⚡ Altcoin Performance Diverging – Dragon Fly Official

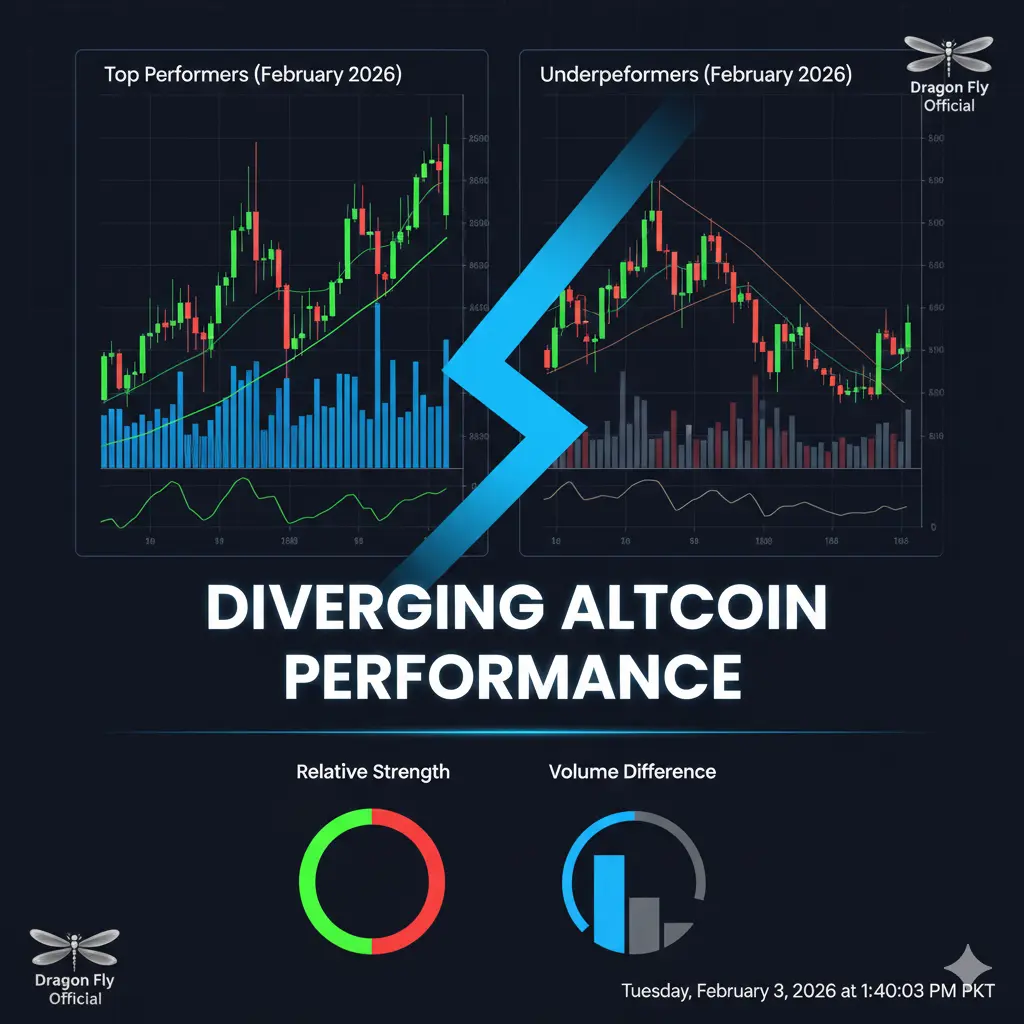

Current Market Snapshot:

Altcoins show mixed performance: some top projects gaining steadily while others are under pressure.

Overall market volatility is rising, creating clear winners and laggards.

