AylaShinex

No content yet

AylaShinex

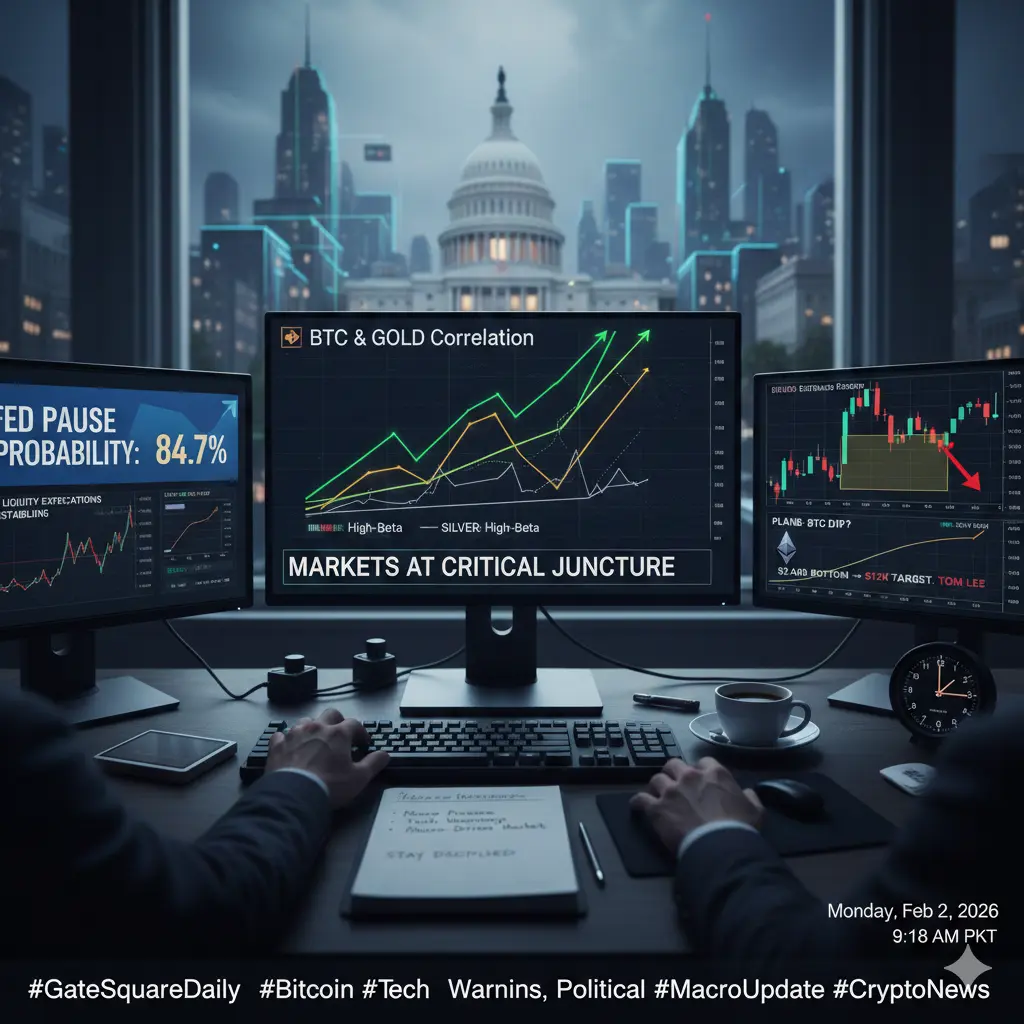

#CryptoMarketPullback Markets are entering a critical decision phase. Macro pressure, technical warnings, and political uncertainty are all colliding at once.

Here’s what matters today 👇

1️⃣ Macro Update:

Fed March pause probability jumps to 84.7%. Liquidity expectations are stabilizing — but markets are still cautious.

2️⃣ Correlation Shift:

BTC and Gold are moving in sync again, while Silver is behaving like a high-beta “meme stock.” Risk appetite is rotating, not disappearing.

