# BItcoin

6.62M

ameely

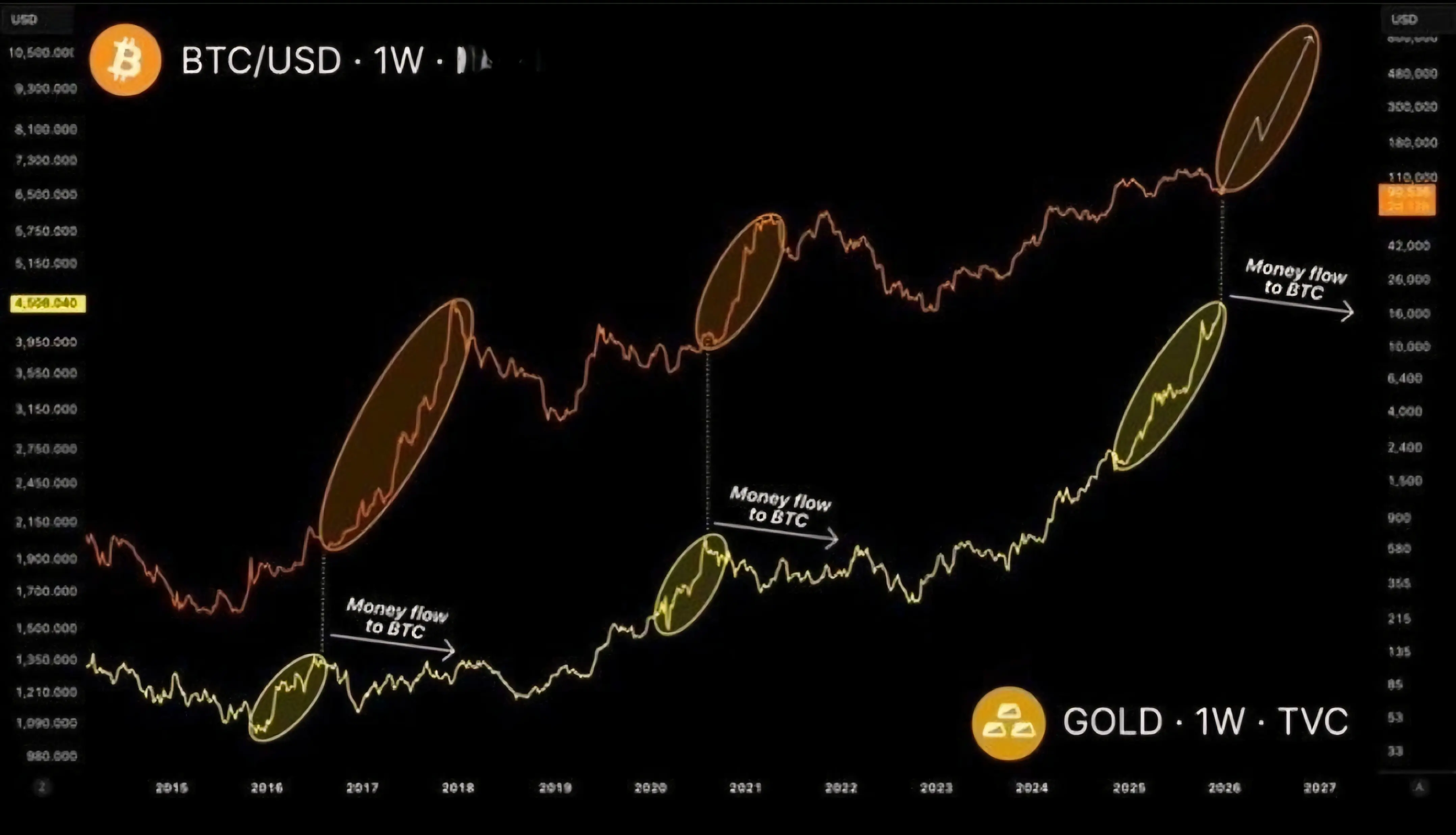

#GoldandSilverHitNewHighs BTC vs #Gold 🚨

What we’re seeing here is a classic rotation cycle playing out. $ENSO

On the downside, there are a few zones the market could still explore without breaking the bigger picture: $KAIA

• $90K

• $85K

• $76K

• $68K

From a higher-timeframe view, none of these levels invalidate the core thesis. $0G

They all sit well within what looks like a rotation bottom / accumulation range.

