SHOLEH0X

No content yet

SHOLEH0X

📈 Diversification Just Went OnChain

For a long time, most crypto portfolios have looked similar a mix of native tokens, a few altcoins, and stablecoins for liquidity. The challenge? Many of these assets move together. When the market rises, they rise together. When it falls, they often fall together.

That’s where STONfi introduces something different.

With xStocks, users can access tokenized representations of real world equities directly inside the TON ecosystem. This means you’re no longer limited to crypto only exposure when building your on-chain portfolio.

🔹 What Changes?

Instead of cho

For a long time, most crypto portfolios have looked similar a mix of native tokens, a few altcoins, and stablecoins for liquidity. The challenge? Many of these assets move together. When the market rises, they rise together. When it falls, they often fall together.

That’s where STONfi introduces something different.

With xStocks, users can access tokenized representations of real world equities directly inside the TON ecosystem. This means you’re no longer limited to crypto only exposure when building your on-chain portfolio.

🔹 What Changes?

Instead of cho

- Reward

- like

- Comment

- Repost

- Share

One of the most interesting developments on STONfi is the launch of xStocks tokenized representations of real-world equities inside the TON ecosystem.

This matters because it expands what users can do onchain.

Instead of managing crypto in one place and traditional stocks in another, users can now gain stock linked exposure directly from their TON wallet. No separate brokerage interface. No leaving the ecosystem.

That’s a meaningful shift in accessibility.

🌍 What This Unlocks

• Unified portfolio management (crypto + tokenized equities)

• On-chain swaps powered by liquidity pools

• Broader di

This matters because it expands what users can do onchain.

Instead of managing crypto in one place and traditional stocks in another, users can now gain stock linked exposure directly from their TON wallet. No separate brokerage interface. No leaving the ecosystem.

That’s a meaningful shift in accessibility.

🌍 What This Unlocks

• Unified portfolio management (crypto + tokenized equities)

• On-chain swaps powered by liquidity pools

• Broader di

TON-1,5%

- Reward

- like

- Comment

- Repost

- Share

DeFi is no longer just about swapping meme tokens or chasing short term yield. The space is evolving and STONfi is helping bring real world market exposure directly onto the blockchain.

With the introduction of xStocks, users can now access tokenized representations of traditional equities without leaving the TON ecosystem.

Let that sink in.

You can stay fully onchain inside your wallet and gain exposure to assets that were traditionally only available through brokerage accounts.

For years, DeFi and traditional finance operated in parallel worlds.

Now, they’re starting to merge.

STONfi is help

With the introduction of xStocks, users can now access tokenized representations of traditional equities without leaving the TON ecosystem.

Let that sink in.

You can stay fully onchain inside your wallet and gain exposure to assets that were traditionally only available through brokerage accounts.

For years, DeFi and traditional finance operated in parallel worlds.

Now, they’re starting to merge.

STONfi is help

TON-1,5%

- Reward

- like

- Comment

- Repost

- Share

Ecosystem Update: BTC & ETH Liquidity Now Live on TON via STONfi

Bitcoin and Ethereum liquidity are now available directly on STONfi on the TON blockchain through cbBTC and WETH, both backed 1:1 by their native assets and integrated in a non-custodial manner.

This integration allows users to access BTC and ETH exposure on TON without relying on synthetic assets or IOU-based representations. Liquidity is routed via Omniston, enabling optimized swaps across available TON liquidity sources and improving execution quality for traders.

Key highlights:

Native BTC & ETH exposure on TON (cbBTC, WETH)

Bitcoin and Ethereum liquidity are now available directly on STONfi on the TON blockchain through cbBTC and WETH, both backed 1:1 by their native assets and integrated in a non-custodial manner.

This integration allows users to access BTC and ETH exposure on TON without relying on synthetic assets or IOU-based representations. Liquidity is routed via Omniston, enabling optimized swaps across available TON liquidity sources and improving execution quality for traders.

