# BItcoin

6.62M

MissCrypto

#NextFedChairPredictions

Who’s the Favorite for Fed Chair — And How Will It Impact Markets?

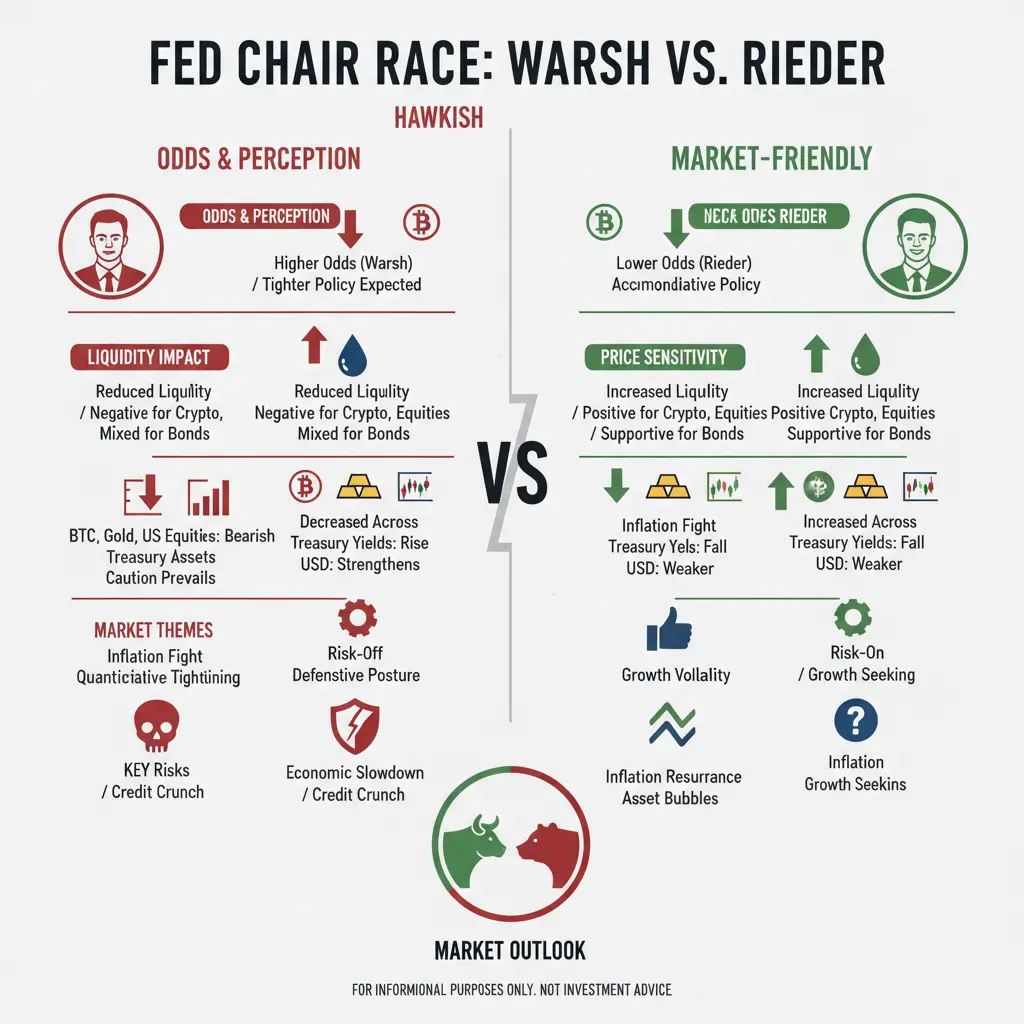

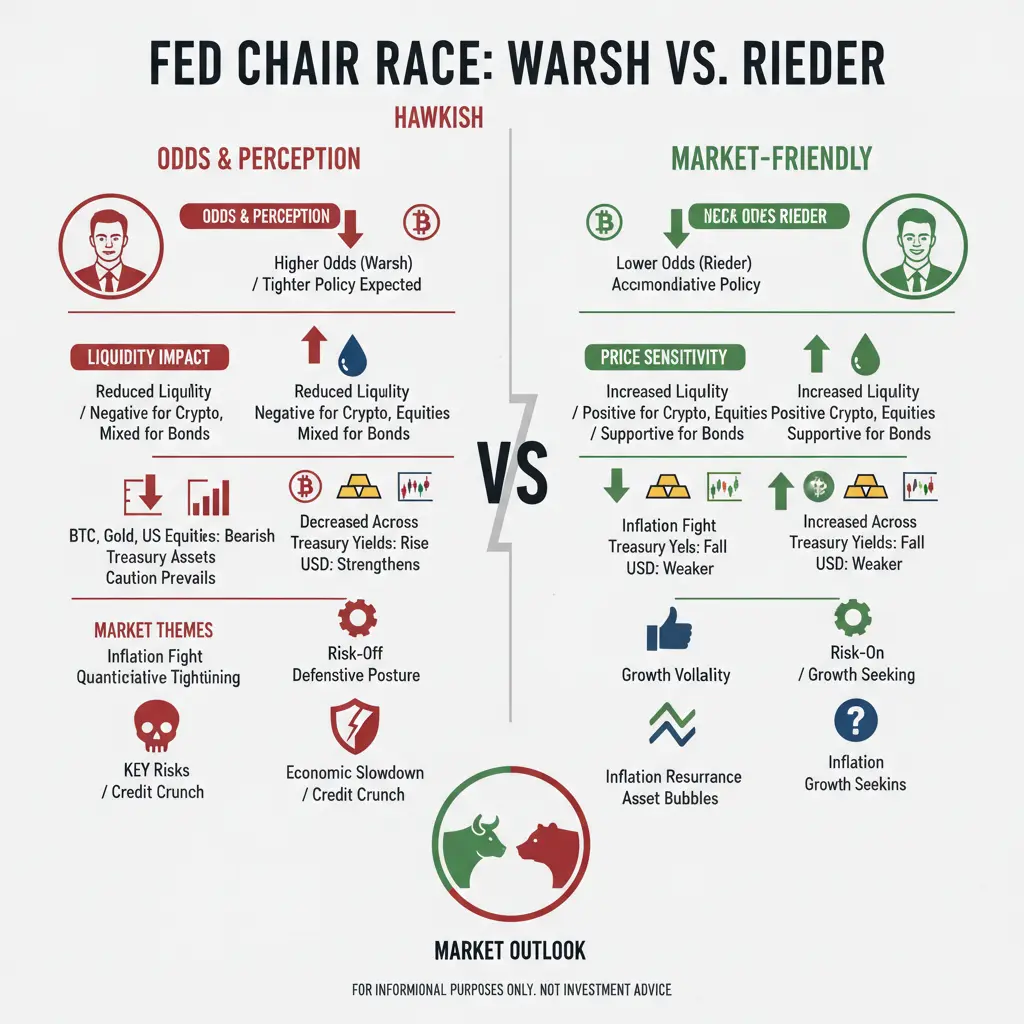

The race to replace Jerome Powell as Chair of the Federal Reserve has become one of the most influential macro events in global finance. President Trump has narrowed his shortlist, with Kevin Warsh and Rick Rieder emerging as clear frontrunners. Trump has hinted he could announce his decision as soon as next week, with Powell’s term ending in May.

This decision is not only political — it will directly impact liquidity, interest rates, market volatility, capital flow, and asset prices across crypto, equi

Who’s the Favorite for Fed Chair — And How Will It Impact Markets?

The race to replace Jerome Powell as Chair of the Federal Reserve has become one of the most influential macro events in global finance. President Trump has narrowed his shortlist, with Kevin Warsh and Rick Rieder emerging as clear frontrunners. Trump has hinted he could announce his decision as soon as next week, with Powell’s term ending in May.