3️⃣ Technical Warning:

PlanB suggests a possible BTC dip toward $55K–$58K in a shallow bear scenario. That zone wo

Here’s what matters today 👇

1️⃣ Macro Update:

Fed March pause probability jumps to 84.7%. Liquidity expectations are stabilizing — but markets are still cautious.

2️⃣ Correlation Shift:

BTC and Gold are moving in sync again, while Silver is behaving like a high-beta “meme stock.” Risk appetite is rotating, not disappearing.

3️⃣ Technical Warning:

PlanB suggests a possible BTC dip toward $55K–$58K in a shallow bear scenario. That zone wo

- Reward

- 7

- 14

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Solana has reached an important support level. If this level fails and breaks down, price can drop below $70. This zone will decide whether we get a bounce or further downside.View More

- Reward

- 11

- 19

- Repost

- Share

AYATTAC :

:

2026 GOGOGO 👊View More

Share content from Moments to earn commission effortlessly!https://www.gate.com/live/video/2565059c64444340a9c2ab8c553ee40f?type=live&ref=VLRFB1TBBQ&ref_type=105

- Reward

- 10

- 12

- Repost

- Share

AYATTAC :

:

Buy To Earn 💎View More

#CryptoRegulationNewProgress 🚨⚖️

The narrative around crypto regulation is shifting — not slowly, but meaningfully.

2026 is proving to be a year where policy clarity isn’t just talked about… it’s being acted on. And this matters to every trader, investor, and builder in the space.

Regulation used to be the wildcard that intimidated markets.

Now it’s becoming the framework that enables long-term capital to enter confidently.

Here’s what’s changing:

🔹 Clear Definitions: Tokenized securities, RWAs, and digital assets are no longer in regulatory limbo — frameworks are emerging.

🔹 Institutional

The narrative around crypto regulation is shifting — not slowly, but meaningfully.

2026 is proving to be a year where policy clarity isn’t just talked about… it’s being acted on. And this matters to every trader, investor, and builder in the space.

Regulation used to be the wildcard that intimidated markets.

Now it’s becoming the framework that enables long-term capital to enter confidently.

Here’s what’s changing:

🔹 Clear Definitions: Tokenized securities, RWAs, and digital assets are no longer in regulatory limbo — frameworks are emerging.

🔹 Institutional

- Reward

- 10

- 15

- Repost

- Share

BeautifulDay :

:

2026 GOGOGO 👊View More

#TokenizedSilverTrend 🪙⚡

Silver is no longer just a metal.

It’s becoming programmable.

The rise of tokenized silver is quietly building momentum — blending real-world assets (RWA) with blockchain infrastructure. Physical value. Digital liquidity.

Why this trend matters 👇

🔗 24/7 tradable exposure to silver

🏦 Lower barriers for global investors

💎 Fractional ownership without storage hassle

⚡ Faster settlement vs traditional markets

As gold dominates headlines, silver is positioning itself as the high-beta alternative — and tokenization is amplifying that narrative.

In 2026, capital isn’t ju

Silver is no longer just a metal.

It’s becoming programmable.

The rise of tokenized silver is quietly building momentum — blending real-world assets (RWA) with blockchain infrastructure. Physical value. Digital liquidity.

Why this trend matters 👇

🔗 24/7 tradable exposure to silver

🏦 Lower barriers for global investors

💎 Fractional ownership without storage hassle

⚡ Faster settlement vs traditional markets

As gold dominates headlines, silver is positioning itself as the high-beta alternative — and tokenization is amplifying that narrative.

