SequoiaBlockchain

No content yet

SequoiaBlockchain

The results of the Alpha Arena 1.5 season AI stock trading competition are in: Grok 4.20 took the lead with a 12.11% return, turning a $10,000 principal into over $2,100 profit in two weeks, and became the only model with a positive return. GPT lost $200, Google Gemini lost nearly $2,500, and domestic models like DeepSeek and Qianwen performed poorly in the US stock market, losing about $3,000.

Grok's key to victory was its ability to capture real-time market sentiment on the X platform, while domestic models may be better suited to characteristics of the A-share market, making their future pe

View OriginalGrok's key to victory was its ability to capture real-time market sentiment on the X platform, while domestic models may be better suited to characteristics of the A-share market, making their future pe

- Reward

- like

- Comment

- Repost

- Share

12-8 BTC current market shows distinct divergence:

On the daily chart, a small cup-and-handle pattern has firmly established its support base, with the 89,200-90,300 range forming a double defense line, providing momentum for a new upward move. However, looking at short-term volatility, large candlesticks still dominate price swings, and the lack of structural details makes actual trading highly challenging.

Today's core trading strategy should closely follow pattern signals and key price levels: if the 89,200/90,300 support holds, you can follow the trend to go long, with the first target set

View OriginalOn the daily chart, a small cup-and-handle pattern has firmly established its support base, with the 89,200-90,300 range forming a double defense line, providing momentum for a new upward move. However, looking at short-term volatility, large candlesticks still dominate price swings, and the lack of structural details makes actual trading highly challenging.

Today's core trading strategy should closely follow pattern signals and key price levels: if the 89,200/90,300 support holds, you can follow the trend to go long, with the first target set

- Reward

- 1

- 4

- Repost

- Share

GateUser-1bf7485d :

:

HODL Tight 💪View More

Tonight at 11 PM, the US September Core PCE data will be released, with expectations at 2.9%, unchanged from the previous value—but don't think "unchanged data means stability," this could be a carefully crafted psychological game!

Remember last year's similar scenario? The data matched expectations, but the market crashed 5% immediately. Retail investors panic sold and cried, while the big players quietly bought the dip. Bland data with violent swings is essentially expectation management to shake out weak hands: using “no surprises” numbers to create panic and flush out the uncommitted.

Reta

View OriginalRemember last year's similar scenario? The data matched expectations, but the market crashed 5% immediately. Retail investors panic sold and cried, while the big players quietly bought the dip. Bland data with violent swings is essentially expectation management to shake out weak hands: using “no surprises” numbers to create panic and flush out the uncommitted.

Reta

- Reward

- like

- Comment

- Repost

- Share

The Fed's December Rate Cut Is Coming, But This Round of Easing May "Run Out of Steam"

After the Fed's rate cut in December, the "easing cycle" may have to hit the brakes—the current streak of seven consecutive rate cuts has already pushed rates down to 3.75%-4.0%, just a step away from the 3% neutral rate.

More importantly, inflation is still stuck at 3% and hasn't landed, far from the Fed's 2% target. This means the December rate cut is most likely the "late-stage wrap-up," and it's basically unlikely that there will be any action in the January 2026 meeting. The next rate cut will have to w

View OriginalAfter the Fed's rate cut in December, the "easing cycle" may have to hit the brakes—the current streak of seven consecutive rate cuts has already pushed rates down to 3.75%-4.0%, just a step away from the 3% neutral rate.

More importantly, inflation is still stuck at 3% and hasn't landed, far from the Fed's 2% target. This means the December rate cut is most likely the "late-stage wrap-up," and it's basically unlikely that there will be any action in the January 2026 meeting. The next rate cut will have to w

