StacyMuur

No content yet

StacyMuur

What\'s your core grind these days, anon?

- Reward

- like

- Comment

- Repost

- Share

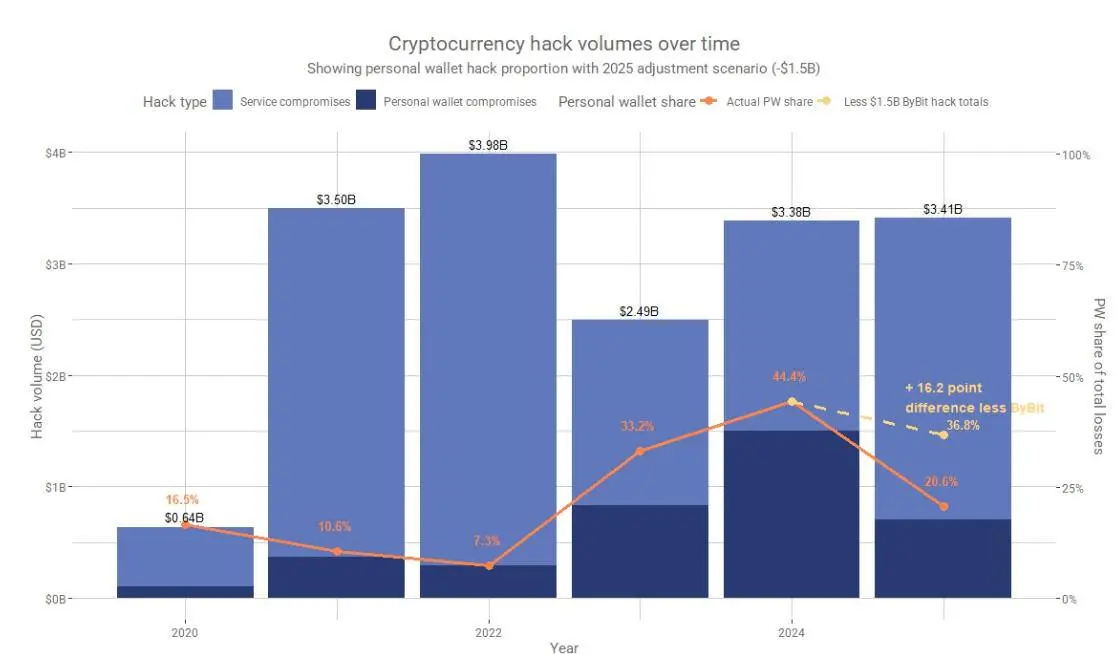

Hacks are still a huge problem.And most protocols never make it back.

- Reward

- like

- Comment

- Repost

- Share

Are you still farming airdrops, anon?

- Reward

- like

- Comment

- Repost

- Share

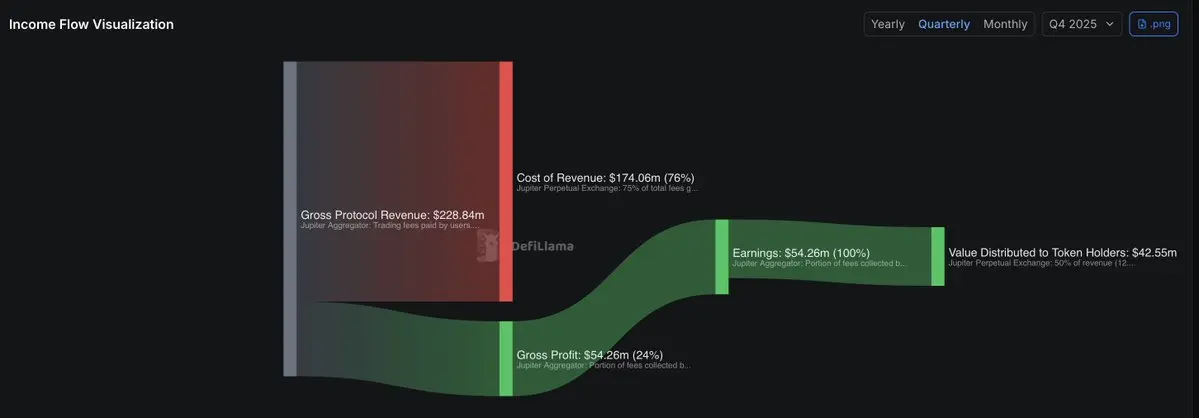

Visualization of @JupiterExchange's revenue flow here.