That’s the part most people miss.

Corrections inside accumulation feel chaotic, but structurally they’re normal.

Zoomed out, Bitcoin already looks like it’s in the zone where

What we’re seeing here is a classic rotation cycle playing out. $ENSO

On the downside, there are a few zones the market could still explore without breaking the bigger picture: $KAIA

• $90K

• $85K

• $76K

• $68K

From a higher-timeframe view, none of these levels invalidate the core thesis. $0G

They all sit well within what looks like a rotation bottom / accumulation range.

That’s the part most people miss.

Corrections inside accumulation feel chaotic, but structurally they’re normal.

Zoomed out, Bitcoin already looks like it’s in the zone where

- Reward

- 2

- 8

- Repost

- Share

映月 :

:

DYOR 🤓View More

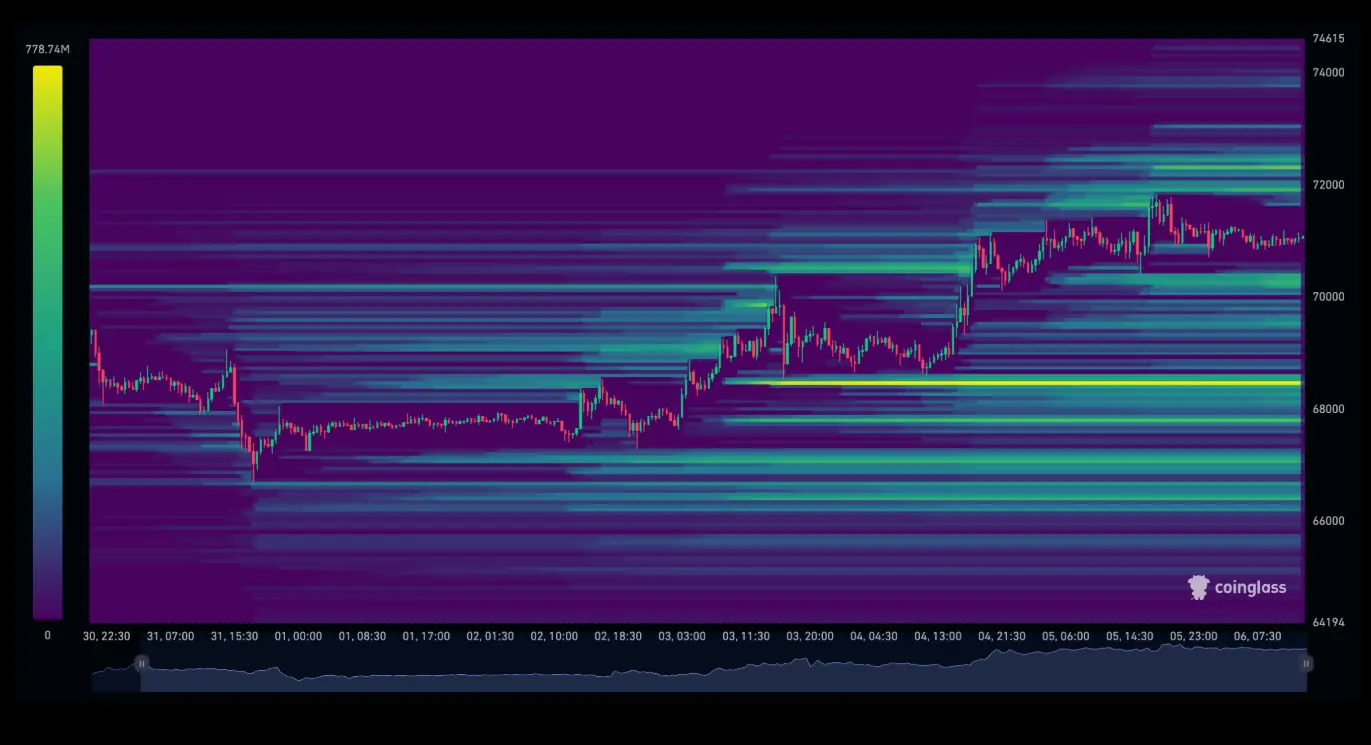

🚨 $60M Short Liquidated Amid Market Spike

According to BlockBeats News (Jan 24) and EmberCN monitoring, crypto market volatility struck again:

At around 1:00 a.m., Bitcoin briefly surged above $91,000 and Ethereum climbed past $3,000, triggering the liquidation of a massive short position held by “Rolling Trader 0xD83…Fd7”.

🔻 Key Details:

• Liquidation size: ~$60 million

