AfnovaWarrior

No content yet

AfnovaWarrior

I’m seeing short exposure get cleared around $0.02121, and price stayed composed instead of slipping further. That response indicates sell attempts were checked quickly while buy-side interest absorbed the move.

EP (Entry Price): $0.02145

TP1: $0.02235

TP2: $0.02375

TP3: $0.02590

SL (Stop Loss): $0.02010

Price is maintaining footing above the $0.021 reaction area, keeping the structure orderly rather than pressured.

Upside traction is forming as liquidation flow reduces selling influence and opens room to advance.

Liquidity is stacked above $0.0228 and $0.0246, which often pulls price higher i

EP (Entry Price): $0.02145

TP1: $0.02235

TP2: $0.02375

TP3: $0.02590

SL (Stop Loss): $0.02010

Price is maintaining footing above the $0.021 reaction area, keeping the structure orderly rather than pressured.

Upside traction is forming as liquidation flow reduces selling influence and opens room to advance.

Liquidity is stacked above $0.0228 and $0.0246, which often pulls price higher i

ARPA55,8%

- Reward

- like

- Comment

- Repost

- Share

I’m noticing short pressure getting lifted around $0.04546, and price stayed resilient rather than sliding back. That response suggests downside attempts were neutralized while buying interest absorbed the flow.

EP (Entry Price): $0.04620

TP1: $0.04840

TP2: $0.05180

TP3: $0.05690

SL (Stop Loss): $0.04290

Price is maintaining acceptance above the $0.0454 reaction band, keeping the structure orderly and supported.

Upward drive is forming as liquidation activity reduces selling influence and clears room for continuation.

Liquidity is positioned above $0.0495 and $0.0540, which often pulls price h

EP (Entry Price): $0.04620

TP1: $0.04840

TP2: $0.05180

TP3: $0.05690

SL (Stop Loss): $0.04290

Price is maintaining acceptance above the $0.0454 reaction band, keeping the structure orderly and supported.

Upward drive is forming as liquidation activity reduces selling influence and clears room for continuation.

Liquidity is positioned above $0.0495 and $0.0540, which often pulls price h

PHA14,3%

- Reward

- like

- Comment

- Repost

- Share

I’m seeing short exposure get peeled away near $0.90555, and price stayed buoyant rather than rolling over. That behavior points to sell-side pressure losing grip while buyers quietly absorbed the flow.

EP (Entry Price): $0.9128

TP1: $0.9450

TP2: $0.9895

TP3: $1.0550

SL (Stop Loss): $0.8720

Price is holding firm above the $0.902 reaction band, keeping the structure organized and supported.

Upside participation is increasing as liquidation activity removes selling weight from the range.

Liquidity is stacked above $0.955 and $1.015, which often draws price higher if engagement remains active.

$B

EP (Entry Price): $0.9128

TP1: $0.9450

TP2: $0.9895

TP3: $1.0550

SL (Stop Loss): $0.8720

Price is holding firm above the $0.902 reaction band, keeping the structure organized and supported.

Upside participation is increasing as liquidation activity removes selling weight from the range.

Liquidity is stacked above $0.955 and $1.015, which often draws price higher if engagement remains active.

$B

BERA4,02%

- Reward

- like

- Comment

- Repost

- Share

I’m tracking short positions getting lifted near $0.30535, and price didn’t fade or slip afterward. That response signals sell attempts lost effectiveness while demand absorbed the flow with ease.

EP (Entry Price): $0.3092

TP1: $0.3225

TP2: $0.3410

TP3: $0.3685

SL (Stop Loss): $0.2920

Price is stabilizing above the $0.304 reaction band, preserving an orderly structure.

Upward pressure is emerging as liquidation activity removes downside influence and clears space higher.

Liquidity is concentrated above $0.330 and $0.355, which often draws price upward when participation remains active.

$PIPPIN

EP (Entry Price): $0.3092

TP1: $0.3225

TP2: $0.3410

TP3: $0.3685

SL (Stop Loss): $0.2920

Price is stabilizing above the $0.304 reaction band, preserving an orderly structure.

Upward pressure is emerging as liquidation activity removes downside influence and clears space higher.

Liquidity is concentrated above $0.330 and $0.355, which often draws price upward when participation remains active.

