HighAmbition

No content yet

HighAmbition

#ETHTrendWatch

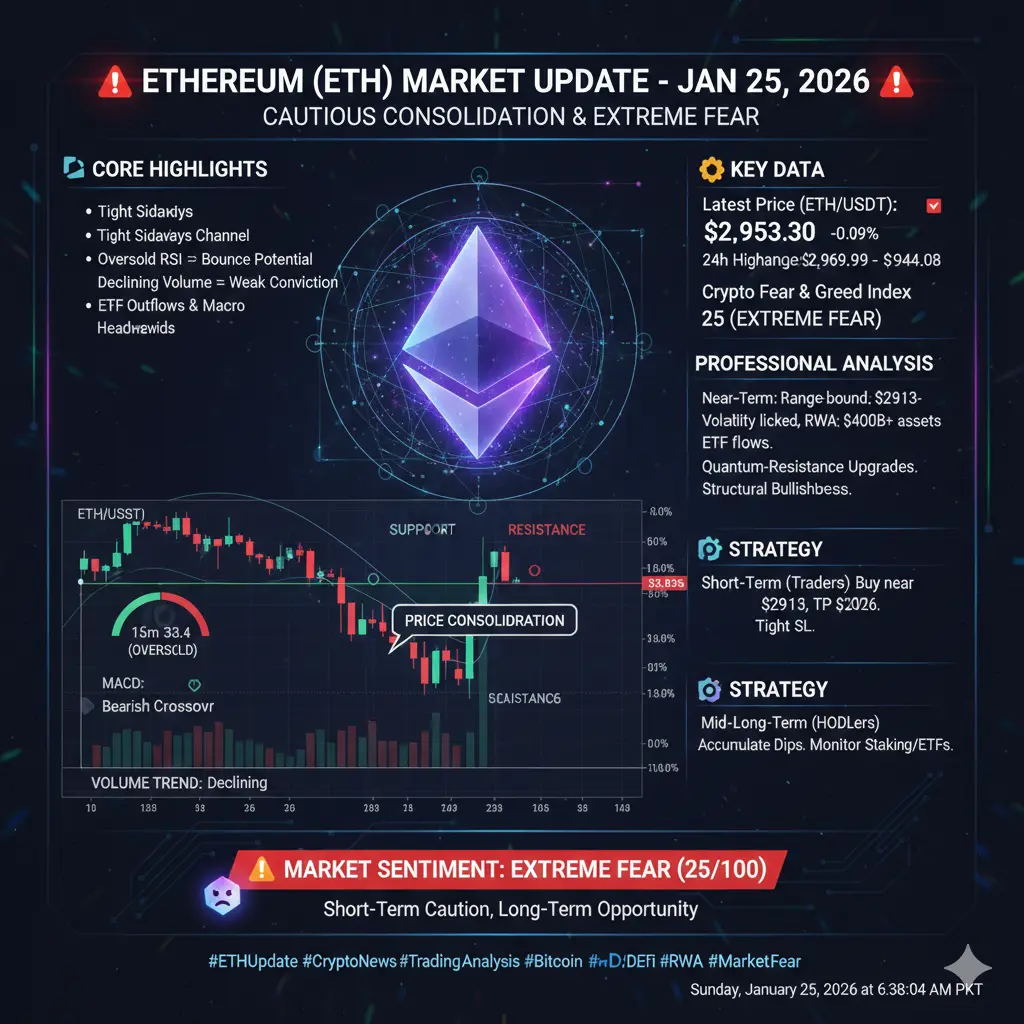

🚨 Ethereum (ETH) Market Update – January 25, 2026

Ethereum is currently navigating a cautious consolidation phase, with technical indicators reflecting mixed momentum, declining trading activity, and a market sentiment dominated by “Extreme Fear.” While long-term fundamentals remain solid, short-term price action is muted, primarily influenced by broader market liquidity, ETF outflows, and ongoing macro uncertainty.

📊 Core Highlights

ETH remains in a tight sideways channel, with buyers and sellers balancing near key support levels.

Technical signals show oversold conditions i

🚨 Ethereum (ETH) Market Update – January 25, 2026

Ethereum is currently navigating a cautious consolidation phase, with technical indicators reflecting mixed momentum, declining trading activity, and a market sentiment dominated by “Extreme Fear.” While long-term fundamentals remain solid, short-term price action is muted, primarily influenced by broader market liquidity, ETF outflows, and ongoing macro uncertainty.

📊 Core Highlights

ETH remains in a tight sideways channel, with buyers and sellers balancing near key support levels.