• Total short position reduced from $300M → $238M

• Unrealized gains fell from $24M (2 days ago) to ~$4M

⚠️ This move once again highlights how high leverage + sudden volatility can quickly wipe out even large positions.

💬

According to BlockBeats News (Jan 24) and EmberCN monitoring, crypto market volatility struck again:

At around 1:00 a.m., Bitcoin briefly surged above $91,000 and Ethereum climbed past $3,000, triggering the liquidation of a massive short position held by “Rolling Trader 0xD83…Fd7”.

🔻 Key Details:

• Liquidation size: ~$60 million

• Total short position reduced from $300M → $238M

• Unrealized gains fell from $24M (2 days ago) to ~$4M

⚠️ This move once again highlights how high leverage + sudden volatility can quickly wipe out even large positions.

💬

- Reward

- 11

- 11

- Repost

- Share

neesa04 :

:

2026 GOGOGO 👊View More

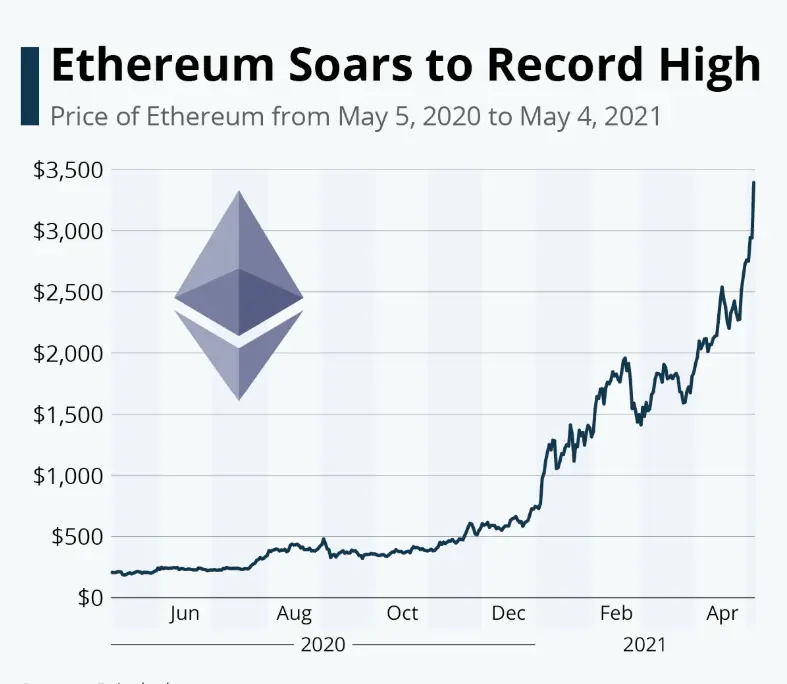

First #الذهب . Then #البيتكوين .

History shows a clear pattern during monetary shifts: capital first moves to #XAUUSDT , then shifts to #BTCUSDT .

Gold leads this cycle, reaching record levels as central banks buy in and global risks rise. In contrast, Bitcoin lags behind gold, a pattern observed before major Bitcoin price surges.

