Search results for "NET"

Bitcoin breaks through 128 million KRW... ETH, XRP, SOL year-end market analysis

The flagship cryptocurrency in the market, Bitcoin, continues its year-end upward trend, breaking through 128 million Korean Won. Bitcoin, which has risen 1.5% in 24 hours and broke out of the range in mid-December, has gained upward momentum.

Despite decreased trading volume and reduced volatility, Bitcoin remains stable. Dragonfly's Hashib Kureši predicts that Bitcoin's price could rise above 150 million Korean Won by the end of 2026, but also notes that its market dominance may weaken.

Spot Bitcoin ETF experienced an outflow of approximately 1.1 trillion Korean Won, and experts analyze that the end-of-year tax optimization strategies for loss realization are the reasons for the capital withdrawal.

Ethereum rebounded from the $2800 support level, breaking through 4.3 million Korean Won, with a 1.8% increase in 24 hours. Over the past month, spot Ethereum ETFs saw an outflow of about 612 billion Korean Won, with a single-day net outflow of 9.6 billion Korean Won on December 29.

TechubNews·7m ago

XRP ETF Retains 29-Day Inflow Streak

Key Notes

US spot XRP ETFs recorded $8.44 million in daily total net inflows on December 29.

Its cumulative net inflows have now surged to $1.15 billion.

XRP price is still struggling to hit $2 despite the ETF outperformance.

A turbulent December was not strong enough to disrupt the

Coinspeaker·1h ago

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

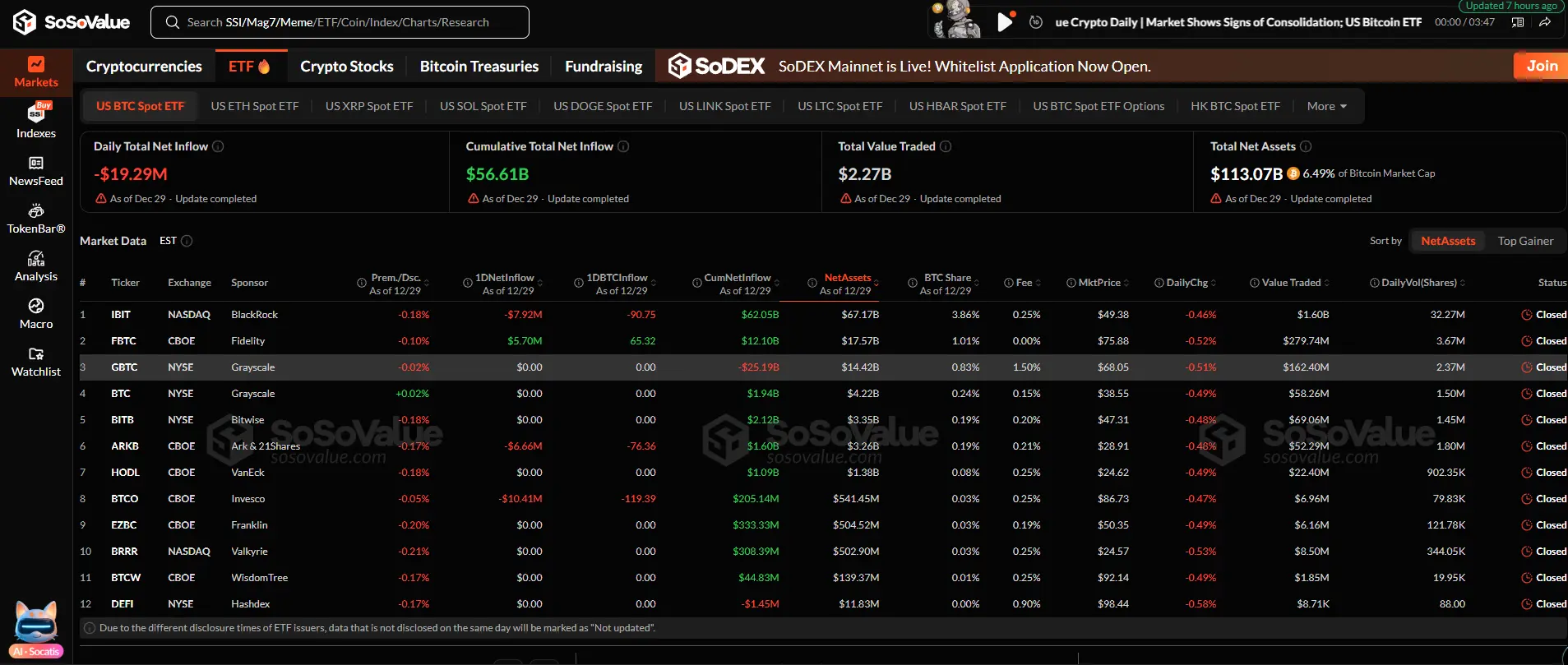

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·1h ago

Crypto ETPs Face $446M Outflows as Year-End Sentiment Dives

Crypto ETPs Witness Continued Outflows Amid Market Caution

Recent data indicates that crypto exchange-traded products (ETPs) experienced net outflows of $446 million last week, extending a trend of cautious investor activity that has persisted since the sharp market correction in October. Despite s

