Post content & earn content mining yield

placeholder

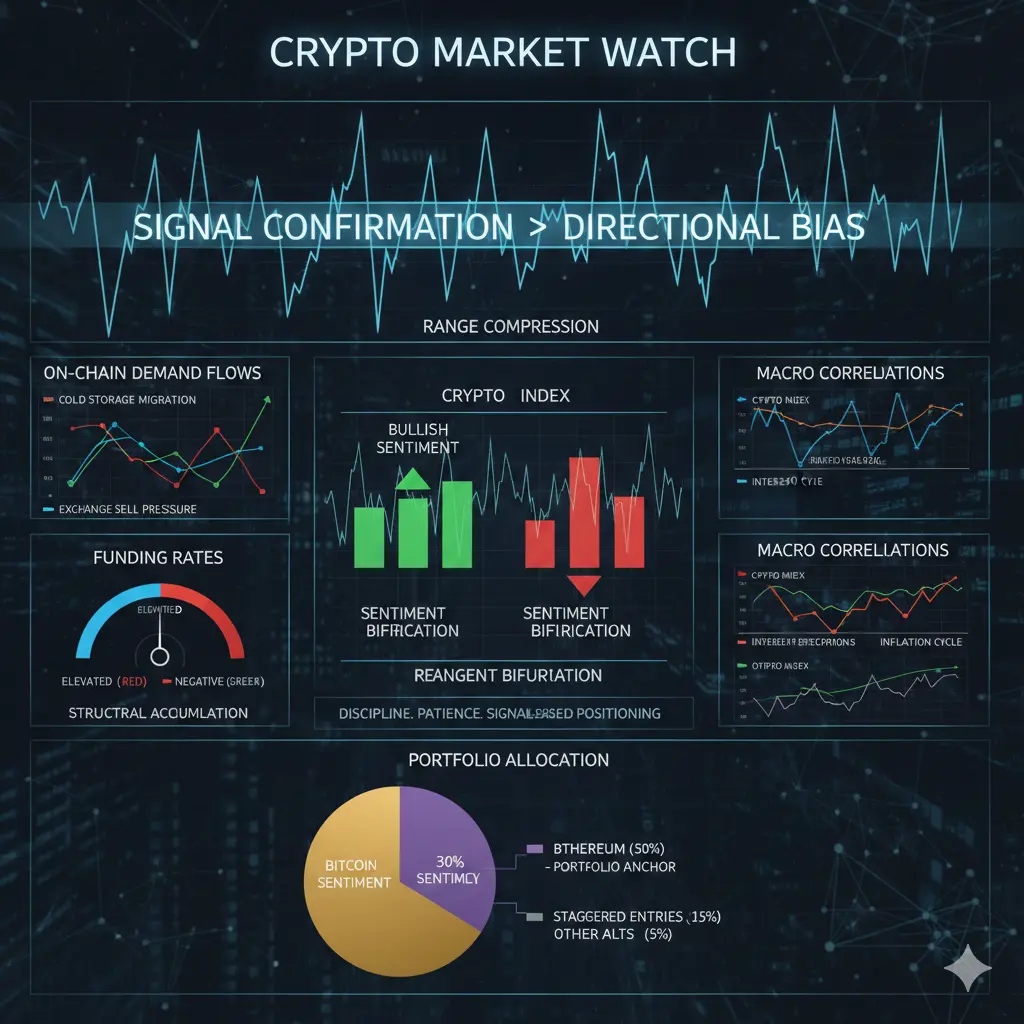

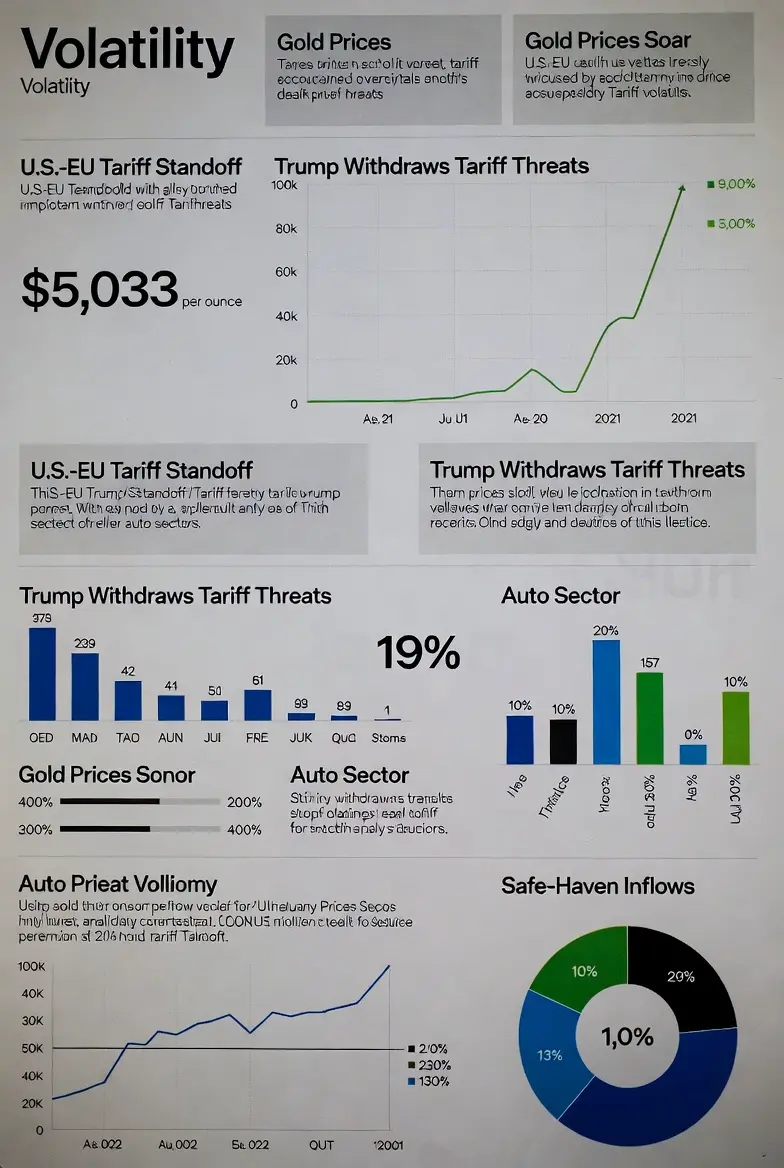

#CryptoMarketWatch Navigating Transitional Volatility

Recent market volatility has intensified, highlighting a growing divergence between bullish and bearish participants. This environment is no longer defined by simple trend continuation; instead, it reflects a classic regime transition, where price action becomes erratic as capital rotates and markets reassess macro and micro catalysts. Volatility itself is not directional — it is a symptom of uncertainty and repositioning.

My stance remains constructively bullish over the medium to long term, while tactically cautious in the short term. Thi

Recent market volatility has intensified, highlighting a growing divergence between bullish and bearish participants. This environment is no longer defined by simple trend continuation; instead, it reflects a classic regime transition, where price action becomes erratic as capital rotates and markets reassess macro and micro catalysts. Volatility itself is not directional — it is a symptom of uncertainty and repositioning.

My stance remains constructively bullish over the medium to long term, while tactically cautious in the short term. Thi

- Reward

- 3

- 2

- Repost

- Share

楚老魔 :

:

Stay tuned to 🔍View More

ADE

Digital Future ASSET COIN

Created By@Canoy212

Listing Progress

0.00%

MC:

$3.4K

Create My Token

This image says it all 🌿Start with you. Make a difference. Read the article 👉 Earn GREEN when you act with ECOX Network:#ECOX #GREEN #ECO_TO_EARN