$PIPPIN

PIPPIN0,29%

- Reward

- like

- Comment

- Repost

- Share

I’m seeing short sellers get forced out near $0.2178, and price stayed firm instead of rolling back. That reaction suggests downside attempts lost control while demand absorbed the move efficiently.

EP (Entry Price): $0.2215

TP1: $0.2318

TP2: $0.2475

TP3: $0.2700

SL (Stop Loss): $0.2085

Price is holding above the $0.217 reaction zone, keeping the structure stable and constructive.

Upward momentum is building as liquidation activity removes selling pressure from the market.

Liquidity is positioned above $0.235 and $0.255, which often pulls price higher if buyers remain active.

$FHE

EP (Entry Price): $0.2215

TP1: $0.2318

TP2: $0.2475

TP3: $0.2700

SL (Stop Loss): $0.2085

Price is holding above the $0.217 reaction zone, keeping the structure stable and constructive.

Upward momentum is building as liquidation activity removes selling pressure from the market.

Liquidity is positioned above $0.235 and $0.255, which often pulls price higher if buyers remain active.

$FHE

FHE24,03%

- Reward

- like

- Comment

- Repost

- Share

I’m seeing short exposure get removed near $0.07998, and price held its ground instead of dipping back. That response implies downside pressure was checked while buy-side interest absorbed the flow.

EP (Entry Price): $0.0811

TP1: $0.0852

TP2: $0.0914

TP3: $0.1005

SL (Stop Loss): $0.0764

Price is staying supported above the $0.080 reaction area, preserving a healthy structure.

Upside strength is developing as forced exits reduce selling influence and open room for continuation.

Liquidity is stacked above $0.087 and $0.095, which often draws price higher when participation remains active.

$PLAY

EP (Entry Price): $0.0811

TP1: $0.0852

TP2: $0.0914

TP3: $0.1005

SL (Stop Loss): $0.0764

Price is staying supported above the $0.080 reaction area, preserving a healthy structure.

Upside strength is developing as forced exits reduce selling influence and open room for continuation.

Liquidity is stacked above $0.087 and $0.095, which often draws price higher when participation remains active.

$PLAY

- Reward

- like

- Comment

- Repost

- Share

I’m seeing a wave of short positions get taken off the board near $369.73, and price didn’t collapse after that event. The reaction looks resilient, showing selling effort was absorbed while buyers stepped in.

EP (Entry Price): $374.8

TP1: $392.5

TP2: $418.0

TP3: $455.0

SL (Stop Loss): $352.0

Price is holding above the $368 reaction zone, keeping the broader structure intact.

Upside momentum is rebuilding as forced exits reduce downward pressure and improve follow-through.

Liquidity is concentrated above $400 and $435, which often attracts price higher if demand stays active.

$ZEC

EP (Entry Price): $374.8

TP1: $392.5

TP2: $418.0

TP3: $455.0

SL (Stop Loss): $352.0

Price is holding above the $368 reaction zone, keeping the broader structure intact.

Upside momentum is rebuilding as forced exits reduce downward pressure and improve follow-through.

Liquidity is concentrated above $400 and $435, which often attracts price higher if demand stays active.

$ZEC

ZEC0,58%

- Reward

- like

- Comment

- Repost

- Share

I’m seeing short sellers get forced out near $28.33275, and price remained elevated instead of slipping back. That reaction points to selling attempts being absorbed while buyers held control.

EP (Entry Price): $28.65

TP1: $29.90

TP2: $31.55

TP3: $34.20

SL (Stop Loss): $26.95

Price is holding firm above the $28.30 reaction zone, keeping the structure organized rather than stretched.

Upside energy is increasing as liquidation flow removes downside pressure from the market.

Liquidity is stacked above $30.40 and $32.80, which often pulls price higher if participation stays active.

$RIVER

EP (Entry Price): $28.65

TP1: $29.90

TP2: $31.55

TP3: $34.20

SL (Stop Loss): $26.95

Price is holding firm above the $28.30 reaction zone, keeping the structure organized rather than stretched.

Upside energy is increasing as liquidation flow removes downside pressure from the market.

Liquidity is stacked above $30.40 and $32.80, which often pulls price higher if participation stays active.

$RIVER

- Reward

- like

- Comment

- Repost

- Share

I’m noticing short positions getting cleared near $0.05385, and price stayed composed rather than slipping lower. That response suggests selling pressure was neutralized while demand absorbed the flow.