CryptoBreaking·4h ago

Gate Research Institute: CC increased over 43% last week, Ethereum had the largest net inflow | Gate VIP Weekly Report

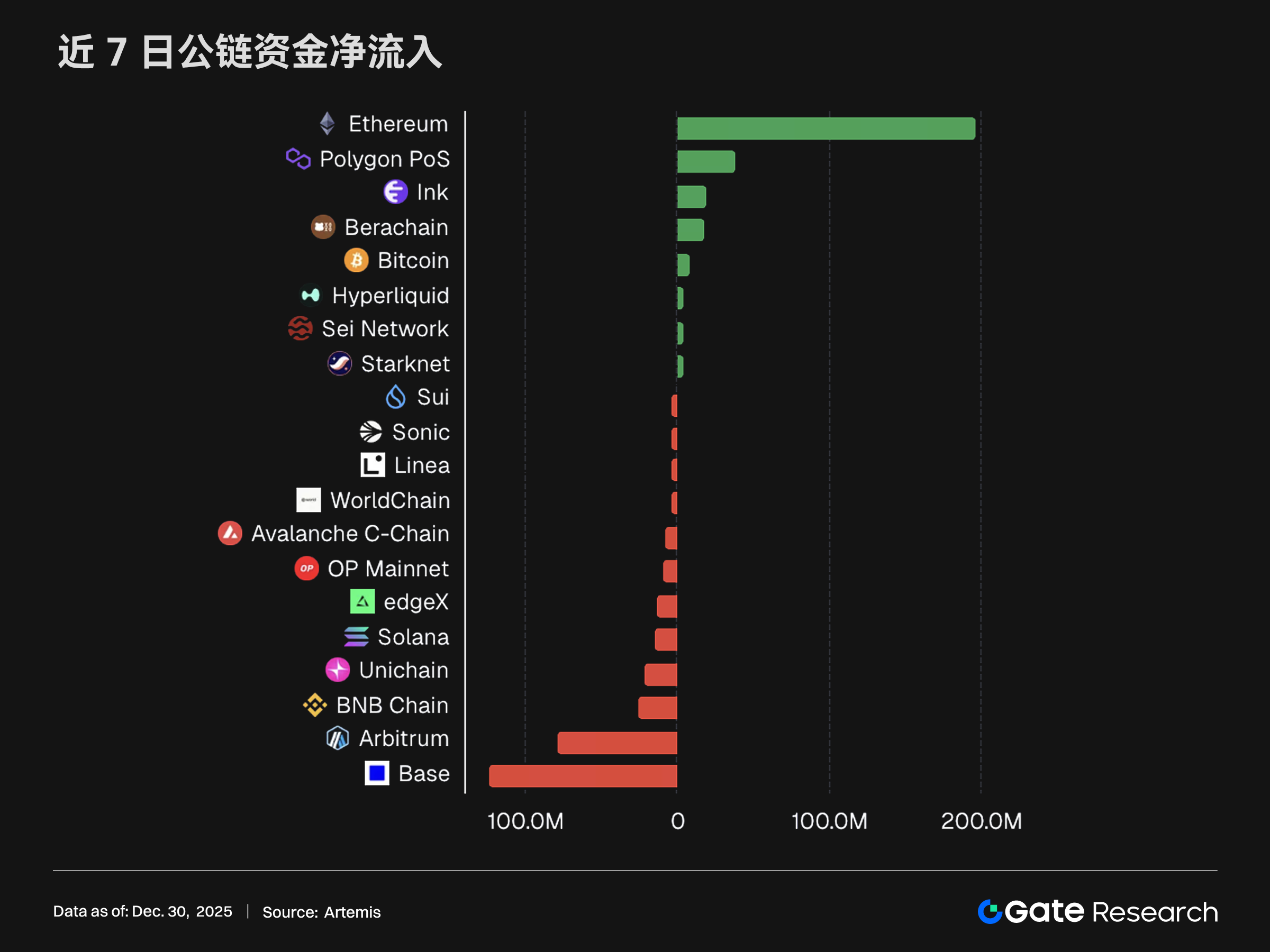

Last week in the market, BTC and ETH stabilized amid fluctuations, with ETH's rebound being stronger than BTC. On-chain capital inflow was primarily into Ethereum, while L2 networks experienced net outflows. The growth in crypto payment card transactions reflects application trends amid market caution. The report will provide an in-depth analysis of these market dynamics.