Key highlights:

Native BTC & ETH exposure on TON (cbBTC, WETH)

- Reward

- 4

- 2

- Repost

- Share

Vortex_King :

:

To The Moon 🌕View More

A Risk Aware Perspective: Innovation Requires Responsibility

While STONfi introduces useful tools and expands access to tokenized assets, it’s important to approach any DeFi platform with a clear understanding of risk.

DeFi innovation often moves faster than traditional finance. That speed creates opportunity but it also requires users to take personal responsibility.

🔹 Smart Contract Risk

All decentralized platforms rely on smart contracts. Even well-designed systems can face:

Bugs or vulnerabilities

Exploits

Unexpected technical failures

Audits and security measures reduce risk, but they do

While STONfi introduces useful tools and expands access to tokenized assets, it’s important to approach any DeFi platform with a clear understanding of risk.

DeFi innovation often moves faster than traditional finance. That speed creates opportunity but it also requires users to take personal responsibility.

🔹 Smart Contract Risk

All decentralized platforms rely on smart contracts. Even well-designed systems can face:

Bugs or vulnerabilities

Exploits

Unexpected technical failures

Audits and security measures reduce risk, but they do

TON-1,5%

- Reward

- 1

- Comment

- Repost

- Share

Beyond its trading interface and tokenized assets, STONfi invests in something that many DeFi platforms overlook: structured education.

In fast moving ecosystems, misinformation spreads quickly. Users often rely on short posts, speculation, or incomplete explanations when making financial decisions. This creates confusion and increases risk.

The STONfi Blog helps address that gap by providing clear, organized content that explains:

How to complete your first xStocks swap step-by-step

How tokenized real world assets are represented on TON

What ecosystem metrics like TVL mean in context

How DeFi

In fast moving ecosystems, misinformation spreads quickly. Users often rely on short posts, speculation, or incomplete explanations when making financial decisions. This creates confusion and increases risk.

The STONfi Blog helps address that gap by providing clear, organized content that explains:

How to complete your first xStocks swap step-by-step

How tokenized real world assets are represented on TON

What ecosystem metrics like TVL mean in context

How DeFi

- Reward

- 1

- Comment

- Repost

- Share

Beginner Friendly Design: Lowering the Barrier to TON DeFi

Entering DeFi for the first time can feel intimidating. New users are often confronted with unfamiliar terms, complex interfaces, and technical steps that aren’t clearly explained. Without proper guidance, even a simple token swap can seem risky or confusing.

STONfi addresses this challenge by focusing on beginner friendly design and clear user flows.

🔹 Simple and Intuitive Interface

The platform’s swap interface is designed to be straightforward:

Clear token selection

Transparent pricing

Easy-to-understand transaction details

Minimal

Entering DeFi for the first time can feel intimidating. New users are often confronted with unfamiliar terms, complex interfaces, and technical steps that aren’t clearly explained. Without proper guidance, even a simple token swap can seem risky or confusing.

STONfi addresses this challenge by focusing on beginner friendly design and clear user flows.

🔹 Simple and Intuitive Interface

The platform’s swap interface is designed to be straightforward:

Clear token selection

Transparent pricing

Easy-to-understand transaction details

Minimal

TON-1,5%

- Reward

- 1

- Comment

- Repost

- Share

Strong Position Within TON’s Growth Cycle

As the TON ecosystem continues to expand, infrastructure becomes increasingly important. Growth in users, liquidity, and activity requires reliable platforms that can handle volume while remaining accessible. STONfi has positioned itself as one of those foundational layers within TON DeFi.

Over time, TON has seen substantial increases in total value locked (TVL) and user participation. A major driver behind this growth is its integration with Telegram, which provides powerful distribution and onboarding potential. When access to DeFi tools is embedded

As the TON ecosystem continues to expand, infrastructure becomes increasingly important. Growth in users, liquidity, and activity requires reliable platforms that can handle volume while remaining accessible. STONfi has positioned itself as one of those foundational layers within TON DeFi.