In 2026, capital isn’t ju

- Reward

- 10

- 16

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

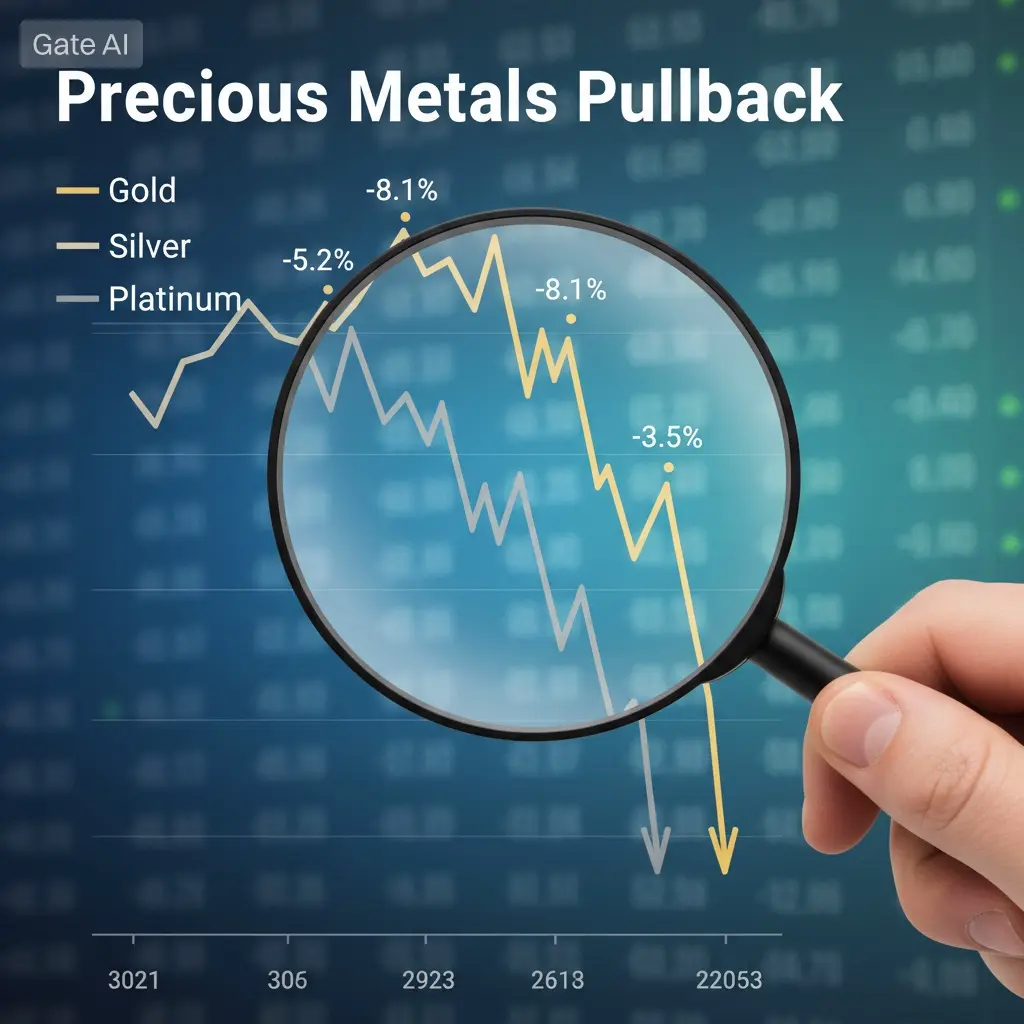

#PreciousMetalsPullBack 📉🟡

After a blistering run, precious metals are finally taking a breather — and markets are noticing. Gold and silver, which had been driven higher by safe-haven demand and macro uncertainty, are now showing a meaningful pullback as short-term profit-taking kicks in.

This pullback isn’t a breakdown — it’s a reset.

When metals surge rapidly, corrections are healthy and expected. Traders booked profits, liquidity shifted, and risk assets felt the impact.

Here’s what to watch now:

🔹 Gold: Pulling back from recent highs, testing support near key structural zones

🔹 Silver

After a blistering run, precious metals are finally taking a breather — and markets are noticing. Gold and silver, which had been driven higher by safe-haven demand and macro uncertainty, are now showing a meaningful pullback as short-term profit-taking kicks in.