View Original

- Reward

- like

- Comment

- Repost

- Share

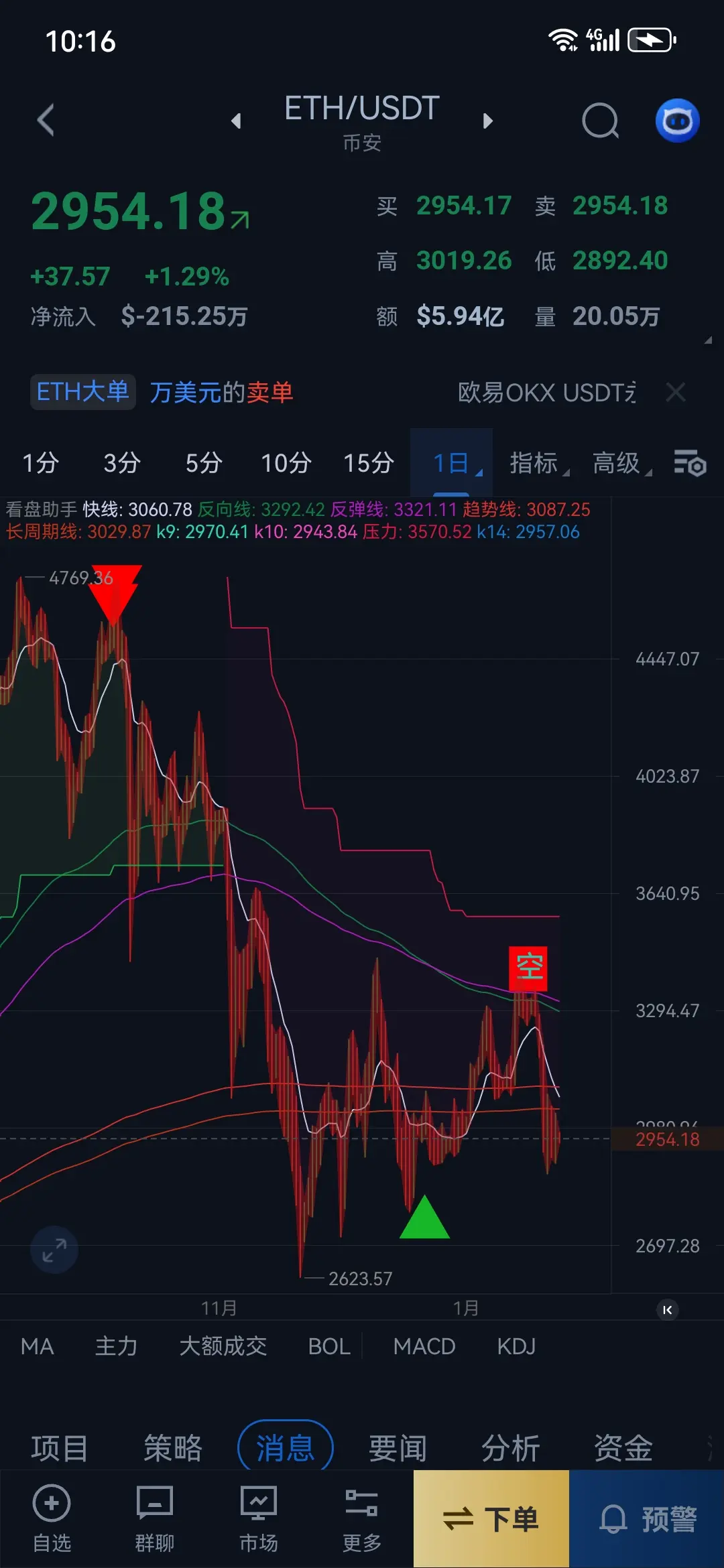

#ETH Four-Hour Market Analysis

1. EMA20, 55, 144 are in a bearish arrangement, indicating a major bearish trend.

2. MACD has broken below the zero line, and the golden cross upward suggests a rebound during the decline. Currently, the market is consolidating sideways, waiting for the indicator to reset! Liquidity is poor on Saturday and Sunday, so a downward move is expected tonight!

3. The price has broken below the four-hour upward trendline. Overall, the market is now mainly in a downtrend, and all upward movements are just rebounds!

4. The daily chart is about to break below the zero line,

1. EMA20, 55, 144 are in a bearish arrangement, indicating a major bearish trend.

2. MACD has broken below the zero line, and the golden cross upward suggests a rebound during the decline. Currently, the market is consolidating sideways, waiting for the indicator to reset! Liquidity is poor on Saturday and Sunday, so a downward move is expected tonight!

3. The price has broken below the four-hour upward trendline. Overall, the market is now mainly in a downtrend, and all upward movements are just rebounds!

4. The daily chart is about to break below the zero line,

ETH-0,31%

- Reward

- like

- Comment

- Repost

- Share

Hello everyone, I am GM Diamond Hand 💎. There are a total of 1 billion chips with a market cap of 10 million. Before listing on spot, I only buy and never sell. Boom, GM to the Moon!!!

GMWAGMI0,23%

MC:$173.45KHolders:77624

100.00%

- Reward

- 1

- Comment

- Repost

- Share

There is a skill to trading, and reflection is the way

The Dao De Jing says: “The movement of the Dao is reversal; the use of the weak is the Dao.” Trading is not based on impulse; blindly following the trend will ultimately lead to a trap.

Reflecting and consolidating after each trade is to follow the “Dao.” Summarizing the causes of gains and losses, clarifying the rhythm changes, only then can one avoid the restlessness of “confusion from excess.”

Maintain the habit of reflection, abandon impulsiveness, use calm contemplation to guide the market, which is the fundamental for long-term profi

The Dao De Jing says: “The movement of the Dao is reversal; the use of the weak is the Dao.” Trading is not based on impulse; blindly following the trend will ultimately lead to a trap.

Reflecting and consolidating after each trade is to follow the “Dao.” Summarizing the causes of gains and losses, clarifying the rhythm changes, only then can one avoid the restlessness of “confusion from excess.”

Maintain the habit of reflection, abandon impulsiveness, use calm contemplation to guide the market, which is the fundamental for long-term profi

ETH-0,31%

- Reward

- like

- Comment

- Repost

- Share

The Brainwashing Technique of Chives Coins

@

#中文Meme币热潮 Investing is a process. A good coin can be understood by its trend. Projects that lack vision and only aim for quick profits will run away in three days, so take some time and be patient. Why do some people manage to earn the returns they want (they have a broader vision)? Most people only see the immediate profits (destined to be chives). They play contracts, see profits, and run away quickly. When they hold a position, they are determined to fight the market makers to the end🤭. So, Tesla is just a spot asset. Since its successful launc

View Original@

#中文Meme币热潮 Investing is a process. A good coin can be understood by its trend. Projects that lack vision and only aim for quick profits will run away in three days, so take some time and be patient. Why do some people manage to earn the returns they want (they have a broader vision)? Most people only see the immediate profits (destined to be chives). They play contracts, see profits, and run away quickly. When they hold a position, they are determined to fight the market makers to the end🤭. So, Tesla is just a spot asset. Since its successful launc