This decision is not only political — it will directly impact liquidity, interest rates, market volatility, capital flow, and asset prices across crypto, equi

- Reward

- 14

- 22

- Repost

- Share

HighAmbition :

:

Happy New Year! 🤑View More

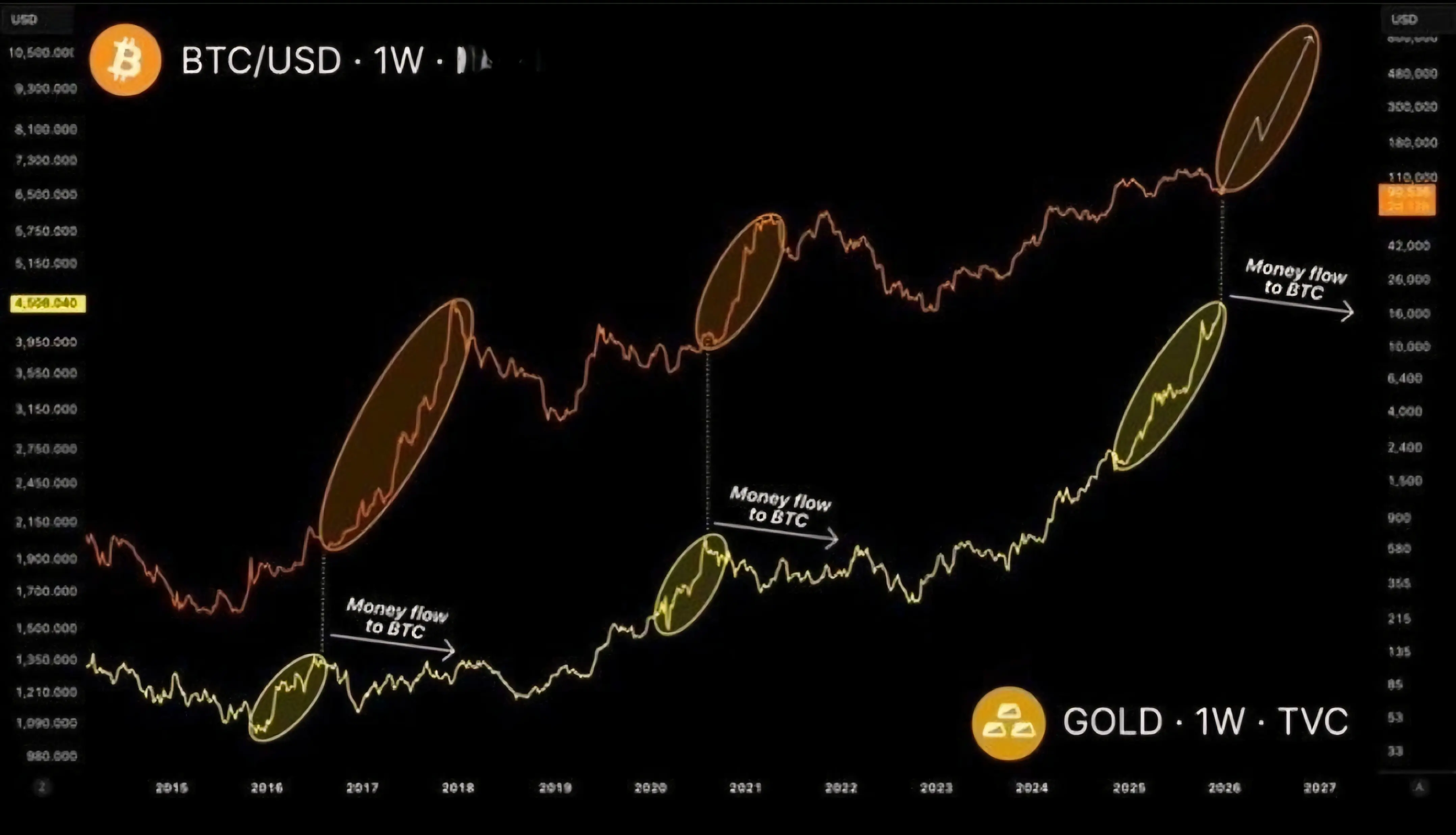

First #الذهب . Then #البيتكوين .

