# Marketupdate

15.56K

Dark_Angel

📊 #GoldandSilverHitNewHighs — 26 January 2026 Market Update

Hello everyone! 👋 Today, gold and silver once again reached historic new highs amid strong safe-haven demand and ongoing global uncertainty — marking another major milestone for precious metals this year.

🔶 Gold soared well above $5,100 per ounce, driven by continued investor demand for safety as macroeconomic risks and geopolitical tensions persist.

🔷 Silver also hit new record levels above $100 per ounce — a rare and notable achievement for the white metal that reflects both safe-haven buying and tighter supplies.

📈 This ral

Hello everyone! 👋 Today, gold and silver once again reached historic new highs amid strong safe-haven demand and ongoing global uncertainty — marking another major milestone for precious metals this year.

🔶 Gold soared well above $5,100 per ounce, driven by continued investor demand for safety as macroeconomic risks and geopolitical tensions persist.

🔷 Silver also hit new record levels above $100 per ounce — a rare and notable achievement for the white metal that reflects both safe-haven buying and tighter supplies.

📈 This ral

- Reward

- 1

- 4

- Repost

- Share

AylaShinex :

:

1000x VIbes 🤑View More

📊 #GoldandSilverHitNewHighs — 26 January 2026 Market Update

Hello everyone! 👋 Today, gold and silver once again reached historic new highs amid strong safe-haven demand and ongoing global uncertainty — marking another major milestone for precious metals this year.

🔶 Gold soared well above $5,100 per ounce, driven by continued investor demand for safety as macroeconomic risks and geopolitical tensions persist.

🔷 Silver also hit new record levels above $100 per ounce — a rare and notable achievement for the white metal that reflects both safe-haven buying and tighter supplies.

📈 This ral

Hello everyone! 👋 Today, gold and silver once again reached historic new highs amid strong safe-haven demand and ongoing global uncertainty — marking another major milestone for precious metals this year.

🔶 Gold soared well above $5,100 per ounce, driven by continued investor demand for safety as macroeconomic risks and geopolitical tensions persist.

🔷 Silver also hit new record levels above $100 per ounce — a rare and notable achievement for the white metal that reflects both safe-haven buying and tighter supplies.

📈 This ral

- Reward

- 1

- 4

- Repost

- Share

AylaShinex :

:

1000x VIbes 🤑View More

JUST IN: Bitcoin Rejects $90,000 as "Tariff Relief" Rally Fails to Hold.

The weekend bounce was a trap. Despite the revocation of the U.S.-Greenland tariffs, Bitcoin has failed to sustain momentum above psychological resistance and is currently trading back at $88,455. The "Extreme Fear" sentiment (Index 34) is overriding the geopolitical relief.

This matters because the market structure is weakening.

We are seeing a "spot demand void." Open Interest has dropped to $27.9 billion, signaling that institutions are de-risking rather than accumulating at these levels. With the $90,200 moving averag

The weekend bounce was a trap. Despite the revocation of the U.S.-Greenland tariffs, Bitcoin has failed to sustain momentum above psychological resistance and is currently trading back at $88,455. The "Extreme Fear" sentiment (Index 34) is overriding the geopolitical relief.

This matters because the market structure is weakening.

We are seeing a "spot demand void." Open Interest has dropped to $27.9 billion, signaling that institutions are de-risking rather than accumulating at these levels. With the $90,200 moving averag

