AlaouiCapital

No content yet

AlaouiCapital

You can only pick one

- Reward

- 1

- Comment

- Repost

- Share

FREE GTA VI, if your child is born on release day

Norwegian electronic retailer Komplett says it’ll make it happen

Best side quest ever? 👶🎮

Norwegian electronic retailer Komplett says it’ll make it happen

Best side quest ever? 👶🎮

- Reward

- like

- Comment

- Repost

- Share

What part of crypto do you enjoy way more than you expected?

Be honest

Be honest

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

You just made $10,000,000

What's the first thing you're spending on?

What's the first thing you're spending on?

- Reward

- like

- Comment

- Repost

- Share

This man pays $21,000 for a haircut

That’s more than most people’s rent 💀

He has a personal barber who flies in and out of the country, all expenses paid, just to give him the perfect lineup

Would you want a personal barber?

That’s more than most people’s rent 💀

He has a personal barber who flies in and out of the country, all expenses paid, just to give him the perfect lineup

Would you want a personal barber?

- Reward

- 4

- Comment

- Repost

- Share

GM CT 👑

Never Stop Grinding

Never Stop Grinding

- Reward

- like

- Comment

- Repost

- Share

Sam Bankman Fried continues to back Donald Trump even tho he won’t be receiving any pardon from the president

Bro is working so hard for his release 😭

Bro is working so hard for his release 😭

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

You're stuck in an island with only one of them

Who are you picking ?

Who are you picking ?

- Reward

- like

- Comment

- Repost

- Share

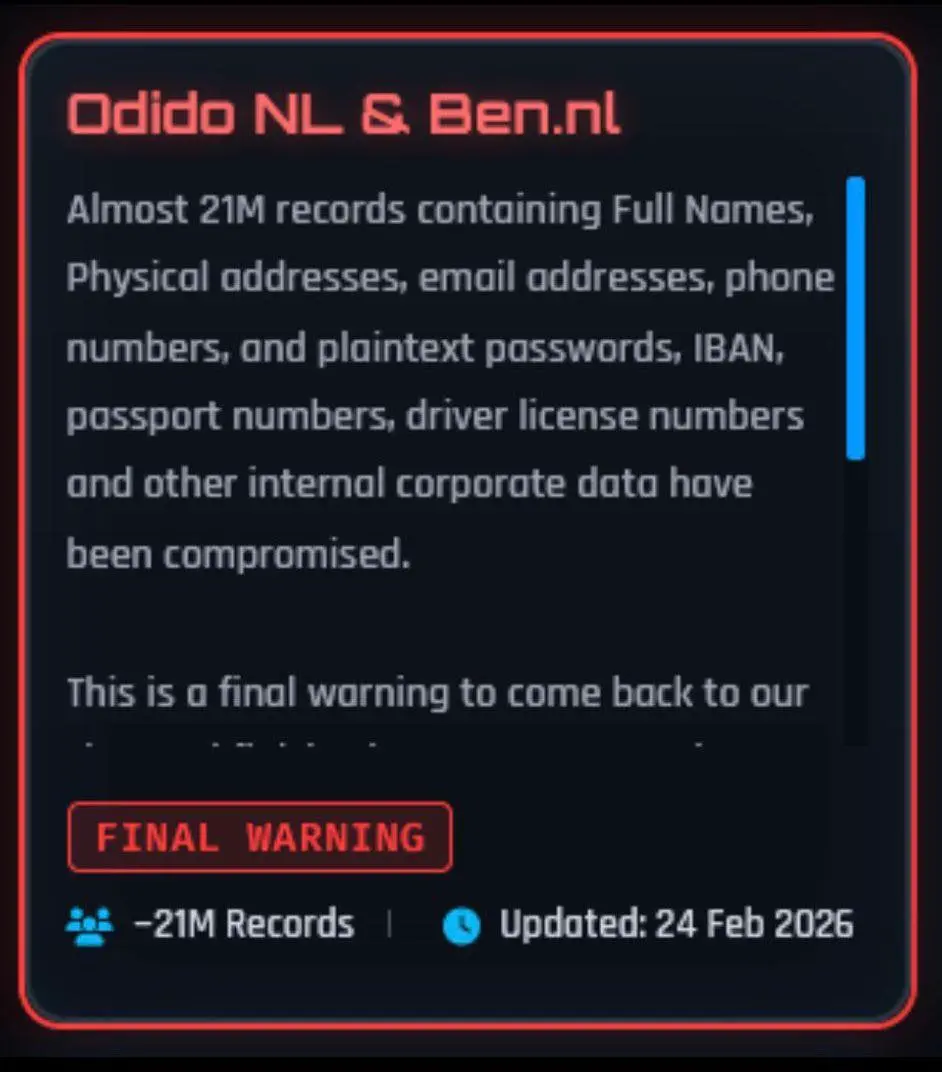

Hackers are now holding stolen data hostage 💀

A hacking group breached the Dutch telecom company Odido recently

Demanding €1 MILLION or they’ll release over 21 million stolen records if the ransom isn’t paid before Thursday

A hacking group breached the Dutch telecom company Odido recently

Demanding €1 MILLION or they’ll release over 21 million stolen records if the ransom isn’t paid before Thursday

- Reward

- like

- Comment

- Repost

- Share

This man sold his pigeon for $400,000 💀

The pigeon, named Usain Bolt, was reportedly a world class racing bird

A collector became so interested he bought it for $400K

Could you ever spend that much on a pigeon?

The pigeon, named Usain Bolt, was reportedly a world class racing bird

A collector became so interested he bought it for $400K

Could you ever spend that much on a pigeon?

- Reward

- 1

- Comment

- Repost

- Share