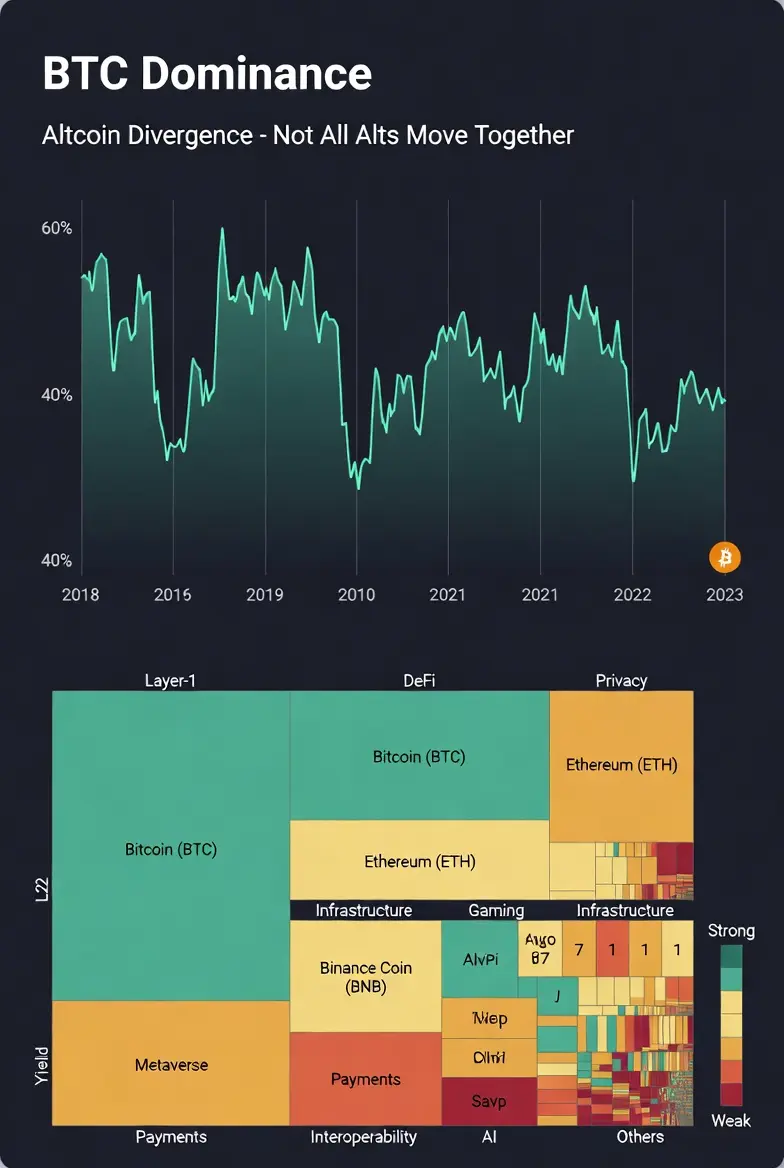

📉 Price vs Fundamentals: Altcoin Divergence

Price Signals (Dragon Fly Official):

Many altcoins are struggling to sustain rallies, while a few outperform consistently.

Short-term price action is choppy, making timing tricky.

Fundamentals (Dragon Fly Official):

On-chain activity, staking, and development metrics vary widely across projects.

Layer-2 and DeFi integration amplify divergence — some tokens benefit more than others.

Institutional interest and liquidity flows tend to favor higher-quality altcoins.

Insight: This divergence highlights the importance of selective observation — not all altcoins move together, and understanding relative strength is key.