EP (Entry Price): $0.05460

TP1: $0.05720

TP2: $0.06110

TP3: $0.06680

SL (Stop Loss): $0.05090

Price is maintaining acceptance above the $0.0537 reaction area, keeping the structure orderly and supported.

Upward traction is increasing as liquidation activity removes sell-side influence from the range.

Liquidity is clustered above $0.0585 and $0.0635, which often draws price higher if participatio

EP (Entry Price): $0.05460

TP1: $0.05720

TP2: $0.06110

TP3: $0.06680

SL (Stop Loss): $0.05090

Price is maintaining acceptance above the $0.0537 reaction area, keeping the structure orderly and supported.

Upward traction is increasing as liquidation activity removes sell-side influence from the range.

Liquidity is clustered above $0.0585 and $0.0635, which often draws price higher if participatio

BANK7,51%

- Reward

- like

- Comment

- Repost

- Share

I’m spotting short interest getting erased around $1.72353, and price stayed elevated instead of rolling over. That behavior points to sell-side attempts losing grip while demand absorbed the move.

EP (Entry Price): $1.7415

TP1: $1.8120

TP2: $1.9185

TP3: $2.0900

SL (Stop Loss): $1.6580

Price is maintaining strength above the $1.72 reaction band, preserving a constructive structure.

Upside acceleration is forming as forced exits remove selling friction from the path.

Liquidity is gathered above $1.85 and $1.98, which often attracts price higher if participation remains active.

$ZRO

EP (Entry Price): $1.7415

TP1: $1.8120

TP2: $1.9185

TP3: $2.0900

SL (Stop Loss): $1.6580

Price is maintaining strength above the $1.72 reaction band, preserving a constructive structure.

Upside acceleration is forming as forced exits remove selling friction from the path.

Liquidity is gathered above $1.85 and $1.98, which often attracts price higher if participation remains active.

$ZRO

ZRO4,8%

- Reward

- like

- Comment

- Repost

- Share

I’m noticing short positions getting unwound near $0.01436, and price remained steady rather than slipping lower. That reaction shows sell attempts were absorbed and downside pressure lost influence.

EP (Entry Price): $0.01455

TP1: $0.01535

TP2: $0.01660

TP3: $0.01840

SL (Stop Loss): $0.01370

Price is holding above the $0.0143 reaction zone, keeping the structure supported and organized.

Upward momentum is forming as liquidation flow removes selling weight from the market.

Liquidity is positioned above $0.0158 and $0.0175, which often draws price higher if buyers remain active.

$ROSE

EP (Entry Price): $0.01455

TP1: $0.01535

TP2: $0.01660

TP3: $0.01840

SL (Stop Loss): $0.01370

Price is holding above the $0.0143 reaction zone, keeping the structure supported and organized.

Upward momentum is forming as liquidation flow removes selling weight from the market.

Liquidity is positioned above $0.0158 and $0.0175, which often draws price higher if buyers remain active.

$ROSE

ROSE30,48%

- Reward

- like

- Comment

- Repost

- Share

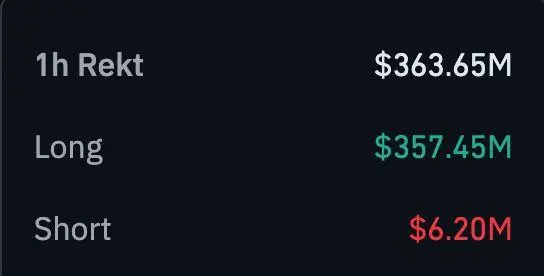

$357M in Crypto Longs Wiped Out as Bitcoin Slips Below $93K

A sudden wave of market stress just slammed the crypto space. In less than an hour, more than $357 million worth of leveraged long positions across Bitcoin and the broader crypto market were forcefully liquidated after Bitcoin dropped below the critical $93,000 level.

As prices slid, margin calls kicked in fast. Exchanges automatically closed bullish positions to cover losses, triggering a chain reaction of forced selling that rattled traders and amplified the downside move. What started as a modest dip quickly turned into a liquidati

A sudden wave of market stress just slammed the crypto space. In less than an hour, more than $357 million worth of leveraged long positions across Bitcoin and the broader crypto market were forcefully liquidated after Bitcoin dropped below the critical $93,000 level.