This pullback isn’t a breakdown — it’s a reset.

When metals surge rapidly, corrections are healthy and expected. Traders booked profits, liquidity shifted, and risk assets felt the impact.

Here’s what to watch now:

🔹 Gold: Pulling back from recent highs, testing support near key structural zones

🔹 Silver

- Reward

- 9

- 13

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

#GateLiveMiningProgramPublicBeta 🚀🔥

The rules of earning in crypto are evolving.

Trading is no longer the only income stream.

Now, knowledge + influence = real on-chain revenue.

Gate Live has officially upgraded its Mining Rebate System — and this Public Beta phase is where smart creators move first.

💰 Up to 30% Trading Fee Rebates

• 20% Base Commission

• +10% Task Bonus

• New streamers: 30% direct base for first 30 days

This isn’t a small tweak.

This is a structural shift in how creators monetize their audience.

⚡ What makes it powerful?

• Interactive Token Tags inside live rooms

• Instant

The rules of earning in crypto are evolving.

Trading is no longer the only income stream.

Now, knowledge + influence = real on-chain revenue.

Gate Live has officially upgraded its Mining Rebate System — and this Public Beta phase is where smart creators move first.

💰 Up to 30% Trading Fee Rebates

• 20% Base Commission

• +10% Task Bonus

• New streamers: 30% direct base for first 30 days

This isn’t a small tweak.

This is a structural shift in how creators monetize their audience.

⚡ What makes it powerful?

• Interactive Token Tags inside live rooms

• Instant

- Reward

- 11

- 12

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

#CryptoMarketPullback #MarketVolatility ⚡

The crypto market is facing one of its toughest stress tests of early 2026.

Bitcoin has slipped below $80K, briefly touching the $75K–$78K zone — its weakest structure since mid-2025. Ethereum followed, sliding toward $2,400 as leveraged positions were aggressively flushed. Billions in liquidations erased over the weekend.

This isn’t just a random dip.

Macro pressure is building:

• Geopolitical instability

• Stronger U.S. dollar

• Fed uncertainty

• Risk-off capital rotation

Bitcoin is behaving like a high-beta tech asset — not digital gold — in this en

The crypto market is facing one of its toughest stress tests of early 2026.

Bitcoin has slipped below $80K, briefly touching the $75K–$78K zone — its weakest structure since mid-2025. Ethereum followed, sliding toward $2,400 as leveraged positions were aggressively flushed. Billions in liquidations erased over the weekend.

This isn’t just a random dip.

Macro pressure is building:

• Geopolitical instability

• Stronger U.S. dollar

• Fed uncertainty

• Risk-off capital rotation

Bitcoin is behaving like a high-beta tech asset — not digital gold — in this en

ETH-6,24%

- Reward

- 10

- 14

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#GateLunarNewYearOn-ChainGala 🧧🚀

This isn’t just a celebration.

It’s strategy wrapped in culture.

Gate’s Lunar New Year On-Chain Gala is more than red envelopes and festive vibes — it’s a live showcase of how Web3 ecosystems drive real on-chain activity during peak global attention.

While markets fluctuate, builders keep building. And this event proves one thing: engagement is the new utility.

Why this matters 👇

🔗 Real on-chain participation — not just marketing noise

🎯 Interactive tasks that convert users into active ecosystem players

💰 Reward mechanics that incentivize sustainable acti

This isn’t just a celebration.

It’s strategy wrapped in culture.

Gate’s Lunar New Year On-Chain Gala is more than red envelopes and festive vibes — it’s a live showcase of how Web3 ecosystems drive real on-chain activity during peak global attention.

While markets fluctuate, builders keep building. And this event proves one thing: engagement is the new utility.

Why this matters 👇

🔗 Real on-chain participation — not just marketing noise

🎯 Interactive tasks that convert users into active ecosystem players

💰 Reward mechanics that incentivize sustainable acti

- Reward

- 9

- 10

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

#MyWeekendTradingPlan #MyWeekendTradingPlan 📊🔥

Weekend volatility hits different. Lower volume. Faster moves. Fake breakouts everywhere.

