BlockHero

No content yet

BlockHero

Today's live broadcast poll!!! 77% are shorting.

View Original

- Reward

- like

- Comment

- Repost

- Share

Tonight, the clock is extended. Watching the live broadcast.

View Original

- Reward

- like

- Comment

- Repost

- Share

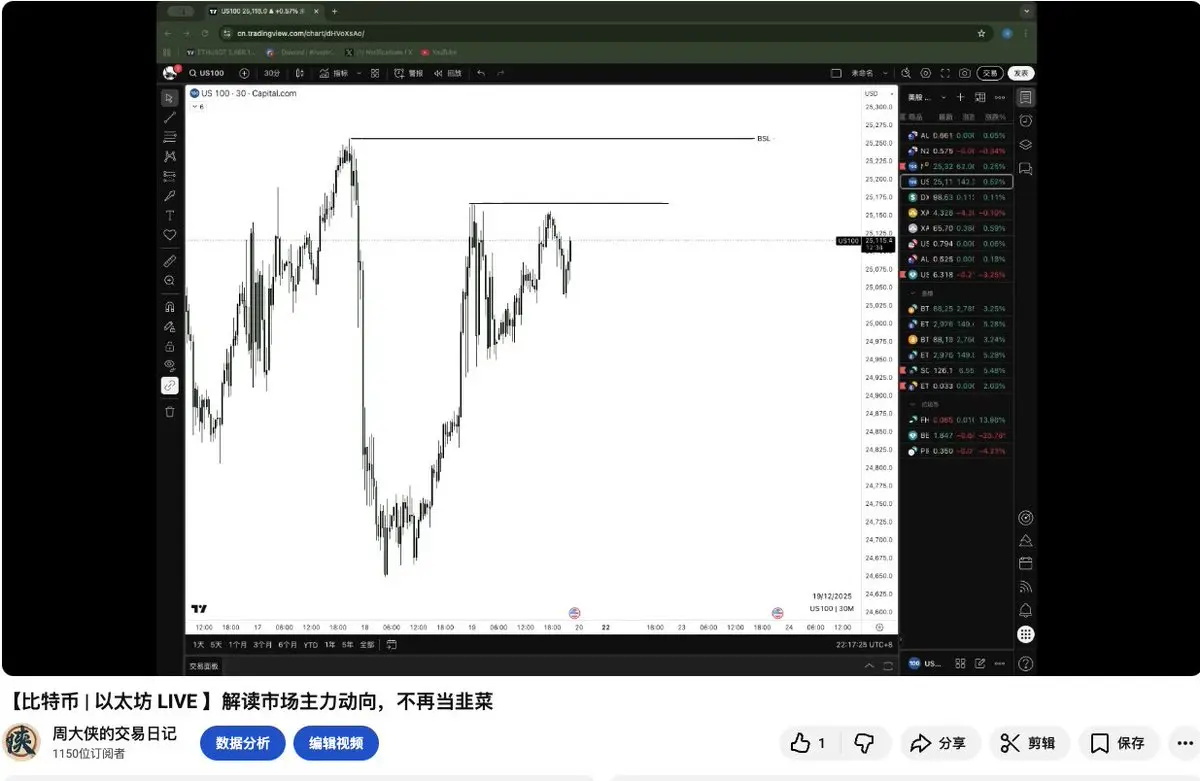

Nasdaq, draw a door for me! #NAS100

View Original- Reward

- like

- Comment

- Repost

- Share

There will be a public live broadcast tonight at 9:30 PM.

Click subscribe, and don't miss tonight's exciting content.

View OriginalClick subscribe, and don't miss tonight's exciting content.

