HanssiMazak

No content yet

HanssiMazak

#CryptoMarketWatch Dominates, But Opportunity Emerges

Global crypto markets are signaling caution as the Crypto Fear & Greed Index plunges to 20, reflecting extreme risk aversion among investors. Volatility remains elevated, and participants are carefully weighing their next moves.

Key Market Highlights

1️⃣ Gold Surges:

Gold has surpassed $5,000 per ounce, reaffirming its role as a safe-haven amid uncertainty. Institutional and sovereign allocations are driving demand, reflecting broader market risk-off behavior.

2️⃣ Japan Plans Spot Crypto ETFs:

Regulatory discussions suggest Japan may approv

Global crypto markets are signaling caution as the Crypto Fear & Greed Index plunges to 20, reflecting extreme risk aversion among investors. Volatility remains elevated, and participants are carefully weighing their next moves.

Key Market Highlights

1️⃣ Gold Surges:

Gold has surpassed $5,000 per ounce, reaffirming its role as a safe-haven amid uncertainty. Institutional and sovereign allocations are driving demand, reflecting broader market risk-off behavior.

2️⃣ Japan Plans Spot Crypto ETFs:

Regulatory discussions suggest Japan may approv

- Reward

- 4

- 4

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#DOGEETFListsonNasdaq The DOGE Spot ETF has officially debuted on Nasdaq, marking a historic milestone for Dogecoin and the broader cryptocurrency ecosystem. This launch brings regulated, exchange-traded exposure to DOGE, providing institutional and retail investors with a simpler, compliant pathway to participate in one of crypto’s most iconic community-driven assets.

📍 Today’s Key Prices (Jan 28, 2026)

DOGE: ~$0.89 — showing early momentum post-ETF launch

Bitcoin (BTC): ~$89,000 — consolidating near resistance

Ethereum (ETH): ~$3,000 — steady with moderate gains

1️⃣ Institutional Access to

📍 Today’s Key Prices (Jan 28, 2026)

DOGE: ~$0.89 — showing early momentum post-ETF launch

Bitcoin (BTC): ~$89,000 — consolidating near resistance

Ethereum (ETH): ~$3,000 — steady with moderate gains

1️⃣ Institutional Access to

- Reward

- 3

- 3

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#RIVERUp50xinOneMonth RIVER has captured the crypto spotlight with one of 2026’s most dramatic rallies. After reaching an all-time high near ~$87.7, the token is now consolidating in the $50–$55 range (approx. current price ~$52) following January’s parabolic momentum. This meteoric performance positions RIVER as one of the top-performing altcoins this year, delivering gains near 1,800–2,000% monthly and roughly 500% year-to-date in the context of broader market conditions.

💹 Price Action & Forecast

RIVER’s recent peak near $87.7 reflected extreme buying momentum, followed by a natural pullba

💹 Price Action & Forecast

RIVER’s recent peak near $87.7 reflected extreme buying momentum, followed by a natural pullba

RIVER3L-18,69%

- Reward

- 6

- 2

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

#BitcoinFallsBehindGold Global markets are quietly signaling a shift in safe-haven hierarchy. Recent price action shows a growing divergence between Bitcoin and Gold, reflecting a decisive change in investor priorities. Amid escalating geopolitical tension, monetary uncertainty, and macro instability, capital is increasingly favoring protection over innovation.

Gold’s advance is deliberate, not emotional. Its move toward the $4,900–$5,000 per ounce range reflects calculated allocations by institutions, central banks, and sovereign entities. In a world of rising debt, persistent inflation risks

Gold’s advance is deliberate, not emotional. Its move toward the $4,900–$5,000 per ounce range reflects calculated allocations by institutions, central banks, and sovereign entities. In a world of rising debt, persistent inflation risks

BTC0,98%

- Reward

- 3

- 2

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

#TrumpWithdrawsEUTariffThreats The opening weeks of 2026 offered a familiar reminder to global markets: political signaling often moves capital faster than economic fundamentals. When the possibility of new U.S. customs tariffs on several European nations surfaced, uncertainty rippled through markets instantly. It was not the scale of the proposal that mattered, but the ambiguity it created.