Technical signals show oversold conditions i

ETH0,03%

- Reward

- 3

- 4

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

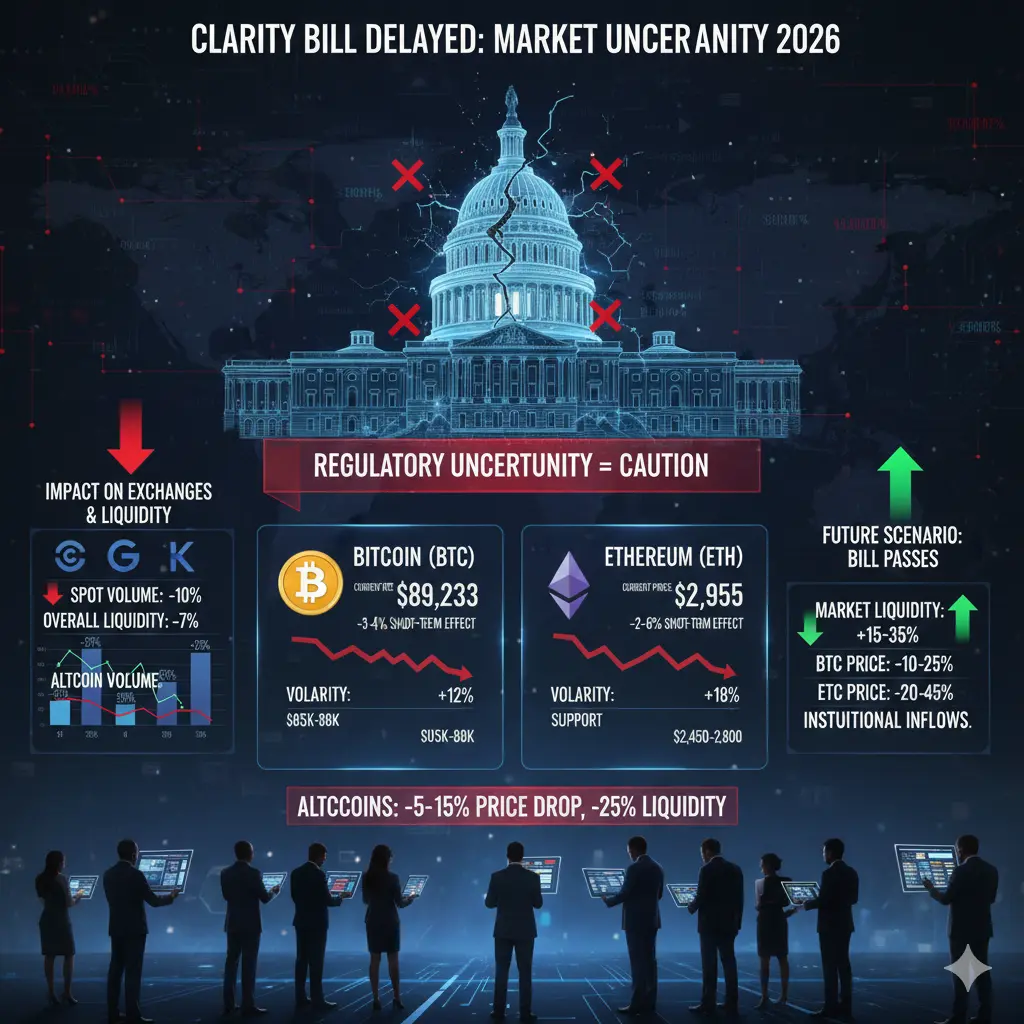

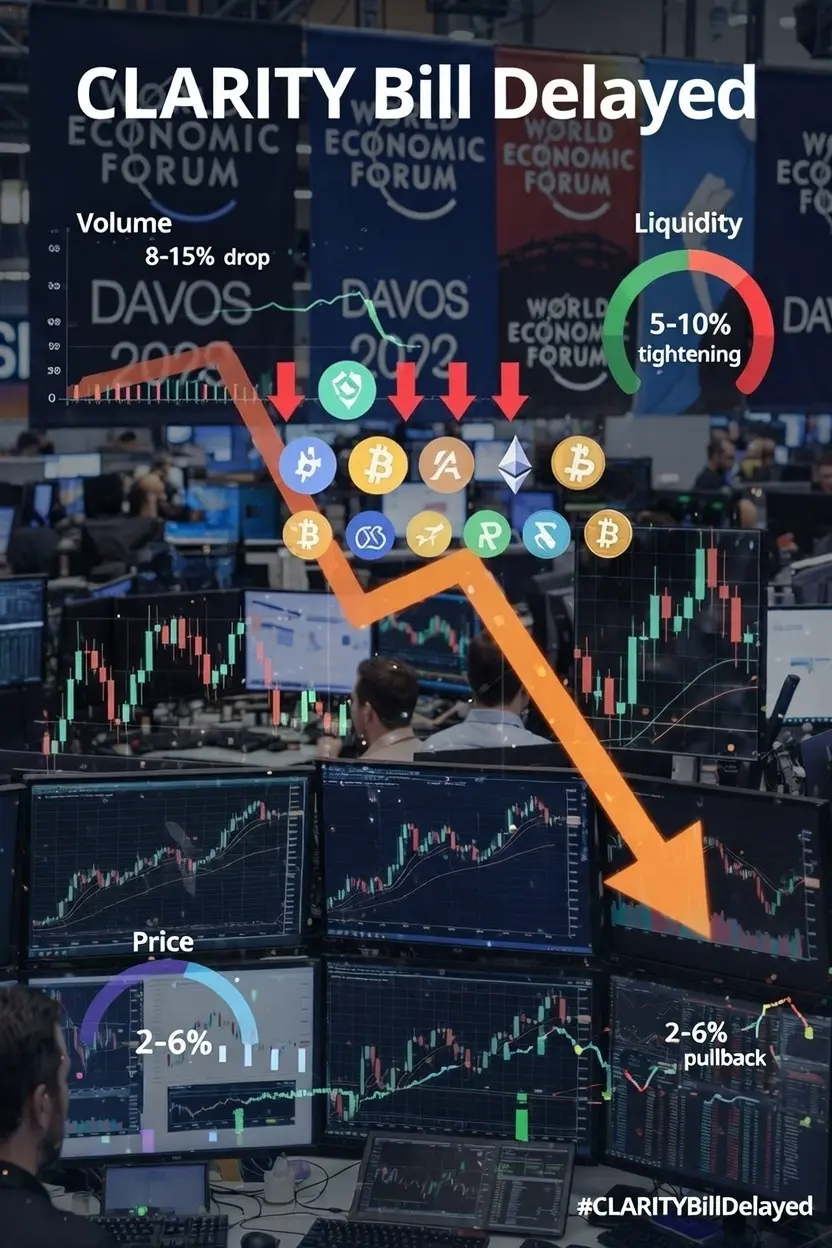

#CLARITYBillDelayed

The sudden delay of the U.S. Digital Asset Market CLARITY Act in mid-January 2026 has caused significant uncertainty, revealing deep fractures within the crypto industry and government. This isn't merely a procedural setback but a pivotal event affecting exchanges, liquidity, and long-term market structure .

The Bill's Core Purpose: A Quest for Certainty

The CLARITY Act was designed to resolve the foundational question that has plagued U.S. crypto regulation for a decade: which federal agency regulates which digital assets .

The legislation sought to:

· Define a regulatory

The sudden delay of the U.S. Digital Asset Market CLARITY Act in mid-January 2026 has caused significant uncertainty, revealing deep fractures within the crypto industry and government. This isn't merely a procedural setback but a pivotal event affecting exchanges, liquidity, and long-term market structure .

The Bill's Core Purpose: A Quest for Certainty

The CLARITY Act was designed to resolve the foundational question that has plagued U.S. crypto regulation for a decade: which federal agency regulates which digital assets .