BTC-0,3%

- Reward

- 1

- Comment

- Repost

- Share

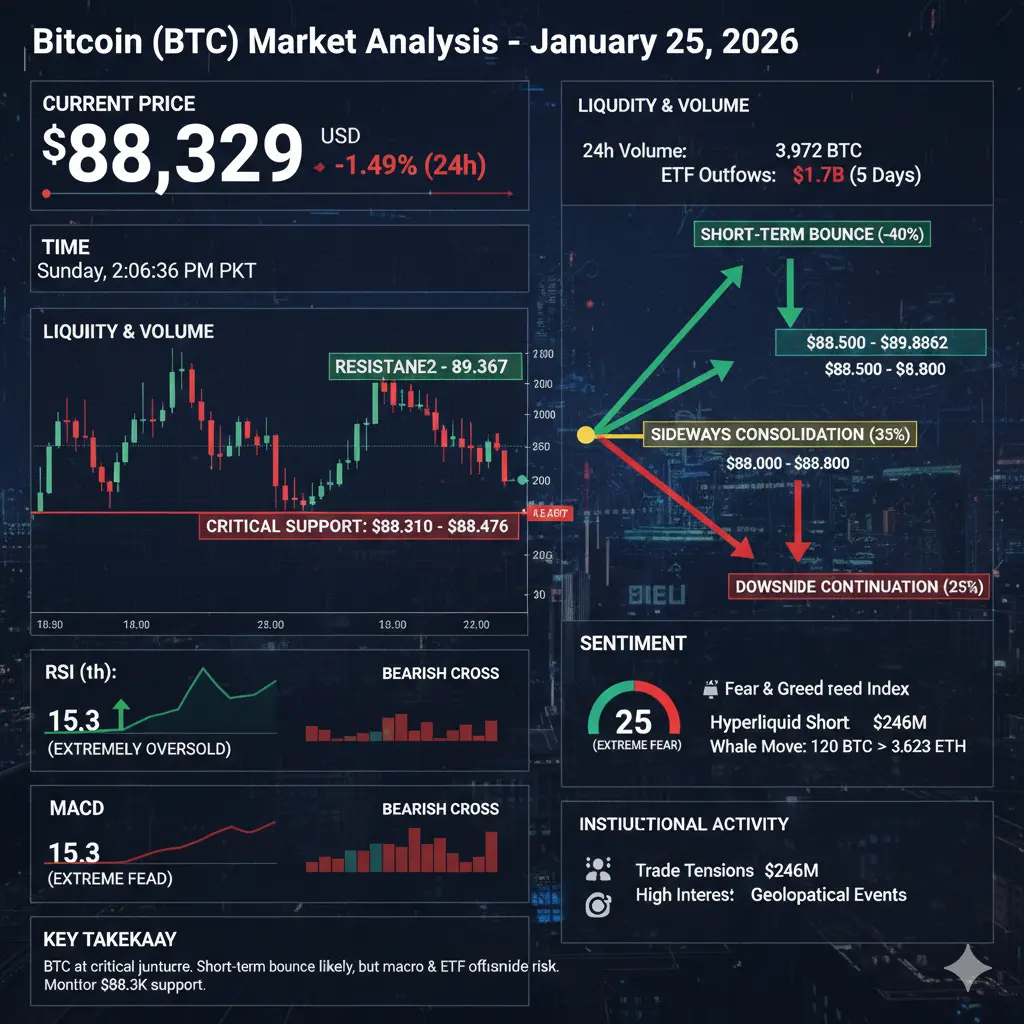

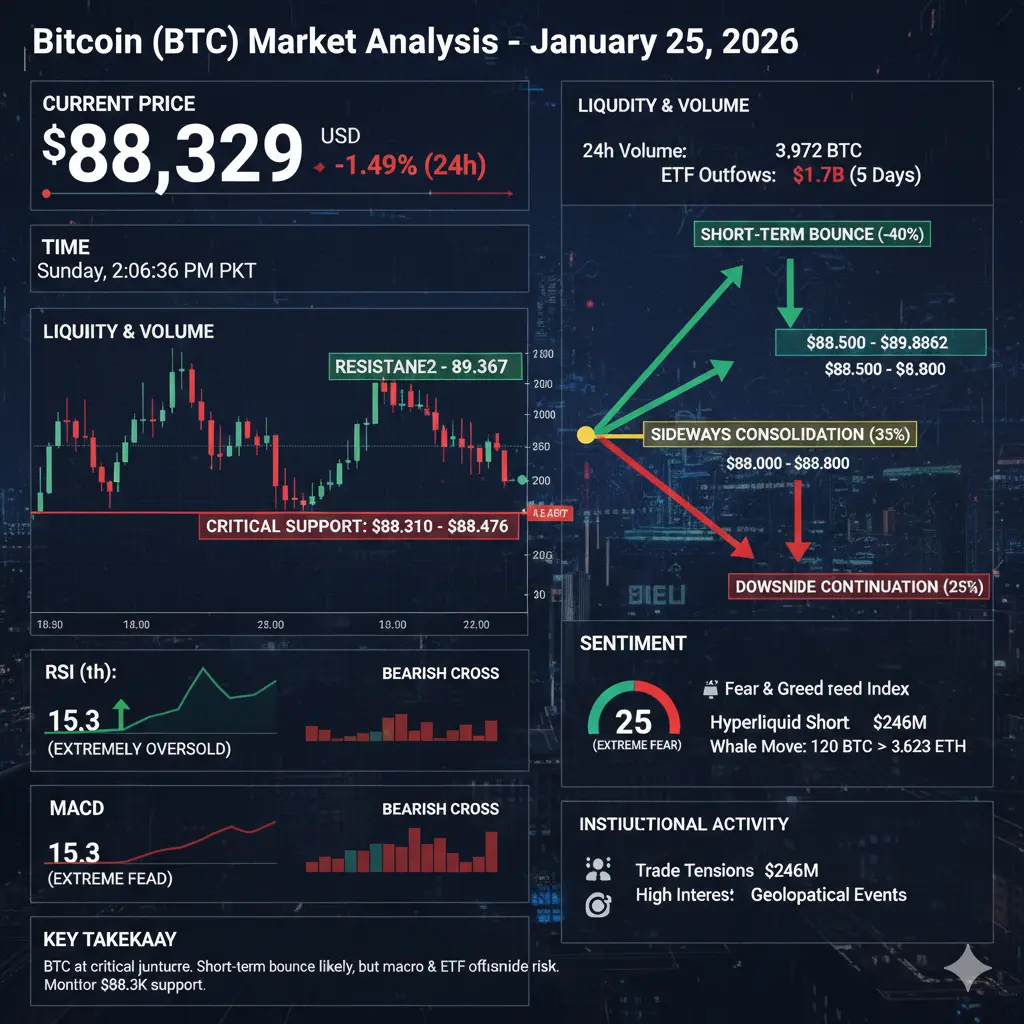

