# CryptoMarketPullback

349.77K

Trade concerns have pushed BTC and major altcoins lower, weakening short-term risk appetite. Is this a defensive phase, or a setup for the next rebound?

xxx40xxx

#CryptoMarketPullback

🧠 How to Position in This Market?

When fear is high, winners are not the fastest — they are the clearest thinkers.

The market is in Extreme Fear.

Price action is indecisive.

Volume is selective.

In this environment, positioning is not about trading more —

it’s about deciding who you are in the market.

① Position Your Mind First

The biggest mistake during fear phases:

➡️ Acting fast

➡️ Reacting emotionally

📌 Reality check:

If the market is uncertain, you cannot be aggressive.

Position size shrinks. Discipline expands.

② No Volume, No Strength

Price can rise.

But without

🧠 How to Position in This Market?

When fear is high, winners are not the fastest — they are the clearest thinkers.

The market is in Extreme Fear.

Price action is indecisive.

Volume is selective.

In this environment, positioning is not about trading more —

it’s about deciding who you are in the market.

① Position Your Mind First

The biggest mistake during fear phases:

➡️ Acting fast

➡️ Reacting emotionally

📌 Reality check:

If the market is uncertain, you cannot be aggressive.

Position size shrinks. Discipline expands.

② No Volume, No Strength

Price can rise.

But without

- Reward

- 54

- 53

- Repost

- Share

kblyfb1907 :

:

2026 GOGOGO 👊View More

Grayscale Keeps the Faith in NEAR Despite the Dip – A New ETF Application Signals Strong Belief**

You know, I've been following the crypto space closely, and the recent news from Grayscale has really caught my attention. They've just filed with the SEC for a NEAR Protocol spot ETF, and it's quite a statement considering the overall market conditions.

It’s been a rough ride for NEAR, like so many altcoins. Remember the hype around AI in 2022? NEAR shot up to around $20. But then the bear market hit hard, and it plummeted – we’re talking a drop of over 90%! It's been bouncing around the $1.50 to

You know, I've been following the crypto space closely, and the recent news from Grayscale has really caught my attention. They've just filed with the SEC for a NEAR Protocol spot ETF, and it's quite a statement considering the overall market conditions.

It’s been a rough ride for NEAR, like so many altcoins. Remember the hype around AI in 2022? NEAR shot up to around $20. But then the bear market hit hard, and it plummeted – we’re talking a drop of over 90%! It's been bouncing around the $1.50 to

- Reward

- 62

- 57

- Repost

- Share

LandscapeView :

:

Hold on tight, we're about to take off 🛫View More

🇯🇵 Japan Bond Market Shock: A Liquidity Event With Global Consequences

Japan’s government bond market has just experienced an extraordinary shock.

Long-term Japanese Government Bond (JGB) yields surged at a pace not seen since 2003.

The 30-year yield jumped more than 30 basis points to ~3.9%, marking a 27-year high — a move so extreme that officials described it as a six-standard-deviation event.

This was not a routine sell-off.

It was a liquidity breakdown.

📉 What Happened

The disruption began around January 20–21

Buyers stepped aside, causing bond prices to collapse

Liquidity dried up com

Japan’s government bond market has just experienced an extraordinary shock.

Long-term Japanese Government Bond (JGB) yields surged at a pace not seen since 2003.

The 30-year yield jumped more than 30 basis points to ~3.9%, marking a 27-year high — a move so extreme that officials described it as a six-standard-deviation event.

This was not a routine sell-off.

It was a liquidity breakdown.

📉 What Happened

The disruption began around January 20–21

Buyers stepped aside, causing bond prices to collapse

Liquidity dried up com

- Reward

- 37

- 48

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#CryptoMarketPullback As of January 22, 2026, the crypto market is undergoing a noticeable pullback following several weeks of elevated volatility and strong upside momentum. While corrections often trigger uncertainty among short-term participants, pullbacks remain a natural and necessary phase within healthy market cycles.

After recent rallies across major assets — including Bitcoin, Ethereum, and high-beta altcoins — profit-taking has increased as traders reassess exposure amid shifting macroeconomic signals and changing liquidity conditions.

This retracement is not occurring in isolation.

After recent rallies across major assets — including Bitcoin, Ethereum, and high-beta altcoins — profit-taking has increased as traders reassess exposure amid shifting macroeconomic signals and changing liquidity conditions.

This retracement is not occurring in isolation.

