#CMEGroupPlansCMEToken 🏦 CME Group Plans Proprietary Digital Token — “CME Token” Could Power 24/7 Crypto Trading & Tokenized Collateral

In a major signal of traditional finance embracing blockchain infrastructure, CME Group, the world’s largest derivatives marketplace, is exploring the launch of a proprietary digital token, informally dubbed the “CME Token”. The news emerged during CME’s Q4 2025 earnings call in early February 2026, where Chairman and CEO Terrence Duffy highlighted initiatives to modernize post-trade processes through tokenized cash and decentralized settlement systems.

Duffy explained that CME’s research is focused on creating a digital asset to support margin, collateral management, and settlement for institutional participants. The token would likely operate on a decentralized or distributed ledger, enabling faster and more capital-efficient processing of high-value derivatives transactions compared with traditional banking rails. While specifics remain preliminary, the concept signals CME’s broader push to modernize infrastructure and improve liquidity efficiency in highly regulated markets.

🏦 Tokenized Cash and Google Cloud Partnership

The CME Token initiative runs alongside CME’s ongoing collaboration with Google Cloud, which began in March 2025. The partnership focuses on a tokenized cash solution scheduled for rollout later in 2026, leveraging Google Cloud’s Universal Ledger technology to digitize bank deposits and cash equivalents for use as trading collateral. This would allow near-instant settlement, reduce counterparty friction, and support continuous market operations—capabilities increasingly critical as markets move toward 24/7 trading models.

📈 Crypto Derivatives Expansion and 24/7 Trading

CME’s token plans coincide with a major expansion of its cryptocurrency derivatives products. The exchange intends to offer round-the-clock trading for major crypto futures and options — including BTC, ETH, SOL, XRP, ADA, LINK, and XLM — pending regulatory approval. Crypto derivatives volumes have surged dramatically, with Q4 2025 daily averages rising over 90% YoY to $13 billion, underscoring growing institutional demand and the need for efficient collateral and settlement solutions.