Over time, TON has seen substantial increases in total value locked (TVL) and user participation. A major driver behind this growth is its integration with Telegram, which provides powerful distribution and onboarding potential. When access to DeFi tools is embedded

TON-1,5%

- Reward

- 1

- Comment

- Repost

- Share

xStocks: Expanding Portfolio Possibilities on TON

One of the most distinctive features of STONfi is the introduction of xStocks tokenized representations of real world stocks issued on TON as jettons.

At a basic level, xStocks allow users to gain price exposure to traditional equities while staying entirely within the crypto ecosystem. Instead of opening a traditional brokerage account, switching platforms, or moving capital off-chain, users can access stock linked assets directly through their TON wallet.

But the impact goes deeper than convenience.

🔹 Why This Matters

Most crypto portfolios

One of the most distinctive features of STONfi is the introduction of xStocks tokenized representations of real world stocks issued on TON as jettons.

At a basic level, xStocks allow users to gain price exposure to traditional equities while staying entirely within the crypto ecosystem. Instead of opening a traditional brokerage account, switching platforms, or moving capital off-chain, users can access stock linked assets directly through their TON wallet.

But the impact goes deeper than convenience.

🔹 Why This Matters

Most crypto portfolios

- Reward

- 2

- Comment

- Repost

- Share

DeFi can feel overwhelming especially for newcomers.

Between wallets, liquidity pools, slippage, token standards, and real-world asset tokenization, the learning curve can discourage even motivated users.

STONfi helps simplify that experience.

Instead of presenting users with complex dashboards and assuming prior knowledge, the platform focuses on clarity and accessibility. Basic token swaps are straightforward and intuitive, making it easier for users to move assets without confusion. The interface is designed to reduce friction, not add to it.

But simplicity in design is only part of the eq

Between wallets, liquidity pools, slippage, token standards, and real-world asset tokenization, the learning curve can discourage even motivated users.

STONfi helps simplify that experience.

Instead of presenting users with complex dashboards and assuming prior knowledge, the platform focuses on clarity and accessibility. Basic token swaps are straightforward and intuitive, making it easier for users to move assets without confusion. The interface is designed to reduce friction, not add to it.

But simplicity in design is only part of the eq

TON-1,5%

- Reward

- 2

- Comment

- 1

- Share

TON’s DeFi Is Designed for Scale

Scaling DeFi is not just about handling more transactions per second. It is about maintaining quality as usage grows.

Many networks can process transactions quickly, but struggle when:

Liquidity becomes fragmented

Slippage increases

Execution becomes unreliable

Infrastructure breaks under demand

User experience deteriorates

TON approaches scaling differently.

It combines:

A high-performance blockchain with low fees and fast finality

Native distribution through Telegram

Invisible UX design

Aggregated liquidity routing

And professional liquidity infrastructure

Th

Scaling DeFi is not just about handling more transactions per second. It is about maintaining quality as usage grows.

Many networks can process transactions quickly, but struggle when:

Liquidity becomes fragmented

Slippage increases

Execution becomes unreliable

Infrastructure breaks under demand

User experience deteriorates

TON approaches scaling differently.

It combines:

A high-performance blockchain with low fees and fast finality

Native distribution through Telegram

Invisible UX design

Aggregated liquidity routing

And professional liquidity infrastructure

Th

TON-1,5%

- Reward

- like

- Comment

- Repost

- Share

Liquidity Providers Are Ecosystem Partners

Liquidity providers are often treated as short-term participants in DeFi people who deposit capital, earn fees, and leave when yields drop.

In reality, they play a much more important role.

Liquidity providers are not just chasing rewards.

They are supplying the capital infrastructure that allows decentralized markets to function at all.

Without them:

Swaps cannot execute efficiently

Prices become unstable

Slippage increases

Aggregators fail to find good routes

Applications lose reliability

They are closer to market makers than casual users.

STONfi re

Liquidity providers are often treated as short-term participants in DeFi people who deposit capital, earn fees, and leave when yields drop.