The legislation sought to:

· Define a regulatory

- Reward

- 4

- 5

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

#Non-StopEarningsThisLunarNewYear:

🌙✨ Ride the Golden Horse to Non-Stop Earnings This Lunar New Year! ✨🌙

Celebrate the Lunar New Year in style and let the Golden Horse bring prosperity to your wallet!

Here’s what awaits:

Massive Rewards: Unlock your share of exclusive prizes and bonuses worth thousands!

Non-Stop Opportunities: Trade, stake, or participate — your earnings keep galloping forward.

Golden Horse Bonuses: Special festival rewards inspired by the Golden Horse, symbolizing luck, wealth, and unstoppable growth.

Social & Sharing Rewards: Invite friends, share posts, and watch your r

🌙✨ Ride the Golden Horse to Non-Stop Earnings This Lunar New Year! ✨🌙

Celebrate the Lunar New Year in style and let the Golden Horse bring prosperity to your wallet!

Here’s what awaits:

Massive Rewards: Unlock your share of exclusive prizes and bonuses worth thousands!

Non-Stop Opportunities: Trade, stake, or participate — your earnings keep galloping forward.

Golden Horse Bonuses: Special festival rewards inspired by the Golden Horse, symbolizing luck, wealth, and unstoppable growth.

Social & Sharing Rewards: Invite friends, share posts, and watch your r

GT-0,7%

- Reward

- 4

- 7

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

#CryptoMarketWatch

Crypto Market 2026: Bitcoin & Ethereum Outlook — Current Prices, Forecast & Market Direction

The crypto market in 2026 is evolving from speculation into a mature financial ecosystem, driven by institutional adoption, regulation, real-world utility, stablecoins, and asset tokenization. At the center of this transformation are Bitcoin (BTC) and Ethereum (ETH) — the two most influential digital assets.

This market cycle is now shaped more by macro trends, ETF flows, liquidity conditions, and real adoption, rather than retail hype.

💰 Current Market Prices (Latest Update)

Bitco

Crypto Market 2026: Bitcoin & Ethereum Outlook — Current Prices, Forecast & Market Direction

The crypto market in 2026 is evolving from speculation into a mature financial ecosystem, driven by institutional adoption, regulation, real-world utility, stablecoins, and asset tokenization. At the center of this transformation are Bitcoin (BTC) and Ethereum (ETH) — the two most influential digital assets.

This market cycle is now shaped more by macro trends, ETF flows, liquidity conditions, and real adoption, rather than retail hype.

💰 Current Market Prices (Latest Update)

Bitco

- Reward

- 7

- 12

- Repost

- Share

Yusfirah :

:

Buy To Earn 💎View More

#GoldandSilverHitNewHighs

Gold & Silver at Record Highs — Historic Rally Explained (2026 Outlook)

Based on reported prices — Gold: $5,033 and Silver: $101.3 — both metals are trading at new all-time highs, extending a historic bull run that began in 2025.

This surge reflects a powerful mix of macroeconomic stress, monetary policy shifts, industrial demand growth, and global investor behavior.

📈 Historic Rally Snapshot

Reported Prices: Gold $5,033 | Silver $101.3

Recent Market Highs (Jan 22–23, 2026): Gold ~$4,987.82 | Silver ~$100.49

2025 Performance:

Gold: +65%

Silver: +150%

Major Bank Fore

Gold & Silver at Record Highs — Historic Rally Explained (2026 Outlook)

Based on reported prices — Gold: $5,033 and Silver: $101.3 — both metals are trading at new all-time highs, extending a historic bull run that began in 2025.

This surge reflects a powerful mix of macroeconomic stress, monetary policy shifts, industrial demand growth, and global investor behavior.

📈 Historic Rally Snapshot

Reported Prices: Gold $5,033 | Silver $101.3

Recent Market Highs (Jan 22–23, 2026): Gold ~$4,987.82 | Silver ~$100.49

2025 Performance:

Gold: +65%

Silver: +150%

Major Bank Fore

XAUT0,7%

- Reward

- 7

- 10

- Repost

- Share

Yusfirah :

:

Buy To Earn 💎View More

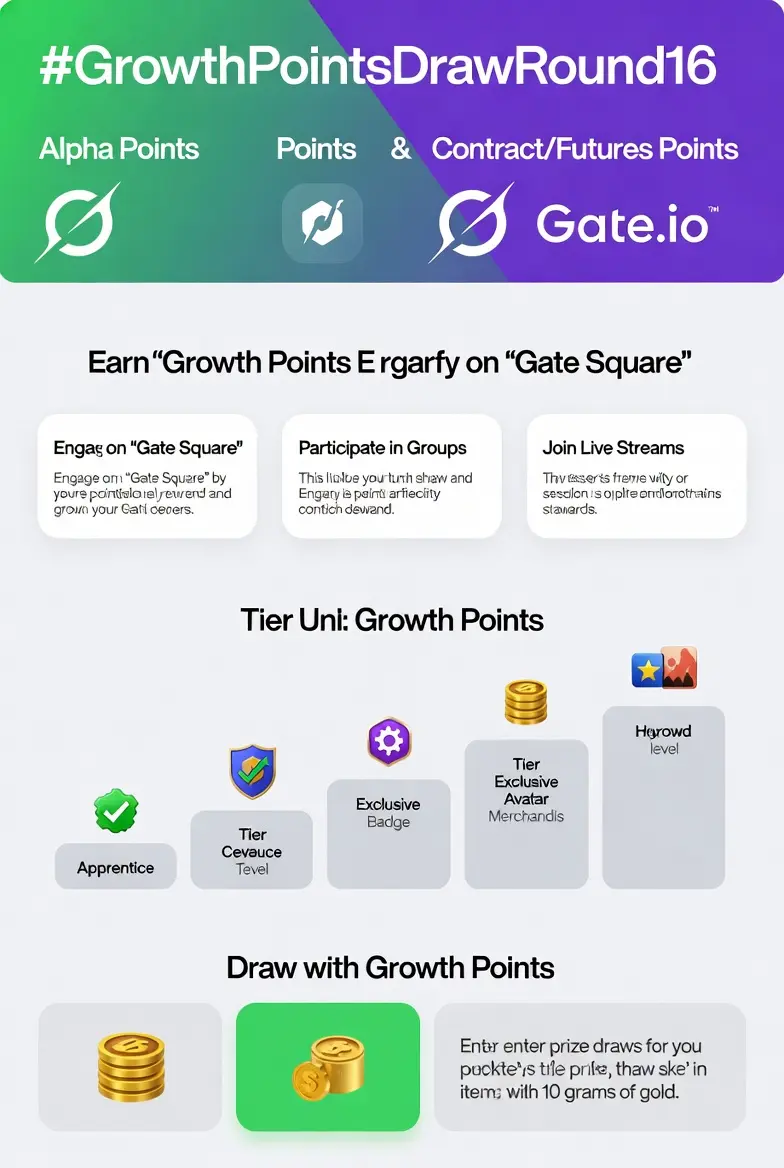

#GrowthPointsDrawRound16

🎯 How to Earn & Use Growth Points

Here are the main ways to earn and use these points, based on Gate.io's official rules:

1. Core Activities to Earn Points

· Engage on "Gate Square": Post content and get likes, comments, and "Featured" tags.

· Participate in Groups: Be active in community groups.

· Join Live Streams: Participate in live sessions (task expansion planned).

2. Growth Tiers & Benefits

Points are calculated from the last 180 days. As you accumulate more points, you level up through tiers (Apprentice, Explorer, etc.), unlocking better rewards:

· Entry

🎯 How to Earn & Use Growth Points

Here are the main ways to earn and use these points, based on Gate.io's official rules:

1. Core Activities to Earn Points

· Engage on "Gate Square": Post content and get likes, comments, and "Featured" tags.

· Participate in Groups: Be active in community groups.

· Join Live Streams: Participate in live sessions (task expansion planned).

2. Growth Tiers & Benefits

Points are calculated from the last 180 days. As you accumulate more points, you level up through tiers (Apprentice, Explorer, etc.), unlocking better rewards:

· Entry

- Reward

- 15

- 16

- 2

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

#GateTradFi1gGoldGiveaway

🎁 Core Giveaway Event: "Gold Lucky Bag"

· Event Name: Gate TradFi Gold Lucky Bag

· Duration: January 20, 2026 (15:40 UTC+8) to January 30, 2026 (16:20 UTC+8).

· Total Prize: Up to 1,152 grams of gold to be given away.

· Mechanics: Every 10 minutes, one user wins 1 gram of gold.

· To Enter: Complete a single trade of ≥100 USDT in the "TradFi" section.

· Reward: Each eligible trade grants entry into 5 consecutive 10-minute draws.

· No Registration: Participation is automatic based on trading activity.

· Prize Details: Winners receive XAUT (Tether Gold), a digita

🎁 Core Giveaway Event: "Gold Lucky Bag"

· Event Name: Gate TradFi Gold Lucky Bag

· Duration: January 20, 2026 (15:40 UTC+8) to January 30, 2026 (16:20 UTC+8).

· Total Prize: Up to 1,152 grams of gold to be given away.

· Mechanics: Every 10 minutes, one user wins 1 gram of gold.

· To Enter: Complete a single trade of ≥100 USDT in the "TradFi" section.

· Reward: Each eligible trade grants entry into 5 consecutive 10-minute draws.

· No Registration: Participation is automatic based on trading activity.

· Prize Details: Winners receive XAUT (Tether Gold), a digita

- Reward

- 13

- 15

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

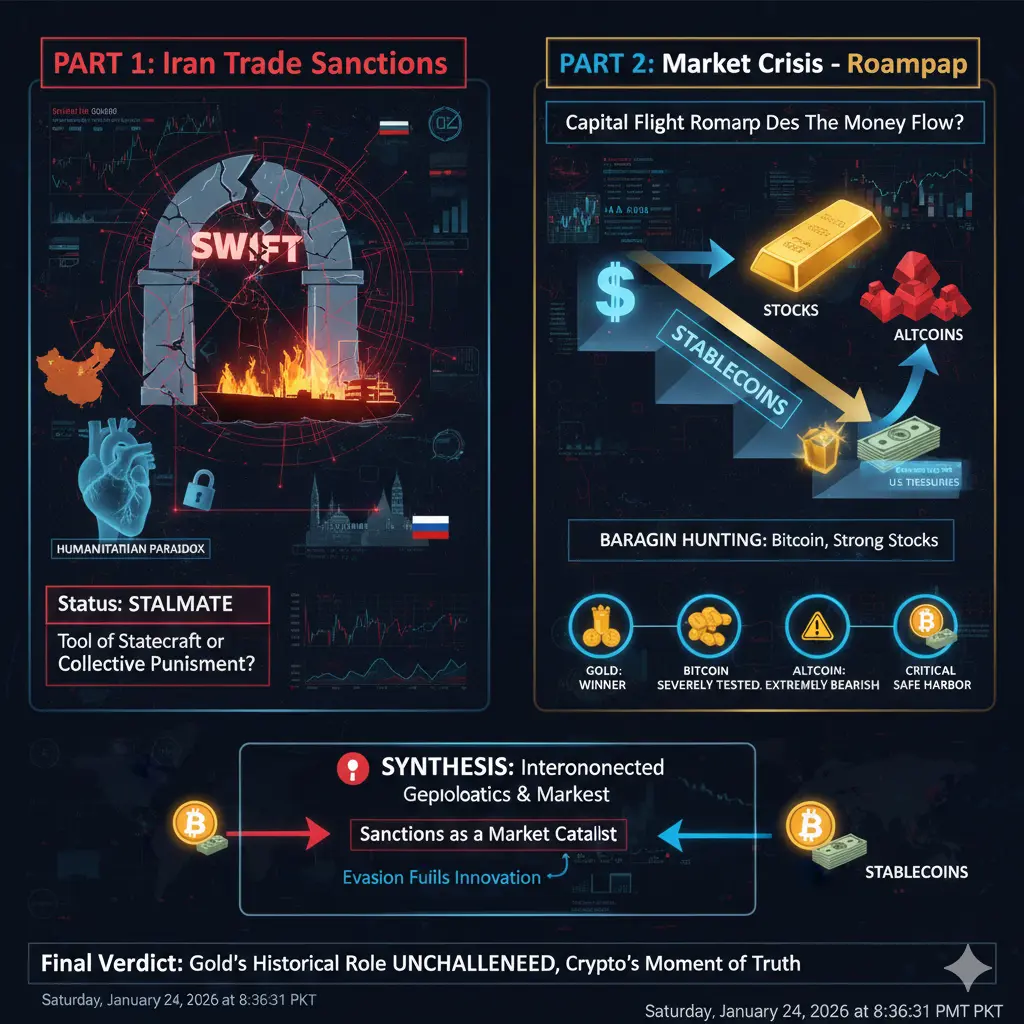

#IranTradeSanctions

Iran Trade Sanctions - A Geopolitical Quagmire

1. The Sanctions Arsenal

A multi-pronged economic siege comprising:

· Financial Blockade: Exclusion from SWIFT, asset freezes, dollar transaction bans.