- Reward

- 4

- 48

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🌱 “Growth mindset activated! Learning so much from these posts.”View More

#CryptoMarketPullback

#CryptoMarketPullback

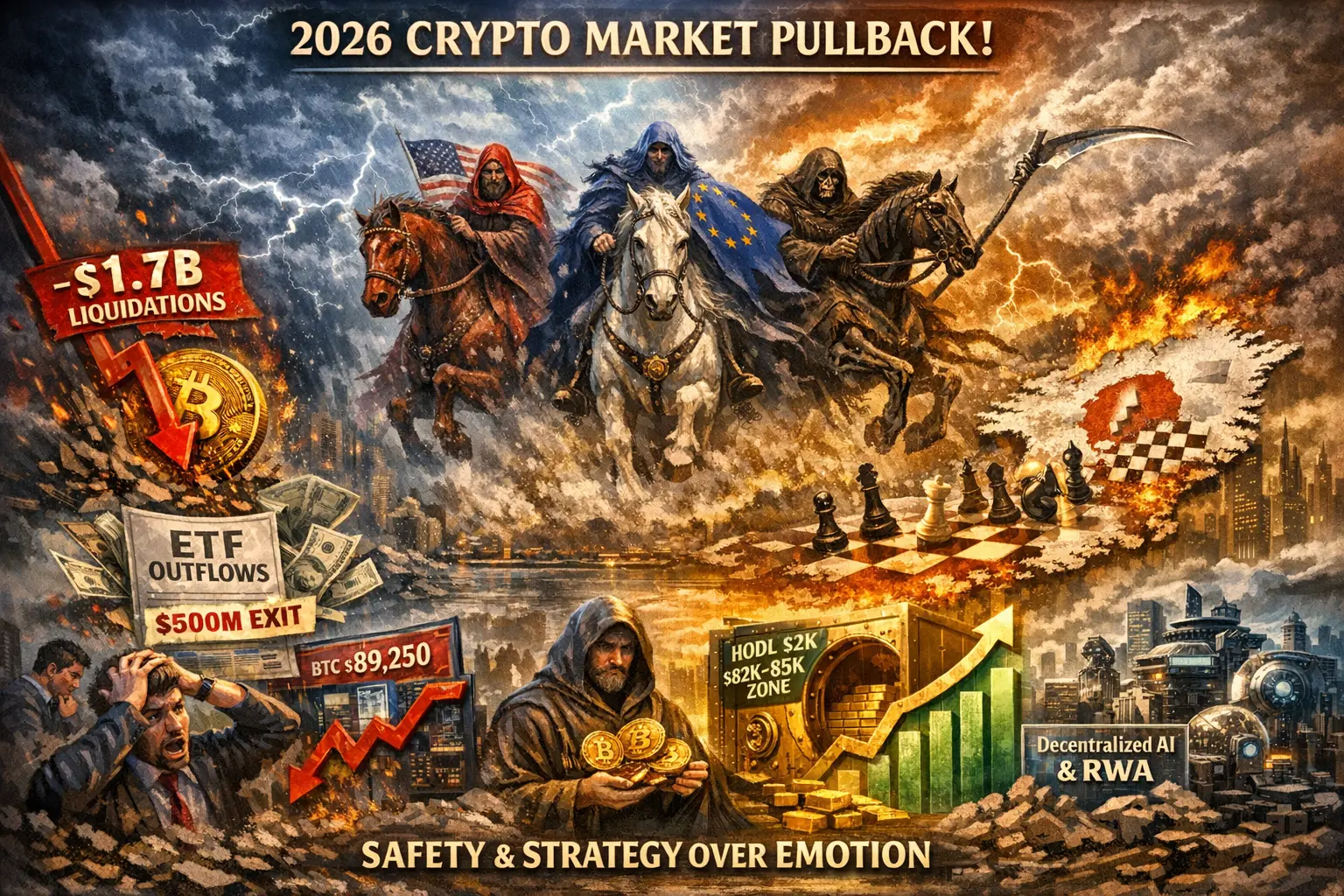

While the cryptocurrency market made a magnificent entrance into 2026, it is facing a harsh reality check in this final week of January. Although Bitcoin dipping below the $90,000 mark and double-digit pullbacks in altcoins have sparked the question "Is the Bull run over?", this situation is actually performing one of the most classic scenes of modern finance: Leverage Flushing and Risk Rotation.

🌩️ The Three Horsemen of the Storm: Why Are We Dropping?

This pullback is less about crypto's internal dynamics and more about the shifting of major globa

#CryptoMarketPullback

While the cryptocurrency market made a magnificent entrance into 2026, it is facing a harsh reality check in this final week of January. Although Bitcoin dipping below the $90,000 mark and double-digit pullbacks in altcoins have sparked the question "Is the Bull run over?", this situation is actually performing one of the most classic scenes of modern finance: Leverage Flushing and Risk Rotation.

🌩️ The Three Horsemen of the Storm: Why Are We Dropping?

This pullback is less about crypto's internal dynamics and more about the shifting of major globa

- Reward

- 82

- 71

- Repost

- Share

kblyfb1907 :

:

2026 GOGOGO 👊View More

#CryptoMarketPullback

#CryptoMarketPullback

As of January 22, 2026, the crypto market is experiencing a noticeable pullback after weeks of heightened volatility and strong upside momentum. While price corrections often trigger fear among short-term participants, market pullbacks are a natural and necessary part of any healthy financial cycle. Following recent rallies across major assets like Bitcoin, Ethereum, and high-beta altcoins, profit-taking has intensified as traders reassess risk amid shifting macroeconomic signals and liquidity conditions.

This pullback is not occurring in isolation.