- Reward

- like

- Comment

- Repost

- Share

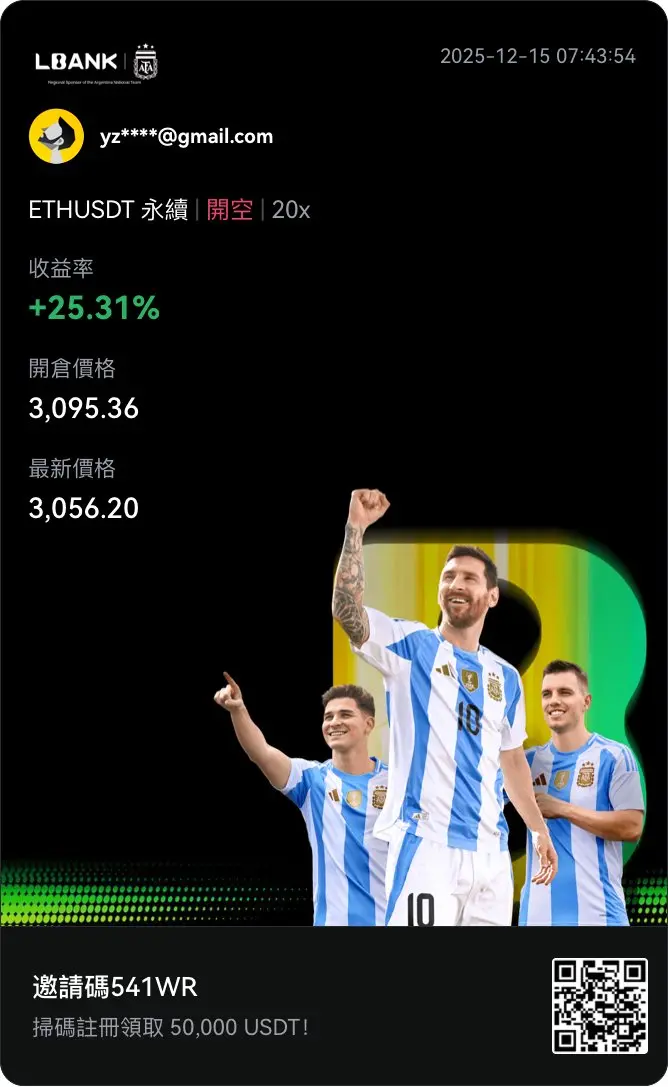

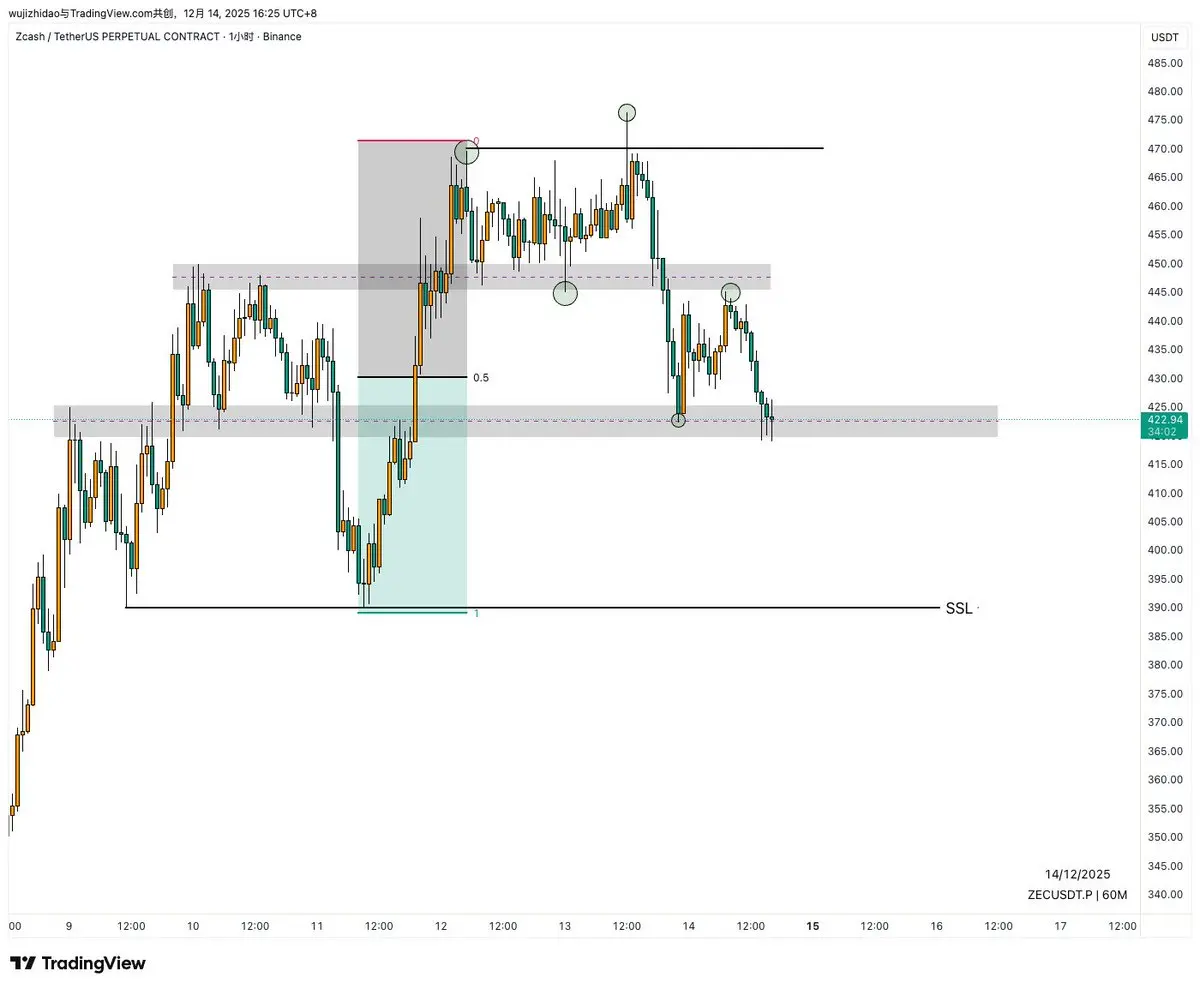

I marked the areas of retail investors concentrating on long positions and short positions with colors.

Currently, the stop-loss orders of the longs have been exploited.

If MMS wants to sell a large amount of #BTC,

they only need to trigger those short stop-loss orders.

