# XAUUSDT

131

BasheerAlgundubi

First #الذهب . Then #البيتكوين .

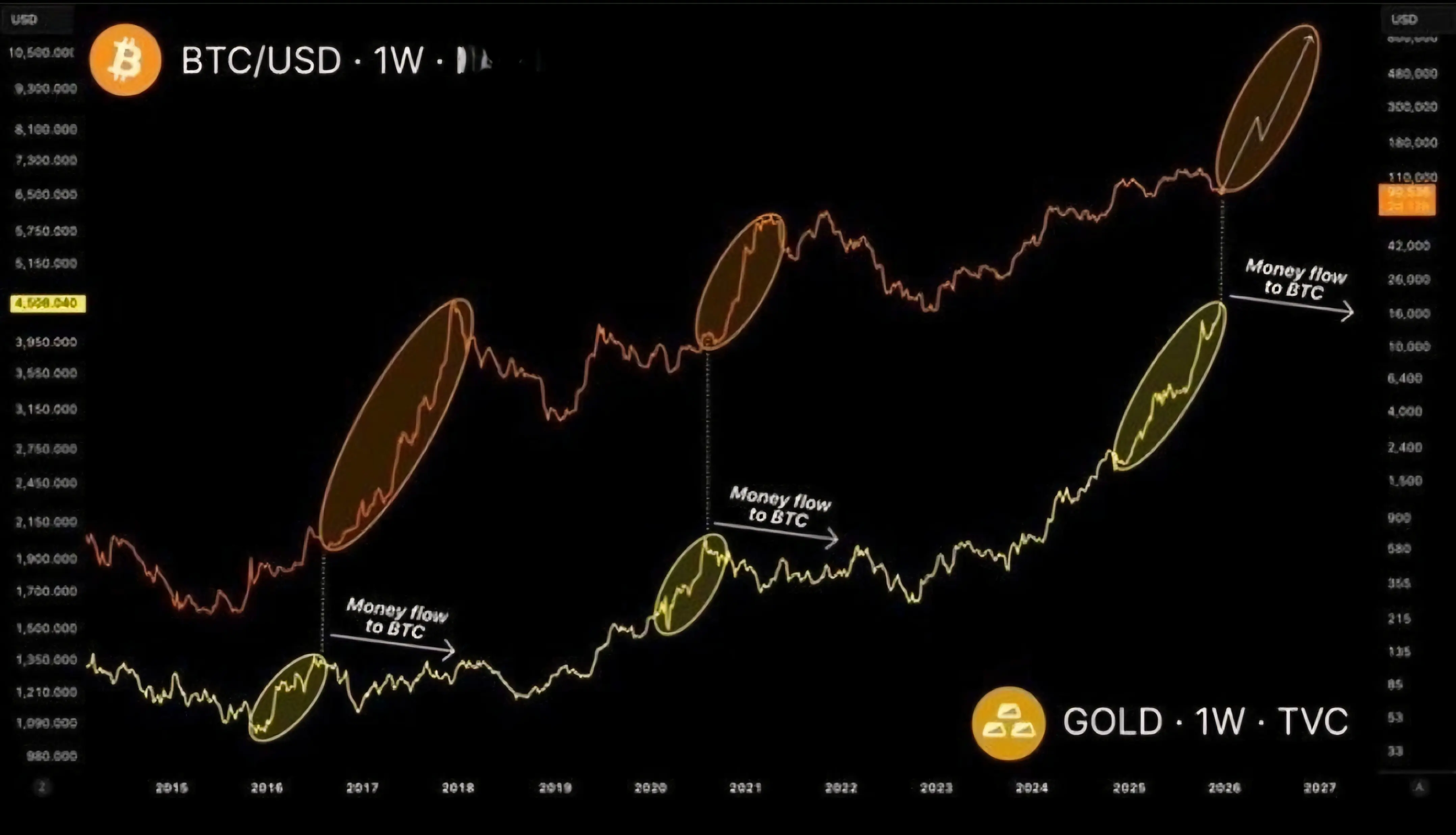

History shows a clear pattern during monetary shifts: capital first moves to #XAUUSDT , then shifts to #BTCUSDT .

Gold leads this cycle, reaching record levels as central banks buy in and global risks rise. In contrast, Bitcoin lags behind gold, a pattern observed before major Bitcoin price surges.

This divergence is temporary. Once gold's rally completes and supply diminishes, capital looks for further gains, and Bitcoin becomes the next destination.

Bitcoin ETFs currently absorb more than the new supply.

If history repeats itself, the rise in gold is the sign

History shows a clear pattern during monetary shifts: capital first moves to #XAUUSDT , then shifts to #BTCUSDT .

Gold leads this cycle, reaching record levels as central banks buy in and global risks rise. In contrast, Bitcoin lags behind gold, a pattern observed before major Bitcoin price surges.

This divergence is temporary. Once gold's rally completes and supply diminishes, capital looks for further gains, and Bitcoin becomes the next destination.

Bitcoin ETFs currently absorb more than the new supply.

If history repeats itself, the rise in gold is the sign

BTC-0,68%

- Reward

- 1

- 1

- Repost

- Share

BasheerAlgundubi :

:

Bitcoin exchange-traded funds currently absorb more than the new supply. If history repeats itself, the rise in gold is the signal, and Bitcoin will follow suit. 🚀

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

51.74K Popularity

31.31K Popularity

24.99K Popularity

8.15K Popularity

19.42K Popularity

14.38K Popularity

12.05K Popularity

79.98K Popularity

39.52K Popularity

24.05K Popularity

12.87K Popularity

1.47K Popularity

256.36K Popularity

21.82K Popularity

164.88K Popularity

News

View MoreData: In the past 24 hours, the total liquidation across the network was $80,035,800,000, with long positions liquidated at $44,110,900,000 and short positions at $35,924,900,000.

7 m

Data: If BTC breaks through $93,845, the total liquidation strength of mainstream CEX short positions will reach $861 million.

1 h

Data: If ETH breaks through $3,111, the total liquidation strength of mainstream CEX short positions will reach $610 million.

1 h

Data: Over the past 24 hours, the entire network has liquidated $252 million, with long positions liquidated at $63.1456 million and short positions at $189 million.

3 h

Data: 1,400,500 TON transferred from an anonymous address, worth approximately $2.14 million

3 h

Pin