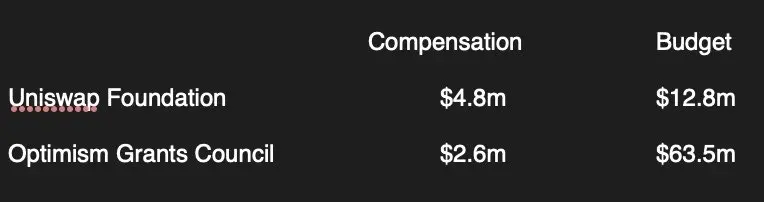

People have asked why the Uniswap Foundation executive compensation is considered unusually high. Let’s compare UF to another large grants-giving organization: the Optimism Grants Council.

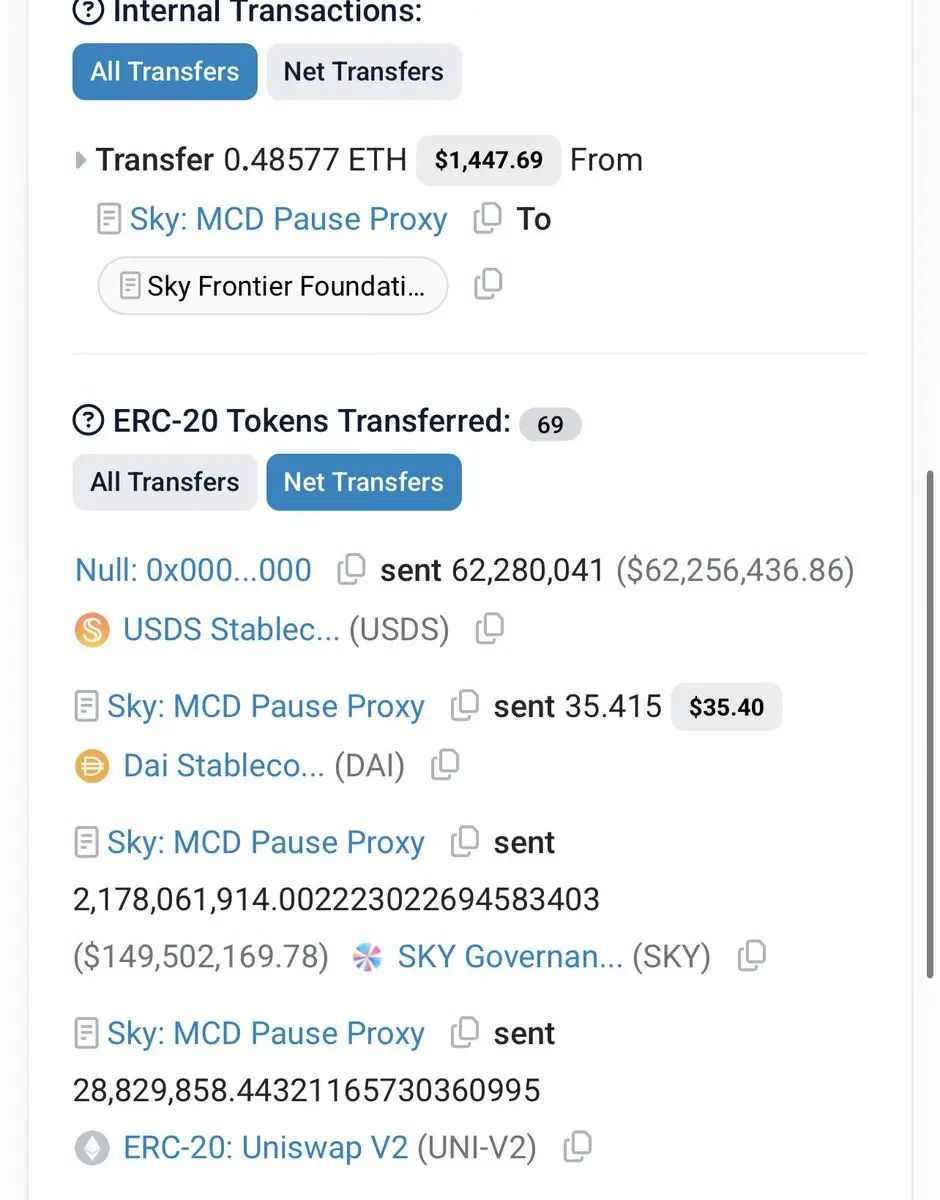

UF filings show they gave $9,992,919 in grants, and had $4,794,393 in employee compensation. Of that, $3,871,155 was for officers.

That’s $4.8m in employee compensation to deliver $10m of grants. Let’s be generous and assume the $2.8m of Other Expenses were supporting Uniswap on par with grants.

UF: $4.8m in comp to deliver $12.8m in spending in 2024

Optimism Grants Council in roughly the same time period ha