#CryptoMarketPullback

As of January 22, 2026, the crypto market is experiencing a noticeable pullback after weeks of heightened volatility and strong upside momentum. While price corrections often trigger fear among short-term participants, market pullbacks are a natural and necessary part of any healthy financial cycle. Following recent rallies across major assets like Bitcoin, Ethereum, and high-beta altcoins, profit-taking has intensified as traders reassess risk amid shifting macroeconomic signals and liquidity conditions.

This pullback is not occurring in isolation.

- Reward

- 4

- 7

- Repost

- Share

Falcon_Official :

:

1000x VIbes 🤑View More

Title: Institutional Bitcoin Buying Remains Strong Despite Market Volatility**

The cryptocurrency market has seen its share of turbulence recently, but one key factor continues to provide a degree of stability: institutional buying. According to CryptoQuant CEO Ki Young Ju, despite significant price dips, major corporations are still accumulating Bitcoin at a robust pace.

Ju highlighted that corporate wallets have added a staggering 577,000 Bitcoin over the past year, and the inflow hasn't stopped. This trend is particularly noteworthy given the backdrop of increasing geopolitical tensions and

The cryptocurrency market has seen its share of turbulence recently, but one key factor continues to provide a degree of stability: institutional buying. According to CryptoQuant CEO Ki Young Ju, despite significant price dips, major corporations are still accumulating Bitcoin at a robust pace.

Ju highlighted that corporate wallets have added a staggering 577,000 Bitcoin over the past year, and the inflow hasn't stopped. This trend is particularly noteworthy given the backdrop of increasing geopolitical tensions and

BTC-0,19%

- Reward

- 65

- 71

- Repost

- Share

kblyfb1907 :

:

Happy New Year! 🤑View More

#CryptoMarketPullback As of January 22, 2026, the crypto market is undergoing a noticeable pullback following several weeks of elevated volatility and strong upside momentum. While corrections often trigger uncertainty among short-term participants, pullbacks remain a natural and necessary phase within healthy market cycles.

After recent rallies across major assets — including Bitcoin, Ethereum, and high-beta altcoins — profit-taking has increased as traders reassess exposure amid shifting macroeconomic signals and changing liquidity conditions.

This retracement is not occurring in isolation.

After recent rallies across major assets — including Bitcoin, Ethereum, and high-beta altcoins — profit-taking has increased as traders reassess exposure amid shifting macroeconomic signals and changing liquidity conditions.

This retracement is not occurring in isolation.

- Reward

- 17

- 31

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Happy New Year! 🤑View More

#CryptoMarketPullback

Crypto Market Pullback: Defensive Phase, Structural Correction, or Setup for the Next Bull Run?

The crypto market has recently experienced a notable pullback, with Bitcoin and major altcoins retreating amid rising trade concerns, geopolitical tensions, and shifts in risk sentiment. Short-term risk appetite has weakened, prompting both retail and institutional investors to reassess positions and recalibrate strategies.

While some see this as a defensive phase, others warn of a potential larger structural correction. Understanding the dynamics at play is critical for anyon

Crypto Market Pullback: Defensive Phase, Structural Correction, or Setup for the Next Bull Run?

The crypto market has recently experienced a notable pullback, with Bitcoin and major altcoins retreating amid rising trade concerns, geopolitical tensions, and shifts in risk sentiment. Short-term risk appetite has weakened, prompting both retail and institutional investors to reassess positions and recalibrate strategies.

While some see this as a defensive phase, others warn of a potential larger structural correction. Understanding the dynamics at play is critical for anyon

- Reward

- 14

- 17

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#CryptoMarketPullback As of January 22, 2026, the crypto market is undergoing a noticeable pullback following several weeks of elevated volatility and strong upside momentum. While corrections often trigger uncertainty among short-term participants, pullbacks remain a natural and necessary phase within healthy market cycles.

After recent rallies across major assets — including Bitcoin, Ethereum, and high-beta altcoins — profit-taking has increased as traders reassess exposure amid shifting macroeconomic signals and changing liquidity conditions.

This retracement is not occurring in isolation.

After recent rallies across major assets — including Bitcoin, Ethereum, and high-beta altcoins — profit-taking has increased as traders reassess exposure amid shifting macroeconomic signals and changing liquidity conditions.

This retracement is not occurring in isolation.

- Reward

- 2

- 1

- Repost

- Share

EagleEye :

:

Happy New Year! 🤑Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

35.4K Popularity

18.77K Popularity

13.49K Popularity

3.29K Popularity

9.94K Popularity

9.37K Popularity

8.19K Popularity

76.34K Popularity

36.4K Popularity

20.13K Popularity

6.94K Popularity

109.06K Popularity

254.13K Popularity

20.23K Popularity

179.21K Popularity

News

View Morea16z Crypto General Partner Arianna Simpson announces departure to establish a new fund

11 m

Market Report: Top 5 cryptocurrencies by decline on January 24, 2026, with The Sandbox experiencing the largest drop.

12 m

Crypto Fear Index rises to 25, the market remains in the "Extreme Fear" zone

19 m

Elon Musk: xAI will launch a dedicated recommendation tab for specific topics and rank content based on quality

26 m

Market Report: Overview of the top 5 cryptocurrencies by gain on January 24, 2026, with Kaia leading the gains.

42 m

Pin