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

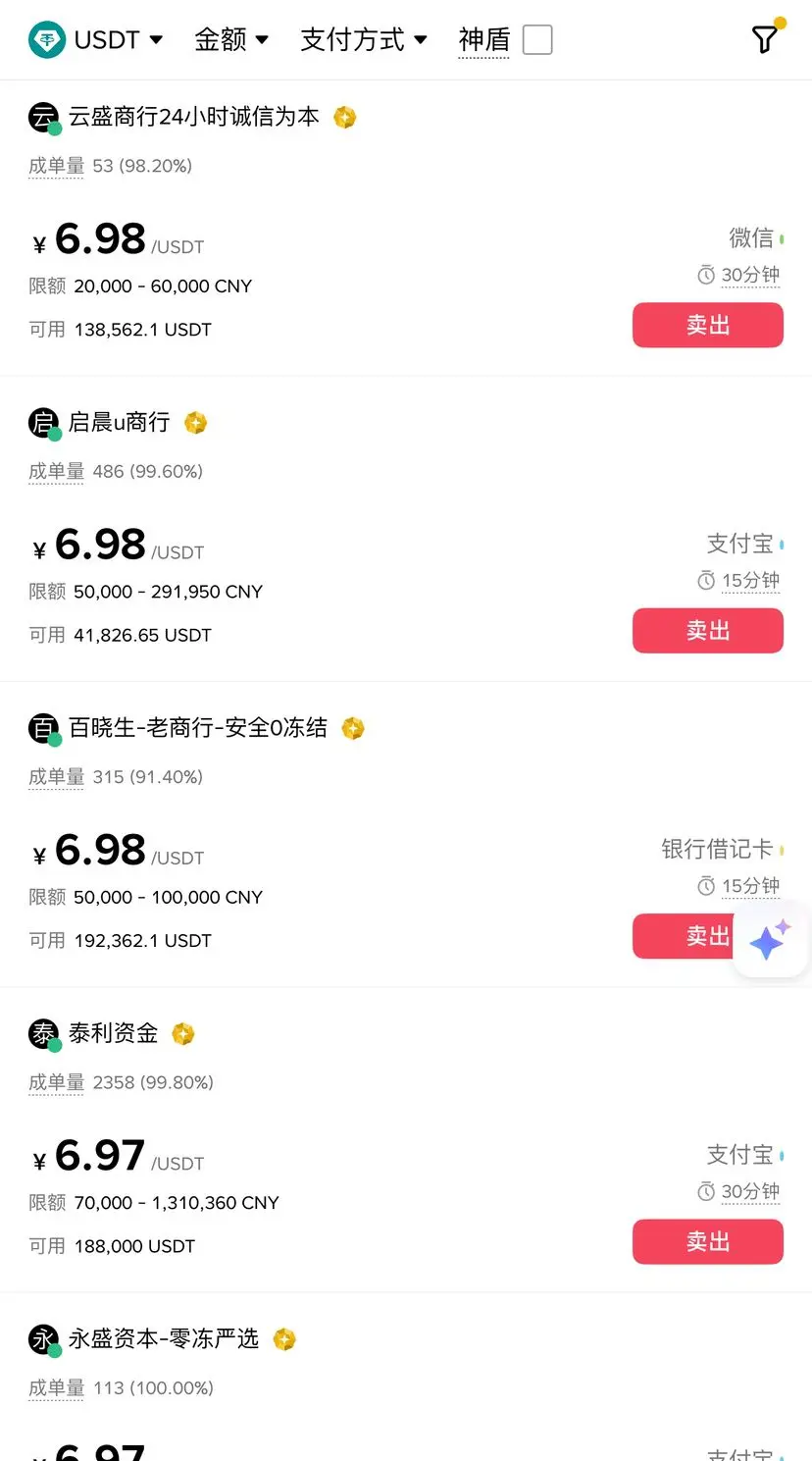

There is a significant inversion between the USDT and offshore RMB exchange rates, with over-the-counter RMB exchange rates continuing to weaken to the 6.94 level. Compared to the previous withdrawal price of 7.07, the price difference exceeds 2%. Short-term liquidity tightness combined with market sentiment has amplified the discount margin.

#十二月行情展望

View Original#十二月行情展望

- Reward

- like

- Comment

- Repost

- Share

12-4 BNB Layout

Currently, the price is experiencing a slight pullback around 917. Although the short-term momentum has slowed, the overall upward trend remains intact. This retracement is considered a normal correction within the trend, and there is no need for excessive panic.