Investors responded immediately. Equities dipped, cryptocurrencies corrected sharply, and capital flowed toward traditional safe havens. The reaction was not a reflection of enacted policy, but of perceive

Investors responded immediately. Equities dipped, cryptocurrencies corrected sharply, and capital flowed toward traditional safe havens. The reaction was not a reflection of enacted policy, but of perceive

BTC0,98%

- Reward

- 3

- Comment

- Repost

- Share

#CryptoRegulationNewProgress Global cryptocurrency regulations are entering a new phase, shifting from uncertainty to structured, action-oriented frameworks. Across regions, policymakers are increasingly treating crypto not merely as a risk to control, but as an opportunity to foster innovation and attract investment. This evolution is creating the foundation for a more mature and sustainable digital asset ecosystem.

In the United States, regulators are taking a disciplined approach, offering clearer guidance and a targeted regulatory strategy. By defining expectations for exchanges, token iss

In the United States, regulators are taking a disciplined approach, offering clearer guidance and a targeted regulatory strategy. By defining expectations for exchanges, token iss

- Reward

- 2

- 3

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#GrowthPointsDrawRound16 The 16th edition of the Growth Value New Year Lottery is far more than a seasonal giveaway—it is a carefully designed incentive engine that rewards consistent engagement while strengthening the Gate ecosystem. Unlike conventional lotteries based purely on luck, this campaign converts strategy, discipline, and community participation into meaningful advantages for proactive users. Understanding its structure is key to maximizing both your reward potential and long-term presence on the platform.

At the core of the lottery is a mechanism that turns daily engagement into t

At the core of the lottery is a mechanism that turns daily engagement into t

- Reward

- 3

- Comment

- Repost

- Share

#VanEckLaunchesAVAXSpotETF The launch of VanEck’s Avalanche spot ETF marks a defining milestone in the evolution of institutional crypto access. With the debut of VAVX on the Nasdaq, Avalanche has officially entered the U.S. regulated ETF landscape, standing alongside Bitcoin and Ethereum as one of the few digital assets to achieve this level of mainstream financial recognition. This development signals a clear expansion of traditional finance’s comfort zone beyond the dominant majors.

What differentiates VAVX from earlier crypto investment vehicles is its direct exposure structure. As a true

What differentiates VAVX from earlier crypto investment vehicles is its direct exposure structure. As a true

- Reward

- 4

- 1

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊#AIBotClawdbotGoesViral The viral emergence of Clawdbot signals a defining moment in the evolving relationship between artificial intelligence and crypto speculation. Unlike earlier AI-driven hype cycles that revolved around distant promises, Clawdbot represents a tangible shift toward functional, user-controlled intelligence. This distinction has reshaped how markets interpret the narrative, blurring the line between technological progress and speculative monetization.

At its core, Clawdbot reflects a growing desire for autonomy in digital tools. As users become increasingly cautious about ce

At its core, Clawdbot reflects a growing desire for autonomy in digital tools. As users become increasingly cautious about ce

- Reward

- 3

- 1

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊#SolanaMemeHypeReturns The Solana meme coin ecosystem is once again commanding market attention, signaling one of the strongest speculative revivals of the current crypto cycle. This resurgence is not merely a repeat of past hype phases, but a reflection of structural improvements across Solana’s infrastructure, user experience, and on-chain liquidity environment.

Unlike earlier meme cycles driven almost entirely by speculation, the current momentum is forming on a more stable foundation. Solana’s network performance has improved significantly, restoring trader confidence after historical cong

Unlike earlier meme cycles driven almost entirely by speculation, the current momentum is forming on a more stable foundation. Solana’s network performance has improved significantly, restoring trader confidence after historical cong

- Reward

- 6

- 2

- Repost

- Share

GateUser-378c4af2 :

:

thanks for the useful information ☺️View More

#FedRateDecisionApproaches As the Federal Reserve’s interest rate decision approaches, global financial markets are entering a phase of heightened sensitivity and recalibration. This event remains one of the most influential macro catalysts, capable of reshaping capital flows across equities, cryptocurrencies, commodities, bonds, and currency markets simultaneously. In the days leading up to the announcement, positioning often becomes as significant as the decision itself.