In reality, they play a much more important role.

Liquidity providers are not just chasing rewards.

They are supplying the capital infrastructure that allows decentralized markets to function at all.

Without them:

Swaps cannot execute efficiently

Prices become unstable

Slippage increases

Aggregators fail to find good routes

Applications lose reliability

They are closer to market makers than casual users.

STONfi re

TON-1,5%

- Reward

- like

- Comment

- Repost

- Share

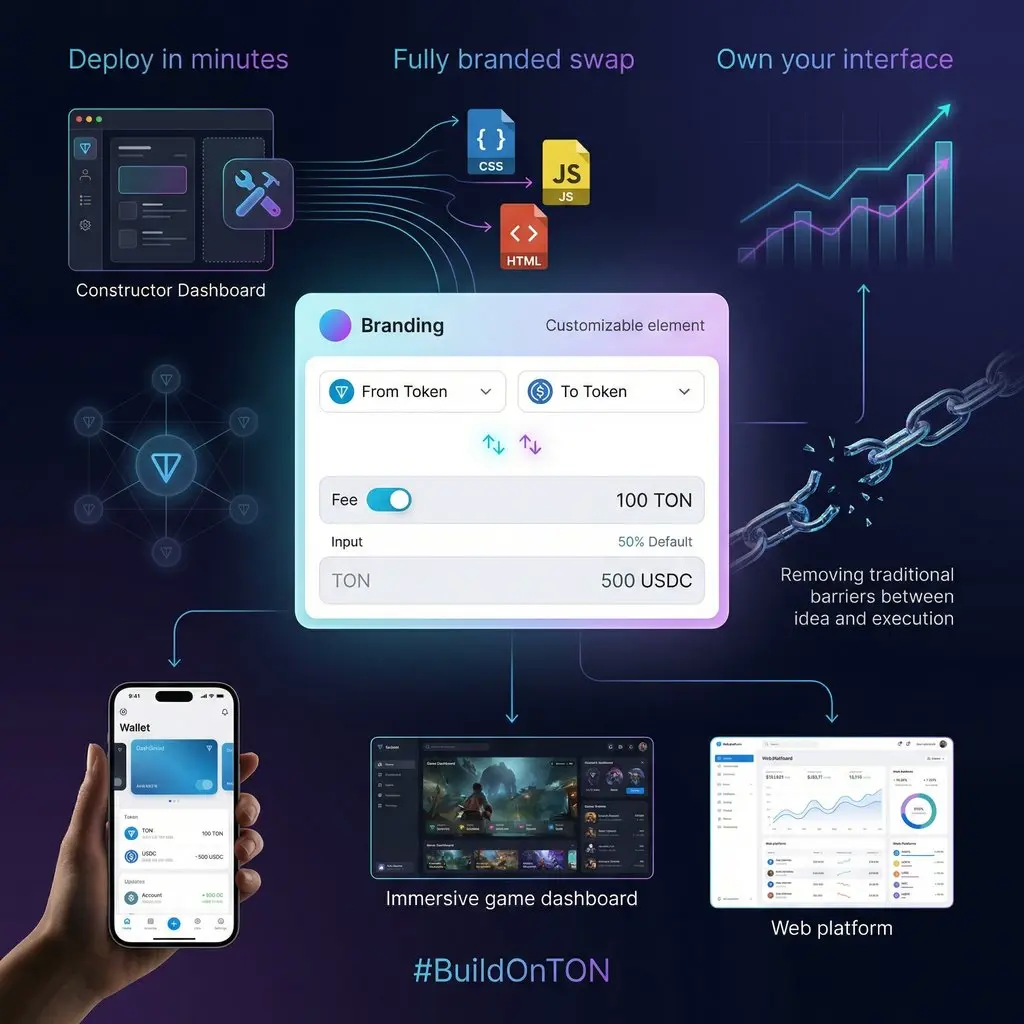

Why Deep Liquidity Attracts Builders

Developers do not build serious financial applications on unstable foundations.

