# BitcoinDropsBelow$65K

14.34K

HighAmbition

#BitcoinDropsBelow$65K

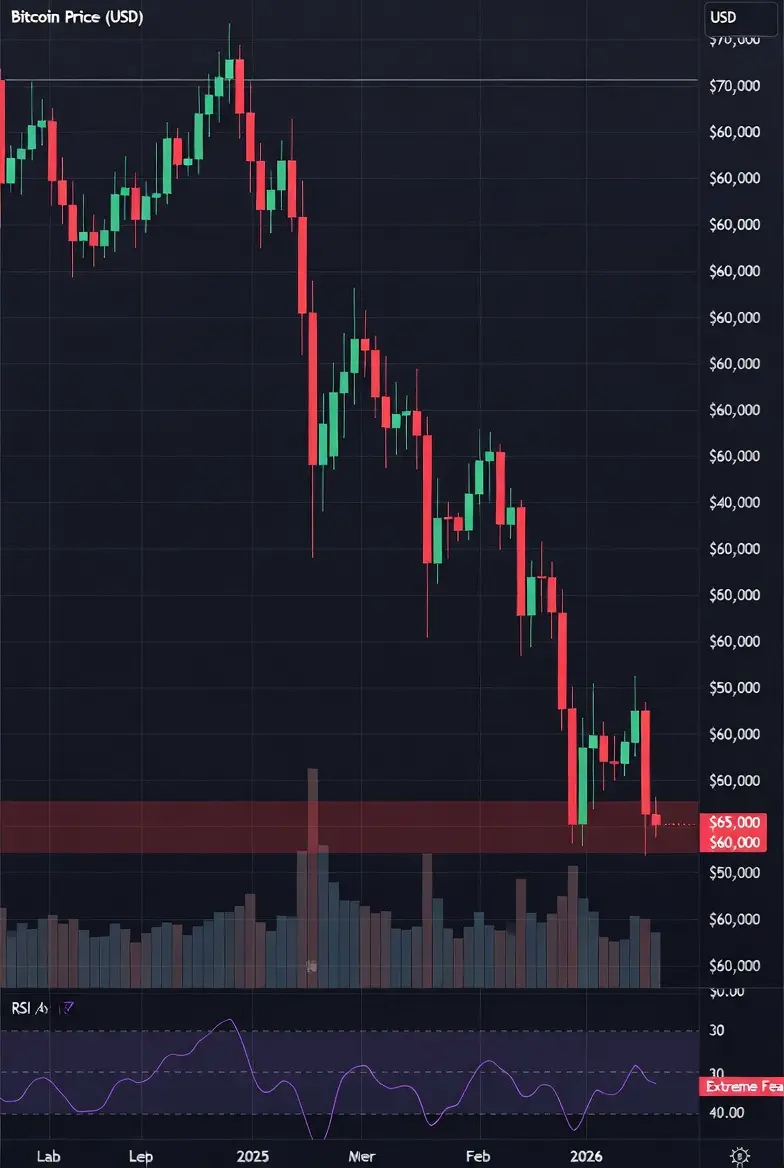

Bitcoin has just broken below the critical $65,000 level in early February 2026, marking a significant escalation in the ongoing pullback from the explosive 2025 bull run highs near $126,000.

Right now, BTC is trading around $69,000 after recovering slightly from brutal lows that dipped near $60,000 earlier this week (with brief flashes below $61,000 reported on February 5). This represents a roughly 45-50% drawdown from the October/November 2025 peak, erasing most post-election gains and pushing the market into a painful reset phase.

The drop below $65K is a key techni

Bitcoin has just broken below the critical $65,000 level in early February 2026, marking a significant escalation in the ongoing pullback from the explosive 2025 bull run highs near $126,000.

Right now, BTC is trading around $69,000 after recovering slightly from brutal lows that dipped near $60,000 earlier this week (with brief flashes below $61,000 reported on February 5). This represents a roughly 45-50% drawdown from the October/November 2025 peak, erasing most post-election gains and pushing the market into a painful reset phase.

The drop below $65K is a key techni

- Reward

- 2

- 2

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#BitcoinDropsBelow$65K Bitcoin Below $65K: Sharp Correction or Start of a Deeper Crypto Winter?

Bitcoin has once again tested investor confidence after falling below the psychologically important $65,000 level in early February 2026. The sell-off pushed BTC briefly into the $60,000–$61,000 range on February 5 before a modest rebound followed. This move represents one of the sharpest short-term declines since the 2022 market crash, erasing a significant portion of post-election gains from late 2024 and placing Bitcoin nearly 50% below its October 2025 peak near $126,000.

The decline was driven

Bitcoin has once again tested investor confidence after falling below the psychologically important $65,000 level in early February 2026. The sell-off pushed BTC briefly into the $60,000–$61,000 range on February 5 before a modest rebound followed. This move represents one of the sharpest short-term declines since the 2022 market crash, erasing a significant portion of post-election gains from late 2024 and placing Bitcoin nearly 50% below its October 2025 peak near $126,000.

