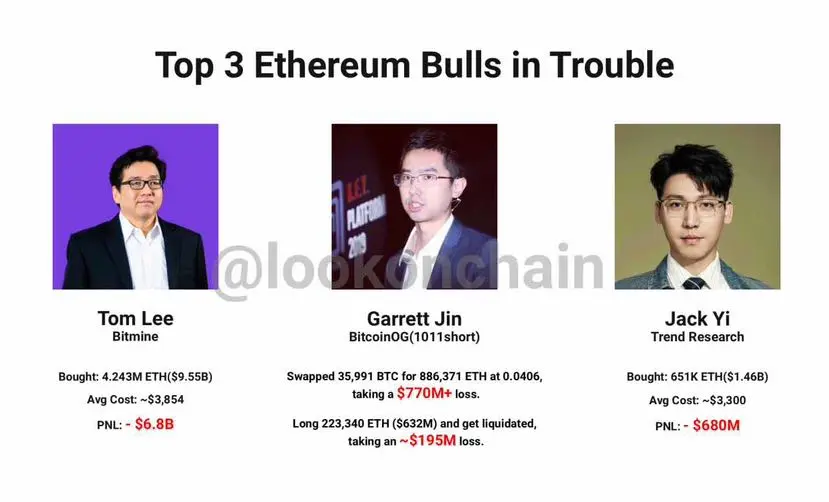

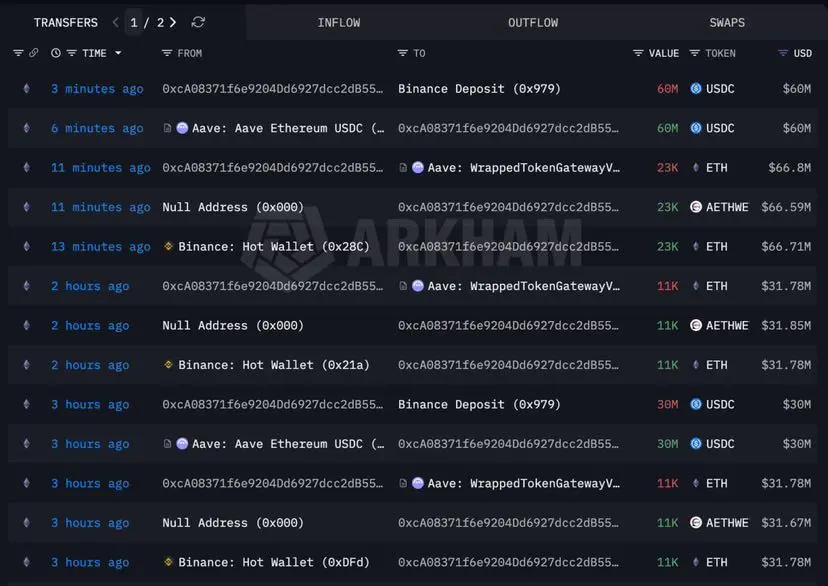

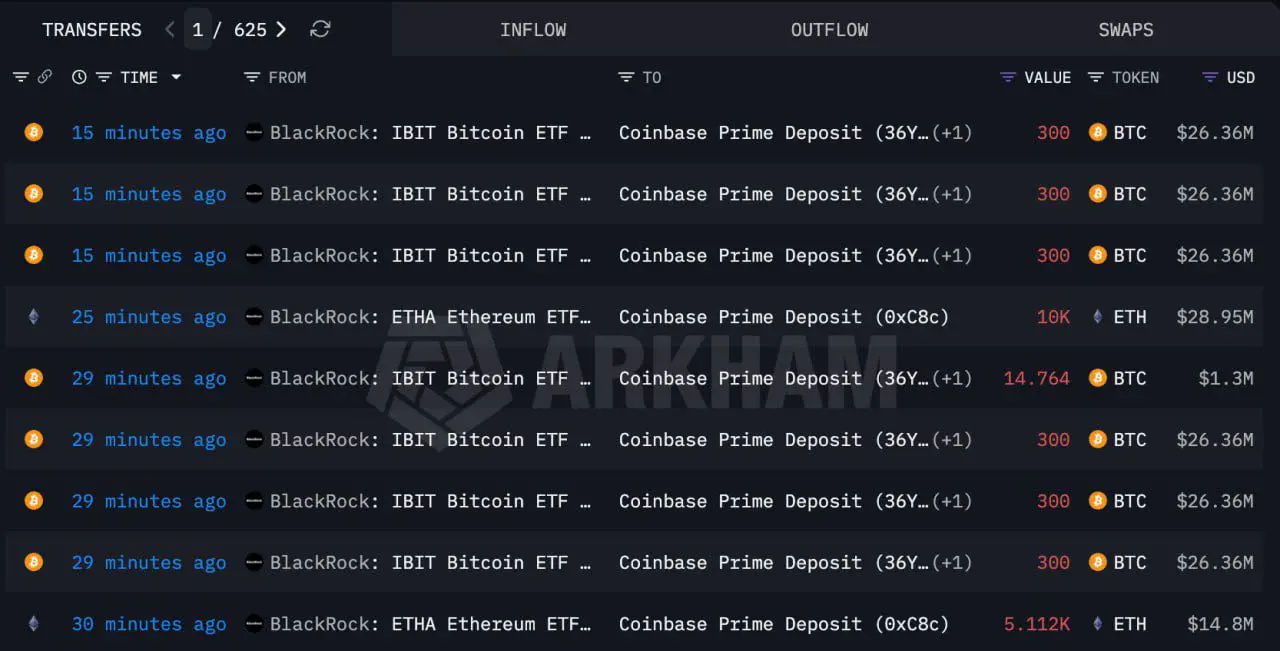

华尔街精英们非常看好以太坊网络的未来,他们想逢低抄底就必然会打压清算掉合约大仓位后在抄底入场。😄🥤- 赞赏

- 点赞

- 评论

- 转发

- 分享

- 赞赏

- 点赞

- 1

- 转发

- 分享

蜜蜂之歌 :

:

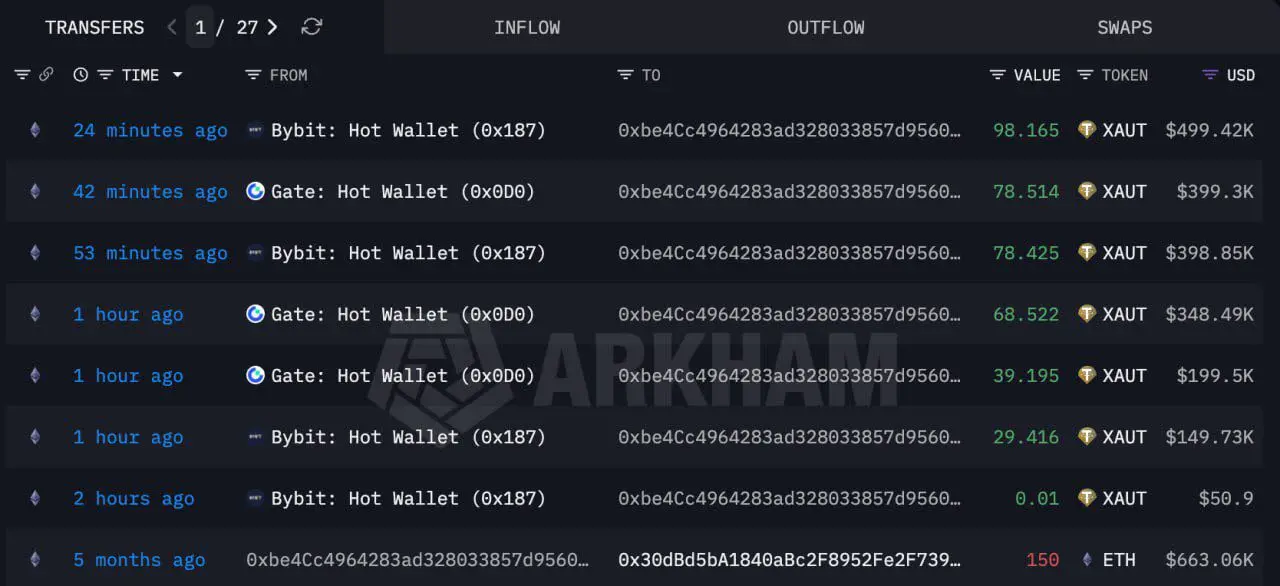

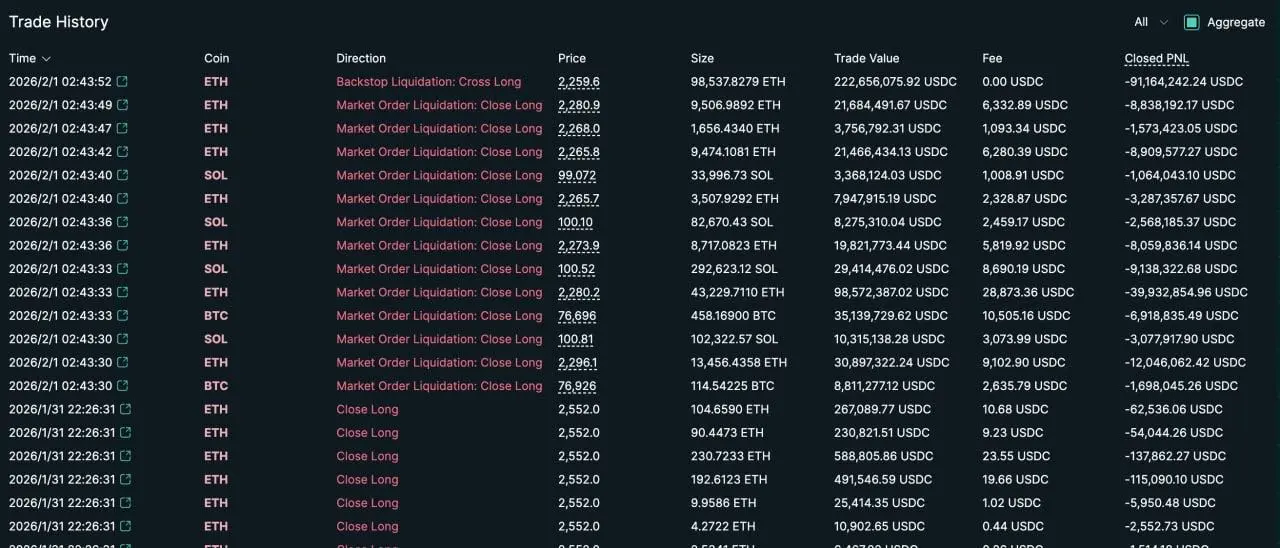

华尔街精英们非常看好以太坊网络的未来,他们想逢低抄底就必然会打压清算掉合约大仓位后在抄底入场。😄🥤市场终于清算了这个#BitcoinOG(1011空单),总清算金额达到5.22亿美元。