No matter how good the user interface is or how innovative the idea may be, an application cannot succeed if:

Prices are inconsistent

Trades fail or execute unpredictably

Liquidity disappears during volatility

Slippage makes features unusable

For builders, these are not minor inconveniences — they are product-breaking risks.

This is why deep, reliable liquidity is one of the most important signals of a healthy ecosystem.

STONfi provides this foundation on TON.

By focusing on lon

Developers do not build serious financial applications on unstable foundations.

No matter how good the user interface is or how innovative the idea may be, an application cannot succeed if:

Prices are inconsistent

Trades fail or execute unpredictably

Liquidity disappears during volatility

Slippage makes features unusable

For builders, these are not minor inconveniences — they are product-breaking risks.

This is why deep, reliable liquidity is one of the most important signals of a healthy ecosystem.

STONfi provides this foundation on TON.

By focusing on lon

- Reward

- like

- Comment

- Repost

- Share

Professional Market Design Matters

Many DeFi platforms compete on speed, new features, or high yields. While these are attractive in the short term, they do not create stable financial systems.

Real markets the kind that institutions and everyday users trust are built on something deeper:

Predictable risk

Stable liquidity

Transparent incentives

Long-term sustainability

Protection against structural weaknesses

This is what professional market design looks like.

In much of DeFi, liquidity providers carry most of the risk, especially from impermanent loss. Fees and token incentives try to compens

Many DeFi platforms compete on speed, new features, or high yields. While these are attractive in the short term, they do not create stable financial systems.

Real markets the kind that institutions and everyday users trust are built on something deeper:

Predictable risk

Stable liquidity

Transparent incentives

Long-term sustainability

Protection against structural weaknesses

This is what professional market design looks like.

In much of DeFi, liquidity providers carry most of the risk, especially from impermanent loss. Fees and token incentives try to compens

TON-1,5%

- Reward

- like

- Comment

- Repost

- Share

TON’s Strategy: Build for Non-Crypto Users

Most blockchains are designed primarily for developers, traders, or technically experienced crypto users. TON takes a different approach.

Its core strategy is simple but powerful: build for everyday users first.

Instead of forcing people to understand wallets, private keys, gas fees, network routing, and token standards, TON aims to hide these complexities behind familiar app-like experiences. The blockchain becomes infrastructure in the background, not something users have to constantly think about.

This design philosophy changes everything.

TON focu

Most blockchains are designed primarily for developers, traders, or technically experienced crypto users. TON takes a different approach.

Its core strategy is simple but powerful: build for everyday users first.

Instead of forcing people to understand wallets, private keys, gas fees, network routing, and token standards, TON aims to hide these complexities behind familiar app-like experiences. The blockchain becomes infrastructure in the background, not something users have to constantly think about.

This design philosophy changes everything.

TON focu

- Reward

- like

- Comment

- Repost

- Share

Aggregators Need Strong Liquidity

In modern DeFi ecosystems, users expect swaps to be fast, affordable, and accurate. Behind this simple experience lies a complex process: finding the best price across many pools and executing trades efficiently. This is the role of aggregators like Omniston.

Aggregators scan multiple liquidity sources across the network, compare prices and available depth, and automatically route each trade through the most efficient path. This saves users from manual comparisons and protects them from unnecessary slippage.

However, even the most advanced routing engine is li

In modern DeFi ecosystems, users expect swaps to be fast, affordable, and accurate. Behind this simple experience lies a complex process: finding the best price across many pools and executing trades efficiently. This is the role of aggregators like Omniston.

Aggregators scan multiple liquidity sources across the network, compare prices and available depth, and automatically route each trade through the most efficient path. This saves users from manual comparisons and protects them from unnecessary slippage.

However, even the most advanced routing engine is li

TON-1,5%

- Reward

- like

- Comment

- Repost

- Share

DeFi Without Friction

One of the main reasons DeFi has struggled to reach mainstream users is friction. Setting up wallets, managing private keys, understanding gas fees, and choosing swap routes can be confusing even for experienced users let alone newcomers.