- Reward

- like

- Comment

- Repost

- Share

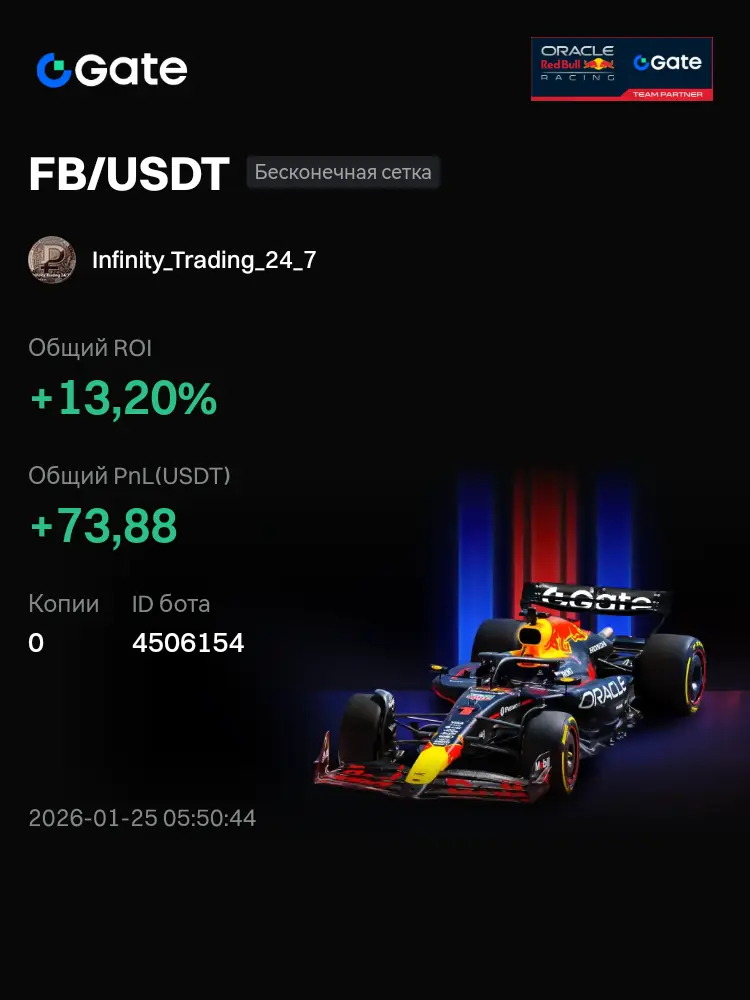

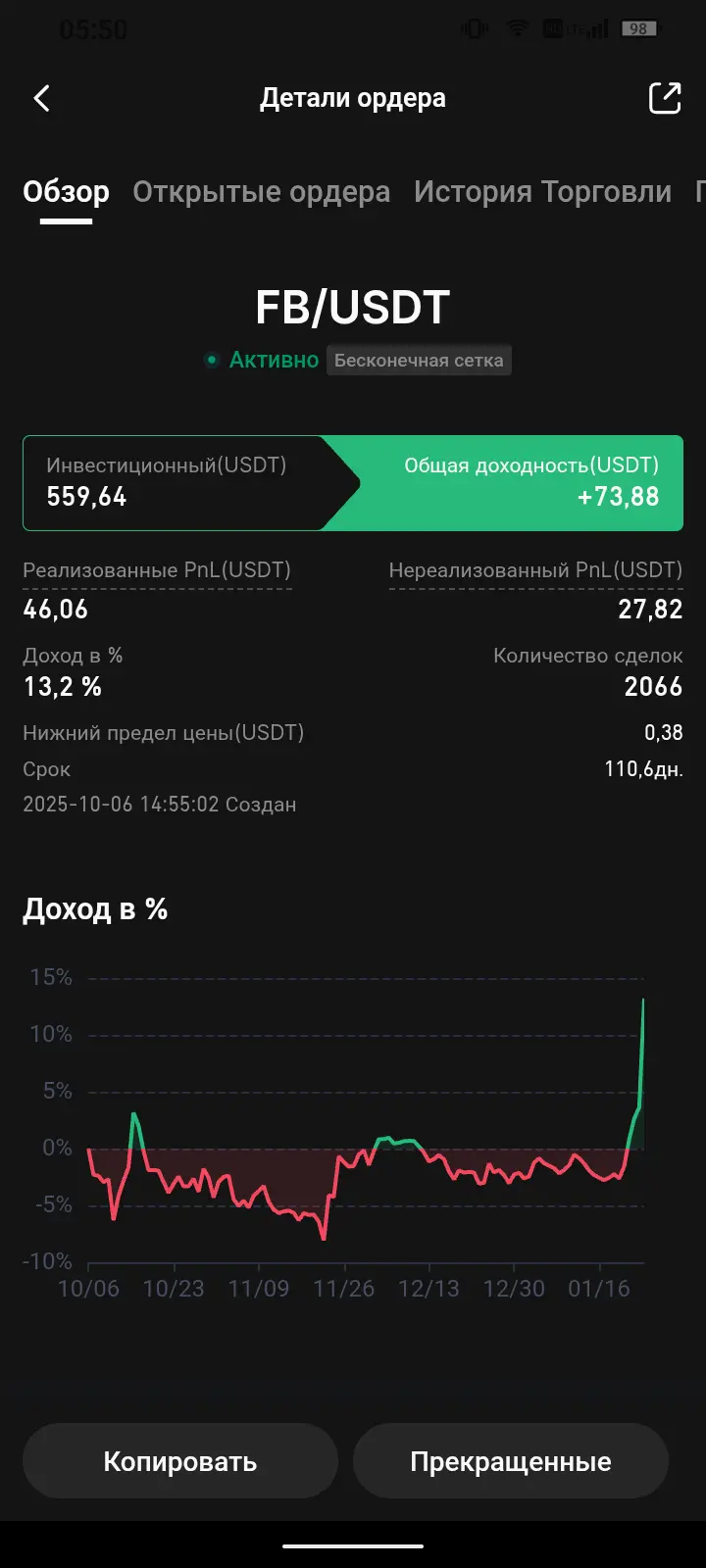

#晒出带单成就##速来!跟我赚钱##稳健带单长线收益#

Be friends with time, take your time to make money! Get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich,

View OriginalBe friends with time, take your time to make money! Get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich, get rich,

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

This token, the one that went viral on Twitter

The token that was pumped on DEXTools is definitely yours, does it feel bad to hold this long? The token has already increased by 88% and will continue to rise just like Ligh.

As long as there are still many buyers holding..

Penguin Solana

#GateWeb3UpgradestoGateDEX

View OriginalThe token that was pumped on DEXTools is definitely yours, does it feel bad to hold this long? The token has already increased by 88% and will continue to rise just like Ligh.

As long as there are still many buyers holding..

Penguin Solana

#GateWeb3UpgradestoGateDEX

- Reward

- like

- Comment

- Repost

- Share

🚨 Kevin O’Leary Streamlines Crypto Portfolio

Shark Tank’s Kevin O’Leary is selling 27 crypto positions, narrowing his bets exclusively to Bitcoin and Ethereum.

💡 What this signals: Even high-profile investors are focusing on blue-chip cryptos, prioritizing liquidity, market dominance, and long-term viability over speculative altcoins.

👀 Takeaway: In a volatile market, quality > quantity. O’Leary’s move highlights a growing trend: institutions and seasoned investors are doubling down on BTC & ETH as the pillars of the crypto ecosystem.

💬 Your thoughts — is this a smart consolidation or play

Shark Tank’s Kevin O’Leary is selling 27 crypto positions, narrowing his bets exclusively to Bitcoin and Ethereum.

💡 What this signals: Even high-profile investors are focusing on blue-chip cryptos, prioritizing liquidity, market dominance, and long-term viability over speculative altcoins.

👀 Takeaway: In a volatile market, quality > quantity. O’Leary’s move highlights a growing trend: institutions and seasoned investors are doubling down on BTC & ETH as the pillars of the crypto ecosystem.

💬 Your thoughts — is this a smart consolidation or play

- Reward

- like

- Comment

- Repost

- Share

