Falcon_Official

No content yet

Pin

Falcon_Official

#GateSquareCreatorNewYearIncentives 🎉

🧧Gate Plaza Creator New Year Campaign Share Ideas, Build Influence & Win from a $60,000 Luxury Reward Pool!

Welcome 2026 with Gate.io Plaza’s largest creator initiative of the year. Whether you’re an experienced crypto voice or just starting your journey, this campaign gives you the perfect platform to transform your crypto insights into real, high-value rewards.

📝 How to Participate

1️⃣ Sign Up First

Complete the official registration form to become eligible

👉 https://www.gate.com/questionnaire/7315

2️⃣ Create & Publish Content

Post your crypto insigh

🧧Gate Plaza Creator New Year Campaign Share Ideas, Build Influence & Win from a $60,000 Luxury Reward Pool!

Welcome 2026 with Gate.io Plaza’s largest creator initiative of the year. Whether you’re an experienced crypto voice or just starting your journey, this campaign gives you the perfect platform to transform your crypto insights into real, high-value rewards.

📝 How to Participate

1️⃣ Sign Up First

Complete the official registration form to become eligible

👉 https://www.gate.com/questionnaire/7315

2️⃣ Create & Publish Content

Post your crypto insigh

- Reward

- 20

- 34

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

#Gate广场明星交易员招募

Bitcoin (BTC) continues to capture global attention as the flagship cryptocurrency. Currently trading in the mid-to-high $80,000s to low $90,000s range, BTC is in a consolidation phase, with neither bulls nor bears fully in control. Traders, analysts, and copy traders on Gate Plaza are closely monitoring key technical indicators to make informed decisions.

In this post, we’ll break down BTC’s technical indicators, potential trade setups, and how you can leverage Gate Plaza Star Copy Trading to participate and earn rewards while sharing insights with the community.

BTC Technical

Bitcoin (BTC) continues to capture global attention as the flagship cryptocurrency. Currently trading in the mid-to-high $80,000s to low $90,000s range, BTC is in a consolidation phase, with neither bulls nor bears fully in control. Traders, analysts, and copy traders on Gate Plaza are closely monitoring key technical indicators to make informed decisions.

In this post, we’ll break down BTC’s technical indicators, potential trade setups, and how you can leverage Gate Plaza Star Copy Trading to participate and earn rewards while sharing insights with the community.

BTC Technical

BTC0,51%

- Reward

- 7

- 10

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#CryptoMarketWatch

Bitcoin (BTC), the flagship cryptocurrency, is showing a consolidation and cautious trend near current major price levels. After reacting to macroeconomic factors and geopolitical shifts, Bitcoin’s price structure continues to reflect mixed technical signals, suggesting that neither bulls nor bears are fully in command. Traders and long‑term holders are closely watching key indicators and support/resistance levels to gauge Bitcoin’s next directional move.

Current Price and Market Context

Recent data indicates BTC trading around the mid‑to‑high $80,000s to low‑$90,000s range

Bitcoin (BTC), the flagship cryptocurrency, is showing a consolidation and cautious trend near current major price levels. After reacting to macroeconomic factors and geopolitical shifts, Bitcoin’s price structure continues to reflect mixed technical signals, suggesting that neither bulls nor bears are fully in command. Traders and long‑term holders are closely watching key indicators and support/resistance levels to gauge Bitcoin’s next directional move.

Current Price and Market Context

Recent data indicates BTC trading around the mid‑to‑high $80,000s to low‑$90,000s range

