CryptoVortex

No content yet

CryptoVortex

more detailed insights into the ongoing #JapanBondMarketSell-Off — combining recent news and deeper structural context so you clearly understand what’s driving this event, how markets are reacting, what authorities are considering, and why it matters globally.

What are Japan's policy options to soothe its bond rout?

Japan's 40-year bond yields surpass 4% for first time

Today

January 20

1) Why the Sell-Off Has Intensified Recently

Fiscal policy & election uncertainty

Prime Minister Sanae Takaichi announced a snap election for February 8, 2026, along with plans for a two-year suspension of the f

What are Japan's policy options to soothe its bond rout?

Japan's 40-year bond yields surpass 4% for first time

Today

January 20

1) Why the Sell-Off Has Intensified Recently

Fiscal policy & election uncertainty

Prime Minister Sanae Takaichi announced a snap election for February 8, 2026, along with plans for a two-year suspension of the f

- Reward

- 2

- 2

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

#BTCMarketAnalysis

#BTCMarketAnalysis

Bitcoin is currently trading in a critical zone where price action is deciding the next directional move. After the recent volatility, the market has shifted into a phase of consolidation, showing that both buyers and sellers are cautious. This phase often acts as a preparation zone for a stronger move, and traders should focus closely on key technical levels and volume behavior.

From a market structure perspective, Bitcoin is still respecting its broader trend, but short term momentum has weakened. Selling pressure has reduced compared to previous sessio

#BTCMarketAnalysis

Bitcoin is currently trading in a critical zone where price action is deciding the next directional move. After the recent volatility, the market has shifted into a phase of consolidation, showing that both buyers and sellers are cautious. This phase often acts as a preparation zone for a stronger move, and traders should focus closely on key technical levels and volume behavior.

From a market structure perspective, Bitcoin is still respecting its broader trend, but short term momentum has weakened. Selling pressure has reduced compared to previous sessio

BTC-0,88%

- Reward

- 7

- 9

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#GateSquareCreatorNewYearIncentives

#GateSquareCreatorNewYearIncentives

Gate.io is kicking off the year with its GateSquare Creator New Year Incentives, a program designed to reward content creators and community participants for their engagement and contributions. This initiative aims to foster creativity, encourage active participation, and strengthen the GateSquare ecosystem by giving creators tangible rewards for their work and insights.

The program allows creators to earn incentives by posting market analysis, sharing trading strategies, reporting on blockchain projects, and engaging wit

#GateSquareCreatorNewYearIncentives

Gate.io is kicking off the year with its GateSquare Creator New Year Incentives, a program designed to reward content creators and community participants for their engagement and contributions. This initiative aims to foster creativity, encourage active participation, and strengthen the GateSquare ecosystem by giving creators tangible rewards for their work and insights.

The program allows creators to earn incentives by posting market analysis, sharing trading strategies, reporting on blockchain projects, and engaging wit

- Reward

- 10

- 12

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#GoldmanEyesPredictionMarkets

#GoldmanEyesPredictionMarkets

Goldman Sachs, one of the world’s leading investment banks, has recently signaled growing interest in prediction markets, a development that could have significant implications for financial innovation, market efficiency, and investor behavior. Prediction markets, which allow participants to trade contracts based on the likelihood of future events, have traditionally been niche platforms. However, Goldman’s attention reflects a shift toward integrating these tools into mainstream finance, potentially reshaping how markets price risk

#GoldmanEyesPredictionMarkets

Goldman Sachs, one of the world’s leading investment banks, has recently signaled growing interest in prediction markets, a development that could have significant implications for financial innovation, market efficiency, and investor behavior. Prediction markets, which allow participants to trade contracts based on the likelihood of future events, have traditionally been niche platforms. However, Goldman’s attention reflects a shift toward integrating these tools into mainstream finance, potentially reshaping how markets price risk

- Reward

- 8

- 9

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#BTCMarketAnalysis

#BTCMarketAnalysis

Bitcoin (BTC) continues to dominate the crypto market, serving as a key indicator of market sentiment. Recent price action shows a volatile environment, with sharp swings driven by macroeconomic pressures, market liquidity, and trader behavior. Understanding critical support and resistance levels is essential for both short-term trading and long-term investment strategies.

Over the past few weeks, BTC has experienced retracements from recent highs as traders take profits and respond to global risk factors. However, key support zones around $91,000–$92,000

#BTCMarketAnalysis

Bitcoin (BTC) continues to dominate the crypto market, serving as a key indicator of market sentiment. Recent price action shows a volatile environment, with sharp swings driven by macroeconomic pressures, market liquidity, and trader behavior. Understanding critical support and resistance levels is essential for both short-term trading and long-term investment strategies.

