SenmanSynmax

Jinan Housing Prices in the Last 10 Years

2014: Average price 9,521 RMB/m²

2015: Average price 9,359 RMB/m²

2016: Average price 11,803 RMB/m²

2017: Average price 15,899 RMB/m²

2018: Average price 17,920 RMB/m²

2019: Average price 16,332 RMB/m²

2020: Average price 15,496 RMB/m²

2021: Average price 15,718 RMB/m²

2022: Average price 16,170 RMB/m²

2023: Average price 15,472 RMB/m²

2024: Average price 13,957 RMB/m²

2025: Average price for the first 11 months 12,984 RMB/m²

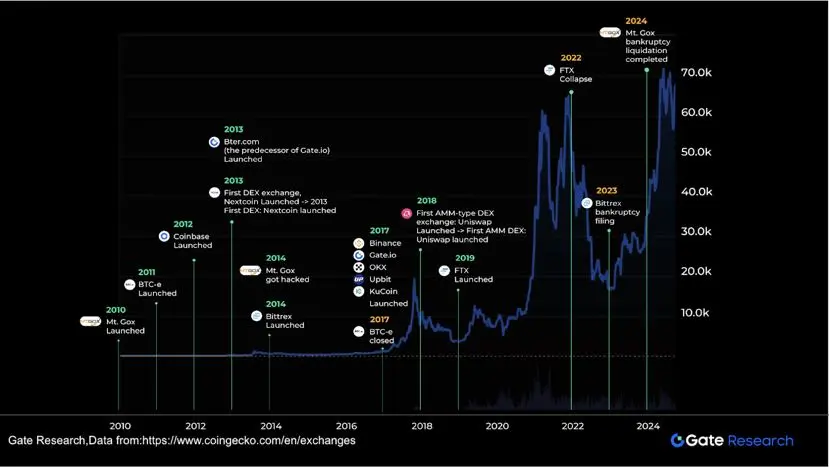

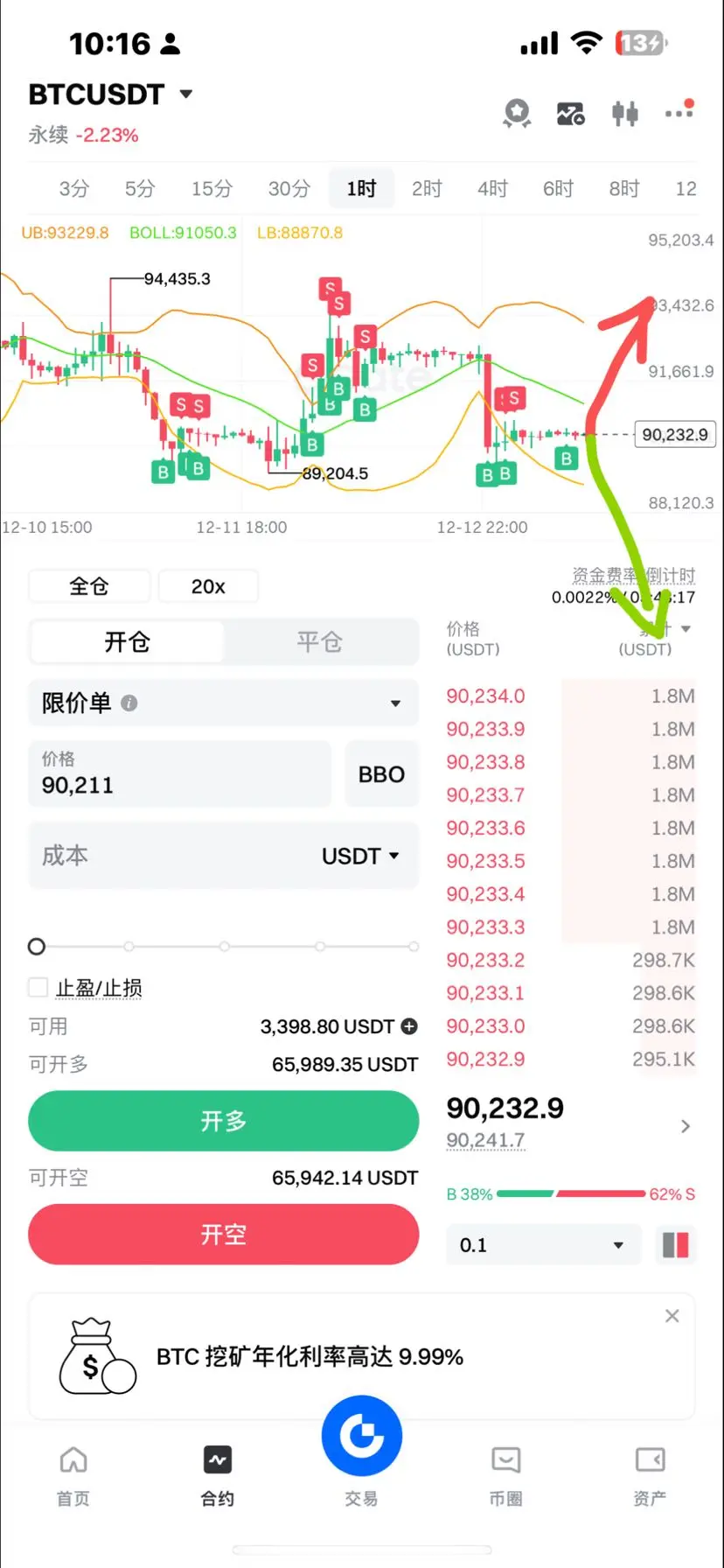

Comment: Still more profitable than Bitcoin @BTC! In 2015, Bitcoin's highest price was $500, now it's $90,000! Over ten years, B