So here’s the plan — no emotions, just structure.

🔹 Bitcoin: Watching the $77K–$78K zone closely.

If price holds and reclaims $80K with strength → short-term long setup.

If weakness continues → protect capital, no blind dip buying.

🔹 Ethereum: Needs stability above $2,350.

Otherwise, patience > forcing trades.

🔹 Risk Management:

• No over-leverage

• Smaller position sizing

• Clear stop-loss

• No revenge trading

Weekends are for smart positioning — not ga

Weekend volatility hits different. Lower volume. Faster moves. Fake breakouts everywhere.

So here’s the plan — no emotions, just structure.

🔹 Bitcoin: Watching the $77K–$78K zone closely.

If price holds and reclaims $80K with strength → short-term long setup.

If weakness continues → protect capital, no blind dip buying.

🔹 Ethereum: Needs stability above $2,350.

Otherwise, patience > forcing trades.

🔹 Risk Management:

• No over-leverage

• Smaller position sizing

• Clear stop-loss

• No revenge trading

Weekends are for smart positioning — not ga

- Reward

- 10

- 13

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

$BTC #CryptoMarketPullback 🚨

The market just delivered a sharp reality check.

Bitcoin has officially broken the key $84,600 support and is now trading in the $77K–$78K range. That level was holding structure — and losing it triggered aggressive selling pressure.

BTC: ~$77,800 (-7%)

ETH: ~$2,370 (-13%)

Billions in liquidations flushed in 24 hours.

This isn’t random.

Macro tension, tech stock weakness, and renewed Fed uncertainty are pushing capital into “risk-off” mode. When liquidity tightens, crypto feels it first.

Now the real question:

Is this a market reset…

or a high-probability accumu

The market just delivered a sharp reality check.

Bitcoin has officially broken the key $84,600 support and is now trading in the $77K–$78K range. That level was holding structure — and losing it triggered aggressive selling pressure.

BTC: ~$77,800 (-7%)

ETH: ~$2,370 (-13%)

Billions in liquidations flushed in 24 hours.

This isn’t random.

Macro tension, tech stock weakness, and renewed Fed uncertainty are pushing capital into “risk-off” mode. When liquidity tightens, crypto feels it first.

Now the real question:

Is this a market reset…

or a high-probability accumu

- Reward

- 11

- 13

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

#CryptoMarketPullback 🚨 Breaking: 🚨Over $400M in longs were liquidated in the past 4 hours.

- Reward

- 9

- 9

- Repost

- Share

AngelEye :

:

2026 GOGOGO 👊View More

#CryptoMarketPullback $SOL Price is in a clear intraday downtrend with strong bearish momentum and lower highs.....

SOL-2,73%

- Reward

- 8

- 9

- Repost

- Share

AngelEye :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold ⚖️

Early 2026 is telling a different story than many expected.

For years, Bitcoin carried the title of “Digital Gold.” But right now, the original gold is winning the race — clearly and decisively.

Gold is climbing, holding strength above $5,000 and pushing toward new highs. Meanwhile, Bitcoin is stuck below key resistance, struggling to regain momentum after rejecting near $97K.

This isn’t just about price.

It’s about capital flow.

When uncertainty rises — inflation fears, geopolitical tension, fiscal instability — large capital looks for depth and stability. Gold offe

Early 2026 is telling a different story than many expected.

For years, Bitcoin carried the title of “Digital Gold.” But right now, the original gold is winning the race — clearly and decisively.

Gold is climbing, holding strength above $5,000 and pushing toward new highs. Meanwhile, Bitcoin is stuck below key resistance, struggling to regain momentum after rejecting near $97K.

This isn’t just about price.

It’s about capital flow.