History shows a clear pattern during monetary shifts: capital first moves to #XAUUSDT , then shifts to #BTCUSDT .

Gold leads this cycle, reaching record levels as central banks buy in and global risks rise. In contrast, Bitcoin lags behind gold, a pattern observed before major Bitcoin price surges.

This divergence is temporary. Once gold's rally completes and supply diminishes, capital looks for further gains, and Bitcoin becomes the next destination.

Bitcoin ETFs currently absorb more than the new supply.

If history repeats itself, the rise in gold is the sign

History shows a clear pattern during monetary shifts: capital first moves to #XAUUSDT , then shifts to #BTCUSDT .

Gold leads this cycle, reaching record levels as central banks buy in and global risks rise. In contrast, Bitcoin lags behind gold, a pattern observed before major Bitcoin price surges.

This divergence is temporary. Once gold's rally completes and supply diminishes, capital looks for further gains, and Bitcoin becomes the next destination.

Bitcoin ETFs currently absorb more than the new supply.

If history repeats itself, the rise in gold is the sign

BTC-1,44%

- Reward

- 1

- 1

- Repost

- Share

BasheerAlgundubi :

:

Bitcoin exchange-traded funds currently absorb more than the new supply. If history repeats itself, the rise in gold is the signal, and Bitcoin will follow suit. 🚀

#NextFedChairPredictions

Who’s the Favorite for Fed Chair — And How Will It Impact Markets?

The race to replace Jerome Powell as Chair of the Federal Reserve has become one of the most influential macro events in global finance. President Trump has narrowed his shortlist, with Kevin Warsh and Rick Rieder emerging as clear frontrunners. Trump has hinted he could announce his decision as soon as next week, with Powell’s term ending in May.

This decision is not only political — it will directly impact liquidity, interest rates, market volatility, capital flow, and asset prices across crypto, equi

Who’s the Favorite for Fed Chair — And How Will It Impact Markets?

The race to replace Jerome Powell as Chair of the Federal Reserve has become one of the most influential macro events in global finance. President Trump has narrowed his shortlist, with Kevin Warsh and Rick Rieder emerging as clear frontrunners. Trump has hinted he could announce his decision as soon as next week, with Powell’s term ending in May.

This decision is not only political — it will directly impact liquidity, interest rates, market volatility, capital flow, and asset prices across crypto, equi

- Reward

- 7

- 3

- Repost

- Share

Selmus :

:

BTC ETH BTC ETH BTC ETHView More

📊 BTCUSDT – 1 Hour Structure Reading

🔎 General Overview

Bitcoin has recovered in a V-shape after a sharp decline.

Then, the price was rejected in the 90.5K–91K zone and rebalanced.

Currently, the market is at a decision point, with no clear direction.

🔴 Resistance Zones

90,500 – 90,900 (yellow & purple lines)

→ Broken but no close above

→ High chance of false breakout

92,200 – 92,400 (purple upper band)

→ Strong sell zone by design

93,000+

→ However, trend continuation may be discussed

🟢 Support Zones

89,300 – 89,000 (current area)

→ Short-term balance

88,200 – 87,800 (green line)

→ Most c

🔎 General Overview

Bitcoin has recovered in a V-shape after a sharp decline.

Then, the price was rejected in the 90.5K–91K zone and rebalanced.

Currently, the market is at a decision point, with no clear direction.

🔴 Resistance Zones

90,500 – 90,900 (yellow & purple lines)

→ Broken but no close above

→ High chance of false breakout

92,200 – 92,400 (purple upper band)

→ Strong sell zone by design

93,000+

→ However, trend continuation may be discussed

🟢 Support Zones

89,300 – 89,000 (current area)

→ Short-term balance

88,200 – 87,800 (green line)

→ Most c

BTC-1,44%

- Reward

- 11

- 9

- Repost

- Share

KatyPaty :

:

Happy New Year! 🤑View More

Is the 2026 Bull Run Just Getting Started? 🚀 3 Reasons Why I’m Bullish Right Now!