Federal Reserve policy directly influences borrowing conditions, liquidity availability, and the pace of economic activity

Federal Reserve policy directly influences borrowing conditions, liquidity availability, and the pace of economic activity

- Reward

- 3

- 1

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊#GameFiSeesaStrongRebound GameFi has re-entered the market narrative with renewed strength, signaling that its earlier decline was not failure, but transformation. What is unfolding in early twenty twenty-six is not a return to the old play-to-earn model, but the emergence of a redesigned digital gaming economy built on sustainability, scalability, and real engagement.

This rebound is being driven by structural recovery rather than speculative excitement. Capital is no longer flowing blindly into experimental concepts. Instead, it is rotating toward projects that survived multiple market cycle

This rebound is being driven by structural recovery rather than speculative excitement. Capital is no longer flowing blindly into experimental concepts. Instead, it is rotating toward projects that survived multiple market cycle

- Reward

- 7

- 1

- Repost

- Share

Peacefulheart :

:

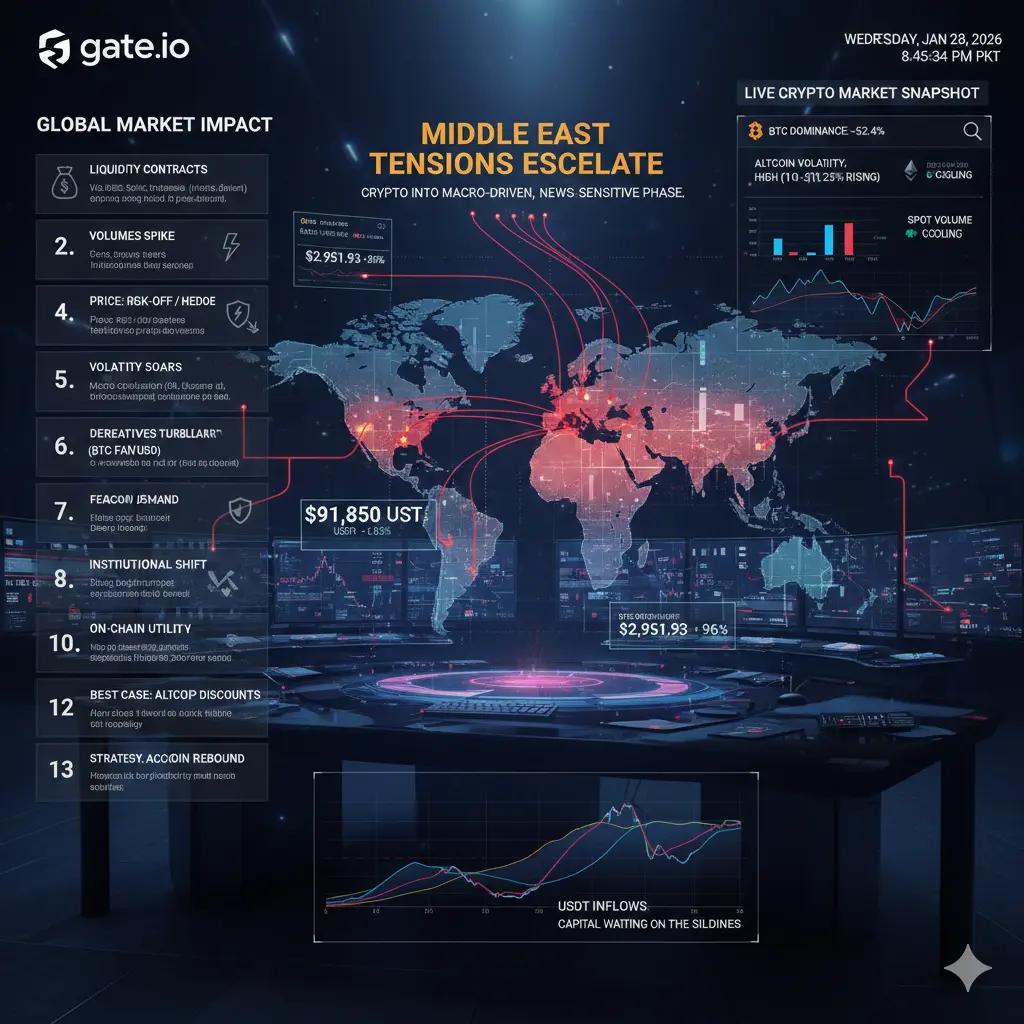

2026 GOGOGO 👊#MiddleEastTensionsEscalate The escalating situation in the Middle East is increasingly reshaping global financial behavior, and the cryptocurrency market is now responding as part of the broader macro system rather than operating in isolation. What was once primarily driven by technical patterns and on-chain cycles has shifted into a news-sensitive, geopolitically reactive environment.

As regional tensions rise, global capital flows are becoming defensive. Investors across traditional and digital markets are prioritizing capital preservation, liquidity access, and downside protection. This sh

As regional tensions rise, global capital flows are becoming defensive. Investors across traditional and digital markets are prioritizing capital preservation, liquidity access, and downside protection. This sh

- Reward

- 8

- 1

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊#ContentMiningRevampPublicBeta The Content Mining Revamp Public Beta represents a major evolution in Gate’s creator ecosystem, signaling a long-term shift toward quality, impact, and sustainable growth. This upgrade is not simply a redesign of rewards, but a strategic framework that connects content creation directly with user education, engagement depth, and real trading participation across the platform.