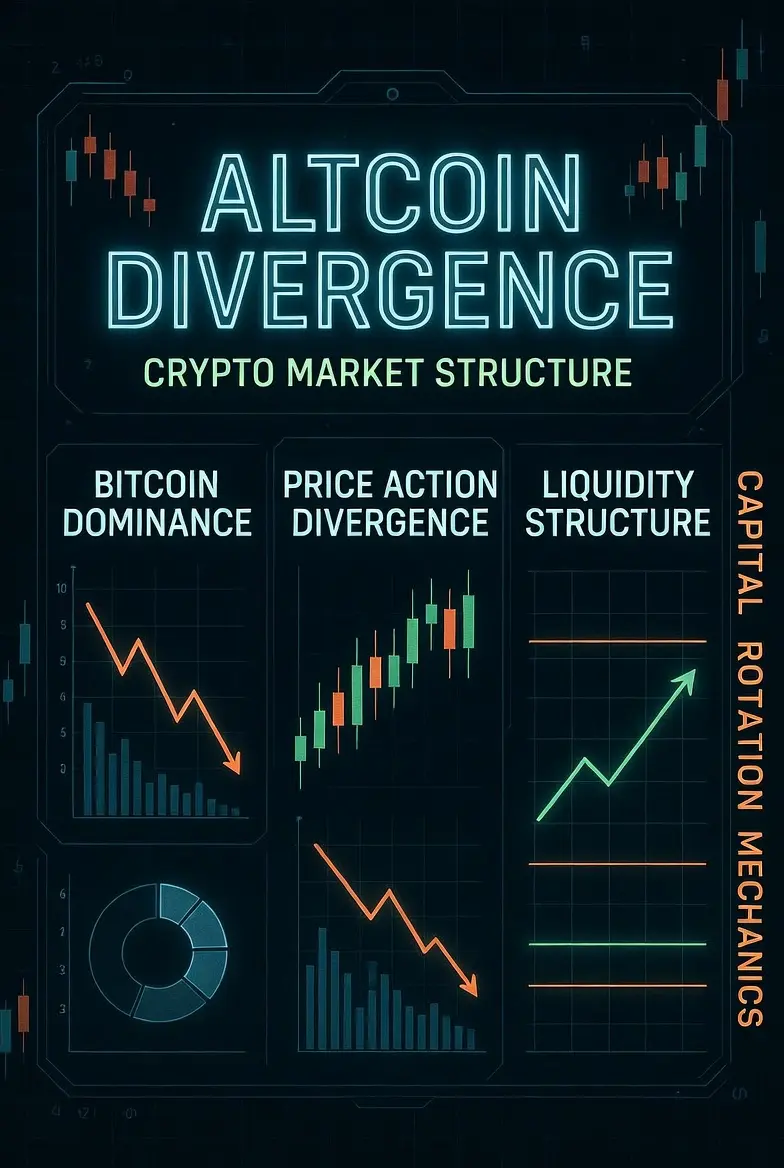

🔎 Why Divergence Exists

Project Fundamentals Vary: Strong tech, active dev teams, and adoption drive outperformance.

Liquidity Flows: Institutional and retail capital often concentrates in top-tier projects.

Macro & Sentiment Factors: Risk-on vs. risk-off behavior affects small/mid-cap altcoins differently.

Market Rotation: Profit-taking in lagging coins can fuel momentum in leaders.

💡 How Dragon Fly Official Approaches Altcoins

Selective Observation: Focus on altcoins showing relative strength vs. the overall market.

Step Back When Unclear: Avoid chasing weak performers during volatile periods.

Monitor On-Chain Metrics: Transactions, staking, and network activity are leading indicators.

Risk Management: Altcoins carry higher volatility — adjust position sizes accordingly.

📈 Long-Term Thesis (Dragon Fly Official View)

High-quality altcoins with strong adoption, development, and Layer-2 integration are more likely to retain value and grow long-term.

Market rotation and selective accumulation can provide opportunities, but patience and discipline are key.

📊 Summary Table

Price TrendDivergent, volatileOn-Chain ActivityVaries by projectLayer-2 / DeFi AdoptionDrives leadersFundamental HealthMixed across altcoinsMarket SentimentRotation in progress

Key Takeaway (Dragon Fly Official): Altcoin performance is diverging — step back when uncertain, or engage selectively in strong performers.

⚠️ Risk Warning

Altcoins are highly volatile:

Price swings can be extreme and unpredictable.

Past performance is not indicative of future results.

Only invest what you can afford to lose.

Use proper risk management, stop-losses, and position sizing.