· Energy Strangulation: Bans on oil/gas investment and technology.

· Secondary Sanctions (U.S.): The most contentious tool, penalizing global entities trading with Iran.

· Humanitarian Paradox: While food/medicine are formally exempt, over-compliance by banks creates de facto blockades, causing severe medical shortages.

2. Impact & Global Fallout

· On Iran: Crushing inflation,

Iran Trade Sanctions - A Geopolitical Quagmire

1. The Sanctions Arsenal

A multi-pronged economic siege comprising:

· Financial Blockade: Exclusion from SWIFT, asset freezes, dollar transaction bans.

· Energy Strangulation: Bans on oil/gas investment and technology.

· Secondary Sanctions (U.S.): The most contentious tool, penalizing global entities trading with Iran.

· Humanitarian Paradox: While food/medicine are formally exempt, over-compliance by banks creates de facto blockades, causing severe medical shortages.

2. Impact & Global Fallout

· On Iran: Crushing inflation,

- Reward

- 14

- 13

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

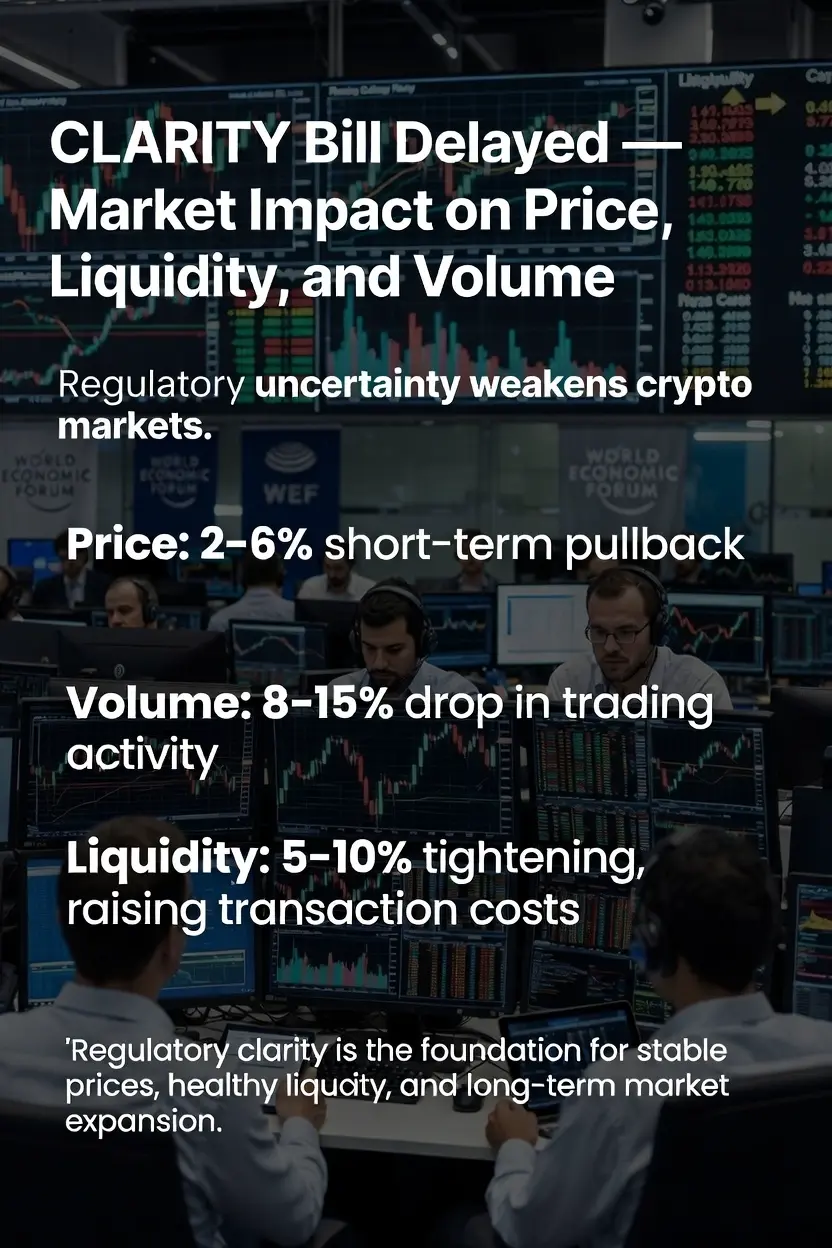

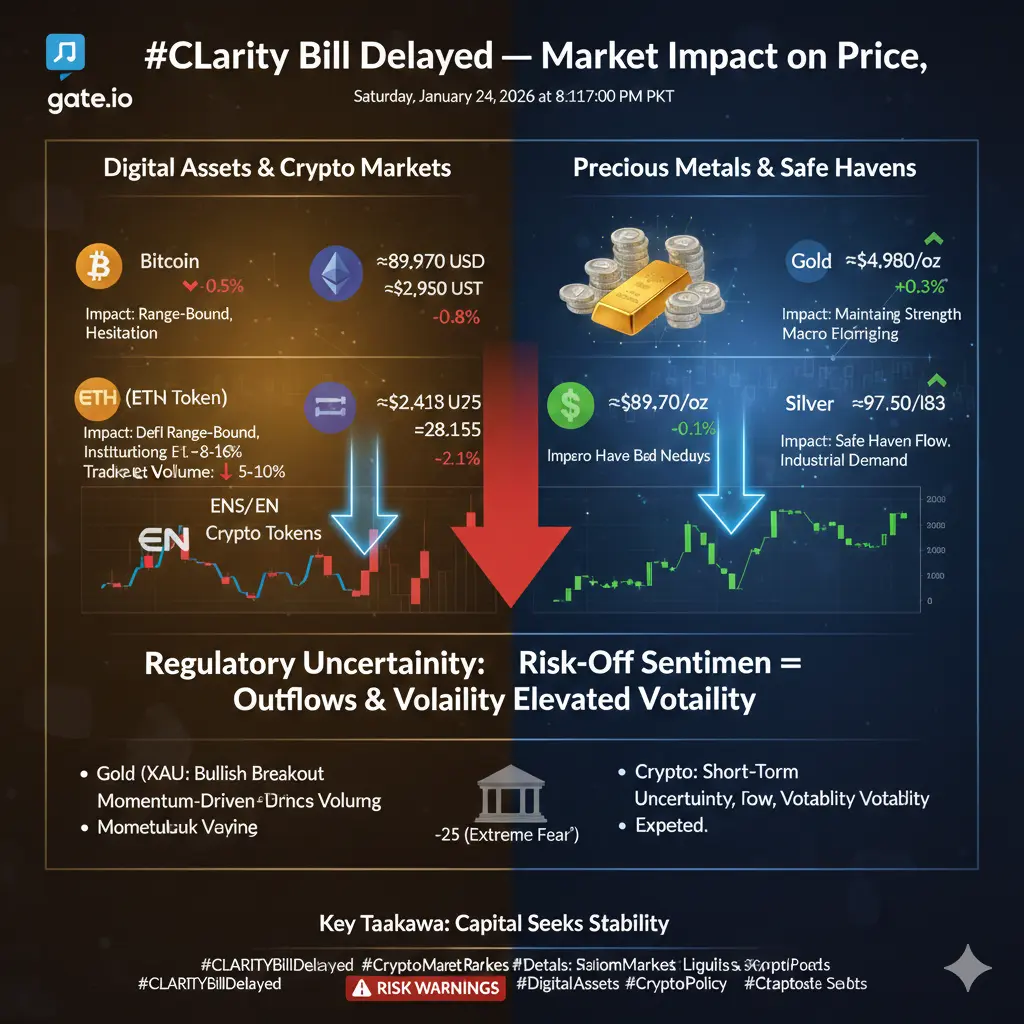

#CLARITYBillDelayed

CLARITY Bill Delayed — Market Impact on Price, Liquidity, and Volume

The delay of the CLARITY Bill has introduced renewed uncertainty into the crypto regulatory landscape, and markets are already reflecting this hesitation. Following the announcement, overall crypto market sentiment weakened, with major assets recording an estimated 2–6% short-term price pullback as traders priced in regulatory risk.

Trading volume has dropped by roughly 8–15%, signaling reduced participation from both retail and institutional investors who prefer operating under clear legal frameworks. At

CLARITY Bill Delayed — Market Impact on Price, Liquidity, and Volume

The delay of the CLARITY Bill has introduced renewed uncertainty into the crypto regulatory landscape, and markets are already reflecting this hesitation. Following the announcement, overall crypto market sentiment weakened, with major assets recording an estimated 2–6% short-term price pullback as traders priced in regulatory risk.

Trading volume has dropped by roughly 8–15%, signaling reduced participation from both retail and institutional investors who prefer operating under clear legal frameworks. At

SOL-0,21%

- Reward

- 13

- 14

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

#TheWorldEconomicForum

The World Economic Forum (WEF) influences not only crypto regulation and adoption, but also market liquidity, trading volume, price volatility, investor behavior, capital flow, and crypto market cycles. Since crypto is highly sensitive to macro sentiment, institutional money, and global economic narratives, WEF-driven discussions can indirectly shape Bitcoin, altcoin, and total crypto market price performance.