The decline was driven

BTC-1.14%

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊When Structure Replaces Emotion: Understanding a Prolonged Bitcoin Drawdown For years many participants learned to interpret Bitcoin through a simple lens. Fixed supply, growing adoption, cycles of fear and greed, halvings tightening issuance, and eventually demand overwhelming sellers. That framework worked reasonably well in earlier eras when most activity was happening in spot markets and when the marginal buyer or seller was typically an investor moving real coins.

However markets evolve. Instruments evolve. Participants evolve. Therefore price behavior evolves.

Today Bitcoin trades insi

However markets evolve. Instruments evolve. Participants evolve. Therefore price behavior evolves.

Today Bitcoin trades insi

BTC-1.14%

- Reward

- 4

- 4

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

#BitcoinDropsBelow$65K Market Shock or Strategic Reset?

Bitcoin slipping below the $65,000 mark has sent a wave of anxiety across the crypto market. Headlines are flashing red, social media is buzzing with fear, and short-term traders are scrambling for answers. But beneath the surface panic, this move may be less about collapse and more about a healthy market reset.

Price levels like $65K are psychologically powerful. When Bitcoin breaks below them, emotions take control and volatility spikes. Many leveraged positions are forced out, stop-losses are triggered, and liquidity hunts accelerate t

Bitcoin slipping below the $65,000 mark has sent a wave of anxiety across the crypto market. Headlines are flashing red, social media is buzzing with fear, and short-term traders are scrambling for answers. But beneath the surface panic, this move may be less about collapse and more about a healthy market reset.

Price levels like $65K are psychologically powerful. When Bitcoin breaks below them, emotions take control and volatility spikes. Many leveraged positions are forced out, stop-losses are triggered, and liquidity hunts accelerate t

BTC-1.14%

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#BitcoinDropsBelow$65K

Bitcoin Drops Below $65K: A Sharp Correction or the Start of a Deeper Crypto Winter?

Bitcoin, the flagship cryptocurrency, has once again tested investor resolve by plunging below the psychologically significant $65,000 level in early February 2026. This dramatic sell-off, which saw BTC briefly dip as low as around $60,000–$61,000 on February 5 before rebounding, marks one of the steepest single-day declines since the FTX collapse in late 2022. With the price erasing much of the post-election gains from late 2024 and falling nearly 50% from its October 2025 peak above $

Bitcoin Drops Below $65K: A Sharp Correction or the Start of a Deeper Crypto Winter?

Bitcoin, the flagship cryptocurrency, has once again tested investor resolve by plunging below the psychologically significant $65,000 level in early February 2026. This dramatic sell-off, which saw BTC briefly dip as low as around $60,000–$61,000 on February 5 before rebounding, marks one of the steepest single-day declines since the FTX collapse in late 2022. With the price erasing much of the post-election gains from late 2024 and falling nearly 50% from its October 2025 peak above $

BTC-1.14%

- Reward

- 25

- 8

- Repost

- Share

xxx40xxx :

:

Happy New Year! 🤑View More

#BitcoinDropsBelow$65K

What the Drop Below $65K Really Means

Bitcoin slipping below $65,000 is a liquidity event, not an automatic trend reversal.

$65K was a psychological + short-term technical level

The break triggered stop-losses and leveraged long liquidations

Spot selling remains controlled, not disorderly

This move looks more like position cleanup than structural failure.

🧠 Key Drivers Behind the Move

Macro pressure: Strong USD + elevated bond yields continue to weigh on risk assets

Derivatives reset: Funding rates cooled → leverage flushed

Equity correlation: Tech weakness dragged cry

What the Drop Below $65K Really Means

Bitcoin slipping below $65,000 is a liquidity event, not an automatic trend reversal.

$65K was a psychological + short-term technical level

The break triggered stop-losses and leveraged long liquidations

Spot selling remains controlled, not disorderly

This move looks more like position cleanup than structural failure.

🧠 Key Drivers Behind the Move

Macro pressure: Strong USD + elevated bond yields continue to weigh on risk assets

Derivatives reset: Funding rates cooled → leverage flushed

Equity correlation: Tech weakness dragged cry

- Reward

- 3

- 6

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

BlackRock’s Bitcoin ETF Sees $231.6M Inflows After Two Days of Record Outflows

Why Did IBIT See Inflows After Heavy Redemptions?

BlackRock’s spot Bitcoin ( $BTC ) exchange-traded fund recorded $231.6 million in inflows on Friday, reversing part of the damage from earlier in the week as Bitcoin prices swung sharply. The rebound followed two consecutive sessions of large redemptions, when the iShares Bitcoin Trust ETF shed a combined $548.7 million on Wednesday and Thursday, according to the data.

Those outflows coincided with a sharp sell-off across crypto markets. Bitcoin briefly fell to $60,0

Why Did IBIT See Inflows After Heavy Redemptions?