#PI #PI The probability of a real breakout to the downside is greater than to the upside. Even if it rises, it's mainly driven by the overall market's upward movement. If it falls, there's nothing surprising about how far it drops. The main reason for buying is to gamble on being the first mover, automatically ignoring how deep the abyss might be after the fall. #PI

PI-1,07%

- Reward

- 6

- Comment

- Repost

- Share

📊 SOL/USDT Daily K Analysis - 【Weak Rebound, Continuing Bearishness】

1. Trend Structure and Moving Average Patterns

The price has been declining unilaterally from the previous high of 205.25 USDT, finding support at 116.78 USDT and entering a correction phase. Currently, the price has dipped to the 127.01 USDT level. The short-term MA5 and MA10 are showing a death cross pattern, with the price breaking below short-term moving averages, indicating that short-term bearish momentum is temporarily dominant; medium- and long-term moving averages (MA20, MA30, MA50, MA100) remain in a bearish arrang

1. Trend Structure and Moving Average Patterns

The price has been declining unilaterally from the previous high of 205.25 USDT, finding support at 116.78 USDT and entering a correction phase. Currently, the price has dipped to the 127.01 USDT level. The short-term MA5 and MA10 are showing a death cross pattern, with the price breaking below short-term moving averages, indicating that short-term bearish momentum is temporarily dominant; medium- and long-term moving averages (MA20, MA30, MA50, MA100) remain in a bearish arrang

SOL-0,52%

- Reward

- like

- Comment

- Repost

- Share

MYJB

蚂蚁金币

Created By@MunanYiBufan

Listing Progress

100.00%

MC:

$8.6K

Create My Token

#GateTradFi1gGoldGiveaway Digital Effort, Real Rewards

In January 2026, Gate TradFi is redefining crypto rewards with its 1g Gold Giveaway, bridging high-speed digital trading with one of the oldest stores of value: gold. Unlike typical promotions, this campaign rewards consistency, discipline, and participation rather than luck, making real-world value the prize.

By connecting digital effort with tangible gold, Gate TradFi emphasizes trust, stability, and long-term engagement. Participants benefit from a fair and inclusive system where every user — big or small — can compete on the same trans

In January 2026, Gate TradFi is redefining crypto rewards with its 1g Gold Giveaway, bridging high-speed digital trading with one of the oldest stores of value: gold. Unlike typical promotions, this campaign rewards consistency, discipline, and participation rather than luck, making real-world value the prize.