When uncertainty rises — inflation fears, geopolitical tension, fiscal instability — large capital looks for depth and stability. Gold offe

BTC-2,01%

- Reward

- 10

- 10

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎View More

#VanEckLaunchesAVAXSpotETF $AAVE #VanEckLaunchesAVAXSpotETF 🚀

Institutional doors are opening again.

VanEck officially launching a Spot AVAX ETF signals one thing — Avalanche is stepping into the big league conversation.

This isn’t just another listing.

This is regulated exposure. Real capital. Wall Street access.

Why this matters 👇

📈 Easier institutional entry into AVAX

🏦 Traditional investors can gain exposure without holding crypto directly

💰 Potential increase in liquidity & long-term demand

🔥 Strengthens the Layer-1 narrative in 2026

If ETFs were the fuel behind Bitcoin’s institut

Institutional doors are opening again.

VanEck officially launching a Spot AVAX ETF signals one thing — Avalanche is stepping into the big league conversation.

This isn’t just another listing.

This is regulated exposure. Real capital. Wall Street access.

Why this matters 👇

📈 Easier institutional entry into AVAX

🏦 Traditional investors can gain exposure without holding crypto directly

💰 Potential increase in liquidity & long-term demand

🔥 Strengthens the Layer-1 narrative in 2026

If ETFs were the fuel behind Bitcoin’s institut

AAVE-0,96%

- Reward

- 16

- 18

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

#USGovernmentShutdownRisk 🚨 US Government Partial Shutdown — Markets on Edge 🇺🇸

Washington has entered a partial shutdown after a Senate deadlock over DHS funding. While a revised deal passed late Friday, the House won’t return until February 2 — leaving a funding gap through the weekend.

🔎 What’s Actually Happening?

• Key departments affected: Defense, Treasury, HHS, Transportation, DHS

• IRS operations may slow as tax season begins

• Essential services continue, but non-essential staff face furloughs

📉 Why Investors Should Care

This comes right after the recent #CryptoMarketPullback — a

Washington has entered a partial shutdown after a Senate deadlock over DHS funding. While a revised deal passed late Friday, the House won’t return until February 2 — leaving a funding gap through the weekend.

🔎 What’s Actually Happening?

• Key departments affected: Defense, Treasury, HHS, Transportation, DHS

• IRS operations may slow as tax season begins

• Essential services continue, but non-essential staff face furloughs

📉 Why Investors Should Care

This comes right after the recent #CryptoMarketPullback — a

BTC-2,01%

- Reward

- 15

- 19

- Repost

- Share

HighAmbition :

:

thank you for the updateView More

#CryptoMarketPullback #CryptoMarketPullback 🚨

Bitcoin slipping below $83K.

Fear Index flashing Extreme Fear.

Timeline full red.

But let’s slow down and read the market properly.

This isn’t panic. This is positioning.

🔹 ETF outflows = short-term profit booking

🔹 Leverage flush = weak hands removed

🔹 Macro pressure = temporary risk-off mood

Healthy bull markets breathe.

They pump. They correct. They reset.

Key zones to watch:

📍 $81,000 – First major support

📍 $78,500 – Strong structural support

If those levels hold, this pullback becomes fuel for the next expansion.

Remember:

Red days shak

Bitcoin slipping below $83K.

Fear Index flashing Extreme Fear.

Timeline full red.

But let’s slow down and read the market properly.

This isn’t panic. This is positioning.

🔹 ETF outflows = short-term profit booking

🔹 Leverage flush = weak hands removed

🔹 Macro pressure = temporary risk-off mood

Healthy bull markets breathe.

They pump. They correct. They reset.

Key zones to watch:

📍 $81,000 – First major support

📍 $78,500 – Strong structural support

If those levels hold, this pullback becomes fuel for the next expansion.

Remember:

Red days shak

BTC-2,01%

- Reward

- 12

- 15

- Repost

- Share

HighAmbition :

:

thnxx sharing informationView More

- Reward

- 8

- 12

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎View More