I think that in 2026, directing value back to token holders is a must.

2025 has shown us what happens when tokens lack utility and connection to product success.

No need for a new 2025 in this context, pls.

I think that in 2026, directing value back to token holders is a must.

2025 has shown us what happens when tokens lack utility and connection to product success.

No need for a new 2025 in this context, pls.

TOKEN-5,29%

- Reward

- like

- Comment

- Repost

- Share

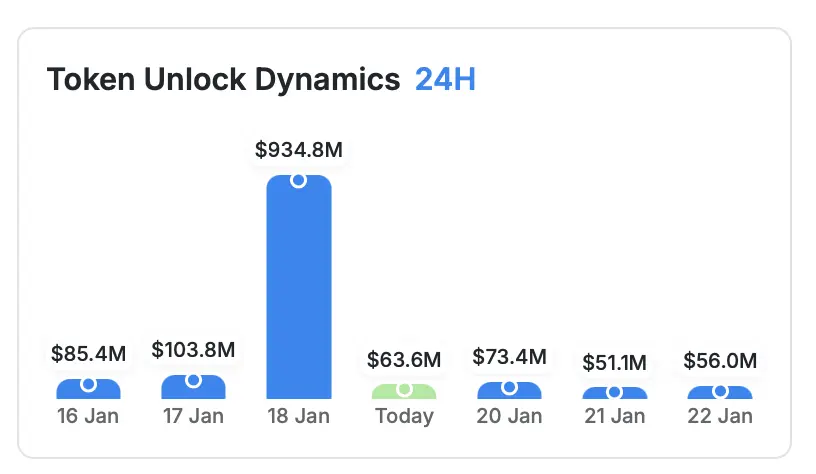

No one noticed but we had almost $1B in new token unlocks yesterday.

There's really no fundamental reason why alts should not bleed.

There's really no fundamental reason why alts should not bleed.

- Reward

- like

- Comment

- Repost

- Share

Wtf do people say that perps are easier than memecoins?

><

><

- Reward

- like

- Comment

- Repost

- Share

Lmao, this is amazing

We're hiring at @GREEND0TS now and sometimes my colleagues send me candidate sumbissions that are too good to be real.

This one is a hidden HR meme.

In short:

Many people are now reverse-engineering their CVs from the JD – which is already cringe and easy to spot.

This guy:

• Reverse-engineered

• Forgot to remove the note from AI

• Sent his Polymarket-ready CV to Green Dots

• Asks $5K per month

Are we cooked or wat?

We're hiring at @GREEND0TS now and sometimes my colleagues send me candidate sumbissions that are too good to be real.

This one is a hidden HR meme.

In short:

Many people are now reverse-engineering their CVs from the JD – which is already cringe and easy to spot.

This guy:

• Reverse-engineered

• Forgot to remove the note from AI

• Sent his Polymarket-ready CV to Green Dots

• Asks $5K per month

Are we cooked or wat?

- Reward

- like

- Comment

- Repost

- Share

Choose one

- Reward

- like

- Comment

- Repost

- Share

Imagine if one day X has a wipe

- Reward

- like

- Comment

- Repost

- Share

Unfortunately, I'm meeting more and more people in Web3 who mention they have problems with sleep.

I also do.