By connecting digital effort with tangible gold, Gate TradFi emphasizes trust, stability, and long-term engagement. Participants benefit from a fair and inclusive system where every user — big or small — can compete on the same trans

- Reward

- 3

- 3

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

#PI I used to be someone who would say a few words about how bad things are whenever I saw others complain, but repeated disappointments have made me see clearly what things are supposed to look like! It's not that we don't support him, but he is gradually wearing down our edges and our love for him!

Initially, he was just a fantasy, gaining millions of fans by drawing pie charts! And those unscrupulous hype hosts! Why not talk about whether the project is good or fake! In the mouths of those hype hosts, this project has already become rotten! Relying on deceiving and fooling those brainles

View OriginalInitially, he was just a fantasy, gaining millions of fans by drawing pie charts! And those unscrupulous hype hosts! Why not talk about whether the project is good or fake! In the mouths of those hype hosts, this project has already become rotten! Relying on deceiving and fooling those brainles

- Reward

- 6

- Comment

- Repost

- Share

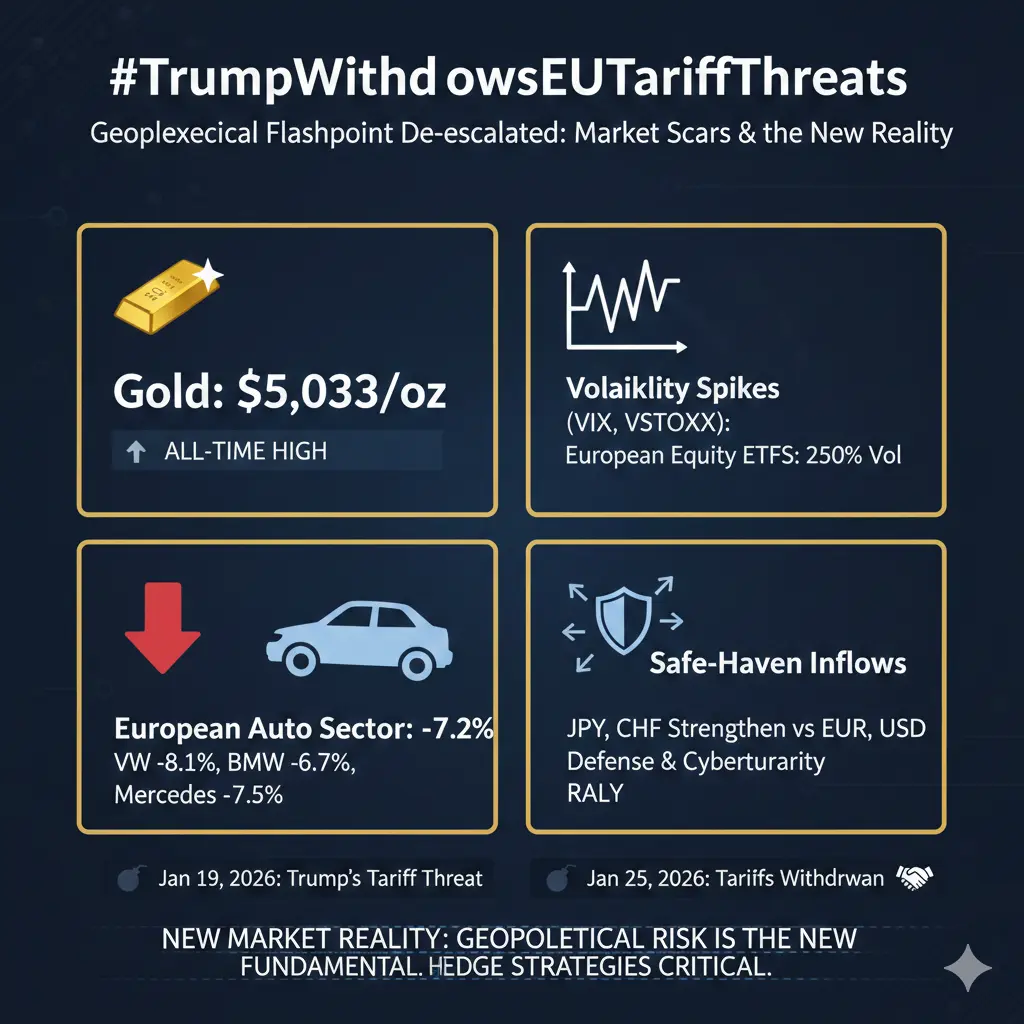

#TrumpWithdrawsEUTariffThreats

Geopolitical Flashpoint De-escalated: A Deep Dive into the U.S.-EU Tariff Standoff and Its Lasting Market Scars

The recent withdrawal of tariff threats by the Trump administration against eight European nations has provided a moment of respite for global markets. However, this de-escalation does not signify a return to the pre-2020 status quo. Instead, it formalizes a new, more volatile geopolitical reality, where financial markets have become the primary battlefield.