With the recent market volatility, many are asking if the top is in. I’ve been looking at the data, and here is why I think we are headed much higher:

Institutional Adoption: We are seeing record inflows into spot ETFs this month. The "Big Money" isn't leaving; they are accumulating.

AI & Blockchain Synergy: Projects merging AI with decentralized finance are seeing real-world utility. This isn't just hype anymore—it’s infrastructure.

Macro Factors: With global interest rates stabilizing, liquidity is flowing

With the recent market volatility, many are asking if the top is in. I’ve been looking at the data, and here is why I think we are headed much higher:

Institutional Adoption: We are seeing record inflows into spot ETFs this month. The "Big Money" isn't leaving; they are accumulating.

AI & Blockchain Synergy: Projects merging AI with decentralized finance are seeing real-world utility. This isn't just hype anymore—it’s infrastructure.

Macro Factors: With global interest rates stabilizing, liquidity is flowing

- Reward

- 1

- Comment

- Repost

- Share

#البيتكوين drops to $86,000 with $60 million long buy positions liquidated within 30 minutes

#Bitcoin price drops to the $86,000 level, recording a decline of more than 3% over the past 24 hours, trading at $86,481.

This decline comes amid a sharp downturn in the crypto markets, where Ethereum's price fell by about 5% to $2,823, while #XRP decreased by 3% to $1.81, and Solana also dropped by 5.63% during the same period.

The fall in #BTC 's price led to the liquidation of long leveraged buy positions worth nearly $60 million in just 30 minutes, reflecting high market volatility.

Meanwhile,

View Original#Bitcoin price drops to the $86,000 level, recording a decline of more than 3% over the past 24 hours, trading at $86,481.

This decline comes amid a sharp downturn in the crypto markets, where Ethereum's price fell by about 5% to $2,823, while #XRP decreased by 3% to $1.81, and Solana also dropped by 5.63% during the same period.

The fall in #BTC 's price led to the liquidation of long leveraged buy positions worth nearly $60 million in just 30 minutes, reflecting high market volatility.

Meanwhile,

- Reward

- 2

- 1

- Repost

- Share

BasheerAlgundubi :

:

Bitcoin is not experiencing a demand problem, but is going through what it describes as a "supply distribution event," explaining that large inflows into (#ETFs ) absorb significant amounts of supply relinquished by early adopters after more than a decade of holding.Can XRP Surpass Bitcoin? Analyst Warns of Global Liquidity Crisis.

Key Points

A cryptocurrency analyst warns that a global liquidity crisis could expose weaknesses in traditional settlement systems.

Oil price shocks and a decline in yen trading may trigger forced sales in #البيتكوين , ETFs, and stablecoins.

The spot settlement model for #Ripple is seen as a potential advantage in turbulent market conditions.

Crypto analyst Jake Cleaver believes XRP will outperform Bitcoin to become the top digital asset. In part four of the "XRP Domino Theory" series, he explains how a global financial crisis

View OriginalKey Points

A cryptocurrency analyst warns that a global liquidity crisis could expose weaknesses in traditional settlement systems.

Oil price shocks and a decline in yen trading may trigger forced sales in #البيتكوين , ETFs, and stablecoins.

The spot settlement model for #Ripple is seen as a potential advantage in turbulent market conditions.

Crypto analyst Jake Cleaver believes XRP will outperform Bitcoin to become the top digital asset. In part four of the "XRP Domino Theory" series, he explains how a global financial crisis

- Reward

- 2

- Comment

- Repost

- Share

📉➡️📈 Bitcoin Seller Fatigue Signals a Potential Market Shift

#Bitcoin #Cryptocurrency #Altcoins

Bitcoin’s recent price action is showing early signs of seller fatigue — a condition where selling pressure weakens despite repeated attempts to push price lower. This behavior often appears near transition phases, when markets move from distribution to stabilization and, eventually, accumulation.