This divergence is temporary. Once gold's rally completes and supply diminishes, capital looks for further gains, and Bitcoin becomes the next destination.

Bitcoin ETFs currently absorb more than the new supply.

If history repeats itself, the rise in gold is the sign

History shows a clear pattern during monetary shifts: capital first moves to #XAUUSDT , then shifts to #BTCUSDT .

Gold leads this cycle, reaching record levels as central banks buy in and global risks rise. In contrast, Bitcoin lags behind gold, a pattern observed before major Bitcoin price surges.

This divergence is temporary. Once gold's rally completes and supply diminishes, capital looks for further gains, and Bitcoin becomes the next destination.

Bitcoin ETFs currently absorb more than the new supply.

If history repeats itself, the rise in gold is the sign

BTC-1,44%

- Reward

- 1

- 1

- Repost

- Share

BasheerAlgundubi :

:

Bitcoin exchange-traded funds currently absorb more than the new supply. If history repeats itself, the rise in gold is the signal, and Bitcoin will follow suit. 🚀

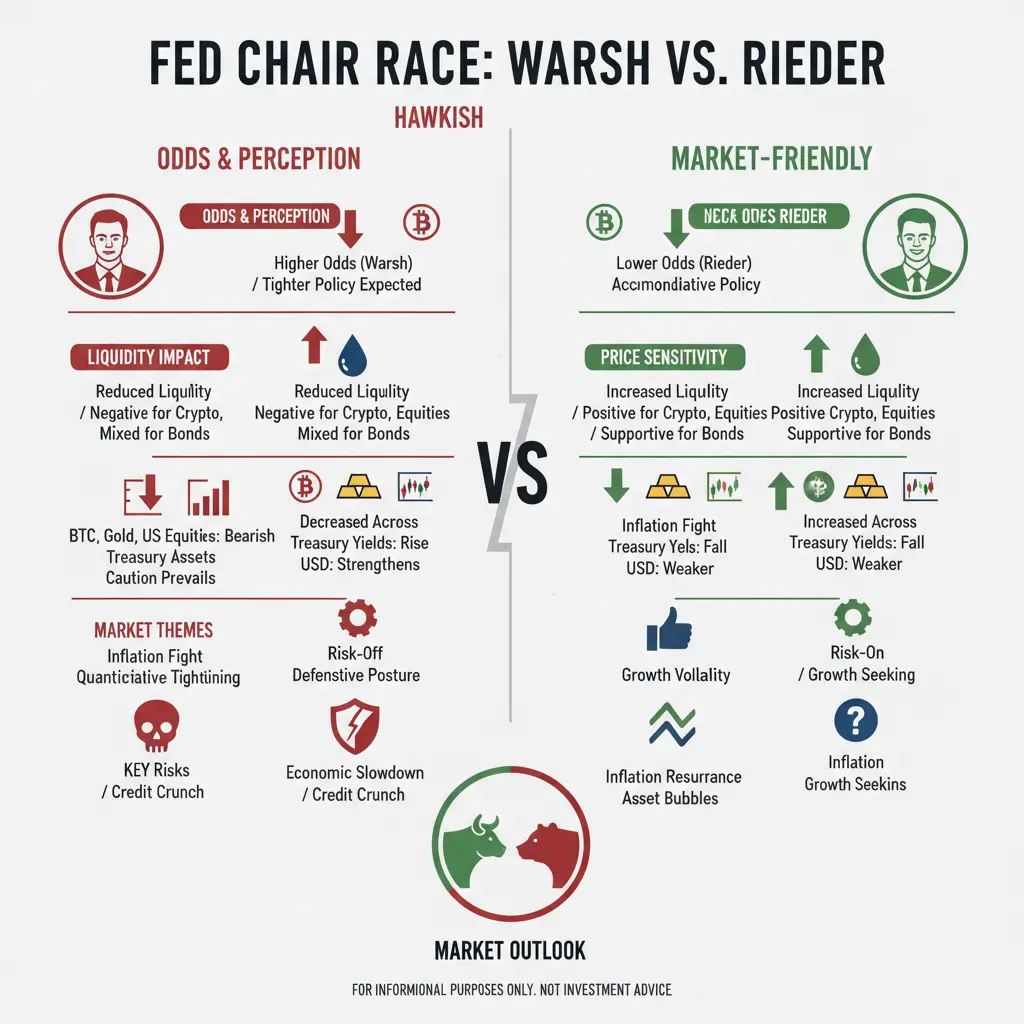

#NextFedChairPredictions

Who’s the Favorite for Fed Chair — And How Will It Impact Markets?

The race to replace Jerome Powell as Chair of the Federal Reserve has become one of the most influential macro events in global finance. President Trump has narrowed his shortlist, with Kevin Warsh and Rick Rieder emerging as clear frontrunners. Trump has hinted he could announce his decision as soon as next week, with Powell’s term ending in May.

This decision is not only political — it will directly impact liquidity, interest rates, market volatility, capital flow, and asset prices across crypto, equi

Who’s the Favorite for Fed Chair — And How Will It Impact Markets?