#AltcoinDivergence

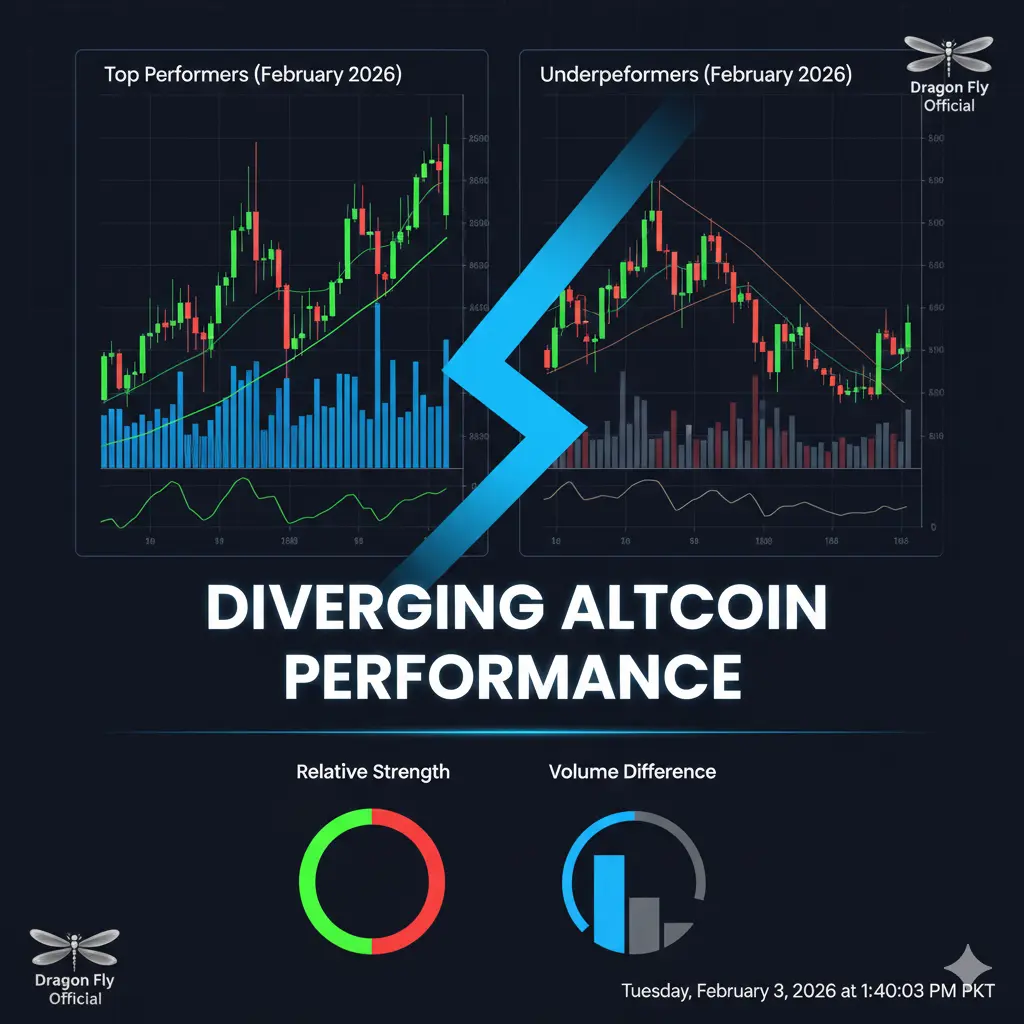

Current Market Snapshot:

Altcoins show mixed performance: some top projects gaining steadily while others are under pressure.

Overall market volatility is rising, creating clear winners and laggards.

📉 Price vs Fundamentals: Altcoin Divergence

Price Signals (Dragon Fly Official):

Many altcoins are struggling to sustain rallies, while a few outperform consistently.

Short-term price action is choppy, making timing tricky.

Fundamentals (Dragon Fly Official):

On-chain activity, staking, and development metrics vary widely across projects.

Layer-2 and DeFi integration amplify divergence — some tokens benefit more than others.

Institutional interest and liquidity flows tend to favor higher-quality altcoins.

Insight: This divergence highlights the importance of selective observation — not all altcoins move together, and understanding relative strength is key.

🔎 Why Divergence Exists

Project Fundamentals Vary: Strong tech, active dev teams, and adoption drive outperformance.

Liquidity Flows: Institutional and retail capital often concentrates in top-tier projects.

Macro & Sentiment Factors: Risk-on vs. risk-off behavior affects small/mid-cap altcoins differently.

Market Rotation: Profit-taking in lagging coins can fuel momentum in leaders.

💡 How Dragon Fly Official Approaches Altcoins

Selective Observation: Focus on altcoins showing relative strength vs. the overall market.

Step Back When Unclear: Avoid chasing weak performers during volatile periods.

Monitor On-Chain Metrics: Transactions, staking, and network activity are leading indicators.

Risk Management: Altcoins carry higher volatility — adjust position sizes accordingly.

📈 Long-Term Thesis (Dragon Fly Official View)

High-quality altcoins with strong adoption, development, and Layer-2 integration are more likely to retain value and grow long-term.