TON is changing this by designing its ecosystem around simplicity and abstraction.

Technical processes such as transaction routing and fee handling are increasingly hidden behind clean, intuitive interfaces. Users interact with applications, not blockchains.

Tools like Privy further remove barriers by simplifying wallet creation and auth

One of the main reasons DeFi has struggled to reach mainstream users is friction. Setting up wallets, managing private keys, understanding gas fees, and choosing swap routes can be confusing even for experienced users let alone newcomers.

TON is changing this by designing its ecosystem around simplicity and abstraction.

Technical processes such as transaction routing and fee handling are increasingly hidden behind clean, intuitive interfaces. Users interact with applications, not blockchains.

Tools like Privy further remove barriers by simplifying wallet creation and auth

TON-1,5%

- Reward

- like

- Comment

- Repost

- Share

Sustainable Liquidity Beats Short Term Yield

For much of DeFi’s history, liquidity growth was driven by high rewards and short-term incentives. Protocols attracted users with attractive yields, but when those rewards declined, liquidity often left just as quickly. This created unstable markets, shallow pools, and unreliable trading conditions.

True sustainability requires a different approach.

STONfi focuses on building liquidity that lasts, not just liquidity that appears for a short time. Instead of relying only on incentives, it prioritizes professional liquidity management and risk reducti

For much of DeFi’s history, liquidity growth was driven by high rewards and short-term incentives. Protocols attracted users with attractive yields, but when those rewards declined, liquidity often left just as quickly. This created unstable markets, shallow pools, and unreliable trading conditions.

True sustainability requires a different approach.

STONfi focuses on building liquidity that lasts, not just liquidity that appears for a short time. Instead of relying only on incentives, it prioritizes professional liquidity management and risk reducti

TON-1,5%

- Reward

- like

- Comment

- Repost

- Share

Building the Future Together

A strong DeFi ecosystem is never built by a single protocol or feature. It emerges from well-designed infrastructure, thoughtful user experience, and reliable market foundations working together.

This is exactly what is happening on TON.

TON provides the base layer: a fast, low-fee, and scalable blockchain designed for real-world applications and seamless integration with platforms like Telegram. Its focus on usability allows developers to build products that feel natural to everyday users, not just crypto-native audiences.

On top of this foundation, Privy simplifi

A strong DeFi ecosystem is never built by a single protocol or feature. It emerges from well-designed infrastructure, thoughtful user experience, and reliable market foundations working together.

This is exactly what is happening on TON.

TON provides the base layer: a fast, low-fee, and scalable blockchain designed for real-world applications and seamless integration with platforms like Telegram. Its focus on usability allows developers to build products that feel natural to everyday users, not just crypto-native audiences.

On top of this foundation, Privy simplifi

TON-1,5%

- Reward

- like

- Comment

- Repost

- Share

Deep Liquidity, Faster Trades

Liquidity is the backbone of any decentralized finance ecosystem. Without sufficient liquidity, trades become slow, slippage increases, and users may receive prices far from what they expect. In short, low liquidity makes DeFi unreliable and frustrating for both traders and developers.

This is where STONfi plays a critical role on TON. By providing deep, stable, and professionally managed liquidity pools, STONfi ensures that token swaps and trades execute smoothly and efficiently. Large transactions can be processed without causing sudden price swings, and users c

Liquidity is the backbone of any decentralized finance ecosystem. Without sufficient liquidity, trades become slow, slippage increases, and users may receive prices far from what they expect. In short, low liquidity makes DeFi unreliable and frustrating for both traders and developers.

This is where STONfi plays a critical role on TON. By providing deep, stable, and professionally managed liquidity pools, STONfi ensures that token swaps and trades execute smoothly and efficiently. Large transactions can be processed without causing sudden price swings, and users c

- Reward

- like

- Comment

- Repost

- Share