The race to replace Jerome Powell as Chair of the Federal Reserve has become one of the most influential macro events in global finance. President Trump has narrowed his shortlist, with Kevin Warsh and Rick Rieder emerging as clear frontrunners. Trump has hinted he could announce his decision as soon as next week, with Powell’s term ending in May.

This decision is not only political — it will directly impact liquidity, interest rates, market volatility, capital flow, and asset prices across crypto, equi

- Reward

- 10

- 18

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

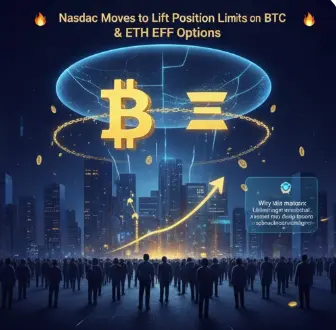

🔥 Nasdaq Moves to Lift Position Limits on BTC & ETH ETF Options 🔥

Big signal from traditional finance 👀

Nasdaq has officially applied to remove the 25,000-contract position limit on spot Bitcoin & Ethereum ETF options, submitting a rule change to the U.S. SEC.

📌 What’s changing?

• ❌ Removes the 25,000 contract cap

• ⚖️ Treats crypto ETF options the same as commodity ETF options

• 🏦 Eliminates what Nasdaq calls “unfair restrictions”

• 🗣️ SEC comment period is now open

• ⏰ Final decision expected by end of February

💡 Why this matters:

This could unlock larger institutional participation,

Big signal from traditional finance 👀

Nasdaq has officially applied to remove the 25,000-contract position limit on spot Bitcoin & Ethereum ETF options, submitting a rule change to the U.S. SEC.

📌 What’s changing?

• ❌ Removes the 25,000 contract cap

• ⚖️ Treats crypto ETF options the same as commodity ETF options

• 🏦 Eliminates what Nasdaq calls “unfair restrictions”

• 🗣️ SEC comment period is now open

• ⏰ Final decision expected by end of February

💡 Why this matters:

This could unlock larger institutional participation,

- Reward

- 16

- 15

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

#CryptoETFDivergence

Day by day, still here. Still observing the market.