As prices slid, margin calls kicked in fast. Exchanges automatically closed bullish positions to cover losses, triggering a chain reaction of forced selling that rattled traders and amplified the downside move. What started as a modest dip quickly turned into a liquidati

- Reward

- like

- Comment

- Repost

- Share

GLOBAL SHOCKWAVES: Tariff Threats Ignite Market Panic as Crypto Crashes and Gold & Silver Hit Record Highs🔥

On January 19, 2026, financial markets around the world were thrown into chaos as fear rippled across both digital and traditional assets. A sudden wave of uncertainty sparked violent price swings, catching traders off guard and triggering one of the most dramatic risk-off moments of the year. Cryptocurrencies plunged in a rapid sell-off, with Bitcoin sliding below $93,000 as panic selling erased hundreds of millions of dollars in leveraged positions within hours.

While crypto markets u

On January 19, 2026, financial markets around the world were thrown into chaos as fear rippled across both digital and traditional assets. A sudden wave of uncertainty sparked violent price swings, catching traders off guard and triggering one of the most dramatic risk-off moments of the year. Cryptocurrencies plunged in a rapid sell-off, with Bitcoin sliding below $93,000 as panic selling erased hundreds of millions of dollars in leveraged positions within hours.

While crypto markets u

BTC0,15%

- Reward

- 3

- 2

- Repost

- Share

MIlhamAbdulR :

:

Fund and withdraw with trusted local options. Simple & fast. Trading on margin is high risk.View More

Silver Blasts Above $94/oz — Up Over +31% in 2026🔥

Silver is on an absolute tear. The metal just surged past $94 per ounce, marking a fresh all-time high as prices continue to accelerate in 2026. Traders and investors are riding massive gains, with momentum building fast amid strong demand and rising market enthusiasm.

Now up more than +31% this year, silver has smashed through past records and is clearly leading the current precious-metals rally. The move underscores just how powerful and relentless this trend has become as capital floods into hard assets.

#TariffTensionsHitCryptoMarket

#si

Silver is on an absolute tear. The metal just surged past $94 per ounce, marking a fresh all-time high as prices continue to accelerate in 2026. Traders and investors are riding massive gains, with momentum building fast amid strong demand and rising market enthusiasm.

Now up more than +31% this year, silver has smashed through past records and is clearly leading the current precious-metals rally. The move underscores just how powerful and relentless this trend has become as capital floods into hard assets.

#TariffTensionsHitCryptoMarket

#si

- Reward

- like

- Comment

- Repost

- Share

Aster Fires Up Aggressive Buybacks for $ASTER — Up to 40% of Daily Fees in Play

Aster has officially activated a bold new buyback strategy for its $ASTER token, redirecting a significant share of the platform’s daily revenue straight into the market. Under the plan, 20% to 40% of fees earned each day will be used to repurchase $ASTER, aiming to reduce circulating supply and add steady buying pressure.

This initiative is part of Stage 5 of Aster’s buyback program. Instead of promises or projections, the system uses actual fees generated by the platform, which are automatically sent to a designa

Aster has officially activated a bold new buyback strategy for its $ASTER token, redirecting a significant share of the platform’s daily revenue straight into the market. Under the plan, 20% to 40% of fees earned each day will be used to repurchase $ASTER, aiming to reduce circulating supply and add steady buying pressure.

This initiative is part of Stage 5 of Aster’s buyback program. Instead of promises or projections, the system uses actual fees generated by the platform, which are automatically sent to a designa

ASTER-4,07%

- Reward

- like

- Comment

- Repost

- Share

$525M IN CRYPTO LONGS ERASED IN JUST ONE HOUR

The crypto market just went into shock mode. In a single hour, traders who were betting on prices rising got hit hard as roughly $525 million worth of long positions were suddenly wiped out. Prices flipped fast, volatility exploded, and crowded trades were forced out all at once.

This rapid liquidation is a clear reminder of how brutal the market can be when momentum shifts without warning. When fear kicks in and leverage stacks up, things can unravel in minutes. Stay alert conditions are intense and emotions are running high out there.

#TariffTens

The crypto market just went into shock mode. In a single hour, traders who were betting on prices rising got hit hard as roughly $525 million worth of long positions were suddenly wiped out. Prices flipped fast, volatility exploded, and crowded trades were forced out all at once.

This rapid liquidation is a clear reminder of how brutal the market can be when momentum shifts without warning. When fear kicks in and leverage stacks up, things can unravel in minutes. Stay alert conditions are intense and emotions are running high out there.