Market rotation and selective accumulation can provide opportunities, but patience and discipline are key.

📊 Summary Table

Price TrendDivergent, volatileOn-Chain ActivityVaries by projectLayer-2 / DeFi AdoptionDrives leadersFundamental HealthMixed across altcoinsMarket SentimentRotation in progress

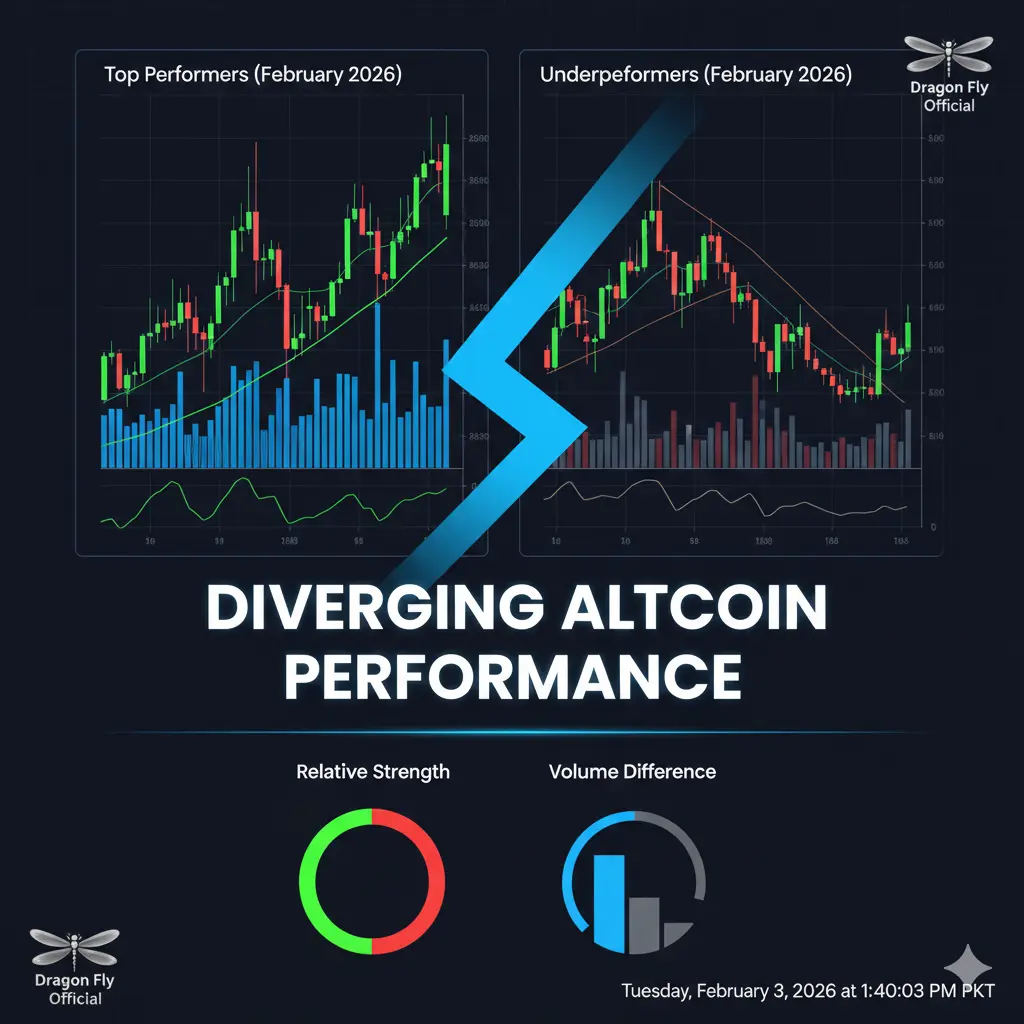

Key Takeaway (Dragon Fly Official): Altcoin performance is diverging — step back when uncertain, or engage selectively in strong performers.

⚠️ Risk Warning

Altcoins are highly volatile:

Price swings can be extreme and unpredictable.

Past performance is not indicative of future results.

Only invest what you can afford to lose.

Use proper risk management, stop-losses, and position sizing.

#AltcoinDivergence