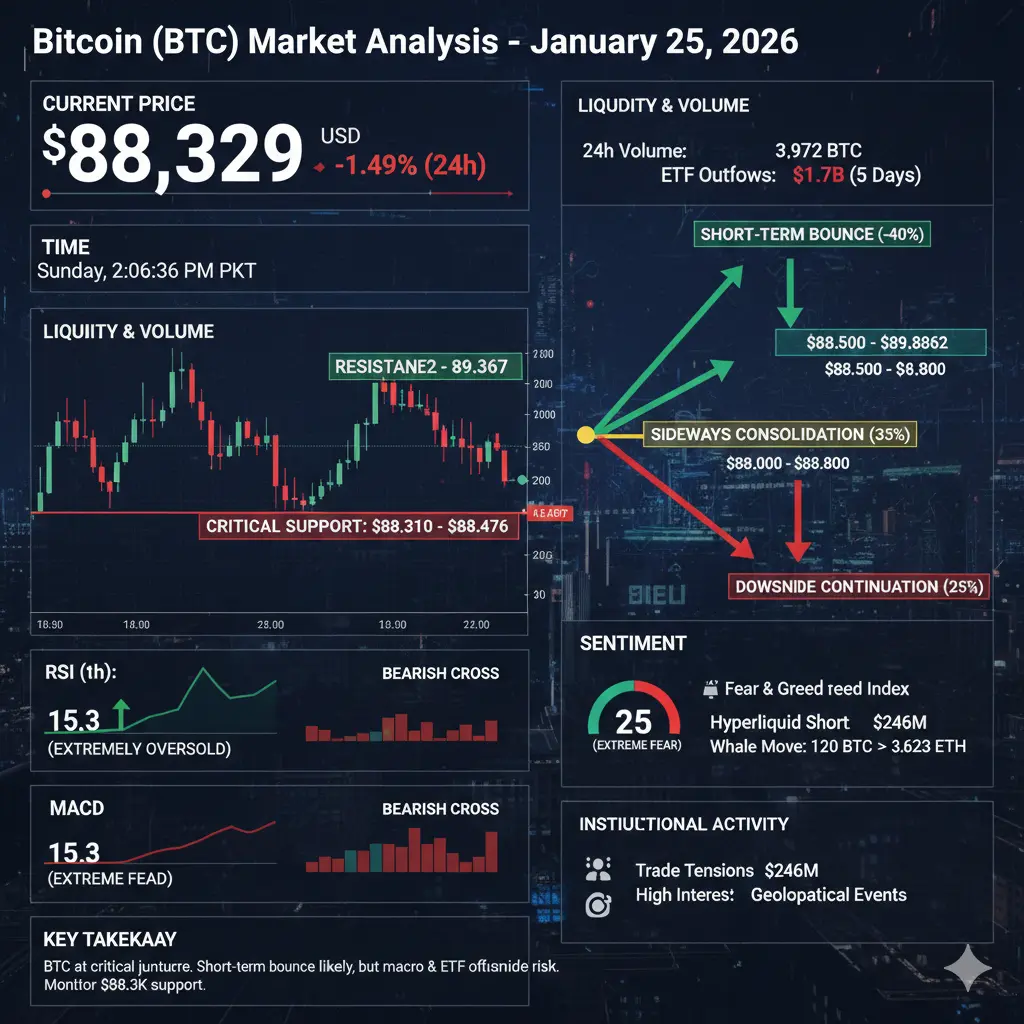

🚨 #BTCMarketAnalysis – Bitcoin Update

Current Price: $88,329 (↓1.49% 24h)