At the core of this revamp is a fundamental change in how creator value is measured. Instead of rewarding content volume alone, the new system prioritizes usefulness, clarity, and influence.

At the core of this revamp is a fundamental change in how creator value is measured. Instead of rewarding content volume alone, the new system prioritizes usefulness, clarity, and influence.

- Reward

- 5

- 3

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#GoldBreaksAbove$5,200 🚀 Gold hits new highs as Bitcoin enters the safe-haven spotlight

#XAU #XAUT #PAXG

Market Overview

• Spot gold trades near record territory with strong year-to-date performance

• Bitcoin remains near the upper eighty-thousand USDT range

• Fear and Greed Index remains in the fear zone

Why it matters

Ongoing dollar weakness combined with rising macro and geopolitical uncertainty is driving renewed safe-haven demand across global markets.

Gold continues to act as the primary defensive asset, while Bitcoin shows growing relevance as a digital hedge during periods of market s

#XAU #XAUT #PAXG

Market Overview

• Spot gold trades near record territory with strong year-to-date performance

• Bitcoin remains near the upper eighty-thousand USDT range

• Fear and Greed Index remains in the fear zone

Why it matters

Ongoing dollar weakness combined with rising macro and geopolitical uncertainty is driving renewed safe-haven demand across global markets.

Gold continues to act as the primary defensive asset, while Bitcoin shows growing relevance as a digital hedge during periods of market s

- Reward

- 3

- 3

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#GoldBreaksAbove$5,200 🚀 Gold hits new highs as Bitcoin enters the safe-haven spotlight

#XAU #XAUT #PAXG

Market Overview

• Spot gold trades near record territory with strong year-to-date performance

• Bitcoin remains near the upper eighty-thousand USDT range

• Fear and Greed Index remains in the fear zone

Why it matters

Ongoing dollar weakness combined with rising macro and geopolitical uncertainty is driving renewed safe-haven demand across global markets.

Gold continues to act as the primary defensive asset, while Bitcoin shows growing relevance as a digital hedge during periods of market s

#XAU #XAUT #PAXG

Market Overview

• Spot gold trades near record territory with strong year-to-date performance

• Bitcoin remains near the upper eighty-thousand USDT range

• Fear and Greed Index remains in the fear zone

Why it matters

Ongoing dollar weakness combined with rising macro and geopolitical uncertainty is driving renewed safe-haven demand across global markets.