1. Liquidity: The Lifeblood of Crypto Markets

Liquidity determines how easily large buy or sell orders can be executed without causing major price swings.

When W

The World Economic Forum (WEF) influences not only crypto regulation and adoption, but also market liquidity, trading volume, price volatility, investor behavior, capital flow, and crypto market cycles. Since crypto is highly sensitive to macro sentiment, institutional money, and global economic narratives, WEF-driven discussions can indirectly shape Bitcoin, altcoin, and total crypto market price performance.

1. Liquidity: The Lifeblood of Crypto Markets

Liquidity determines how easily large buy or sell orders can be executed without causing major price swings.

When W

- Reward

- 15

- 15

- Repost

- Share

ShainingMoon :

:

Happy New Year! 🤑View More

#JapanBondMarketSell-Off

Japan’s government bond market experienced one of its most severe sell-offs in decades in mid-January 2026. This turmoil isn’t just affecting traditional finance—it’s sending ripples through crypto markets, including Bitcoin, Ethereum, and other digital assets. Japan’s role as a major global investor means this event can influence risk sentiment, liquidity, and investor behavior worldwide.

1. How the Sell-Off Affects Crypto

Short-Term Volatility

Rising JGB yields make traditional bonds more attractive relative to riskier assets.

Investors may shift money from crypto i

Japan’s government bond market experienced one of its most severe sell-offs in decades in mid-January 2026. This turmoil isn’t just affecting traditional finance—it’s sending ripples through crypto markets, including Bitcoin, Ethereum, and other digital assets. Japan’s role as a major global investor means this event can influence risk sentiment, liquidity, and investor behavior worldwide.

1. How the Sell-Off Affects Crypto

Short-Term Volatility

Rising JGB yields make traditional bonds more attractive relative to riskier assets.

Investors may shift money from crypto i

- Reward

- 13

- 19

- Repost

- Share

ShainingMoon :

:

Happy New Year! 🤑View More

#NextFedChairPredictions

As Jerome Powell’s term ends in May 2026, the race for the next Federal Reserve Chair has become a major macro catalyst for global financial markets. With Donald Trump back in office, expectations are shifting toward faster growth, easier monetary policy, and stronger political influence over Fed decisions.