GateResearch·6h ago

New Year's Day is approaching, and the crypto market continues to consolidate. What potential "catalysts" could exist in the market in 2026?

Article by: Glendon, Techub News

After briefly climbing above $90,000 yesterday, Bitcoin fell below $87,000 again today, with a intraday decline of 3.76%. Meanwhile, the crypto market has once again experienced a broad decline. According to SoSoValue data, no major sector in the market was spared, with 24-hour declines generally exceeding 3%. Among them, SocialFi, Layer2, AI, RWA, and NFT sectors were hit hardest, each dropping more than 5%.

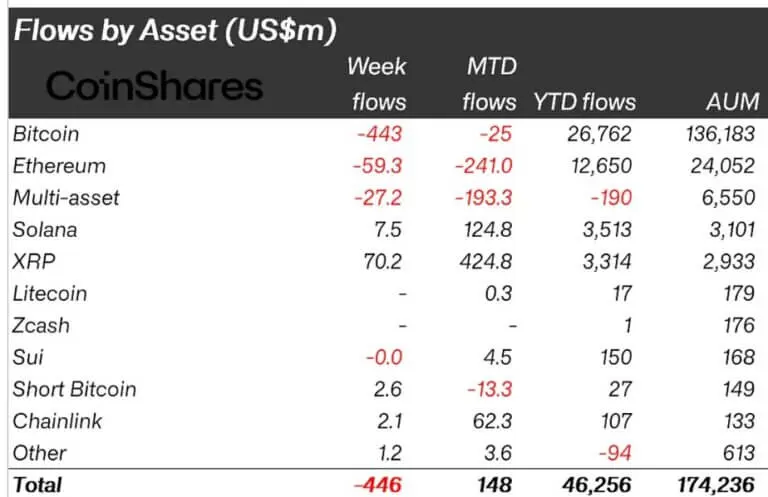

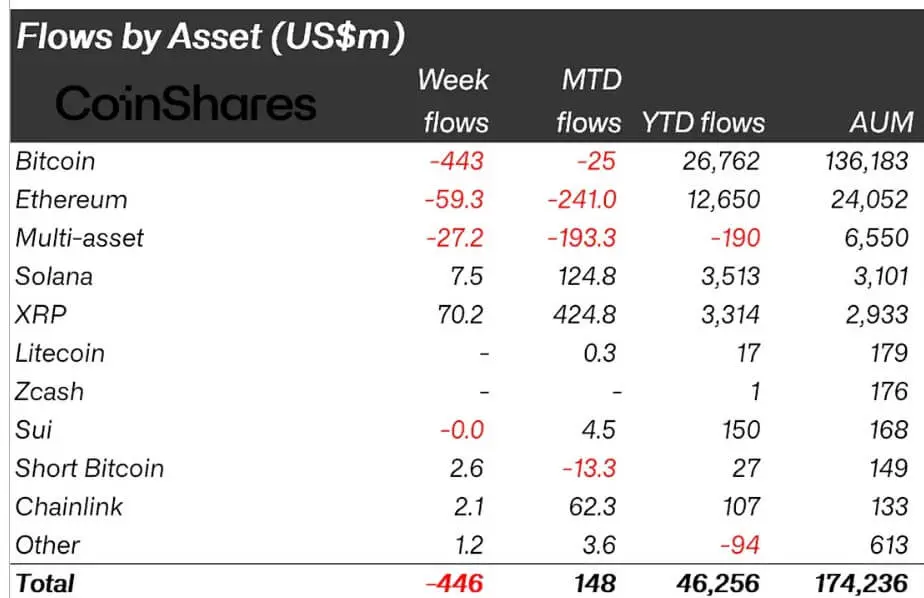

In terms of institutional investment, CoinShares' latest data shows that digital asset investment products saw a net outflow of approximately $446 million last week, bringing the total outflow since October 10 to $3.2 billion. Additionally, last week, Bitcoin spot

TechubNews·6h ago

Cryptocurrency ETF capital flow on 12/29: Bitcoin and Ethereum experience outflows, Solana and XRP attract funds back

According to data from SoSoValue, on December 29th, US-based spot Bitcoin ETFs recorded a total net outflow of $19.29 million, reflecting investors' cautious sentiment as the market enters the end-of-year period. Notably, the Fidelity Bitcoin ETF (FBTC) still led in inflows for the day, with

TapChiBitcoin·9h ago

XRP Spring Supply Trap! Institutions lock in $1 billion, while retail investors panic sell

XRP Shows Contradictory Trends: In December, ETF net inflows reached $424 million, but the price dropped 15%, making it one of the bottom ten. Institutions locked hundreds of millions of coins into cold wallets, reducing circulation and creating a "spring-like" supply mechanism. Retail investor sentiment is pessimistic, but the Canary XRP ETF has raised $300 million, with institutions mechanically increasing holdings. Once the supply black hole encounters renewed demand, prices may rebound sharply.