BTC0,51%

- Reward

- 12

- 22

- 1

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

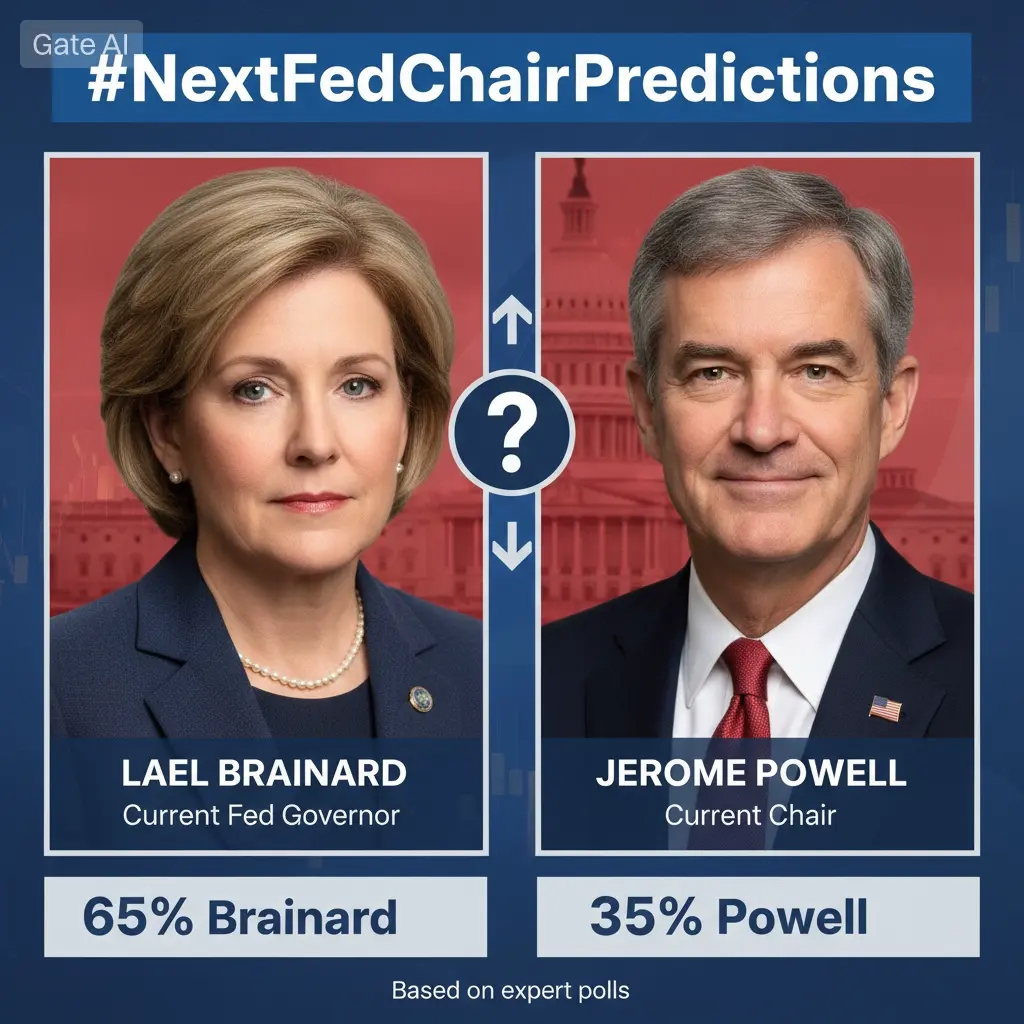

🏛️#NextFedChairPredictions

As Jerome Powell’s term as Federal Reserve Chair approaches its May 2026 expiration, markets, traders, and policymakers are intensely focused on who will succeed him. This leadership transition isn’t just about personnel it could shape the future of interest rates, inflation expectations, and global financial conditions for years to come.

In the current prediction landscape, Lael Brainard is being perceived as the favorite, with roughly a ~65% probability, while Jerome Powell’s chances are significantly lower at around ~35% according to prevailing sentiment and ma

As Jerome Powell’s term as Federal Reserve Chair approaches its May 2026 expiration, markets, traders, and policymakers are intensely focused on who will succeed him. This leadership transition isn’t just about personnel it could shape the future of interest rates, inflation expectations, and global financial conditions for years to come.

In the current prediction landscape, Lael Brainard is being perceived as the favorite, with roughly a ~65% probability, while Jerome Powell’s chances are significantly lower at around ~35% according to prevailing sentiment and ma

- Reward

- 10

- 18

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#GrowthPointsDrawRound16

🎉 Growth Points Episode 16 – Spring Festival Lucky Draw is LIVE! 🎉

Don’t miss your chance to win exciting rewards, including the all-new iPhone 17 and exclusive Spring Festival gifts! 🧧📱

✨ Why join?