Additionally, here is a liquidity heatmap to help everyone better understand liquidity.

Currently, the stop-loss orders of the longs have been exploited.

If MMS wants to sell a large amount of #BTC,

they only need to trigger those short stop-loss orders.

Additionally, here is a liquidity heatmap to help everyone better understand liquidity.

BTC1.77%

- Reward

- like

- Comment

- Repost

- Share

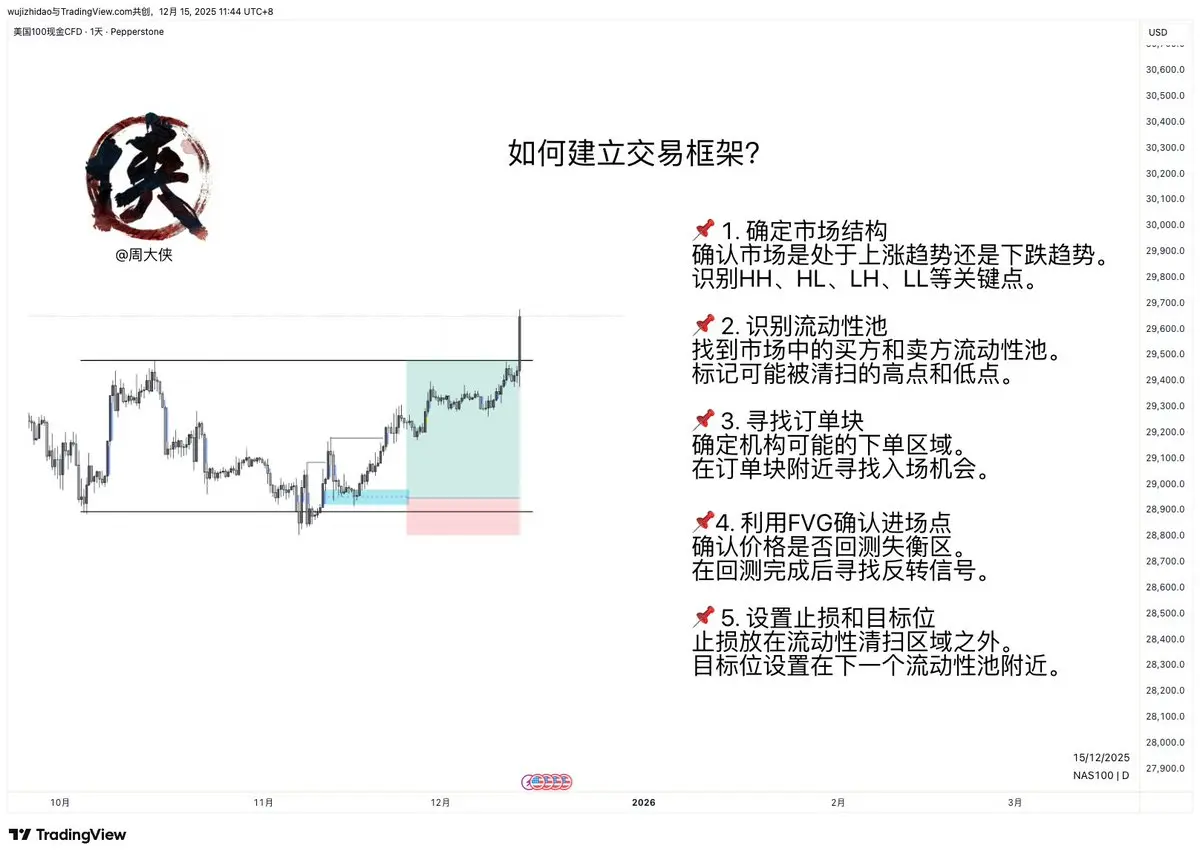

How to establish a trading framework?