MarketWhisper·9h ago

XRP Price Prediction 2026: ETF Zero Outflow Record and On-Chain Selling Pressure Confrontation, How Will XRP Break Through and Return to $3?

As 2025 comes to a close, XRP prices are under pressure at the end of the year, currently hovering around $1.87, with a total decline of 9.7% for the year. However, beneath the market's apparent weakness, there are underlying currents: on one hand, institutional funds have shown remarkable confidence, with a total inflow of $3.3 billion this year, and their spot ETF products have set a record for "zero net outflow days" since launch; on the other hand, long-term holders have shifted to continuous selling in the fourth quarter, posing risks for the 2026 trend. Market analysis suggests that XRP may continue to fluctuate in early 2026, and a clear macro catalyst is needed to establish a direction. The true bullish signal will require the price to stay steadily above $3.00.

MarketWhisper·10h ago

Yesterday, the US Bitcoin spot ETF experienced a net outflow of approximately $19.3 million, marking the seventh consecutive day of net outflows.

According to ichaingo data, the US Bitcoin spot ETF experienced a net outflow of approximately $19.3 million yesterday, marking the seventh consecutive day of net outflows. The specific inflow and outflow situations for ETFs such as BlackRock, Fidelity, Ark & 21Shares, and Invesco vary, with most ETFs showing no significant fund movements for now.

BTC1,67%

TechubNews·10h ago

Ethereum leads DeFi capital flow in 2025 as liquidity returns to layer 1

Ethereum emerged as the leading destination for net capital flow in 2025, solidifying its central role in high-value DeFi liquidity. Although DeFi activity expanded strongly across multiple Layer-2 networks, most of the liquidity ultimately returned to Ethereum's Layer-1. Throughout 2025, Ether

TapChiBitcoin·12h ago

1.2 million HYPE tokens are about to be released, valued at $31 million! Hyperliquid team's monthly unlock wave begins

Decentralized derivatives exchange Hyperliquid's core development organization Hyperliquid Labs plans to distribute approximately 1.2 million HYPE tokens to its team members on January 6, 2026. Based on the current price of about $26, the total value amounts to up to $31.2 million. This is the second monthly distribution the team has received under a linear unlock schedule since the token's initial distribution in November 2024.

Despite competition from emerging rivals like Lighter and Aster, Hyperliquid recorded a net capital inflow of $3.87 billion and an astonishing total trading volume of $2.95 trillion in 2025, maintaining its top position in decentralized perpetual contract trading volume. Although this unlock is part of an established plan, its market impact should not be underestimated given the circulating supply of only about 238 million tokens.

MarketWhisper·14h ago

XRP quietly forming a "spring-loaded" supply, but retail investors are overlooking it

XRP is closing out 2025 with one of the most paradoxical pictures in the crypto market: institutional inflows reaching a record high while price movements are among the weakest.

According to data from CoinShares, XRP-related investment products attracted approximately $70.2 million in net inflows during the week.

XRP0,8%

TapChiBitcoin·14h ago

Cryptocurrency funds lose $446 million in a single week, XRP ETF defies the trend to attract investment and becomes the market focus

According to the latest fund flow report released by CoinShares, digital asset investment products experienced a net outflow of $446 million last week, bringing the total net outflow since mid-October to $3.2 billion. However, the market is not entirely bleak; newly approved XRP and Solana exchange-traded funds demonstrated strong capital attraction, with $70.2 million and $7.5 million in inflows respectively, contrasting sharply with the continued redemptions of Bitcoin and Ethereum products.

This significant divergence among assets reveals that institutional funds are strategically rotating during market adjustments, shifting from mature mainstream assets to alternative assets with event-driven potential. Although the overall capital inflow since the beginning of the year remains at $46.3 billion, the assets under management have only increased by 10%, indicating limited actual gains for retail investors after net flows are accounted for, and market sentiment remains fragile.

MarketWhisper·14h ago

[Korean Stock Market Opening] The Korean stock market is trending downward... Both the Kosdaq and Kospi indices are declining, and individual investors continue to buy actively.

The domestic stock market performed poorly, with both the KOSPI and KOSDAQ indices declining. Retail investors had net buy-ins, but foreign and institutional investors both net sold. The Korean won exchange rate and gold prices also declined, and the overall market trend remains weak.