他从盈利1.42亿美元以上变成亏损1.2887亿美元。

账户已被完全清空——余额为零。

查看原文他从盈利1.42亿美元以上变成亏损1.2887亿美元。

账户已被完全清空——余额为零。

- 赞赏

- 点赞

- 评论

- 转发

- 分享

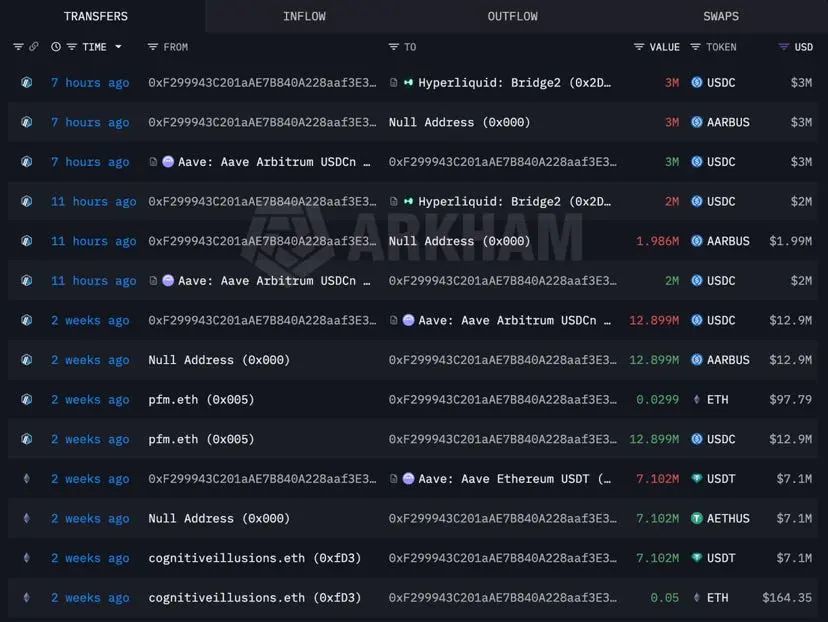