Over the past few weeks, BTC has experienced retracements from recent highs as traders take profits and respond to global risk factors. However, key support zones around $91,000–$92,000

BTC-0,88%

- Reward

- 10

- 12

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#CLARITYBillDelayed:

#CLARITYBillDelayed

The highly anticipated CLARITY Act, a major piece of U.S. legislation aimed at establishing a clear regulatory framework for digital assets, has encountered a significant setback as it has been delayed in the Senate. What was expected to be a pivotal moment for crypto regulation has instead turned into a bout of uncertainty and political negotiation, leaving many in the industry wondering what comes next.

The CLARITY Act was passed by the U.S. House of Representatives in mid‑2025 with strong bipartisan support, raising hopes that comprehensive crypto r

#CLARITYBillDelayed

The highly anticipated CLARITY Act, a major piece of U.S. legislation aimed at establishing a clear regulatory framework for digital assets, has encountered a significant setback as it has been delayed in the Senate. What was expected to be a pivotal moment for crypto regulation has instead turned into a bout of uncertainty and political negotiation, leaving many in the industry wondering what comes next.

The CLARITY Act was passed by the U.S. House of Representatives in mid‑2025 with strong bipartisan support, raising hopes that comprehensive crypto r

- Reward

- 9

- 12

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

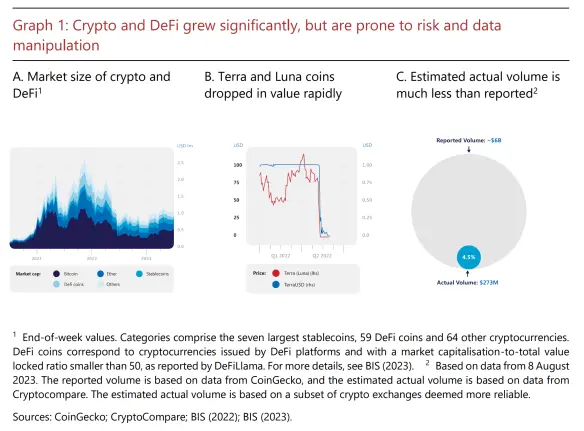

#CryptoMarketWatch

The crypto market remains highly dynamic, with traders and investors closely monitoring price action, volume trends, and market sentiment across major digital assets. Volatility continues to define the market, with sharp swings in Bitcoin, Ethereum, and top altcoins reflecting a mix of macroeconomic factors, regulatory developments, and investor behavior.

Bitcoin, as the leading cryptocurrency, remains the primary indicator for broader market trends. Recent fluctuations in BTC price have influenced altcoins and risk sentiment, highlighting its role as a market bellwether. E

The crypto market remains highly dynamic, with traders and investors closely monitoring price action, volume trends, and market sentiment across major digital assets. Volatility continues to define the market, with sharp swings in Bitcoin, Ethereum, and top altcoins reflecting a mix of macroeconomic factors, regulatory developments, and investor behavior.

Bitcoin, as the leading cryptocurrency, remains the primary indicator for broader market trends. Recent fluctuations in BTC price have influenced altcoins and risk sentiment, highlighting its role as a market bellwether. E

- Reward

- 10

- 15

- Repost

- Share

repanzal :

:

Happy New Year! 🤑View More

#PrivacyCoinsDiverge

#PrivacyCoinsDiverge

The privacy coin market is showing clear divergence as not all privacy-focused cryptocurrencies are moving in the same direction. While some coins gain traction and attract strong investor interest, others are losing momentum, highlighting the varied dynamics within this niche segment of the crypto market.

One group of privacy coins is demonstrating strength due to robust community support, real-world usage, and improved technological adoption. Traders feel more confident in these coins, and increased trading volume confirms growing interest. Price ac

#PrivacyCoinsDiverge

The privacy coin market is showing clear divergence as not all privacy-focused cryptocurrencies are moving in the same direction. While some coins gain traction and attract strong investor interest, others are losing momentum, highlighting the varied dynamics within this niche segment of the crypto market.

One group of privacy coins is demonstrating strength due to robust community support, real-world usage, and improved technological adoption. Traders feel more confident in these coins, and increased trading volume confirms growing interest. Price ac

- Reward

- 10

- 13

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#DoubleRewardsWithGUSD

#DoubleRewardsWithGUSD

Gate.io is giving users an exciting chance to maximize earnings with GUSD through its Double Rewards campaign. By participating, traders can earn double the rewards when trading, holding, or staking GUSD, the USD-backed stablecoin on Gate.io. This campaign is designed to encourage engagement while offering a low-risk opportunity to earn extra value in the crypto market.