TechubNews·15h ago

Crypto ETFs Set for Major Growth in 2026, Experts Predict

Emerging Trends Signal Explosive Growth for Crypto ETFs in 2026

Analysts project a substantial surge in the popularity of crypto exchange-traded funds (ETFs) by 2026, with over 100 new filings anticipated and billions of dollars in net inflows. This growth is driven by regulatory developments,

CryptoBreaking·16h ago

Bitcoin Spot ETFs Record $782M Weekly Outflow While Ethereum ETFs Lose $102M

_Bitcoin ETFs record $782M outflows and Ethereum ETFs $102M, while Solana and XRP ETFs recorded positive inflows._

Bitcoin spot exchange-traded funds recorded a weekly net outflow of $782 million between December 22 and 26, marking one of the largest weekly withdrawals since their launch. All tw

LiveBTCNews·23h ago

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year’s double festival are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." U.S. Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the U.S. Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock’s IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity’s FBTC and Grayscale’s GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net inflow of $84.6 million the previous day.

区块客·12-29 14:17

Japan announces cryptocurrency tax reform for 2026, tax rate reduced to 20%

The Japanese government recently announced the "2026 Tax System Reform Outline," one of the measures most closely watched by the crypto industry is the significant adjustment of the taxation method for cryptocurrency gains. In the future, income from crypto asset investments will be taxed at a flat rate of 20%, aligning with stocks and investment trusts, officially ending the long-standing high tax rate of up to 55%.

Japan's Cryptocurrency Tax Rate Was Once the Highest in the World

Currently in Japan, cryptocurrency gains are classified as "miscellaneous income" and must be combined with the individual's comprehensive income tax (Source: Japan Handbook). Under the highest tax bracket, including local taxes, investors' actual tax burden can reach up to 55%, making it one of the most stringent cryptocurrency tax systems among major global economies. This system not only discourages high-net-worth investors but also leads many Japanese crypto startups and trading volumes to flow overseas.

The Japanese government plans to incorporate cryptocurrencies into the new regulatory

ChainNewsAbmedia·12-29 13:44

Ethereum staking market shows a net inflow again! Entering the queue far exceeds exits, a prelude to the 2026 bull market?

By the end of 2025, the Ethereum network will reach a critical turning point: validators "enter the queue" and reverse, surpassing the "exit queue." The amount of funds staked in Ethereum has far exceeded the amount of funds seeking to unstake and exit, marking a gradual easing of the months-long selling pressure.

(Background: Is Ethereum signaling a bottom before a sharp rise? Staking queue surges by 740,000 ETH, twice the exit volume)

(Additional context: Tom Lee predicts: Ethereum will surge to $9,000 early next year, and Bitcoin could reach $200,000 by 2026)

Table of Contents

Reversal of the Ethereum validator queue

What is the validator queue? Why is it important?

How will the validator queue change in 2025?

Four core drivers behind the December reversal

Summary

As 2025 comes to a close, the Ethereum network reaches a critical turning point: validator

動區BlockTempo·12-29 13:17

Crypto ETPs Face $446M Outflows as Year-End Sentiment Dives

Crypto ETPs Witness Continued Outflows Amid Market Caution

Recent data indicates that crypto exchange-traded products (ETPs) experienced net outflows of $446 million last week, extending a trend of cautious investor activity that has persisted since the sharp market correction in October. Despite s

CryptoBreaking·12-29 12:05

Bitcoin Slides Below $90K as Spot BTC ETFs Record $780M in Outflows

Spot BTC ETFs experienced over $782 million in net outflows, contributing to Bitcoin's price drop from $90k to $87k. Institutional sentiment appears weak amid geopolitical tensions and uncertain Fed rate cuts, while retail trading is showing increased activity.

BTC1,67%

TheNewsCrypto·12-29 11:29

PA Daily | Bitcoin ETF saw a net outflow of $782 million last week; Digital RMB wallet balances will accrue interest starting January 1, 2026

Today's News Highlights:

Lu Lei: The "Action Plan" implemented from January 1, 2026, clarifies that digital renminbi wallet balances can earn interest

Analysis: Copper may face structural shortages in 2026, and prices could remain strong

UBS Group raises target prices for gold in March, June, and September 2026 to $5000

Lu Lei: Future digital renminbi will have the liability attributes of commercial banks, with functions including a monetary value scale, value storage, and cross-border payments

Opinion: Although gold and silver prices may experience profit-taking pressure in the short term, long-term macro factors will continue to support the rise of precious metals

Bitcoin spot ETF saw net outflows of $7.82 billion last week, with BlackRock's IBIT experiencing the largest outflow of $4.35 billion

Macro

Analysis: Copper may face structural shortages in 2026, and prices could remain strong

Copper prices in 2025 increased by over 30%, and in December, they even broke through $12 per ton

PANews·12-29 09:37

Rick Rieder: BlackRock's Chief Managing $2.4 Trillion Eyes Fed Chair

Rick Rieder is BlackRock's CIO managing \$2.4 trillion. Rick Rieder BlackRock serves on Google and Fed committees. Trump will interview Rick Rieder as Fed Chair candidate. Rick Rieder net worth and Rick Rieder generational opportunity thesis built his Wall Street reputation.