Gold continues to act as the primary defensive asset, while Bitcoin shows growing relevance as a digital hedge during periods of market s

- Reward

- 4

- 2

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#CLARITYBillDelayed U.S. Crypto Regulation Enters a New Phase of Uncertainty

The U.S. crypto market is facing renewed regulatory uncertainty as the long-anticipated CLARITY Act has officially been delayed in the Senate. Originally designed as a landmark framework to unify federal oversight of digital assets—including exchanges, custodians, stablecoins, and DeFi platforms—the bill now sits in legislative limbo. For market participants, this has created an environment defined more by ambiguity than clear direction.

The delay reflects a convergence of political, procedural, and industry-driven ob

The U.S. crypto market is facing renewed regulatory uncertainty as the long-anticipated CLARITY Act has officially been delayed in the Senate. Originally designed as a landmark framework to unify federal oversight of digital assets—including exchanges, custodians, stablecoins, and DeFi platforms—the bill now sits in legislative limbo. For market participants, this has created an environment defined more by ambiguity than clear direction.

The delay reflects a convergence of political, procedural, and industry-driven ob

- Reward

- 7

- 3

- Repost

- Share

HanssiMazak :

:

2026 GOGOGO 👊View More

#ETHTrendWatch Ethereum Trend Watch: Navigating Consolidation and Strategic Positioning

Ethereum (ETH), the world’s second-largest cryptocurrency, is currently moving through a consolidation phase characterized by elevated volatility and cautious market participation. Price action remains largely confined within the $2,970–$3,200 range, reflecting a market caught between accumulation interest and hesitation. Over the past month, ETH has oscillated between $2,950 and $3,260, suggesting traders are weighing short-term opportunities against broader uncertainty.

Demand has consistently appeared ne

Ethereum (ETH), the world’s second-largest cryptocurrency, is currently moving through a consolidation phase characterized by elevated volatility and cautious market participation. Price action remains largely confined within the $2,970–$3,200 range, reflecting a market caught between accumulation interest and hesitation. Over the past month, ETH has oscillated between $2,950 and $3,260, suggesting traders are weighing short-term opportunities against broader uncertainty.

Demand has consistently appeared ne

- Reward

- 6

- 2

- Repost

- Share

Yunna :

:

2026 gogoView More

#TheWorldEconomicForum Architect of the Future or Gatekeeper of the Past?

The World Economic Forum (WEF), known for its annual Davos gathering, is far more than a meeting of global elites. For crypto investors and Gate.io users, it represents both a bridge and a barrier between traditional finance (TradFi) and the decentralized future (DeFi). Understanding its influence is crucial for anticipating how global finance and digital assets might evolve.

At the heart of the WEF’s philosophy is “Stakeholder Capitalism,” championed by Klaus Schwab. This concept shifts the focus from shareholder profit

The World Economic Forum (WEF), known for its annual Davos gathering, is far more than a meeting of global elites. For crypto investors and Gate.io users, it represents both a bridge and a barrier between traditional finance (TradFi) and the decentralized future (DeFi). Understanding its influence is crucial for anticipating how global finance and digital assets might evolve.

At the heart of the WEF’s philosophy is “Stakeholder Capitalism,” championed by Klaus Schwab. This concept shifts the focus from shareholder profit

- Reward

- 11

- 6

- 1

- Share

Yunna :

:

2026 gogoView More

#NextFedChairPredictions The Decision That Could Define Global Market Trajectories

As 2026 unfolds, global financial markets are increasingly fixated on one critical question: who will become the next Chair of the Federal Reserve, and how will that leadership shape the direction of liquidity across the world’s largest and most influential financial system? This is far more than a political appointment. The Fed Chair sets the tone for capital flows across asset classes, from U.S. Treasuries to equities, commodities, and cryptocurrencies. Their philosophy influences not just interest rates, but

As 2026 unfolds, global financial markets are increasingly fixated on one critical question: who will become the next Chair of the Federal Reserve, and how will that leadership shape the direction of liquidity across the world’s largest and most influential financial system? This is far more than a political appointment. The Fed Chair sets the tone for capital flows across asset classes, from U.S. Treasuries to equities, commodities, and cryptocurrencies. Their philosophy influences not just interest rates, but

- Reward

- 9

- 3

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More