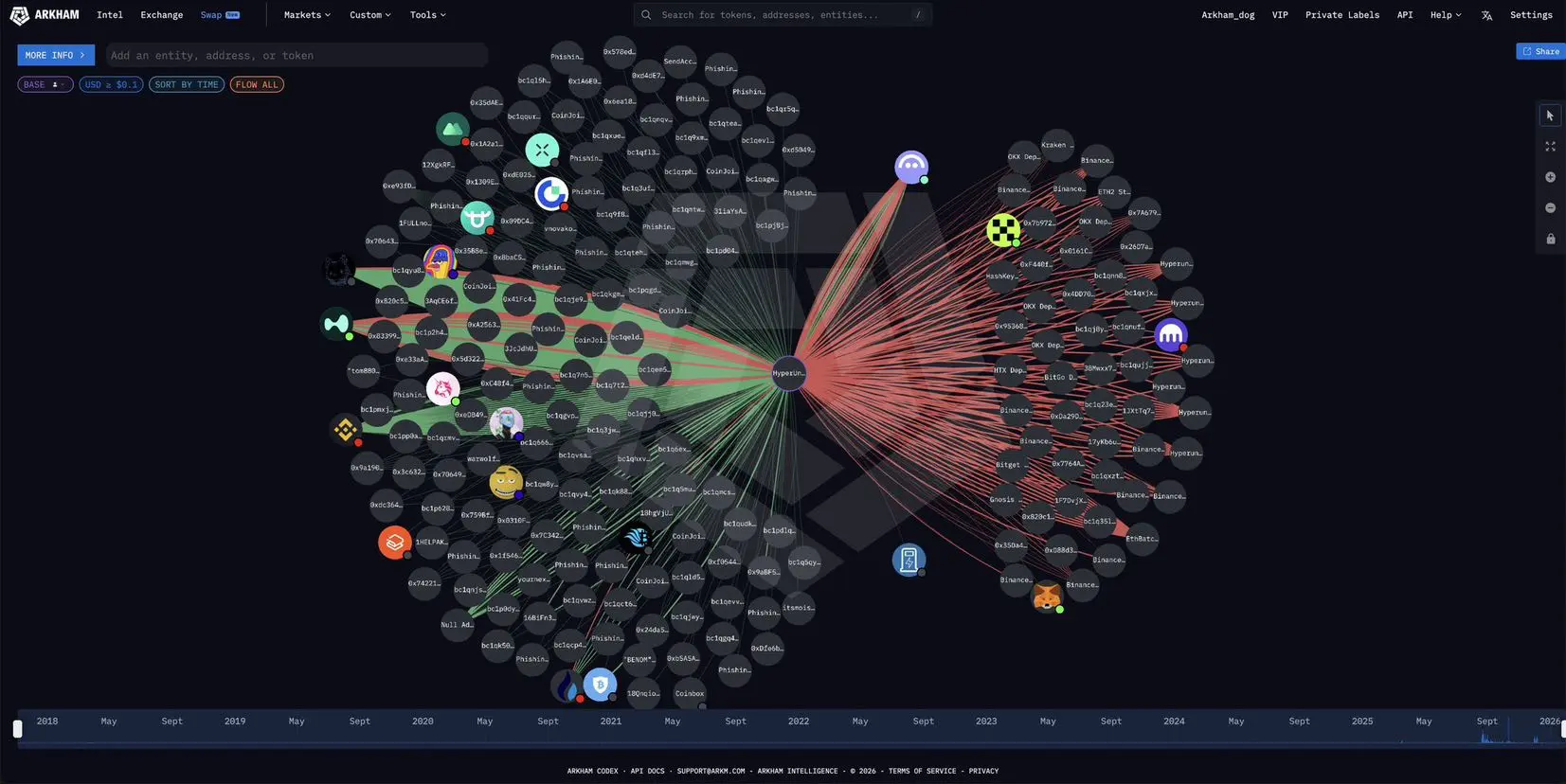

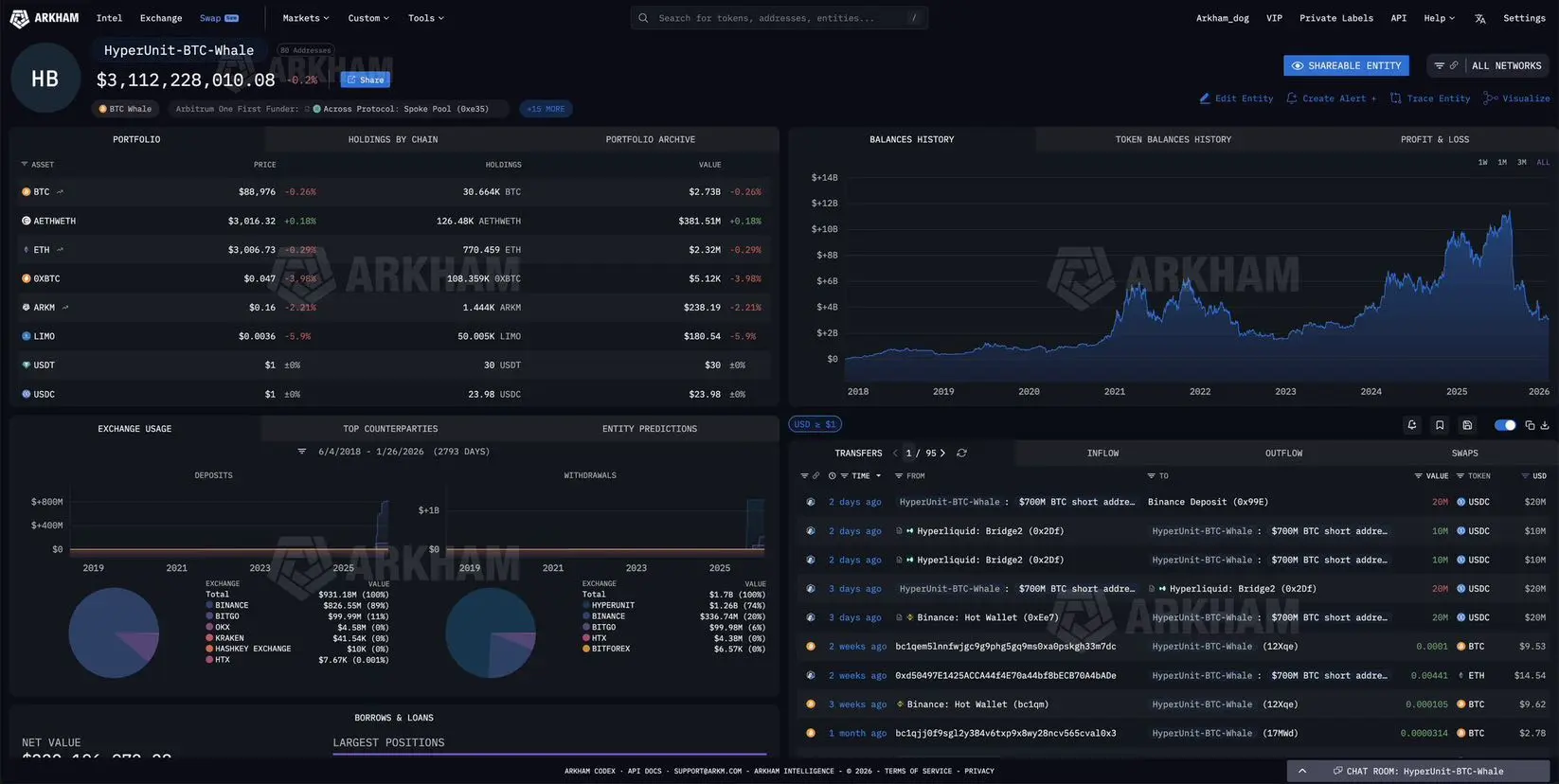

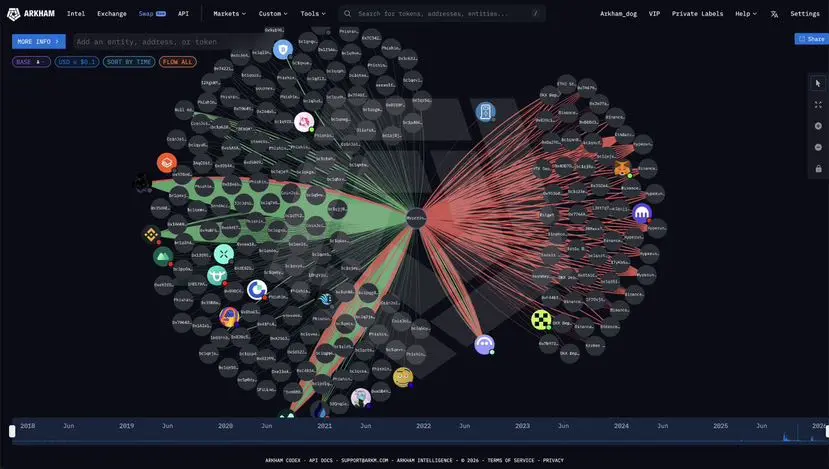