Even before an official announcement, markets are already pricing future liquidity direction, causing visible changes in price, trading volume, funding rates, yield curves, volatility levels, and institutional positioning.

This decision will shape interest rates, m

As Jerome Powell’s term ends in May 2026, the race for the next Federal Reserve Chair has become a major macro catalyst for global financial markets. With Donald Trump back in office, expectations are shifting toward faster growth, easier monetary policy, and stronger political influence over Fed decisions.

Even before an official announcement, markets are already pricing future liquidity direction, causing visible changes in price, trading volume, funding rates, yield curves, volatility levels, and institutional positioning.

This decision will shape interest rates, m

- Reward

- 20

- 20

- 1

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

#ETHTrendWatch

Ethereum is currently trading in the $2,950–$3,000 range, fluctuating around key psychological and technical levels. Over recent weeks, ETH has moved within a broader range of $2,700–$3,400, following a sharp ~15% correction from recent highs. This has shifted short-term sentiment toward a neutral-to-bearish tone, even though the broader structure still shows potential for recovery.

Key Price Zones and Market Structure

The most critical support zone sits between $2,900–$2,950, which is being tested heavily. If this zone fails, price could slide toward the next major support in

Ethereum is currently trading in the $2,950–$3,000 range, fluctuating around key psychological and technical levels. Over recent weeks, ETH has moved within a broader range of $2,700–$3,400, following a sharp ~15% correction from recent highs. This has shifted short-term sentiment toward a neutral-to-bearish tone, even though the broader structure still shows potential for recovery.

Key Price Zones and Market Structure

The most critical support zone sits between $2,900–$2,950, which is being tested heavily. If this zone fails, price could slide toward the next major support in

ETH0,03%

- Reward

- 17

- 17

- Repost

- Share

CryptoChampion :

:

Buy To Earn 💎View More

#DOGEETFListsonNasdaq

1. What is a DOGE ETF?

A Dogecoin Exchange-Traded Fund (ETF) is a financial instrument that allows investors to gain exposure to Dogecoin’s price movements without directly owning the cryptocurrency.

The ETF holds Dogecoin or derivatives, and its price reflects DOGE’s performance.

Investors can buy and sell it like a regular stock on Nasdaq, using traditional brokerage accounts.

This makes crypto more accessible to traditional investors who prefer regulated markets.

2. Why Nasdaq?

Nasdaq is one of the largest stock exchanges in the world, known for tech-heavy listings:

L

1. What is a DOGE ETF?

A Dogecoin Exchange-Traded Fund (ETF) is a financial instrument that allows investors to gain exposure to Dogecoin’s price movements without directly owning the cryptocurrency.

The ETF holds Dogecoin or derivatives, and its price reflects DOGE’s performance.

Investors can buy and sell it like a regular stock on Nasdaq, using traditional brokerage accounts.

This makes crypto more accessible to traditional investors who prefer regulated markets.

2. Why Nasdaq?

Nasdaq is one of the largest stock exchanges in the world, known for tech-heavy listings:

L

- Reward

- 17

- 18

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

#RIVERUp50xinOneMonth

RIVER has surged an astonishing 50x in just one month, capturing the crypto community’s attention. The token’s explosive growth stems from strong project fundamentals, growing adoption, and strategic partnerships. Traders are exploring short-term opportunities while long-term holders remain bullish. Market sentiment, social media hype, and innovative use cases have all contributed to this rapid appreciation. Risk management remains crucial in such high-velocity markets.

RIVER Rockets 50x in One Month!

Explosive growth shocks investors and traders, signaling a major marke

RIVER has surged an astonishing 50x in just one month, capturing the crypto community’s attention. The token’s explosive growth stems from strong project fundamentals, growing adoption, and strategic partnerships. Traders are exploring short-term opportunities while long-term holders remain bullish. Market sentiment, social media hype, and innovative use cases have all contributed to this rapid appreciation. Risk management remains crucial in such high-velocity markets.

RIVER Rockets 50x in One Month!

Explosive growth shocks investors and traders, signaling a major marke

- Reward

- 11

- 14

- Repost

- Share

CryptoChampion :

:

Buy To Earn 💎View More

#GateTradFi1gGoldGiveaway

Gate.io shines with the Gate TradFi 1g Gold Giveaway, blending real-world value with digital finance. By offering genuine gold rewards, the platform shows its dedication to user engagement, transparency, and credibility. Innovative events like this reinforce Gate.io’s reputation as a forward-thinking exchange, delivering both exciting opportunities and tangible benefits to traders globally, making it a leader in crypto and TradFi integration.$XAUT

Gate.io shines with the Gate TradFi 1g Gold Giveaway, blending real-world value with digital finance. By offering genuine gold rewards, the platform shows its dedication to user engagement, transparency, and credibility. Innovative events like this reinforce Gate.io’s reputation as a forward-thinking exchange, delivering both exciting opportunities and tangible benefits to traders globally, making it a leader in crypto and TradFi integration.$XAUT

XAUT0,7%

- Reward

- 12

- 13

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3871?ref=VLFCVA8MAQ&ref_type=132

- Reward

- 12

- 15

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

In January 2026, the long-standing "Digital Gold" narrative faces its most severe test yet. While Bitcoin continues to dominate the crypto space, it has notably underperformed its tangible predecessor, Gold. The BTC/Gold ratio has plunged to multi-year lows, highlighting a clear market preference for stability over speculative growth amid heightened global uncertainty.