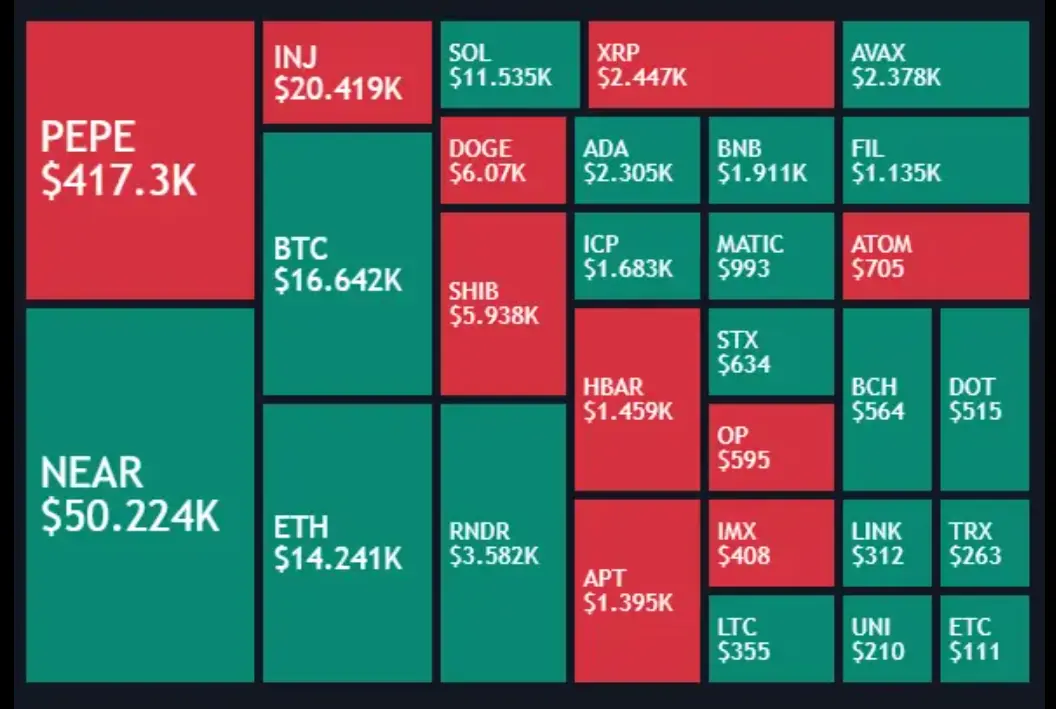

The crypto market is showing divergent signals between spot price movements and ETF flows. While Bitcoin and Ethereum are attempting short-term rebounds, ETF inflows are not fully aligned, creating a temporary disconnect in momentum.

📊 Market Overview

Ethereum (ETH):

Price stabilized near 3000 after failing to hold resistance around 3170–3180.

Recent rebound near 3130 is weak; a retest below 3100, potentially toward 3070, is likely.

Volatility remains high, and ETF flows are cautious, limiting strong upward moves.

Bitcoi

Day by day, still here. Still observing the market.

The crypto market is showing divergent signals between spot price movements and ETF flows. While Bitcoin and Ethereum are attempting short-term rebounds, ETF inflows are not fully aligned, creating a temporary disconnect in momentum.

📊 Market Overview

Ethereum (ETH):

Price stabilized near 3000 after failing to hold resistance around 3170–3180.

Recent rebound near 3130 is weak; a retest below 3100, potentially toward 3070, is likely.

Volatility remains high, and ETF flows are cautious, limiting strong upward moves.

Bitcoi

ETH-0,77%

MC:$3.55KHolders:1

0.00%

- Reward

- 7

- 10

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

📉 #ExchangeBTCNetOutflowsExpand

Bitcoin exchanges are seeing a notable increase in net outflows, signaling that more BTC is moving off centralized platforms than coming in. This trend often indicates stronger long-term holding behavior among investors, as coins are being transferred to private wallets rather than remaining on exchanges for trading or selling.

Key Points:

🏦 Exchange Outflows Rising: The net outflows have expanded over the past week, showing growing investor confidence and potential accumulation.

🔒 HODL Signals: Higher outflows often correlate with longer-term holding, reduci

Bitcoin exchanges are seeing a notable increase in net outflows, signaling that more BTC is moving off centralized platforms than coming in. This trend often indicates stronger long-term holding behavior among investors, as coins are being transferred to private wallets rather than remaining on exchanges for trading or selling.

Key Points:

🏦 Exchange Outflows Rising: The net outflows have expanded over the past week, showing growing investor confidence and potential accumulation.