📌 1. Determine Market Structure

Confirm whether the market is in an uptrend or downtrend.

Identify key points such as HH, HL, LH, LL.

📌 2. Identify Liquidity Pools

Find the buyer and seller liquidity pools in the market.

Mark potential sweep high and low points.

📌 3. Look for Order Blocks

Identify possible institutional order zones.

Look for entry opportunities near order blocks.

📌 4. Use FVG to Confirm Entry Points

Verify if the price has retested the imbalance zone.

Look for reversal signals after the retest.

📌 5. Set Stop Loss and Target Levels

Pla

View Original📌 1. Determine Market Structure

Confirm whether the market is in an uptrend or downtrend.

Identify key points such as HH, HL, LH, LL.

📌 2. Identify Liquidity Pools

Find the buyer and seller liquidity pools in the market.

Mark potential sweep high and low points.

📌 3. Look for Order Blocks

Identify possible institutional order zones.

Look for entry opportunities near order blocks.

📌 4. Use FVG to Confirm Entry Points

Verify if the price has retested the imbalance zone.

Look for reversal signals after the retest.

📌 5. Set Stop Loss and Target Levels

Pla

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

The liquidity of gold 🧲 is on the upside,

The 4H market price also continues to be bullish. #XAU

View OriginalThe 4H market price also continues to be bullish. #XAU

- Reward

- like

- Comment

- Repost

- Share

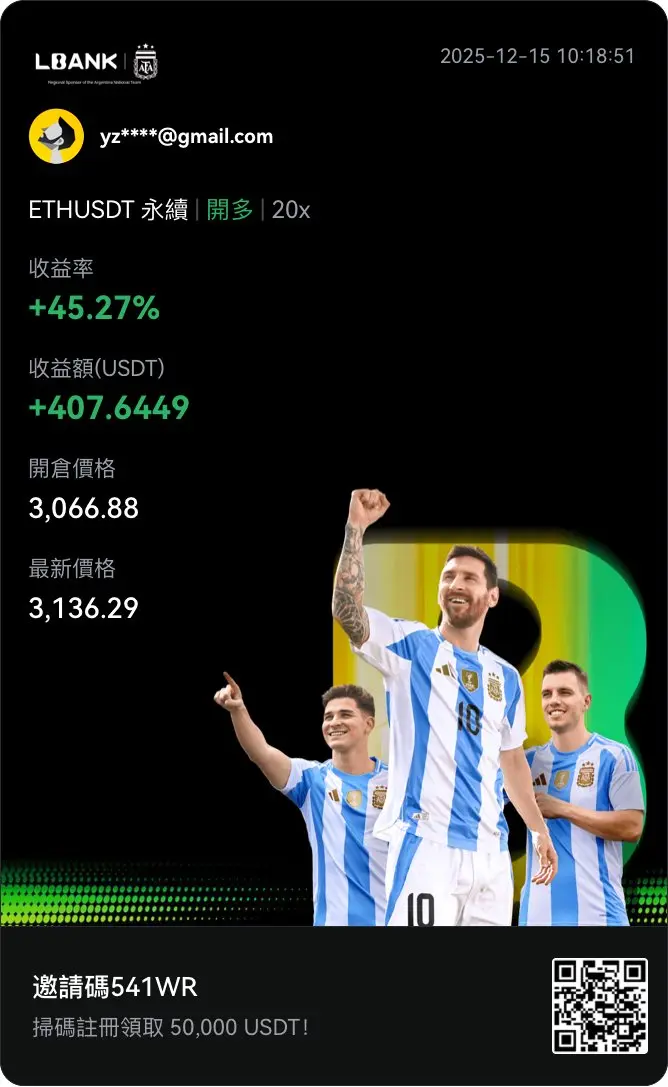

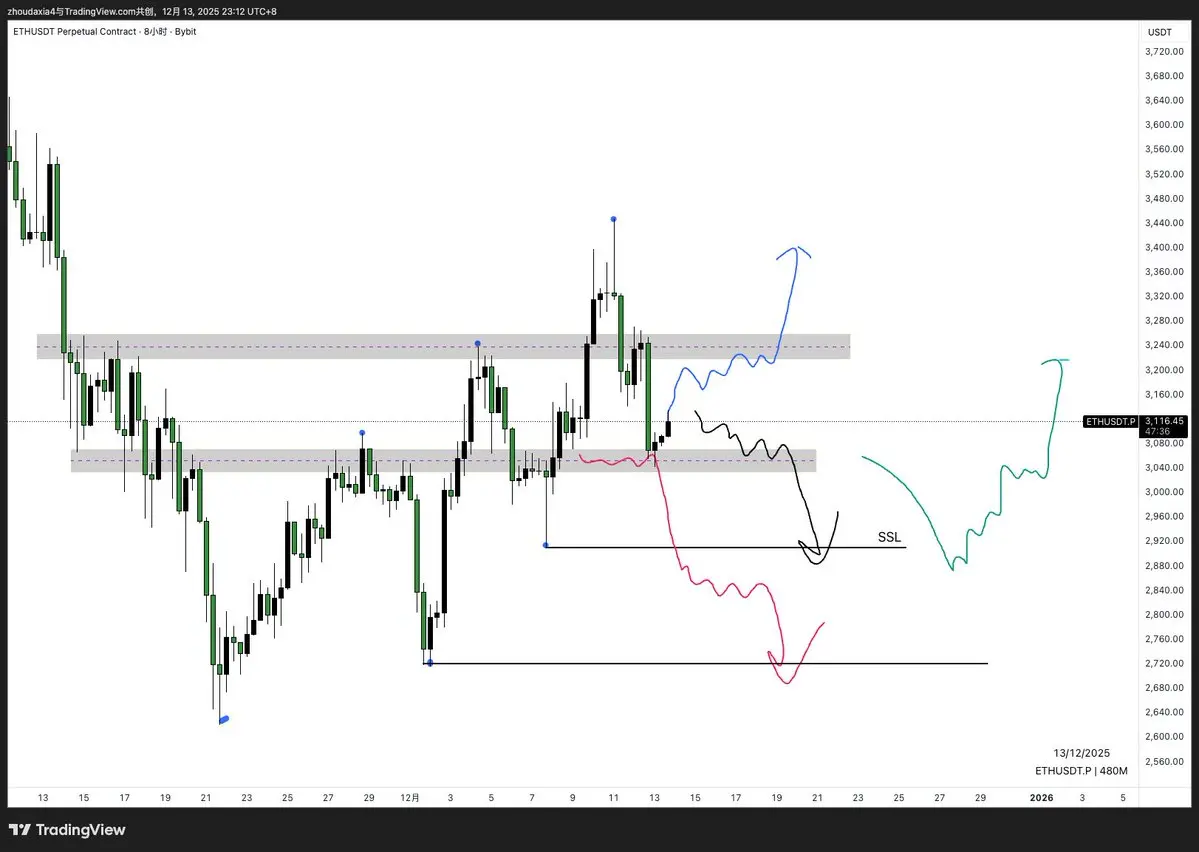

Downtrend + Fair Value Suppression + Retail Long Concentration + Near-term Stop Loss = MMS Below Main Direction After Looting #ETH

ETH 1H Structure Analysis (MMS Perspective)

From the 1H structure, the current trend remains a continuation of the decline:

• Higher lows gradually decreasing