1. Divergence in Price Action

Gold’s Historic Surge:

Gold has ascended toward the $5,000/oz milestone, driven by aggressive accumulation from central banks and a pronounced global flight to safety. Over a 12-month trailing perio

1. Divergence in Price Action

Gold’s Historic Surge:

Gold has ascended toward the $5,000/oz milestone, driven by aggressive accumulation from central banks and a pronounced global flight to safety. Over a 12-month trailing perio

BTC-0,36%

- Reward

- 28

- 20

- Repost

- Share

Kiips :

:

What do you think about the gold price at the end of the year? Will it break through the 7000 mark? or will it return to 4000??View More

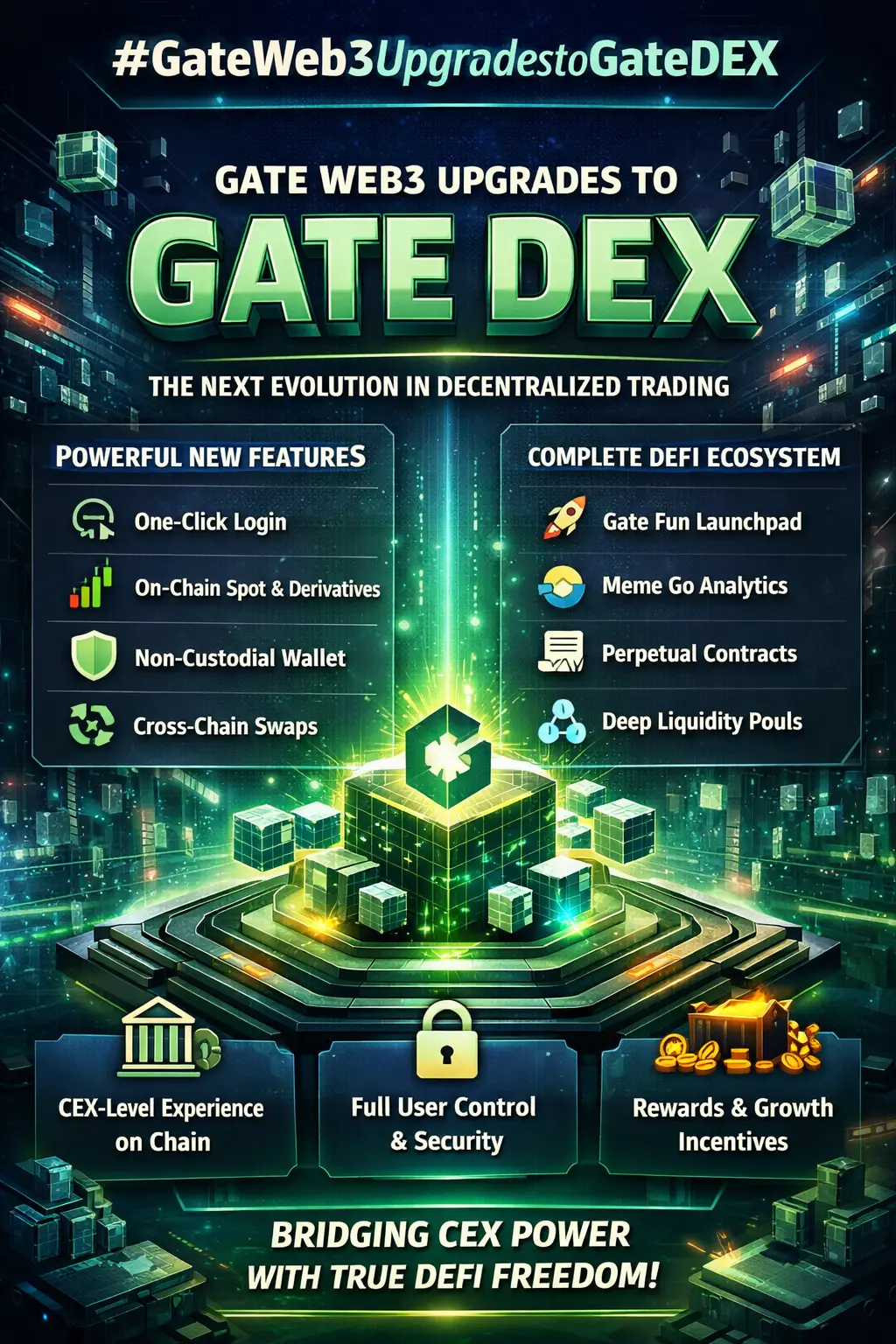

#GateWeb3UpgradestoGateDEX

Today marks a major milestone in the decentralized finance (DeFi) landscape as Gate — one of the world’s leading crypto trading platforms — has completed a comprehensive upgrade of its decentralized product offering by officially rebranding Gate Web3 to Gate DEX. This isn’t just a rename — it’s a strategic, full‑spectrum evolution of Gate’s decentralized trading entry point, product architecture, and long‑term Web3 vision.

Gate.com

🌐 1. From Web3 Gateway to True On‑Chain Trading Hub

Gate DEX represents a systematic restructuring of Gate’s decentralized trading pla

Today marks a major milestone in the decentralized finance (DeFi) landscape as Gate — one of the world’s leading crypto trading platforms — has completed a comprehensive upgrade of its decentralized product offering by officially rebranding Gate Web3 to Gate DEX. This isn’t just a rename — it’s a strategic, full‑spectrum evolution of Gate’s decentralized trading entry point, product architecture, and long‑term Web3 vision.

Gate.com

🌐 1. From Web3 Gateway to True On‑Chain Trading Hub

Gate DEX represents a systematic restructuring of Gate’s decentralized trading pla

- Reward

- 14

- 13

- Repost

- Share

CryptoEye :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs

Gold has surged to $4,980, approaching the $5,000 psychological level, driven by global uncertainty, inflation pressures, and safe-haven demand. Central bank accumulation and institutional inflows are reinforcing the rally, pushing Gold into price discovery zones. Short-term corrections may occur near $4,850, but overall momentum remains bullish. Traders are watching key resistance at $5,100+, confirming Gold’s role as the ultimate wealth-preserving asset in volatile markets.

Silver

Silver has exploded past $101, entering historic triple-digit territory. Its rally i

Gold has surged to $4,980, approaching the $5,000 psychological level, driven by global uncertainty, inflation pressures, and safe-haven demand. Central bank accumulation and institutional inflows are reinforcing the rally, pushing Gold into price discovery zones. Short-term corrections may occur near $4,850, but overall momentum remains bullish. Traders are watching key resistance at $5,100+, confirming Gold’s role as the ultimate wealth-preserving asset in volatile markets.

Silver

Silver has exploded past $101, entering historic triple-digit territory. Its rally i

XAUT0,7%

- Reward

- 11

- 10

- 1

- Share

MissCrypto :

:

2026 GOGOGO 👊View More

Trending Topics

View More57.29K Popularity

33.5K Popularity

27.52K Popularity

11.47K Popularity

21.11K Popularity

Pin