🔒 HODL Signals: Higher outflows often correlate with longer-term holding, reduci

BTC-1,44%

- Reward

- 9

- 11

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

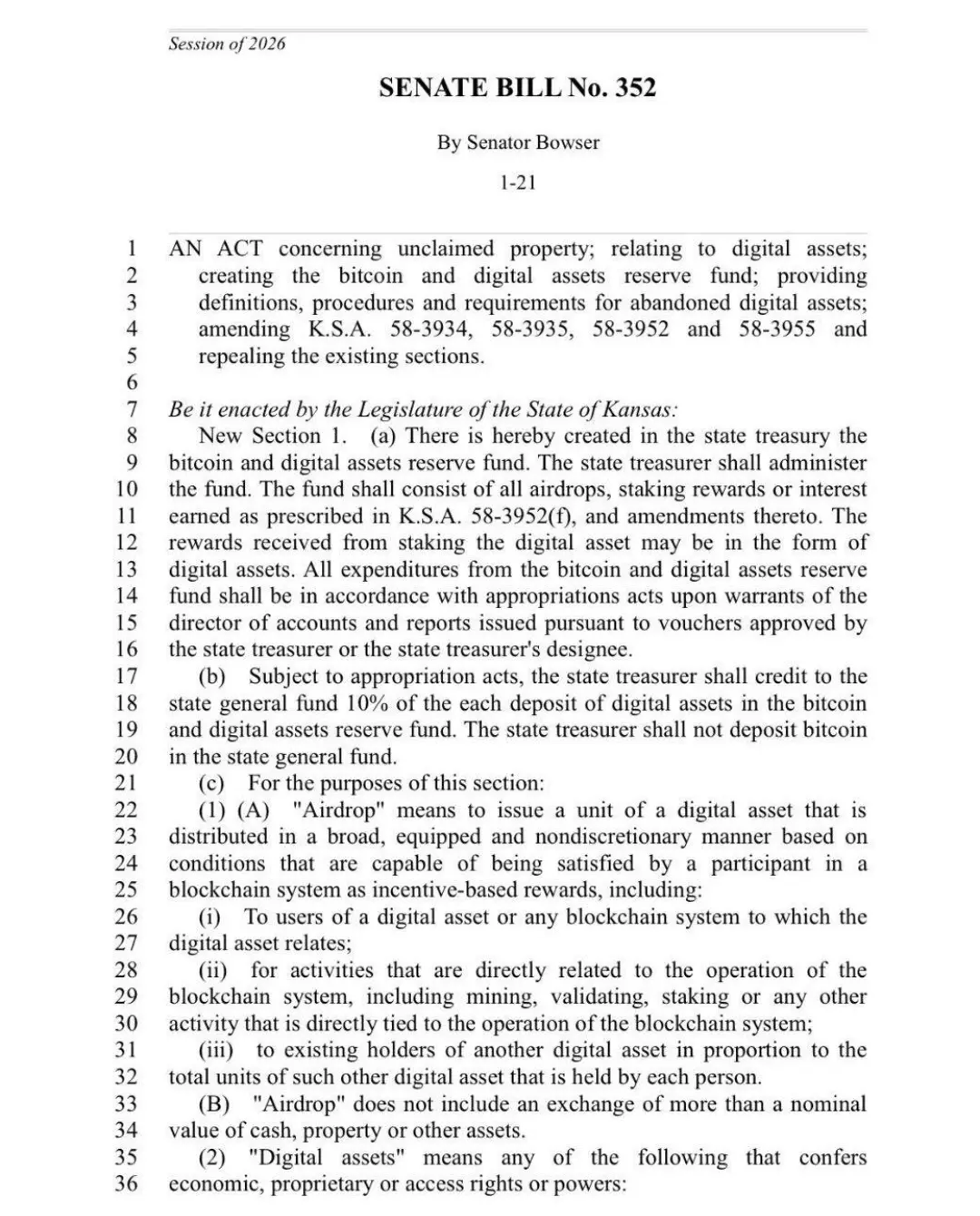

The state of Kansas is moving towards adopting #البيتكوين as a strategic asset in the public treasury.