🔍 What the Market Is Telling Us • Downside momentum is slowing despite negative headlines

• Sell-offs are being absorbed more quickly

• Volume on red candles is declining, suggesting exhaustion rather t

#Bitcoin #Cryptocurrency #Altcoins

Bitcoin’s recent price action is showing early signs of seller fatigue — a condition where selling pressure weakens despite repeated attempts to push price lower. This behavior often appears near transition phases, when markets move from distribution to stabilization and, eventually, accumulation.

🔍 What the Market Is Telling Us • Downside momentum is slowing despite negative headlines

• Sell-offs are being absorbed more quickly

• Volume on red candles is declining, suggesting exhaustion rather t

BTC-1,44%

- Reward

- 3

- 1

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊JUST IN: Bitcoin Rejects $90,000 as "Tariff Relief" Rally Fails to Hold.

The weekend bounce was a trap. Despite the revocation of the U.S.-Greenland tariffs, Bitcoin has failed to sustain momentum above psychological resistance and is currently trading back at $88,455. The "Extreme Fear" sentiment (Index 34) is overriding the geopolitical relief.

This matters because the market structure is weakening.

We are seeing a "spot demand void." Open Interest has dropped to $27.9 billion, signaling that institutions are de-risking rather than accumulating at these levels. With the $90,200 moving averag

The weekend bounce was a trap. Despite the revocation of the U.S.-Greenland tariffs, Bitcoin has failed to sustain momentum above psychological resistance and is currently trading back at $88,455. The "Extreme Fear" sentiment (Index 34) is overriding the geopolitical relief.

This matters because the market structure is weakening.

We are seeing a "spot demand void." Open Interest has dropped to $27.9 billion, signaling that institutions are de-risking rather than accumulating at these levels. With the $90,200 moving averag

BTC-1,44%

- Reward

- 1

- Comment

- Repost

- Share

#CryptoMarketWatch 📊 | Market Snapshot

The crypto market shows mixed signals as volatility stays high.

🔹 Bitcoin (BTC): Trading near key support — holding steady amid cautious sentiment.

🔹 Ethereum (ETH): Under pressure but defending short-term support zones.

📌 Market Highlights:

Institutional interest in crypto continues to grow, signaling long-term confidence.

Traders are watching macro signals and upcoming policy moves.

Short-term consolidation could lead to heightened volatility.

⚠️ Sentiment: Neutral → cautious. Focus on risk management and monitor key levels for potential breakouts.

The crypto market shows mixed signals as volatility stays high.

🔹 Bitcoin (BTC): Trading near key support — holding steady amid cautious sentiment.

🔹 Ethereum (ETH): Under pressure but defending short-term support zones.

📌 Market Highlights:

Institutional interest in crypto continues to grow, signaling long-term confidence.

Traders are watching macro signals and upcoming policy moves.

Short-term consolidation could lead to heightened volatility.

⚠️ Sentiment: Neutral → cautious. Focus on risk management and monitor key levels for potential breakouts.

- Reward

- 2

- 1

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

81.18K Popularity

54.11K Popularity

44.13K Popularity

17.51K Popularity

32.89K Popularity

26.92K Popularity

19.31K Popularity

90.79K Popularity

59.25K Popularity

29.24K Popularity

19.75K Popularity

13.93K Popularity

266.58K Popularity

29.18K Popularity

186.71K Popularity

News

View MoreTrader Exits PENGUIN Position with $109.4K Profit, Reinvests in GHOST

8 m

BTR (Bitlayer) increased by 37.53% in the past 24 hours

9 m

Nansen now supports Sui, providing real-time ecosystem data and on-chain insights

12 m

MoonPay signs multi-million dollar naming sponsorship deal with extreme sports event X Games

14 m

A certain wallet received 465,000 HYPE from Galaxy Digital OTC, worth $10.32 million.

17 m

Pin