MarketWhisper·12-29 08:57

[Korean Stock Market Closing行情] Korea Composite Stock Price Index and KOSDAQ Index rise for two consecutive days… Electronics, Electrical, and Pharmaceutical sectors strengthen

South Korea's stock market KOSPI rose by 2.20%, closing at 4220.56 points, driven by large-cap and electrical electronic stocks. KOSDAQ also increased by 1.40%, supported by the pharmaceutical industry. Foreign investors' net purchases were significant, the Korean won appreciated, and international oil prices rose slightly.

TechubNews·12-29 07:36

2025 Crypto ETF Year in Review: Wall Street Bids Farewell to Caution, Regulatory Green Light Opens Multi-Asset Era

Author: André Beganski, Decrypt

Translation: Felix, PANews

This year, with the US SEC adopting new regulatory approaches to cryptocurrency products, ETFs have opened multiple doors for the crypto market on Wall Street.

Although asset management firms previously strived to launch products tracking the spot prices of Bitcoin and Ethereum, the regulatory environment began to change after Donald Trump was re-elected president in January. Many companies foresee potential market opportunities in 2025.

Regarding Bitcoin, according to Farside Investors data, as of December 15, since the first launch in January 2024, spot Bitcoin ETFs have accumulated a net inflow of $57.7 billion, a 59% increase from $36.2 billion at the beginning of this year, but the funds

PANews·12-29 06:30

XRP Today's News: 7-week ETF inflow of 64 million, decoupling from BTC remains bullish

Although XRP's price is below $2, the fundamentals and technicals are diverging. The US XRP spot ETF has seen seven consecutive weeks of inflows, with a net inflow of $64 million that week, while the BTC spot ETF experienced a net outflow of $589 million during the same period. Progress in the Market Structure Bill, increased practicality, and ongoing institutional demand are laying the foundation for XRP to break free from BTC's constraints.

MarketWhisper·12-29 03:48

2025 Cryptocurrency ETF attracts 57.7 billion! XRP and Solana flood into Wall Street's feast

The 2025 cryptocurrency ETF opens the door to Wall Street, with the SEC adopting a new strategy. The spot Bitcoin ETF has generated a net inflow of $57.7 billion, and the Ethereum ETF $12.6 billion. After the SEC approved general listing standards in September, XRP and Solana ETFs were listed in November, generating net inflows of $883 million and $92 million respectively.

MarketWhisper·12-29 02:11

Year-End Review: 2025 Crypto ETFs Surge, XRP and Solana Join the Battle, Billions in Institutional Funds Reshape Market Dynamics

2025 is the year when cryptocurrency asset exchange-traded funds (ETFs) achieve a decisive breakthrough. Since the launch of spot Bitcoin ETFs in 2024, the cumulative net inflow has reached $57.7 billion, a 59% increase within the year; spot Ethereum ETFs have also attracted $12.6 billion in funds. A greater transformation lies in market diversification: under the policy breakthrough of the SEC establishing general listing standards, spot XRP and Solana ETFs successfully listed, respectively gaining net inflows of $883 million and $92 million. Meanwhile, multi-asset index ETFs represented by Hashdex and Bitwise are beginning to rise, and top institutional investors including Abu Dhabi’s sovereign fund and Harvard University’s endowment fund are entering with real capital, marking a historic shift of cryptocurrency assets from retail-driven to institutional allocation.

MarketWhisper·12-29 01:59

[Korean Stock Market Opening] KOSPI breaks through 4180 points... Hanwha Aerospace and SK Hynix lead the gains

On the 29th, the Korean stock market rose, with the KOSPI index up 1.24% to 4,180.78 points, and retail investors net buying 390 billion KRW. The KOSDAQ index increased by 0.60% to 925.15 points, with retail investors net buying 150.2 billion KRW. The Korean won against the US dollar fell by 9.1 won, and domestic gold prices declined.

TechubNews·12-29 00:53

Crypto ETFs Set for Major Growth in 2026, Experts Predict

Emerging Trends Signal Explosive Growth for Crypto ETFs in 2026

Analysts project a substantial surge in the popularity of crypto exchange-traded funds (ETFs) by 2026, with over 100 new filings anticipated and billions of dollars in net inflows. This growth is driven by regulatory developments,

CryptoBreaking·12-29 00:00

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·12-28 14:13

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·12-28 14:10

On December 26, the US Bitcoin spot ETF had a total net outflow of approximately $276 million, marking the sixth consecutive day of net outflows.

According to Techub News, the US Bitcoin spot ETF experienced a total net outflow of approximately $276 million on December 26, continuing for 6 days. BlackRock and Fidelity ETFs each had a single-day net outflow of $193 million and $74.4 million, respectively, while other ETFs showed no significant fund flows.