The episode began with President Trump's threat on January 19, 2026, to impose a 50% tariff on

Geopolitical Flashpoint De-escalated: A Deep Dive into the U.S.-EU Tariff Standoff and Its Lasting Market Scars

The recent withdrawal of tariff threats by the Trump administration against eight European nations has provided a moment of respite for global markets. However, this de-escalation does not signify a return to the pre-2020 status quo. Instead, it formalizes a new, more volatile geopolitical reality, where financial markets have become the primary battlefield.

The episode began with President Trump's threat on January 19, 2026, to impose a 50% tariff on

- Reward

- 5

- 8

- Repost

- Share

Korean_Girl :

:

Happy New Year! 🤑View More

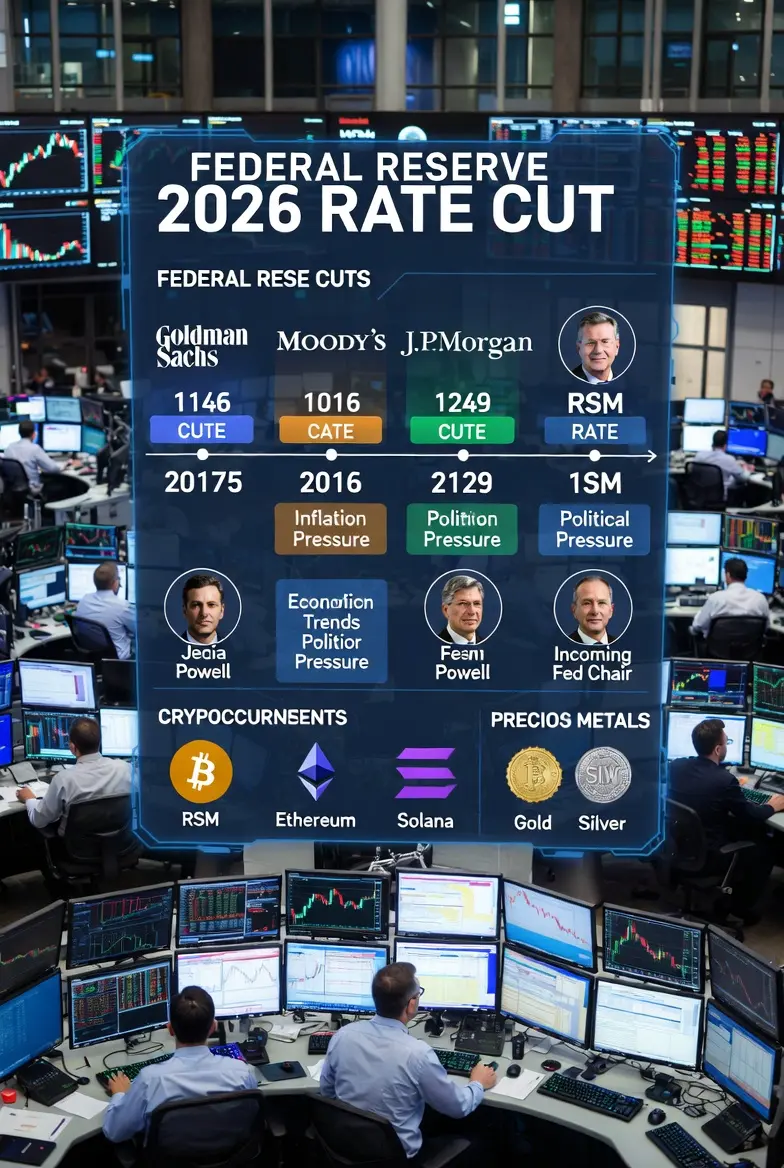

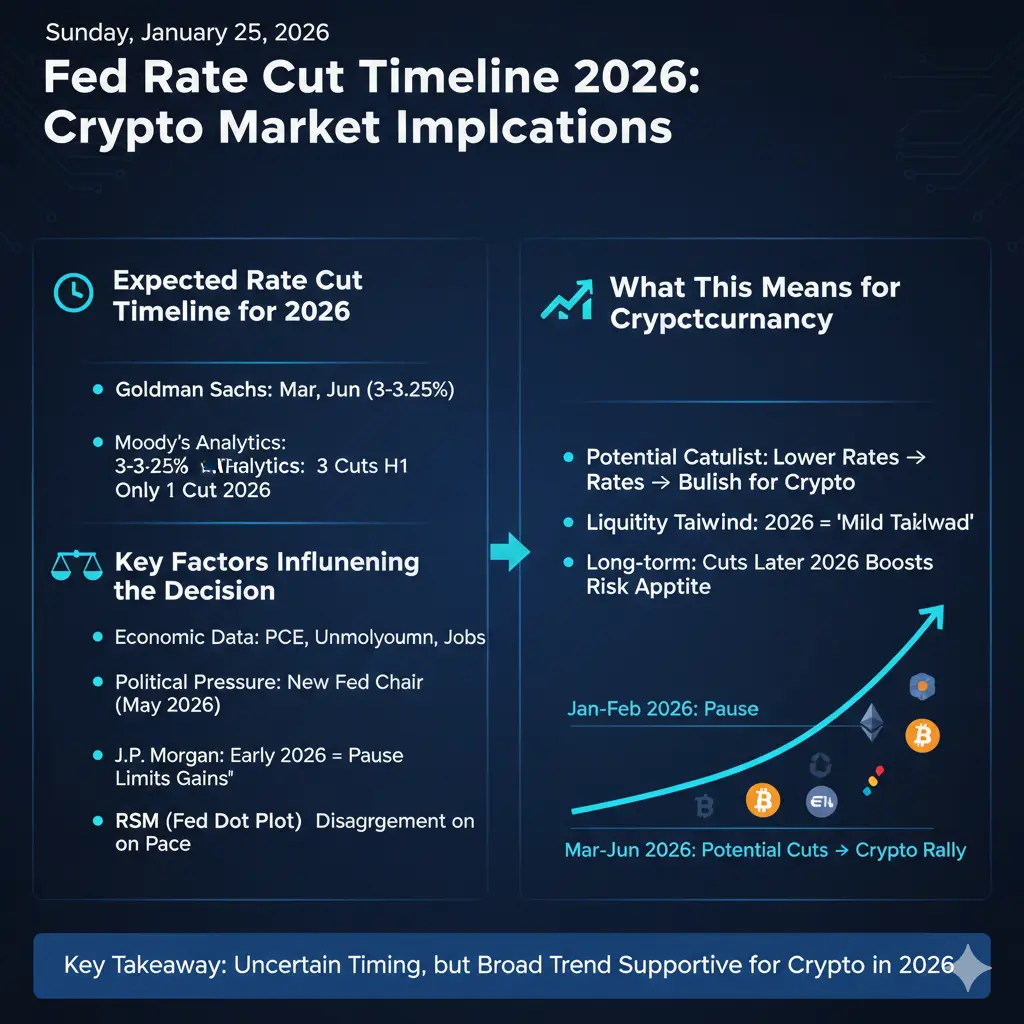

#NextFedChairPredictions

According to the latest outlooks, the most recent Fed rate cut happened in December 2025. The expectations for more cuts in 2026 are mixed, with many experts predicting the Fed will wait before cutting again. The next meeting is scheduled for January 27-28, 2026, but the likelihood of a cut then is very low.

⏳ Expected Rate Cut Timeline for 2026

Different financial institutions have varying forecasts for when the Fed might cut rates again:

· Goldman Sachs Research: Pause in January, then cuts in March and June 2026, bringing the rate to 3-3.25%.

· Mark Zandi, Moody's

According to the latest outlooks, the most recent Fed rate cut happened in December 2025. The expectations for more cuts in 2026 are mixed, with many experts predicting the Fed will wait before cutting again. The next meeting is scheduled for January 27-28, 2026, but the likelihood of a cut then is very low.

⏳ Expected Rate Cut Timeline for 2026

Different financial institutions have varying forecasts for when the Fed might cut rates again:

· Goldman Sachs Research: Pause in January, then cuts in March and June 2026, bringing the rate to 3-3.25%.