2014: Average price 9,521 RMB/m²

2015: Average price 9,359 RMB/m²

2016: Average price 11,803 RMB/m²

2017: Average price 15,899 RMB/m²

2018: Average price 17,920 RMB/m²

2019: Average price 16,332 RMB/m²

2020: Average price 15,496 RMB/m²

2021: Average price 15,718 RMB/m²

2022: Average price 16,170 RMB/m²

2023: Average price 15,472 RMB/m²

2024: Average price 13,957 RMB/m²

2025: Average price for the first 11 months 12,984 RMB/m²

Comment: Still more profitable than Bitcoin @BTC! In 2015, Bitcoin's highest price was $500, now it's $90,000! Over ten years, B

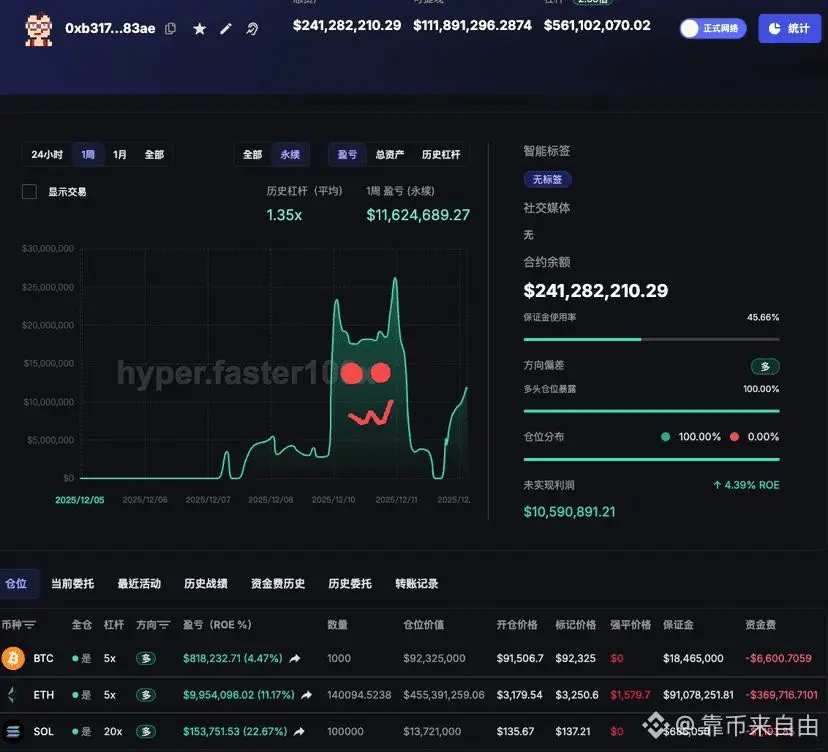

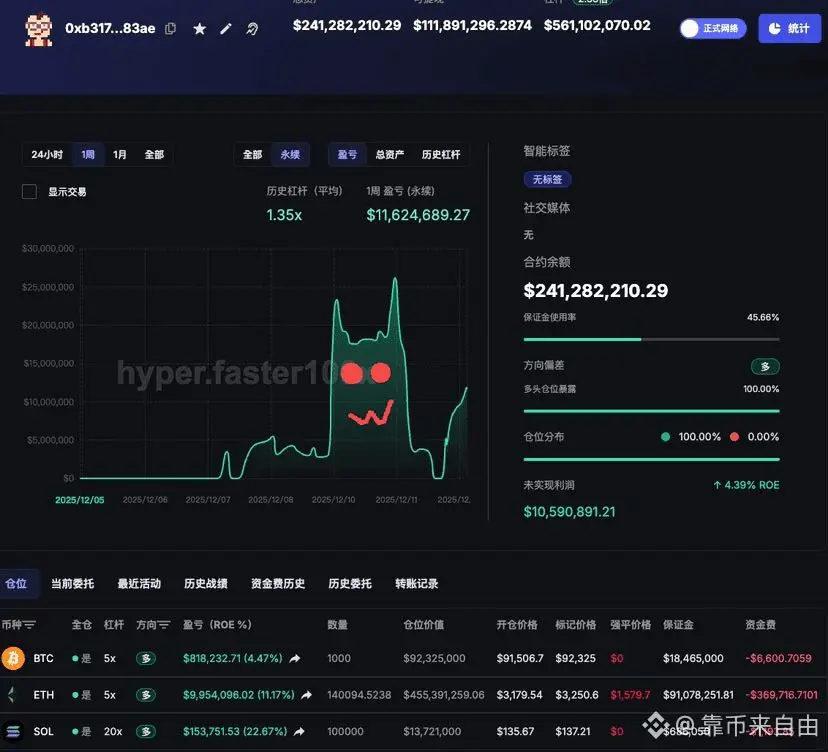

BTC0.11%

[The user has shared his/her trading data. Go to the App to view more.]