After two courses of antidepressants and several episodes of acute insomnia, here's something I want to share with my fellow CT friends:

1. Don't underestimate this. Bad sleep will ruin your life.

2. Insomnia is heavily associated with stress. CT has a culture of "you win if you work on holidays/weekends." This strategy is cool short-term but destructive long-term.

3. My insomnia improved only after visiting a doctor and receiving meds + therapy. Melatonin, etc., are like honey vs. ang

I also do.

After two courses of antidepressants and several episodes of acute insomnia, here's something I want to share with my fellow CT friends:

1. Don't underestimate this. Bad sleep will ruin your life.

2. Insomnia is heavily associated with stress. CT has a culture of "you win if you work on holidays/weekends." This strategy is cool short-term but destructive long-term.

3. My insomnia improved only after visiting a doctor and receiving meds + therapy. Melatonin, etc., are like honey vs. ang

- Reward

- like

- Comment

- Repost

- Share

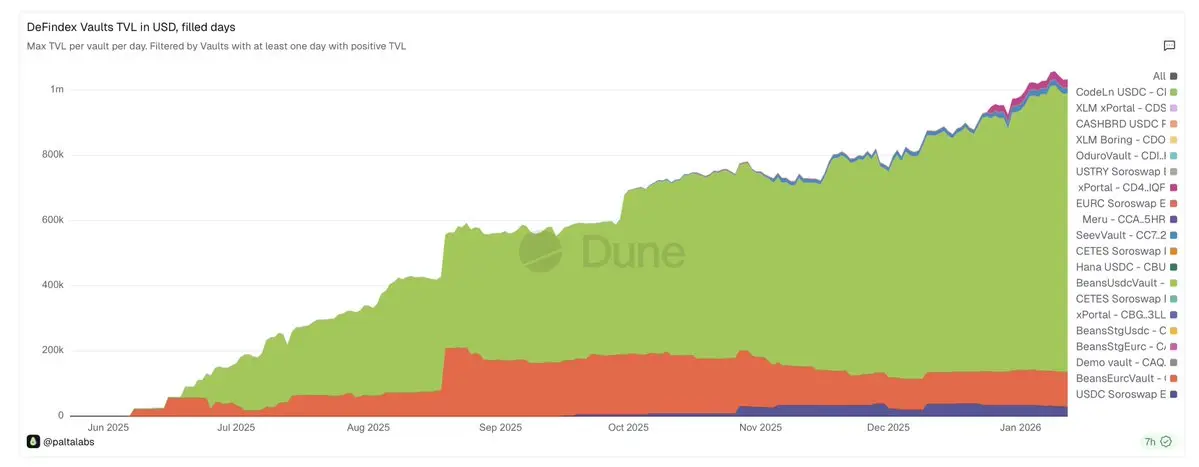

Noticing a weird pattern lately:

Multiple wallets like Hana, X-portal or Beans are suddenly offering near-identical (double digit) stablecoin yield experiences.

Same idea:

• deposit idle USDC

• earn automatically

• all inside the wallet

That means that there's some infra they're all leveraging – and if you understand who sits there, you have the alpha.

So I started digging and it turned out that under the hood, a lot of these wallets are plugging into the same yield layer – @defindex_.

That's basically yield-as-a-service for wallets. With 1M TVL, they are growing fast.

Instead of every wallet

Multiple wallets like Hana, X-portal or Beans are suddenly offering near-identical (double digit) stablecoin yield experiences.

Same idea:

• deposit idle USDC

• earn automatically

• all inside the wallet

That means that there's some infra they're all leveraging – and if you understand who sits there, you have the alpha.

So I started digging and it turned out that under the hood, a lot of these wallets are plugging into the same yield layer – @defindex_.

That's basically yield-as-a-service for wallets. With 1M TVL, they are growing fast.

Instead of every wallet

USDC-0,03%

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More79.06K Popularity

51.77K Popularity

41.87K Popularity

15.05K Popularity

31.82K Popularity

Pin