✔️ 100% win rate everyone wins

✔️ Complete simple growth tasks like posting, liking, commenting, and joining community discussions

✔️ The more you participate, the more rewards you unlock

🎁 Rewards include:

• Gold bars

• iPhone 17

• Gate Spring Festival Gift Box

• Gate × RedBull Bottle Opener

• Trading fee cashback coupons

• And many more surprises!

👉 Join now: https

🎉 Growth Points Episode 16 – Spring Festival Lucky Draw is LIVE! 🎉

Don’t miss your chance to win exciting rewards, including the all-new iPhone 17 and exclusive Spring Festival gifts! 🧧📱

✨ Why join?

✔️ 100% win rate everyone wins

✔️ Complete simple growth tasks like posting, liking, commenting, and joining community discussions

✔️ The more you participate, the more rewards you unlock

🎁 Rewards include:

• Gold bars

• iPhone 17

• Gate Spring Festival Gift Box

• Gate × RedBull Bottle Opener

• Trading fee cashback coupons

• And many more surprises!

👉 Join now: https

- Reward

- 9

- 23

- 1

- Share

Ryakpanda :

:

New Year Wealth Explosion 🤑View More

#GoldandSilverHitNewHighs

As of today, global financial markets are witnessing a decisive shift toward precious metals, with both gold and silver moving into strong bullish territory. Heightened geopolitical risks, persistent inflation uncertainty, and cautious sentiment across risk assets have reinforced demand for traditional safe-haven instruments. Gold and silver are no longer reacting to short-term news alone; instead, their current strength reflects deeper macroeconomic and technical alignment.

Macro & Fundamental Landscape:

The renewed upside in gold and silver is being driven by a com

As of today, global financial markets are witnessing a decisive shift toward precious metals, with both gold and silver moving into strong bullish territory. Heightened geopolitical risks, persistent inflation uncertainty, and cautious sentiment across risk assets have reinforced demand for traditional safe-haven instruments. Gold and silver are no longer reacting to short-term news alone; instead, their current strength reflects deeper macroeconomic and technical alignment.

Macro & Fundamental Landscape:

The renewed upside in gold and silver is being driven by a com

- Reward

- 6

- 12

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

Gate Live Weekend Crypto Party | Win Feitian Moutai & Weekly Airdrops https://www.gate.com/campaigns/3833?ref=VLIWBLOKUW&ref_type=132

- Reward

- 10

- 12

- Repost

- Share

Ryakpanda :

:

New Year Wealth Explosion 🤑View More

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3871?ref=VLIWBLOKUW&ref_type=132

- Reward

- 6

- 8

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

📉 #JapanBondMarketSell-Off

Japan’s government bond market, long viewed as one of the most stable and policy-controlled markets globally, has entered a rare phase of heightened volatility. The recent sell-off in Japanese Government Bonds (JGBs) signals a meaningful shift in investor expectations and market structure. After decades of ultra-loose monetary policy, near-zero yields, and aggressive central bank intervention, Japan’s bond market is now responding more directly to inflation trends, wage growth, and evolving policy signals from the Bank of Japan. This transition marks a critical mom

Japan’s government bond market, long viewed as one of the most stable and policy-controlled markets globally, has entered a rare phase of heightened volatility. The recent sell-off in Japanese Government Bonds (JGBs) signals a meaningful shift in investor expectations and market structure. After decades of ultra-loose monetary policy, near-zero yields, and aggressive central bank intervention, Japan’s bond market is now responding more directly to inflation trends, wage growth, and evolving policy signals from the Bank of Japan. This transition marks a critical mom

- Reward

- 10

- 20

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#TrumpWithdrawsEUTariffThreats

The decision by former U.S. President Donald Trump to withdraw proposed tariff threats against the European Union marks a notable shift in transatlantic trade dynamics. At a time when global markets remain sensitive to geopolitical developments, the easing of tariff pressure has reduced immediate fears of a renewed trade conflict between two of the world’s largest economic blocs. This development carries implications not only for diplomacy but also for financial markets, investor sentiment, and global trade stability.