24h Range: $88,128 – $89,673 (~1.75% volatility)

Support / Resistance: $88,310–$88,476 | $88,862–$89,367

🔹 Key Highlights:

Extreme Fear: Fear & Greed Index 25 → panic selling visible

High Volume Sell-Off: 24h volume 3,972 BTC ($354M), ETF outflows $1.7B in 5 days

Technical Oversold: RSI (1h) 15.3, Bollinger Bands below lower band → short-term bounce possible

Liquidity Tightening: Bid-ask spreads widened, institutional shorts rising

📊 Short-Term Outlook (1–3 Days):

Bounce: $88,500–$88,862 (~40% chance)

Consolidation: $

Current Price: $88,329 (↓1.49% 24h)

24h Range: $88,128 – $89,673 (~1.75% volatility)

Support / Resistance: $88,310–$88,476 | $88,862–$89,367

🔹 Key Highlights:

Extreme Fear: Fear & Greed Index 25 → panic selling visible

High Volume Sell-Off: 24h volume 3,972 BTC ($354M), ETF outflows $1.7B in 5 days

Technical Oversold: RSI (1h) 15.3, Bollinger Bands below lower band → short-term bounce possible

Liquidity Tightening: Bid-ask spreads widened, institutional shorts rising

📊 Short-Term Outlook (1–3 Days):

Bounce: $88,500–$88,862 (~40% chance)

Consolidation: $

BTC-0,3%

- Reward

- 2

- 1

- Repost

- Share

Karik254 :

:

2026 GOGOGO 👊🚨 #BTCMarketAnalysis – Bitcoin Update

Current Price: $88,329 (↓1.49% 24h)

24h Range: $88,128 – $89,673 (~1.75% volatility)

Support / Resistance: $88,310–$88,476 | $88,862–$89,367

🔹 Key Highlights:

Extreme Fear: Fear & Greed Index 25 → panic selling visible

High Volume Sell-Off: 24h volume 3,972 BTC ($354M), ETF outflows $1.7B in 5 days

Technical Oversold: RSI (1h) 15.3, Bollinger Bands below lower band → short-term bounce possible

Liquidity Tightening: Bid-ask spreads widened, institutional shorts rising

📊 Short-Term Outlook (1–3 Days):

Bounce: $88,500–$88,862 (~40% chance)

Consolidation: $

Current Price: $88,329 (↓1.49% 24h)

24h Range: $88,128 – $89,673 (~1.75% volatility)

Support / Resistance: $88,310–$88,476 | $88,862–$89,367

🔹 Key Highlights:

Extreme Fear: Fear & Greed Index 25 → panic selling visible

High Volume Sell-Off: 24h volume 3,972 BTC ($354M), ETF outflows $1.7B in 5 days

Technical Oversold: RSI (1h) 15.3, Bollinger Bands below lower band → short-term bounce possible

Liquidity Tightening: Bid-ask spreads widened, institutional shorts rising

📊 Short-Term Outlook (1–3 Days):

Bounce: $88,500–$88,862 (~40% chance)

Consolidation: $

BTC-0,3%

- Reward

- 1

- Comment

- Repost

- Share

🚀 DMC on Fire! 🚀

DMC Price Update

💰 $0.0017306

📈 +154.09% in 24h

Strong momentum, explosive volume, and growing attention across the market. DMC is showing classic breakout behavior — early movers are already in profit while late entries should watch for pullbacks and confirmation.

⚠️ Always manage risk and wait for confirmation before chasing pumps.

🔍 Keep DMC on your watchlist — volatility = opportunity.

#DMC #CryptoMomentum #Altcoins #CryptoTrading #MarketUpdate

$DMC $PIPE

DMC Price Update

💰 $0.0017306

📈 +154.09% in 24h

Strong momentum, explosive volume, and growing attention across the market. DMC is showing classic breakout behavior — early movers are already in profit while late entries should watch for pullbacks and confirmation.