· Mark Zandi, Moody's

BTC-0,67%

- Reward

- 4

- 8

- Repost

- Share

Korean_Girl :

:

2026 GOGOGO 👊View More

☀Excellent opportunity, compliant track☀

🚀Lindatong's ten-thousand-fold ecosystem token LDT, with unlimited potential and daily increases! 2026 super dark horse! Extremely deflationary destruction, with ten-thousand-fold appreciation space. Missing out will be a lifelong regret. LDT does not promise overnight riches or fleeting fame; it is a choice for ordinary people to take fewer detours.

Lindatong (Limdex) was officially established on October 30, 2024, in Canada 🇨🇦, founded by seasoned Wall Street financier Matteo Luskka. It is a global technology financial platform audited by Canadian

🚀Lindatong's ten-thousand-fold ecosystem token LDT, with unlimited potential and daily increases! 2026 super dark horse! Extremely deflationary destruction, with ten-thousand-fold appreciation space. Missing out will be a lifelong regret. LDT does not promise overnight riches or fleeting fame; it is a choice for ordinary people to take fewer detours.

Lindatong (Limdex) was officially established on October 30, 2024, in Canada 🇨🇦, founded by seasoned Wall Street financier Matteo Luskka. It is a global technology financial platform audited by Canadian

BTC-0,67%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More58.58K Popularity

34.29K Popularity

28.43K Popularity

10.3K Popularity

21.9K Popularity

News

View MoreRootData: EIGEN will unlock tokens worth approximately $12.91 million in one week

22 m

RootData: BEAT will unlock tokens worth approximately $6.02 million in one week.

22 m

Overview of popular cryptocurrencies on January 25, 2026, with the top three in popularity being: PENGUIN, FIGHT, ENSO

23 m

RootData: ZETA will unlock tokens worth approximately $3.19 million in one week

23 m

Brazil Central Bank: Banks and brokerages must hire independent third-party compliance certification to conduct cryptocurrency business

24 m

Pin