Market Reaction and Investor Response

Global

The decision by former U.S. President Donald Trump to withdraw proposed tariff threats against the European Union marks a notable shift in transatlantic trade dynamics. At a time when global markets remain sensitive to geopolitical developments, the easing of tariff pressure has reduced immediate fears of a renewed trade conflict between two of the world’s largest economic blocs. This development carries implications not only for diplomacy but also for financial markets, investor sentiment, and global trade stability.

Market Reaction and Investor Response

Global

- Reward

- 7

- 14

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

🎉#GateSquareCreatorNewYearIncentives represents more than just a campaign hashtag it marks Gate Square’s commitment to empowering creators, rewarding ideas, and turning community participation into real value. As we step into 2026, this initiative brings creators, beginners, and crypto thinkers together on one global platform, where sharing insights, engaging in discussions, and staying consistent can unlock visibility, credibility, and meaningful rewards. This hashtag is your entry point into Gate Square’s creator economy, where every post has the potential to build influence and turn knowle

- Reward

- 10

- 17

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3881?ref=VLIWBLOKUW&ref_type=132&utm_cmp=TpIkMKPZ

- Reward

- 6

- 8

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3871?ref=VLIWBLOKUW&ref_type=132

- Reward

- 9

- 11

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3881?ref=VLIWBLOKUW&ref_type=132&utm_cmp=TpIkMKPZ

- Reward

- 10

- 13

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3867?ref=VLIWBLOKUW&ref_type=132

- Reward

- 9

- 10

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4-gold-lucky-draw?ref_type=132

- Reward

- 10

- 12

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3767?ref=VLIWBLOKUW&ref_type=132&utm_cmp=LjFqK91p

- Reward

- 11

- 9

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#ETHTrendWatch

Ethereum in a Mixed Technical Environment

Ethereum (ETH) remains one of the most closely watched crypto assets, with traders assessing directional momentum, key support/resistance levels, and macro influences. As of today’s market conditions, Ethereum shows signs of consolidation and short-term weakness, even as mid-term technical setups and potential breakout zones continue to shape trader decisions. This analysis uses current data from major technical indicators to determine trend bias, entry/exit priorities, and risk signals for both short- and medium-term strategies.

📈 Pri

Ethereum in a Mixed Technical Environment

Ethereum (ETH) remains one of the most closely watched crypto assets, with traders assessing directional momentum, key support/resistance levels, and macro influences. As of today’s market conditions, Ethereum shows signs of consolidation and short-term weakness, even as mid-term technical setups and potential breakout zones continue to shape trader decisions. This analysis uses current data from major technical indicators to determine trend bias, entry/exit priorities, and risk signals for both short- and medium-term strategies.

📈 Pri

ETH1,63%

- Reward

- 11

- 11

- 1

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#IranTradeSanctions

The Return of Trade Sanctions on Iran:

The re-imposition of trade sanctions on Iran marks a significant geopolitical and economic event with far-reaching consequences. Targeted sanctions, typically imposed to curb nuclear ambitions or influence political behavior, have direct and indirect effects on global trade, commodity prices, and investor sentiment. The renewed sanctions are expected to affect Iran’s export capacity, international banking interactions, and cross-border commercial relationships, creating ripples across multiple markets.

🔹 Scope and Mechanism of the Sa

The Return of Trade Sanctions on Iran:

The re-imposition of trade sanctions on Iran marks a significant geopolitical and economic event with far-reaching consequences. Targeted sanctions, typically imposed to curb nuclear ambitions or influence political behavior, have direct and indirect effects on global trade, commodity prices, and investor sentiment. The renewed sanctions are expected to affect Iran’s export capacity, international banking interactions, and cross-border commercial relationships, creating ripples across multiple markets.

🔹 Scope and Mechanism of the Sa

- Reward

- 7

- 7

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More