BTC1,67%

TechubNews·12-28 05:35

Pantera, Sequoia, and Samsung team up to bet, is FIN aiming to take over traditional banks' jobs?

Writing by: KarenZ, Foresight News

In the current global financial system, large-scale cross-border transfers are still plagued by "slow arrival, high fees, and complicated procedures." A startup called FIN is directly addressing this pain point with stablecoins, attempting to rewrite the industry landscape.

As a project founded by two former Citadel employees, FIN is not just making small moves on the fringes but is building a large-scale payment track using stablecoin technology, dedicated to providing instant and efficient cross-border transfer experiences for enterprises and high-net-worth individuals.

In early December 2025, FIN announced the completion of a $17 million funding round, led by Pantera Capital, with Sequoia and Samsung

SOL1,61%

TechubNews·12-28 01:17

CryptoQuant asserts "The bear market has arrived"! Bitcoin demand momentum has cooled off, possibly testing the $70,000 level again.

CryptoQuant has released a report indicating that Bitcoin demand momentum has significantly weakened, suggesting the market may be entering a bear market and warning of increased downside risk. The current support level is at $70,000, and if it retraces to $56,000, it could become the smallest retracement in history for a bear market. The report cites ETF net selling, large investors pulling back, and cooling derivatives markets to support its view.

区块客·12-28 00:25

In 2025, these ten billionaires' net worth surged by $730 billion

Written by: Sofia Chierchio

Translated by: Lemin

Source: Forbes

Elon Musk's pursuit of a trillion-dollar fortune is no longer just talk.

At the beginning of the year, his net worth was $421 billion. By October, he became the first person in history to surpass $500 billion. Subsequently, the rocket manufacturer SpaceX launched a share sale plan, with a valuation reaching approximately $800 billion, making Musk the first person in history to have a net worth of over $600 billion. Soon after, a court in Delaware ruled that Musk could retain the massive stock option awards previously canceled by Tesla, which made him the world's first person to have a net worth exceeding $700 billion last Friday. As the year draws to a close, as of December 22, Musk's net worth has reached $754 billion.

Musk is capable of

PANews·12-28 00:05

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·12-27 14:04

Elon Musk's net worth surpasses 700 billion USD! By 2025, global billionaire wealth will surge by 3.6 trillion USD, with the top ten winners raking in 7290 billion USD.

In 2025, the wealth of the world's super-rich skyrocketed by $3.6 trillion, led by Elon Musk with an increase of $333 billion. The combined net worth of the top ten winners grew by over $729 billion, with American tech billionaires occupying the top five spots. This article is based on a piece by Forbes, compiled, edited, and written by Foresight News.

(Previous summary: Elon Musk's net worth approaches $750 billion, a historic first! Courts restore sky-high salaries, SpaceX IPO sparks imagination)

(Additional background: When Chinese crypto billionaires start buying gold, you should wake up: the market has already changed)

Table of Contents

1. Elon Musk

2. Larry Page

3. Sergey Brin

4. Jensen Huang

5. Larry Ellison

6. Amancio Ortega

7. German

動區BlockTempo·12-26 16:40

Vitalik Says Grok Keeps X Honest Despite Bias

_Ethereum co-founder Vitalik Buterin admires Grok because it makes X more truth-friendly and notes that this is a net improvement despite the well-known limitations and biases of the AI chatbot._

Vitalik Buterin commended the AI chatbot Grok, created by X, and called it a significant truth

LiveBTCNews·12-26 16:15

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·12-26 14:04

Bitcoin ETFs Face $175 Million Outflows While Solana and XRP Gain

_Bitcoin ETFs saw $175M in outflows on Dec 24, led by BlackRock’s IBIT, while Solana and XRP ETFs gained $1.48M and $11.93M, respectively._

On December 24, U.S. spot Bitcoin ETFs experienced net outflows of $175 million. BlackRock’s IBIT ETF led

LiveBTCNews·12-26 12:00

Spot Bitcoin and Ether ETFs Record Outflows Amid Holiday De-Risking

U.S. spot Bitcoin and Ethereum ETFs experienced net outflows on Tuesday, December 23, as year-end portfolio adjustments and thin holiday liquidity prompted investors to reduce exposure ahead of Christmas.