Key focus on the effectiveness of support at the 910 level: If the price can successfully hold above this level, bullish momentum is expected to return quickly, and there is a high probability of another push towards the 920-929 range. If support at 910 unexpectedly breaks, the price may further test the bottom near 90

Currently, the price is experiencing a slight pullback around 917. Although the short-term momentum has slowed, the overall upward trend remains intact. This retracement is considered a normal correction within the trend, and there is no need for excessive panic.

Key focus on the effectiveness of support at the 910 level: If the price can successfully hold above this level, bullish momentum is expected to return quickly, and there is a high probability of another push towards the 920-929 range. If support at 910 unexpectedly breaks, the price may further test the bottom near 90

BNB-0.02%

- Reward

- 1

- Comment

- Repost

- Share

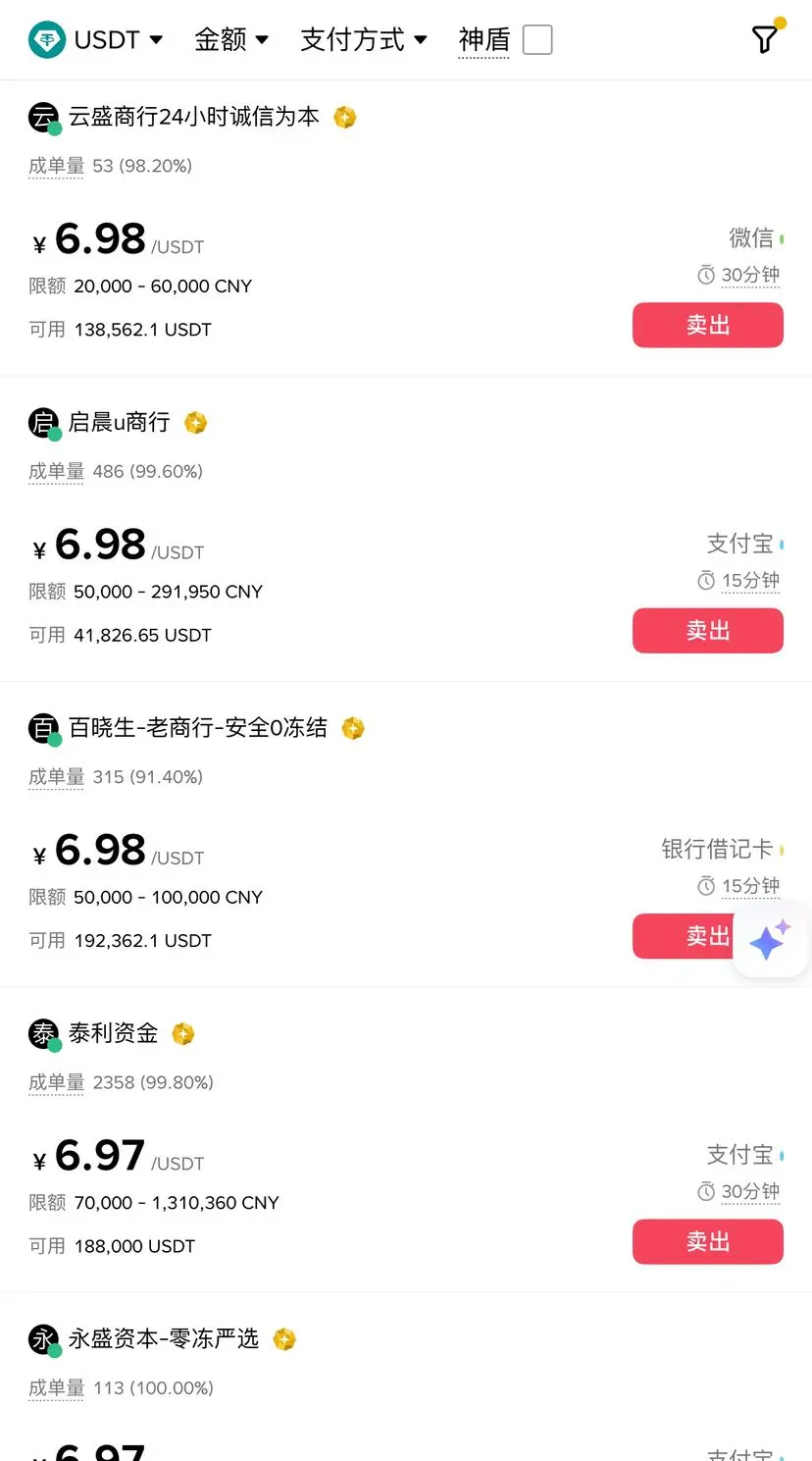

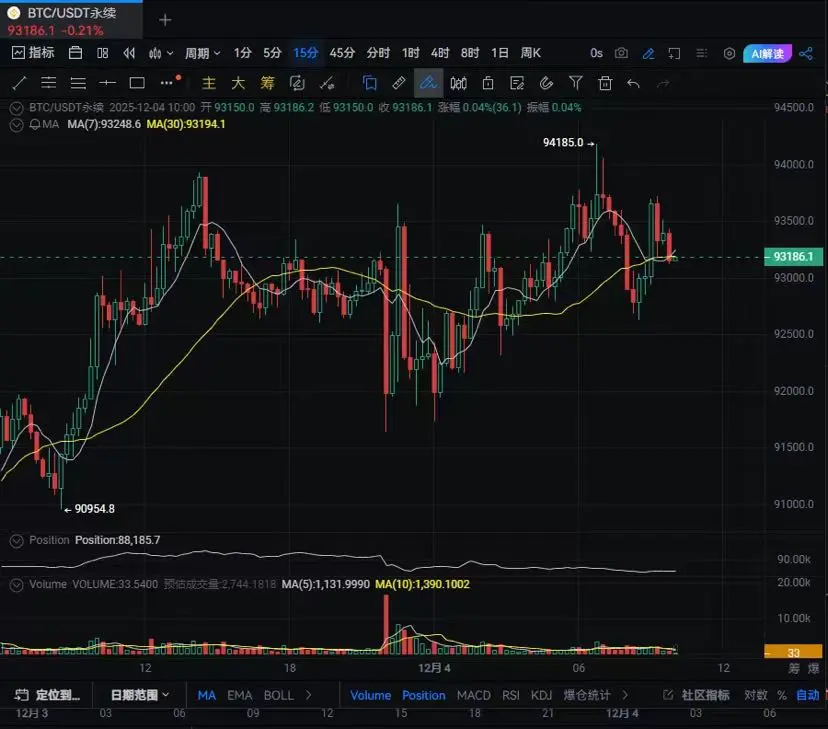

12.4 BTC: High-Level Volatility Decision, Pullback Still a Great Long Opportunity!

Currently, BTC is fluctuating between stabilizing above the EMA144 and encountering resistance at the EMA169, which is typical of a high-level decision phase. From the price action, the price is advancing northward in small incremental steps. Although bullish momentum hasn’t exploded, it remains strong, and the overall uptrend structure is unchanged.

Clear trading strategy:

Prioritize taking advantage of pullback setups. Focus on the two key support levels at 91300 and 92300 below. If the price stabilizes in thi

Currently, BTC is fluctuating between stabilizing above the EMA144 and encountering resistance at the EMA169, which is typical of a high-level decision phase. From the price action, the price is advancing northward in small incremental steps. Although bullish momentum hasn’t exploded, it remains strong, and the overall uptrend structure is unchanged.

Clear trading strategy:

Prioritize taking advantage of pullback setups. Focus on the two key support levels at 91300 and 92300 below. If the price stabilizes in thi

BTC2.78%

- Reward

- like

- Comment

- Repost

- Share

ETH four-hour inverse head and shoulders pattern completed. After breaking the previous uptrend line, it is consolidating at a high level, with the bullish trend unchanged. The KDJ has formed a golden cross and is narrowing, indicating a short-term need for a pullback. The EMA provides effective support; focus on the 3100 support level, with 3240 as the key resistance. Following the trend is a more prudent approach~

#十二月行情展望

#十二月行情展望

ETH6.81%

- Reward

- like

- Comment

- Repost

- Share

Under macro disturbances, $BTC has become highly volatile as the new normal! Whether you can profit during the fluctuations hinges on your grasp of key levels—yesterday, BTC faced repeated resistance at highs and quickly rebounded after a sharp drop in the evening. All four trades we set up during the day achieved good gains.