⚠️ Always manage risk and wait for confirmation before chasing pumps.

🔍 Keep DMC on your watchlist — volatility = opportunity.

#DMC #CryptoMomentum #Altcoins #CryptoTrading #MarketUpdate

$DMC $PIPE

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

🚨 MARKET ALERT!

Silver shines brighter than ever, hitting a new all-time high at $105! ✨

Gold is not far behind, soaring to $5,000 per ounce! 🏆

📈 Safe-haven assets are stealing the spotlight as global uncertainty drives demand higher.

💡 Insight: Investors are flocking to precious metals—this momentum signals strong confidence in gold and silver as ultimate hedges.

#Gold #Silver #MarketUpdate #InvestSmart #SafeHavenAssets

Silver shines brighter than ever, hitting a new all-time high at $105! ✨

Gold is not far behind, soaring to $5,000 per ounce! 🏆

📈 Safe-haven assets are stealing the spotlight as global uncertainty drives demand higher.

💡 Insight: Investors are flocking to precious metals—this momentum signals strong confidence in gold and silver as ultimate hedges.

#Gold #Silver #MarketUpdate #InvestSmart #SafeHavenAssets

- Reward

- 1

- Comment

- Repost

- Share

#GoldandSilverHitNewHighs ✨

Gold and silver are back in the spotlight as both metals surge to fresh highs, signaling strong investor confidence in safe-haven assets. 📈

Gold’s rally reflects growing demand amid economic uncertainty, while silver is gaining momentum thanks to its dual role as both a precious and industrial metal. Together, they’re proving once again why metals remain a key hedge against inflation and market volatility.

With global risks still in play, the precious metals market looks firmly supported — and the trend is catching serious attention from traders and long-term inves

Gold and silver are back in the spotlight as both metals surge to fresh highs, signaling strong investor confidence in safe-haven assets. 📈

Gold’s rally reflects growing demand amid economic uncertainty, while silver is gaining momentum thanks to its dual role as both a precious and industrial metal. Together, they’re proving once again why metals remain a key hedge against inflation and market volatility.

With global risks still in play, the precious metals market looks firmly supported — and the trend is catching serious attention from traders and long-term inves

- Reward

- 3

- 3

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

JUST IN: Bitcoin Slips Below $89,000 as "Recovery" Rally Fails to Hold.

The market is waking up to a harsh reality check. After briefly teasing a run at $95k, Bitcoin has rejected the range highs and slid back to $88,455, driven by renewed geopolitical friction over U.S. sovereignty claims in Greenland.

This matters because the "risk-on" switch has been flipped off.

We are seeing a broad sentiment shift back into "Fear" territory. While Bitcoin consolidates, Solana is showing notable weakness, trading around $126 and acting as the "canary in the coal mine" for broader altcoin correction.

Trade

The market is waking up to a harsh reality check. After briefly teasing a run at $95k, Bitcoin has rejected the range highs and slid back to $88,455, driven by renewed geopolitical friction over U.S. sovereignty claims in Greenland.

This matters because the "risk-on" switch has been flipped off.

We are seeing a broad sentiment shift back into "Fear" territory. While Bitcoin consolidates, Solana is showing notable weakness, trading around $126 and acting as the "canary in the coal mine" for broader altcoin correction.

Trade

- Reward

- 1

- 1

- Repost

- Share

PumpSpreeLive :

:

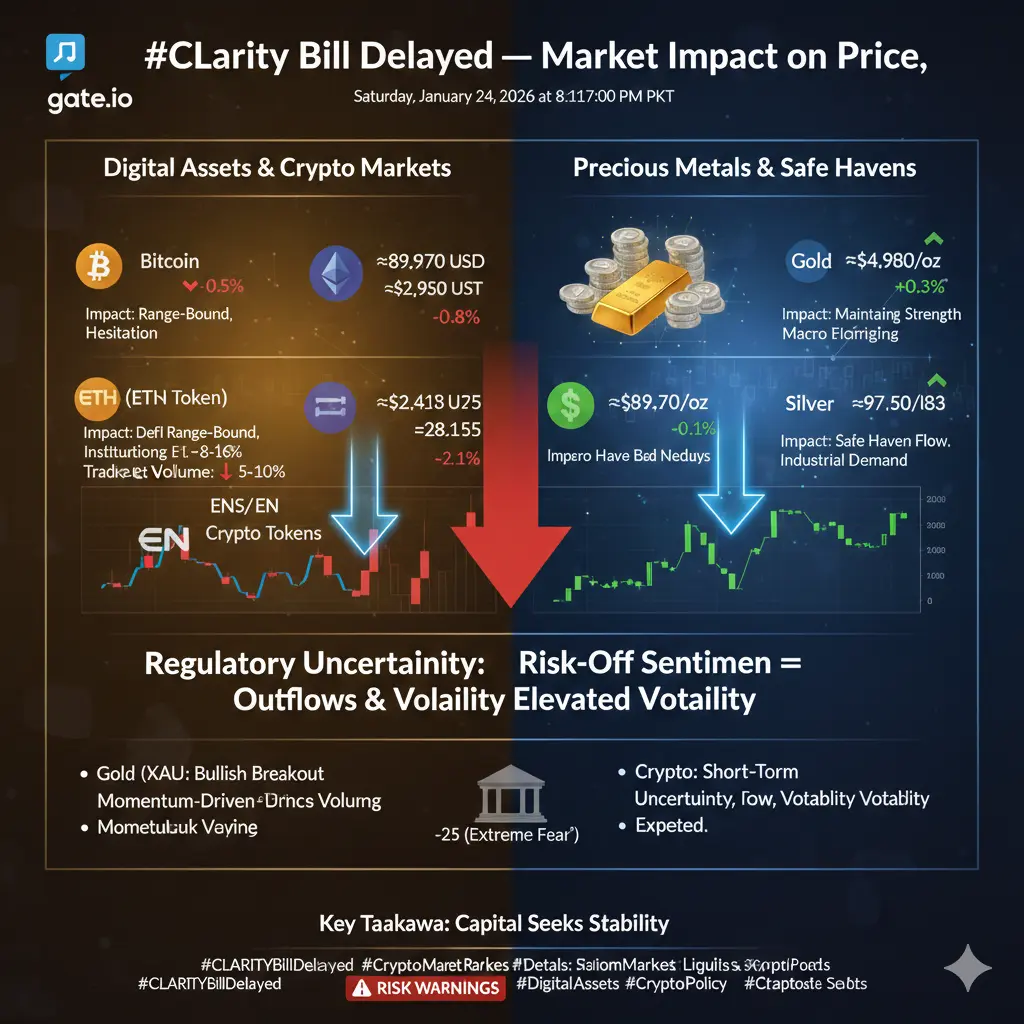

HODL Tight 💪🚨 #CLARITYBillDelayed – Market Update

The delay of the CLARITY Bill is shaking the crypto landscape:

Price Impact: Major assets down 2–6% short-term

Trading Volume: Dropped 8–15% as investors hesitate

Liquidity: Tightened 5–10%, raising bid-ask spreads

💡 Why It Matters:

Regulatory uncertainty slows adoption, discourages capital inflows, and limits sustainable growth. Markets crave clarity, transparency, and innovation-friendly policy to thrive.

⚠️ Takeaway:

This isn’t just a temporary setback — it highlights the urgent need for stable regulations that protect investors while fostering long-t

The delay of the CLARITY Bill is shaking the crypto landscape:

Price Impact: Major assets down 2–6% short-term

Trading Volume: Dropped 8–15% as investors hesitate

Liquidity: Tightened 5–10%, raising bid-ask spreads

💡 Why It Matters:

Regulatory uncertainty slows adoption, discourages capital inflows, and limits sustainable growth. Markets crave clarity, transparency, and innovation-friendly policy to thrive.

⚠️ Takeaway:

This isn’t just a temporary setback — it highlights the urgent need for stable regulations that protect investors while fostering long-t

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

15.99K Popularity

95.41K Popularity

67.65K Popularity

19.87K Popularity

38.28K Popularity

31.95K Popularity

23K Popularity

96.97K Popularity

62.66K Popularity

32.58K Popularity

22.45K Popularity

16.06K Popularity

142.48K Popularity

32.7K Popularity

172.37K Popularity

News

View MoreData: 112 BTC transferred from an anonymous address to Cumberland DRW, worth approximately $9.54 million

22 m

Spot silver continues to rise and has now surpassed $113 per ounce

56 m

Sky Protocol上周斥资190万枚USDS回购2952万枚SKY

1 h

Matt Hougan: The rise in gold reflects the sovereign-level "self-custody" wealth trend

1 h

The US Dollar Index drops to a 4-month low, currently at 96.9.

1 h

Pin