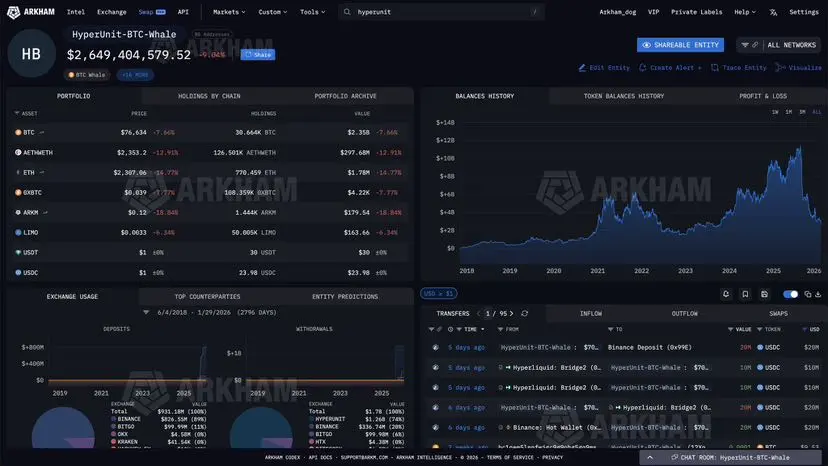

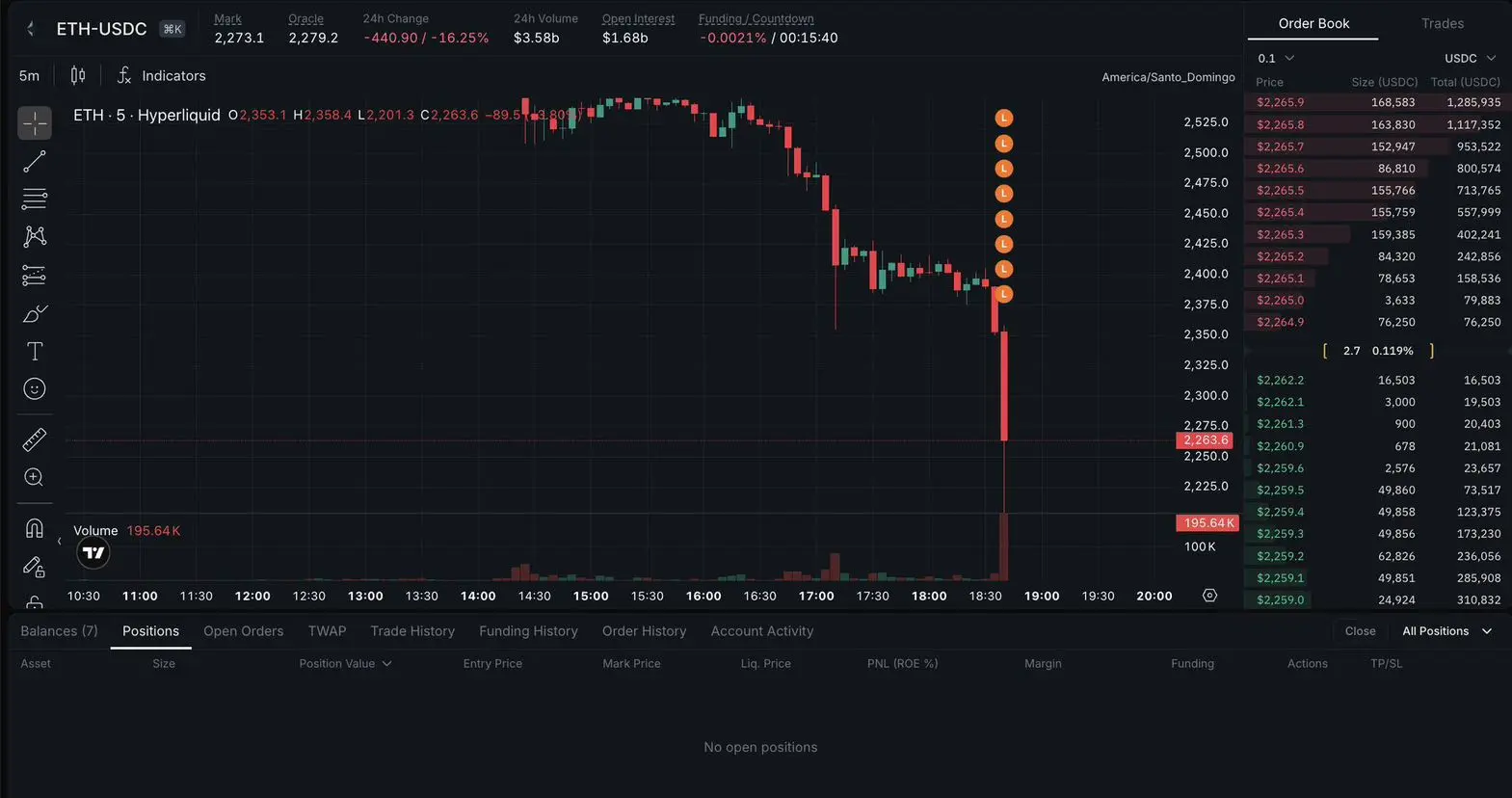

爆仓:HYPERUNIT鲸鱼 [GARRETT JIN]

Hyperunit鲸鱼Garrett Jin刚刚出售了他全部的ETH仓位,亏损总额达$250 百万。

他的Hyperliquid账户中还剩下$53 。

Hyperunit鲸鱼Garrett Jin刚刚出售了他全部的ETH仓位,亏损总额达$250 百万。

他的Hyperliquid账户中还剩下$53 。

ETH-2.77%

- 赞赏

- 点赞

- 2

- 转发

- 分享

凤亭 :

:

这个数据在那里监控查看更多

- 赞赏

- 点赞

- 评论

- 转发

- 分享

- 赞赏

- 点赞

- 评论

- 转发

- 分享

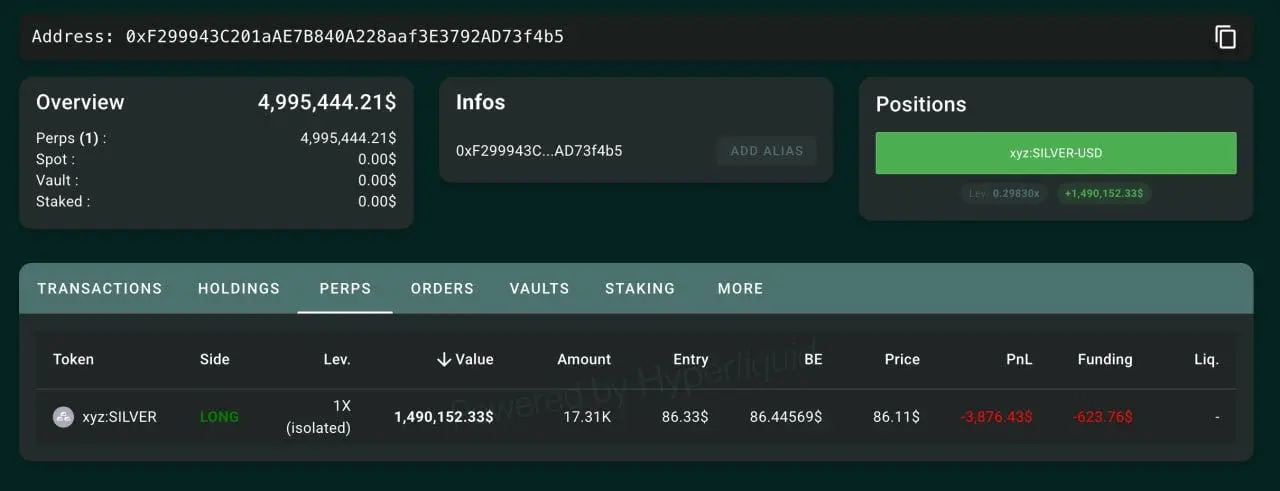

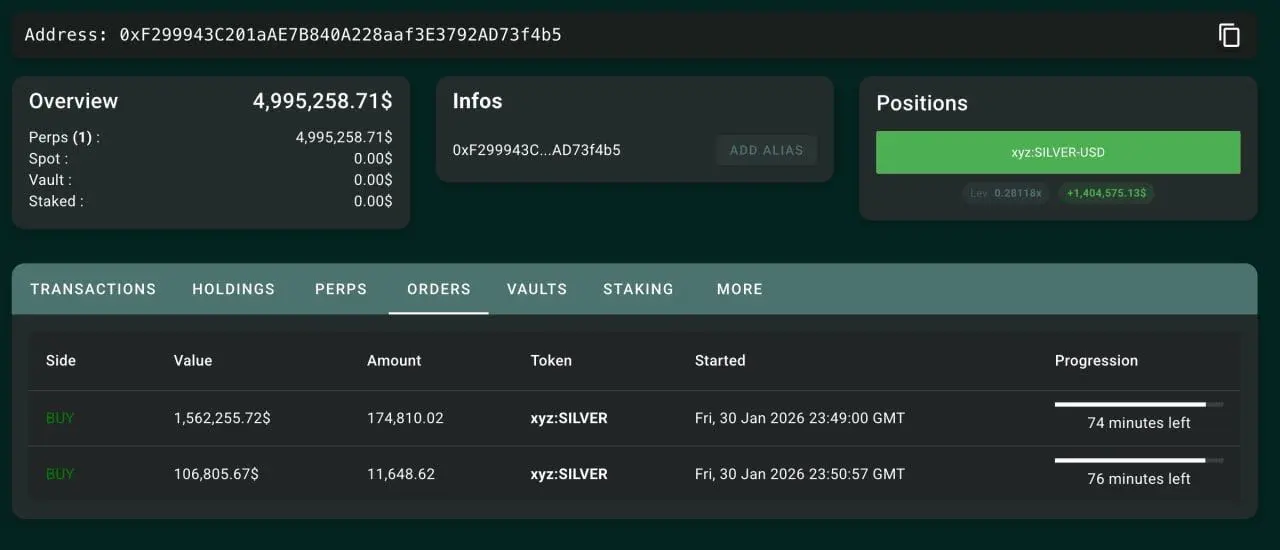

粉丝大获全胜,获利了结,新年快乐

查看原文【当前用户分享了他的交易卡片,若想了解更多优质交易信息,请到App端查看】

- 赞赏

- 点赞

- 评论

- 转发

- 分享

- 赞赏

- 点赞

- 评论

- 转发

- 分享

- 赞赏

- 点赞

- 评论

- 转发

- 分享

- 赞赏

- 点赞

- 评论

- 转发

- 分享

- 赞赏

- 点赞

- 评论

- 转发

- 分享

- 赞赏

- 点赞

- 评论

- 转发

- 分享

热门话题

查看更多22.56万 热度

2.17万 热度

5.15万 热度

1.71万 热度

1.66万 热度

热门 Gate Fun

查看更多- 市值:$2379.31持有人数:10.00%

- 市值:$2379.31持有人数:00.00%

- 市值:$2379.31持有人数:10.00%

- 市值:$2375.86持有人数:00.00%

- 市值:$2351.72持有人数:00.00%

置顶