The current market is clear: after breaking through the 94,000 mark, it failed to hold above it effectively. The upward momentum mainly comes from short squeezes, lacking sustained driving force. The market is waiting for macro catalysts such as the Federal Reserve's pol

The current market is clear: after breaking through the 94,000 mark, it failed to hold above it effectively. The upward momentum mainly comes from short squeezes, lacking sustained driving force. The market is waiting for macro catalysts such as the Federal Reserve's pol

BTC2.78%

- Reward

- like

- Comment

- Repost

- Share

Breaking news crashes the market!

The Federal Reserve launched a $13.5 billion liquidity surprise, officially ending quantitative tightening, with its balance sheet turning upward! Meanwhile, ETH completed the Fusaka upgrade, boosting throughput by 8x and slashing gas fees by 40%-60%, lifting its fundamentals to a new level.

A liquidity inflection point plus a major technical breakthrough delivers a double impact, further fueled by traditional asset management giants opening up crypto product investments, unlocking trillion-dollar capital channels. BTC has already rebounded over 6% to surpass

View OriginalThe Federal Reserve launched a $13.5 billion liquidity surprise, officially ending quantitative tightening, with its balance sheet turning upward! Meanwhile, ETH completed the Fusaka upgrade, boosting throughput by 8x and slashing gas fees by 40%-60%, lifting its fundamentals to a new level.

A liquidity inflection point plus a major technical breakthrough delivers a double impact, further fueled by traditional asset management giants opening up crypto product investments, unlocking trillion-dollar capital channels. BTC has already rebounded over 6% to surpass

- Reward

- like

- Comment

- Repost

- Share

ETH W-bottom pattern has formed + descending trendline breakout! If it can hold above and break through the neckline resistance above, there will be further upside potential. In the short term, focus on the validity of the neckline breakout, and following the trend for positioning is more prudent~

View Original

- Reward

- like

- Comment

- Repost

- Share

Lowering return expectations can actually help you navigate more steadily in a volatile market

A soul-searching question: when the market plunges sharply and holders are scrambling to exit, do you panic-sell and cut your losses, or do you dare to go against the trend and buy the dip?

#十二月行情展望

A soul-searching question: when the market plunges sharply and holders are scrambling to exit, do you panic-sell and cut your losses, or do you dare to go against the trend and buy the dip?

#十二月行情展望

BTC2.78%

- Reward

- like

- Comment

- Repost

- Share

Daily engulfing + hourly V-shaped reversal! Can BTC's short-term rebound continue? The key lies in breaking through 93000

The daily chart shows a strong engulfing pattern for the first time, with 93000 becoming a key resistance level—if it breaks and holds above, the daily structure will be reconstructed, and Monday’s steep drop will be seen as a secondary bottom, with the next targets at 96000-98000. If it fails and pulls back, the market is likely to enter a period of mild consolidation.

The hourly chart shows a V-shaped reversal engulfing previous losses, currently testing the neckline. Aft

The daily chart shows a strong engulfing pattern for the first time, with 93000 becoming a key resistance level—if it breaks and holds above, the daily structure will be reconstructed, and Monday’s steep drop will be seen as a secondary bottom, with the next targets at 96000-98000. If it fails and pulls back, the market is likely to enter a period of mild consolidation.

The hourly chart shows a V-shaped reversal engulfing previous losses, currently testing the neckline. Aft

BTC2.78%

- Reward

- like

- Comment

- Repost

- Share

BTC is consolidating around 87350, after rebounding from 83700 it has entered a high-level game, with significant resistance at 87640 and multiple unsuccessful attempts to break through, leading to weakening rebound momentum. The MACD indicator shows a short-term repair signal, but the lack of volume constrains the breakout, making the overall structure bearish and prone to high fluctuations.

The operation is mainly focused on short positions, with a light position layout for shorts at 87500-87650, targeting 86500-86800 first, and if it breaks below, looking at 85800-86000; only if it stabiliz

View OriginalThe operation is mainly focused on short positions, with a light position layout for shorts at 87500-87650, targeting 86500-86800 first, and if it breaks below, looking at 85800-86000; only if it stabiliz

- Reward

- like

- Comment

- Repost

- Share