CryptopulseElite·12-26 10:18

Gate Research Institute: XRP ETF Net Assets Surpass $1.25 Billion | Trust Wallet Browser Has Extension Vulnerability

Cryptocurrency Market Overview

- BTC (-0.34% | Current price 87,371 USDT): In the past 24 hours, BTC experienced a clear correction first, with the price dropping rapidly to around 86,418.2 USD, then gradually stabilizing supported by buying interest below and beginning a rebound. During the rebound, the price once surged to around 88,590 USD, but after encountering selling pressure at the high level, it turned into a oscillating decline. Currently, the price has fallen back to above 87,000 USD. From an overall structure perspective, BTC remains in a technical adjustment phase within a high-level oscillation. The key support zone below is between 86,800–87,000 USD. If this level can be effectively held, the price may continue to maintain a high-level oscillation; if support is broken, a retest around 86,400 USD cannot be ruled out for consolidation. On the upside, attention is on 88,

GateResearch·12-26 07:36

Gate Research Institute: CHEEL 24-hour increase exceeds 90% | BTC ETF continues to experience net outflows over the past week

Cryptocurrency Asset Panorama

BTC (-0.34% | Current price 87,371 USDT)

In the past 24 hours, BTC first experienced a significant correction, with the price rapidly dropping to around $86,418.2. Subsequently, supported by buying interest below, it gradually stabilized and began to rebound. During the rebound, the price once surged to around $88,590, but after encountering selling pressure at high levels, it turned into a sideways decline. Currently, the price has fallen back to above $87,000. From an overall perspective, BTC remains in a technical adjustment phase within a high-level consolidation. The upward momentum released earlier was relatively sufficient, with short-term profit-taking concentrated, leading to a rapid pullback in price. Technically, the price has fallen back to around the MA30, with short-term MAs5 and MA10 showing signs of turning downward, exerting some resistance on the short-term trend, and the rebound pace has significantly slowed.

GateResearch·12-26 07:06

Solana ecosystem stablecoin USX temporarily de-pegs

Techub News reports that Solana ecosystem DeFi protocol Solstice tweeted that the secondary market for the stablecoin USX will experience significant fluctuations, but the net asset value of the underlying assets and Solstice custody assets remain unaffected, with a collateralization ratio exceeding 100%. The team has requested a third-party to immediately provide an additional certification report, which will be released as soon as it is completed. Solstice stated that this is purely a liquidity issue in the secondary market, and the team and market makers are taking immediate steps to address it. They will continue to inject liquidity into the secondary market to ensure market stability. The 1:1 redemption in the primary market remains fully available.

According to PeckShield monitoring, the stablecoin USX briefly de-pegged and, due to liquidity exhaustion, fell to $0.10 in the secondary market. After Solstice injected liquidity, the exchange rate gradually

TechubNews·12-26 06:02

MICA Daily|Christmas ETH exchange net inflow significantly increases, giant whales may be preparing for large-scale selling

According to CryptoQuant Binance Exchange ETH Netflow indicator data, during the Christmas period (December 24 to 26), a large amount of ETH flowed into Binance, totaling over 140,000 coins, marking the highest value recorded this year. After this peak, ETH inflow slowed down but continued to show persistent inflow. Such one-time large-scale inflows are usually interpreted as investors preparing to sell ETH spot holdings.

Looking more closely at the trend of the Netflow indicator's moving averages, the EMA(7) and EMA(14) are trending upward, while the SMA(30) remains stable. This structural signal indicates that short-term selling intentions are increasing, and investors seem ready to sell when the price rises to resistance levels. Since each upward move may face selling pressure, it is expected

ETH1,95%

区块客·12-26 05:57

XRP Price Prediction: 35% Decline in Q4, Can Yen Arbitrage Trading Become a Catalyst for a Rebound by the End of 2025?

In Q4 2025, XRP is experiencing its most severe test since 2022, with a quarterly decline of up to 35%, potentially ending the previous five consecutive quarters of gains. On-chain data shows that its daily active accounts have dropped to 14,636, indicating a sharp decline in retail participation. However, the market is also brewing a turnaround amid "extreme fear": the US XRP spot ETF demonstrates strong institutional support, recording net inflows for 27 consecutive trading days, totaling over $1.14 billion; at the same time, cooling inflation in Japan has weakened the yen, sparking "arbitrage trading" flows into cryptocurrencies and other risk assets, providing key short-term support for XRP. Amid fierce battles between bulls and bears, $2.0 has become the "decisive factor" in determining XRP's short-term trend direction.

MarketWhisper·12-26 05:37

Elon Musk reboots Republican campaign funding! Trump faces impeachment in the 2026 midterm elections

On December 16, Elon Musk, with a net worth of $749 billion, announced the resumption of funding for the Republican Party, returning after a six-month break from breaking ties with Trump. The 2026 midterm elections are approaching, with the Republican advantage being slight and lagging behind the Democratic Party in funding. Musk gains three major benefits: Tesla's new energy subsidies, SpaceX government contracts, and the passage of autonomous driving legislation. The two sides broke apart in May over the "Beautiful Bill," reconciled in September, and then the EU fines facilitated a trench warfare community.

MarketWhisper·12-26 05:10

Load More