Gate 广场内容挖矿焕新公测进行中!

发帖互动带交易,最高享 60% 手续费返佣!

参与教程

1️⃣ 报名公测:https://www.gate.com/questionnaire/7358

2️⃣ 用代币组件 / 跟单卡片发帖,分享行情观点

3️⃣ 与粉丝互动,促成真实交易

🎁 奖励机制

• 基础返佣:粉丝交易即得 10%

• 发帖 / 互动达标:每周再加 10%

• 排名加码:周榜前 100 再享 10%

• 新 / 回归创作者:返佣翻倍

活动详情:https://www.gate.com/announcements/article/49475

加入 Gate 广场,变身内容矿工,让内容真正变成长期收益Gate 广场“新星计划”正式上线!

开启加密创作之旅,瓜分月度 $10,000 奖励!

参与资格:从未在 Gate 广场发帖,或连续 7 天未发帖的创作者

立即报名:https://www.gate.com/questionnaire/7396

您将获得:

💰 1,000 USDT 月度创作奖池 + 首帖 $50 仓位体验券

🔥 半月度「爆款王」:Gate 50U 精美周边

⭐ 月度前 10「新星英雄榜」+ 粉丝达标榜单 + 精选帖曝光扶持

加入 Gate 广场,赢奖励 ,拿流量,建立个人影响力!

详情:https://www.gate.com/announcements/article/49672