Kansas Senate Bill 352 proposes the creation of a dedicated Bitcoin and digital assets fund, funded through airdrops, staking rewards, interest, and even unclaimed digital currency holdings.

This comes in the context of a broader trend across the United States: more than 30 states are considering similar legislation, and New Hampshire has already enacted laws allowing for the creation of digital currency reserves, along with increasing institutional support following the launch of Bitcoin ex

View OriginalKansas Senate Bill 352 proposes the creation of a dedicated Bitcoin and digital assets fund, funded through airdrops, staking rewards, interest, and even unclaimed digital currency holdings.

This comes in the context of a broader trend across the United States: more than 30 states are considering similar legislation, and New Hampshire has already enacted laws allowing for the creation of digital currency reserves, along with increasing institutional support following the launch of Bitcoin ex

- Reward

- 1

- Comment

- Repost

- Share

🔥 Nasdaq Moves to Lift Position Limits on BTC & ETH ETF Options 🔥

A major signal from traditional finance 👀

Nasdaq has officially filed a proposal with the U.S. SEC to remove the 25,000-contract position limit on options for spot Bitcoin and Ethereum ETFs.

📌 What’s Changing?

• ❌ The 25,000 contract cap will be eliminated

• ⚖️ Crypto ETF options would be regulated the same way as commodity ETF options

• 🏦 Nasdaq calls the current limit an “unfair restriction”

• 🗣️ The SEC comment period is now open

• ⏰ A final decision is expected by the end of February

💡 Why This Matters:

If approved, t

A major signal from traditional finance 👀

Nasdaq has officially filed a proposal with the U.S. SEC to remove the 25,000-contract position limit on options for spot Bitcoin and Ethereum ETFs.

📌 What’s Changing?

• ❌ The 25,000 contract cap will be eliminated

• ⚖️ Crypto ETF options would be regulated the same way as commodity ETF options

• 🏦 Nasdaq calls the current limit an “unfair restriction”

• 🗣️ The SEC comment period is now open

• ⏰ A final decision is expected by the end of February

💡 Why This Matters:

If approved, t

- Reward

- 4

- 4

- Repost

- Share

EagleEye :

:

Buy To Earn 💎View More

🔥 OPINION 🔥

Tyler Winklevoss: "Bitcoin is a hedge against the traditional financial system and a beacon of hope for economic empowerment."

💡 In a world of uncertainty, #Bitcoin isn’t just digital money—it’s financial freedom in action.

#Crypto #BTC #FinancialEmpowerment #DigitalGold

Tyler Winklevoss: "Bitcoin is a hedge against the traditional financial system and a beacon of hope for economic empowerment."

💡 In a world of uncertainty, #Bitcoin isn’t just digital money—it’s financial freedom in action.

#Crypto #BTC #FinancialEmpowerment #DigitalGold

BTC-1,44%

- Reward

- 6

- 3

- Repost

- Share

repanzal :

:

Buy To Earn 💎View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

50.65K Popularity

30.72K Popularity

24.72K Popularity

9.15K Popularity

17.39K Popularity

14.41K Popularity

11.97K Popularity

79.64K Popularity

39.27K Popularity

22.55K Popularity

12.03K Popularity

952 Popularity

258.24K Popularity

21.79K Popularity

164.78K Popularity

News

View MoreData: Over the past 24 hours, the entire network has liquidated $252 million, with long positions liquidated at $63.1456 million and short positions at $189 million.

1 h

Data: 1,400,500 TON transferred from an anonymous address, worth approximately $2.14 million

2 h

Yi Lihua: Crypto-friendly policies are gradually being implemented, and the Crypto Structure Act is highly likely to pass.

2 h

Galaxy Research Director: Key hearings on cryptocurrency market structure legislation will be held next week, with bipartisan lawmakers potentially proposing amendments

2 h

Pantera Capital: Quantum resistance competition may strengthen the "gravitational effect" of blockchain networks like Ethereum

2 h

Pin