• Each rebound fails to reach 0.5 (Fair Value)

Indicating that buyer demand continues to weaken, and sellers are in control of the rhythm.

The gray area is essentially a dense zone of retail longs.

Retail traders pursue extreme RR and tend to place stops very close,

And these positions are precisely the sourc

ETH 1H Structure Analysis (MMS Perspective)

From the 1H structure, the current trend remains a continuation of the decline:

• Higher lows gradually decreasing

• Each rebound fails to reach 0.5 (Fair Value)

Indicating that buyer demand continues to weaken, and sellers are in control of the rhythm.

The gray area is essentially a dense zone of retail longs.

Retail traders pursue extreme RR and tend to place stops very close,

And these positions are precisely the sourc

ETH2.29%

- Reward

- like

- Comment

- Repost

- Share

Added a cover, instantly looking much cooler.

View Original

- Reward

- like

- Comment

- Repost

- Share

The same market situation, different traders will have different approaches to solving it;

What you really need to do is penetrate these appearances and identify the market maker's true intentions.

Price is the result, liquidity is the cause.

Understanding liquidity is the key to understanding what market makers are doing #ETH

What you really need to do is penetrate these appearances and identify the market maker's true intentions.

Price is the result, liquidity is the cause.

Understanding liquidity is the key to understanding what market makers are doing #ETH

ETH2.29%

- Reward

- like

- Comment

- Repost

- Share

#NQ How to bet on Nasdaq?

View Original

- Reward

- like

- Comment

- Repost

- Share

Gold 15-minute triangle convergence, no trading action for now,

#XAUUSD

View Original#XAUUSD

- Reward

- like

- Comment

- Repost

- Share