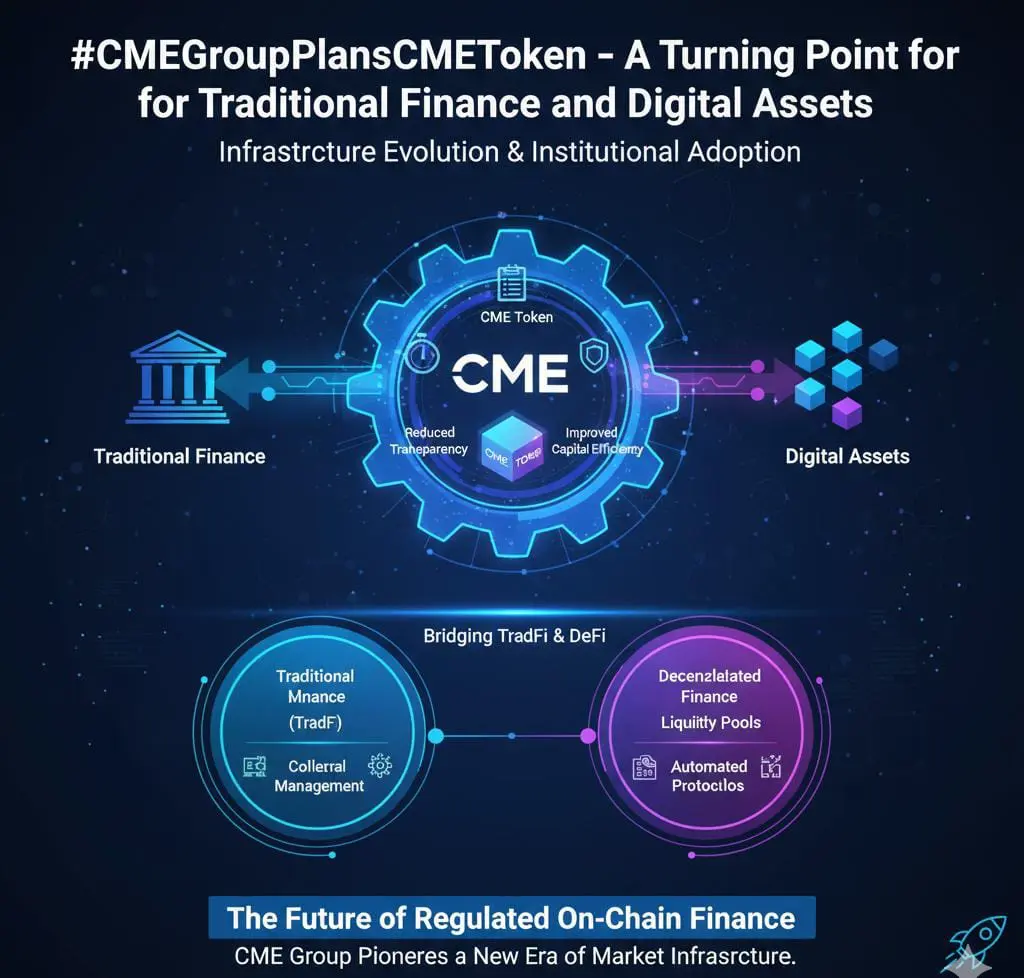

🏛️ Strategic Implications for Institutional Finance

A CME-issued token would represent a significant strategic step in attracting institutional participants. Unlike retail-focused stablecoins, a CME token would prioritize systemic stability, collateral mobility, and regulatory compliance, integrating seamlessly with CME’s multi-trillion-dollar derivatives ecosystem. It could streamline margin calls, reduce settlement risk, and enhance capital efficiency, while positioning CME as a key player in bridging traditional finance and blockchain infrastructure.

⚖️ Regulatory and Technical Challenges

Despite the promise, significant hurdles remain. Oversight from regulators such as the CFTC will be critical in shaping the token’s structure, permissible uses, and risk controls. Technical challenges include integration with existing clearing systems, cybersecurity safeguards, and cross-platform interoperability. Maintaining price stability, operational reliability, and institutional trust will be essential for large-scale adoption.

🔮 Broader Implications for Crypto Markets

CME’s move reflects a wider trend toward tokenized real-world assets and digital settlement layers. A successful CME token could set a benchmark for regulated digital collateral, encouraging adoption among exchanges, custodians, and clearinghouses worldwide. It demonstrates that blockchain is no longer treated solely as an experimental technology, but increasingly as a core component of financial infrastructure.

📌 Impact on Derivatives and Institutional Adoption

By linking digital collateral, tokenized cash, and 24/7 trading, CME could transform how derivatives markets operate. Institutional investors may gain a more seamless, efficient, and compliant path to crypto exposure. The token could also reduce reliance on traditional banking rails for margin and settlement, shortening transaction cycles and increasing capital efficiency for high-frequency and large-volume participants.

💡 Market Perspective

For crypto markets, a CME token could drive broader adoption and credibility. Integrating regulated digital collateral with major exchange infrastructure may increase institutional confidence in trading and holding digital assets. It may also create a bridge between traditional finance and decentralized protocols, further blurring the lines between legacy markets and the emerging crypto ecosystem.

📊 Bottom Line

If realized, a CME-issued token could become one of the most impactful institutional blockchain initiatives to date. By enabling tokenized collateral, faster settlement, and continuous market operations within a regulated framework, CME has the potential to accelerate institutional crypto adoption, reshape derivatives settlement, and reinforce its role as a trusted gateway between traditional finance and digital assets in 2026 and beyond.

In a major signal of traditional finance embracing blockchain infrastructure, CME Group, the world’s largest derivatives marketplace, is exploring the launch of a proprietary digital token, informally dubbed the “CME Token”. The news emerged during CME’s Q4 2025 earnings call in early February 2026, where Chairman and CEO Terrence Duffy highlighted initiatives to modernize post-trade processes through tokenized cash and decentralized settlement systems.