BlackRock’s spot Bitcoin ( $BTC ) exchange-traded fund recorded $231.6 million in inflows on Friday, reversing part of the damage from earlier in the week as Bitcoin prices swung sharply. The rebound followed two consecutive sessions of large redemptions, when the iShares Bitcoin Trust ETF shed a combined $548.7 million on Wednesday and Thursday, according to the data.

Those outflows coincided with a sharp sell-off across crypto markets. Bitcoin briefly fell to $60,0

BTC-1.14%

- Reward

- 1

- Comment

- Repost

- Share

#BitcoinDropsBelow$65K 🚨📉

Bitcoin has officially broken below the $65,000 level — and that changes short-term structure.

This isn’t just a dip.

This is a key psychological and technical breakdown.

What this means:

🔻 Stop-loss clusters below $66K have been triggered

🔻 Liquidations likely accelerating volatility

🔻 Short-term trend shifting bearish

Now the focus shifts to reaction — not emotion.

📊 Key Zones to Watch: • Immediate support: $60K–$62K

• Deeper demand: $55K–$58K

• Reclaim level for recovery: Back above $67K

If BTC quickly reclaims $65K with strong volume, this could turn into a

Bitcoin has officially broken below the $65,000 level — and that changes short-term structure.

This isn’t just a dip.

This is a key psychological and technical breakdown.

What this means:

🔻 Stop-loss clusters below $66K have been triggered

🔻 Liquidations likely accelerating volatility

🔻 Short-term trend shifting bearish

Now the focus shifts to reaction — not emotion.

📊 Key Zones to Watch: • Immediate support: $60K–$62K

• Deeper demand: $55K–$58K

• Reclaim level for recovery: Back above $67K

If BTC quickly reclaims $65K with strong volume, this could turn into a

BTC-1.14%

- Reward

- 11

- 10

- Repost

- Share

MrKing :

:

Buy To Earn 💎View More

#BitcoinDropsBelow$65K | Market Shock or Strategic Reset?

Bitcoin slipping below the $65,000 mark has sent a wave of anxiety across the crypto market. Headlines are flashing red, social media is buzzing with fear, and short-term traders are scrambling for answers. But beneath the surface panic, this move may be less about collapse and more about a healthy market reset.

Price levels like $65K are psychologically powerful. When Bitcoin breaks below them, emotions take control and volatility spikes. Many leveraged positions are forced out, stop-losses are triggered, and liquidity hunts accelerate

Bitcoin slipping below the $65,000 mark has sent a wave of anxiety across the crypto market. Headlines are flashing red, social media is buzzing with fear, and short-term traders are scrambling for answers. But beneath the surface panic, this move may be less about collapse and more about a healthy market reset.

Price levels like $65K are psychologically powerful. When Bitcoin breaks below them, emotions take control and volatility spikes. Many leveraged positions are forced out, stop-losses are triggered, and liquidity hunts accelerate

BTC-1.14%

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊#BitcoinDropsBelow$65K

#BitcoinDropsBelow$65K 📉

I’m not surprised by this move, and I’m not rushing to label it as anything dramatic. Bitcoin moving below $65K doesn’t break structure on its own — it creates a situation. And situations are where the market starts exposing bad positioning, overconfidence, and emotional decision-making.

I’m looking at this through the lens of liquidity, time, and behavior, not headlines. Corrections like this are how leverage gets flushed and sentiment resets. They’re uncomfortable by design. The market needs these moments to breathe before it can continue in

#BitcoinDropsBelow$65K 📉

I’m not surprised by this move, and I’m not rushing to label it as anything dramatic. Bitcoin moving below $65K doesn’t break structure on its own — it creates a situation. And situations are where the market starts exposing bad positioning, overconfidence, and emotional decision-making.

I’m looking at this through the lens of liquidity, time, and behavior, not headlines. Corrections like this are how leverage gets flushed and sentiment resets. They’re uncomfortable by design. The market needs these moments to breathe before it can continue in

BTC-1.14%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

140.2K Popularity

33.4K Popularity

392.4K Popularity

14.34K Popularity

12.98K Popularity

10.98K Popularity

11.59K Popularity

10.88K Popularity

7.71K Popularity

3.32K Popularity

19.48K Popularity

12.41K Popularity

24.87K Popularity

32.64K Popularity

28.17K Popularity

News

View MoreSouth African Reserve Bank Governor warns that the growth in stablecoin usage could impact monetary unity

11 m

SushiSwap will be integrated into the Solana blockchain, supporting cross-chain asset exchanges between Sol and EVM-compatible networks. This integration aims to enhance interoperability, allowing users to seamlessly swap assets across different blockchain ecosystems, thereby improving liquidity and user experience within the decentralized finance (DeFi) space.

17 m

Today, the Fear and Greed Index rose to 7, and the market is in a "severe panic" state.

28 m

Two teenagers in California arrested for violent home invasion robbery of $66 million worth of cryptocurrency

32 m

BTC, ETH trading volume surged abnormally in the early morning, with prices experiencing sharp fluctuations in a short period

46 m

Pin