#TariffTens

BTC0,15%

- Reward

- like

- Comment

- Repost

- Share

I’m tracking short exposure getting taken off near $27.03012, and price didn’t ease back after that sweep. The response suggests sell attempts were checked while demand absorbed the flow.

EP (Entry Price): $27.35

TP1: $28.60

TP2: $30.25

TP3: $33.10

SL (Stop Loss): $25.85

Price is sustaining acceptance above the $27.00 reaction band, keeping the market posture constructive.

Upside drive is developing as forced exits thin out selling pressure and invite continuation.

Liquidity is concentrated above $29.20 and $31.40, which often draws price higher if participation stays active.

$RIVER

EP (Entry Price): $27.35

TP1: $28.60

TP2: $30.25

TP3: $33.10

SL (Stop Loss): $25.85

Price is sustaining acceptance above the $27.00 reaction band, keeping the market posture constructive.

Upside drive is developing as forced exits thin out selling pressure and invite continuation.

Liquidity is concentrated above $29.20 and $31.40, which often draws price higher if participation stays active.

$RIVER

- Reward

- like

- Comment

- Repost

- Share

I’m noticing short positions getting taken off the table around $0.49168, and price remained supported instead of fading. That reaction hints at sell pressure losing control while demand absorbed the move cleanly.

EP (Entry Price): $0.4985

TP1: $0.5220

TP2: $0.5565

TP3: $0.6050

SL (Stop Loss): $0.4680

Price is holding firm above the $0.490 reaction band, keeping the structure constructive and intact.

Upside strength is building as liquidation flow removes selling weight and allows smoother continuation.

Liquidity is concentrated above $0.530 and $0.580, which often pulls price higher if buyers

EP (Entry Price): $0.4985

TP1: $0.5220

TP2: $0.5565

TP3: $0.6050

SL (Stop Loss): $0.4680

Price is holding firm above the $0.490 reaction band, keeping the structure constructive and intact.

Upside strength is building as liquidation flow removes selling weight and allows smoother continuation.

Liquidity is concentrated above $0.530 and $0.580, which often pulls price higher if buyers

WLD2,1%

- Reward

- like

- Comment

- Repost

- Share

I’m observing short positions getting cleared near $0.00357, and price held steady rather than slipping lower. That behavior suggests downside attempts were capped while buying interest absorbed the pressure.

EP (Entry Price): $0.00362

TP1: $0.00388

TP2: $0.00425

TP3: $0.00480

SL (Stop Loss): $0.00335

Price is stabilizing above the $0.00355 reaction area, keeping the structure orderly and intact.

Upside traction is developing as forced exits reduce selling influence and allow progress.

Liquidity is stacked above $0.00395 and $0.00450, which often pulls price higher if participation stays activ

EP (Entry Price): $0.00362

TP1: $0.00388

TP2: $0.00425

TP3: $0.00480

SL (Stop Loss): $0.00335

Price is stabilizing above the $0.00355 reaction area, keeping the structure orderly and intact.

Upside traction is developing as forced exits reduce selling influence and allow progress.

Liquidity is stacked above $0.00395 and $0.00450, which often pulls price higher if participation stays activ

ZRC10,89%

- Reward

- like

- Comment

- Repost

- Share

I’m seeing short exposure get removed near $0.15596, and price stayed buoyant instead of easing back. That response points to sell attempts losing traction while bids absorbed the flow.

EP (Entry Price): $0.1584

TP1: $0.1662

TP2: $0.1785

TP3: $0.1960

SL (Stop Loss): $0.1472

Price is maintaining footing above the $0.156 reaction band, keeping the structure orderly and supportive.

Upside participation is strengthening as forced exits thin out selling influence and allow continuation.

Liquidity is clustered above $0.170 and $0.186, which often draws price higher if demand remains active.

$IO

EP (Entry Price): $0.1584

TP1: $0.1662

TP2: $0.1785

TP3: $0.1960

SL (Stop Loss): $0.1472

Price is maintaining footing above the $0.156 reaction band, keeping the structure orderly and supportive.

Upside participation is strengthening as forced exits thin out selling influence and allow continuation.

Liquidity is clustered above $0.170 and $0.186, which often draws price higher if demand remains active.

$IO

IO-0,45%

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More22.76K Popularity

334.17K Popularity

45.25K Popularity

7.69K Popularity

6.26K Popularity

Pin