Duffy explained that CME’s research is focused on creating a digital asset to support margin, collateral management, and settlement for institutional participants. The token would likely operate on a decentralized or distributed ledger, enabling faster and more capital-efficient processing of high-value derivatives transactions compared with traditional banking rails. While specifics remain preliminary, the concept signals CME’s broader push to modernize infrastructure and improve liquidity efficiency in highly regulated markets.

🏦 Tokenized Cash and Google Cloud Partnership

The CME Token initiative runs alongside CME’s ongoing collaboration with Google Cloud, which began in March 2025. The partnership focuses on a tokenized cash solution scheduled for rollout later in 2026, leveraging Google Cloud’s Universal Ledger technology to digitize bank deposits and cash equivalents for use as trading collateral. This would allow near-instant settlement, reduce counterparty friction, and support continuous market operations—capabilities increasingly critical as markets move toward 24/7 trading models.

📈 Crypto Derivatives Expansion and 24/7 Trading

CME’s token plans coincide with a major expansion of its cryptocurrency derivatives products. The exchange intends to offer round-the-clock trading for major crypto futures and options — including BTC, ETH, SOL, XRP, ADA, LINK, and XLM — pending regulatory approval. Crypto derivatives volumes have surged dramatically, with Q4 2025 daily averages rising over 90% YoY to $13 billion, underscoring growing institutional demand and the need for efficient collateral and settlement solutions.

🏛️ Strategic Implications for Institutional Finance

A CME-issued token would represent a significant strategic step in attracting institutional participants. Unlike retail-focused stablecoins, a CME token would prioritize systemic stability, collateral mobility, and regulatory compliance, integrating seamlessly with CME’s multi-trillion-dollar derivatives ecosystem. It could streamline margin calls, reduce settlement risk, and enhance capital efficiency, while positioning CME as a key player in bridging traditional finance and blockchain infrastructure.

⚖️ Regulatory and Technical Challenges

Despite the promise, significant hurdles remain. Oversight from regulators such as the CFTC will be critical in shaping the token’s structure, permissible uses, and risk controls. Technical challenges include integration with existing clearing systems, cybersecurity safeguards, and cross-platform interoperability. Maintaining price stability, operational reliability, and institutional trust will be essential for large-scale adoption.

🔮 Broader Implications for Crypto Markets

CME’s move reflects a wider trend toward tokenized real-world assets and digital settlement layers. A successful CME token could set a benchmark for regulated digital collateral, encouraging adoption among exchanges, custodians, and clearinghouses worldwide. It demonstrates that blockchain is no longer treated solely as an experimental technology, but increasingly as a core component of financial infrastructure.

📌 Impact on Derivatives and Institutional Adoption

By linking digital collateral, tokenized cash, and 24/7 trading, CME could transform how derivatives markets operate. Institutional investors may gain a more seamless, efficient, and compliant path to crypto exposure. The token could also reduce reliance on traditional banking rails for margin and settlement, shortening transaction cycles and increasing capital efficiency for high-frequency and large-volume participants.

💡 Market Perspective

For crypto markets, a CME token could drive broader adoption and credibility. Integrating regulated digital collateral with major exchange infrastructure may increase institutional confidence in trading and holding digital assets. It may also create a bridge between traditional finance and decentralized protocols, further blurring the lines between legacy markets and the emerging crypto ecosystem.

📊 Bottom Line

If realized, a CME-issued token could become one of the most impactful institutional blockchain initiatives to date. By enabling tokenized collateral, faster settlement, and continuous market operations within a regulated framework, CME has the potential to accelerate institutional crypto adoption, reshape derivatives settlement, and reinforce its role as a trusted gateway between traditional finance and digital assets in 2026 and beyond.