GUSD offers stability in volatile markets, making it an ideal asset for traders who want predictable returns. During the Double Rewards campaign, users can earn additional bonuses

#DoubleRewardsWithGUSD

Gate.io is giving users an exciting chance to maximize earnings with GUSD through its Double Rewards campaign. By participating, traders can earn double the rewards when trading, holding, or staking GUSD, the USD-backed stablecoin on Gate.io. This campaign is designed to encourage engagement while offering a low-risk opportunity to earn extra value in the crypto market.

GUSD offers stability in volatile markets, making it an ideal asset for traders who want predictable returns. During the Double Rewards campaign, users can earn additional bonuses

GUSD-0,01%

- Reward

- 7

- 9

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#DoubleRewardsWithGUSD

#DoubleRewardsWithGUSD

Gate.io is offering an exciting opportunity for traders with its Double Rewards with GUSD campaign. This event allows users to earn double the rewards when trading or holding GUSD, Gate.io’s stablecoin, creating an attractive incentive for both new and experienced participants. The campaign highlights the benefits of leveraging stablecoins for trading rewards while enjoying low volatility and high reliability.

GUSD, as a USD-backed stablecoin, offers stability in volatile markets, making it an ideal asset for traders looking to maximize returns wi

#DoubleRewardsWithGUSD

Gate.io is offering an exciting opportunity for traders with its Double Rewards with GUSD campaign. This event allows users to earn double the rewards when trading or holding GUSD, Gate.io’s stablecoin, creating an attractive incentive for both new and experienced participants. The campaign highlights the benefits of leveraging stablecoins for trading rewards while enjoying low volatility and high reliability.

GUSD, as a USD-backed stablecoin, offers stability in volatile markets, making it an ideal asset for traders looking to maximize returns wi

GUSD-0,01%

- Reward

- 9

- 14

- 1

- Share

repanzal :

:

2026 GOGOGO 👊View More

#WarshLeadsFedChairRace

The race to become the next Federal Reserve Chair is intensifying, with Kevin Warsh emerging as the clear front-runner. Warsh, a former Fed governor and economic expert, has overtaken rival candidates in prediction markets and political momentum, positioning himself as the most likely successor to Jerome Powell when his term ends in May 2026. This development has significant implications for U.S. monetary policy, financial markets, and investor expectations.

Warsh’s rise has been fueled largely by recent statements from President Donald Trump, which appear to indirectly

The race to become the next Federal Reserve Chair is intensifying, with Kevin Warsh emerging as the clear front-runner. Warsh, a former Fed governor and economic expert, has overtaken rival candidates in prediction markets and political momentum, positioning himself as the most likely successor to Jerome Powell when his term ends in May 2026. This development has significant implications for U.S. monetary policy, financial markets, and investor expectations.

Warsh’s rise has been fueled largely by recent statements from President Donald Trump, which appear to indirectly

- Reward

- 8

- 9

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#MajorStockIndexesPlunge

Global stock markets are facing sharp declines as major indexes plunge across the U.S., Europe, and Asia. This downturn reflects growing investor concerns over macroeconomic uncertainty, rising interest rates, geopolitical tensions, and disappointing corporate earnings. The combination of these factors has sparked a risk-off sentiment, causing traders and institutions to reduce exposure to equities and seek safer assets such as bonds, gold, or cash.

The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite have all recorded significant losses, with intraday swing

Global stock markets are facing sharp declines as major indexes plunge across the U.S., Europe, and Asia. This downturn reflects growing investor concerns over macroeconomic uncertainty, rising interest rates, geopolitical tensions, and disappointing corporate earnings. The combination of these factors has sparked a risk-off sentiment, causing traders and institutions to reduce exposure to equities and seek safer assets such as bonds, gold, or cash.

The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite have all recorded significant losses, with intraday swing

- Reward

- 8

- 9

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#JapanBondMarketSell‑Off

Japan’s government bond market is experiencing one of the most dramatic sell‑offs in decades, not only reshaping domestic financial conditions but also sending ripples through global markets. For years, Japanese Government Bonds (JGBs) were seen as ultra‑safe and ultra‑low yield instruments, supported by aggressive central bank policies. But recent developments have upended that narrative and exposed vulnerabilities in one of the world’s largest fixed‑income markets.

At the heart of the sell‑off is a sharp rise in yields, particularly on long‑dated securities such as t

Japan’s government bond market is experiencing one of the most dramatic sell‑offs in decades, not only reshaping domestic financial conditions but also sending ripples through global markets. For years, Japanese Government Bonds (JGBs) were seen as ultra‑safe and ultra‑low yield instruments, supported by aggressive central bank policies. But recent developments have upended that narrative and exposed vulnerabilities in one of the world’s largest fixed‑income markets.

At the heart of the sell‑off is a sharp rise in yields, particularly on long‑dated securities such as t

- Reward

- 7

- 9

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#CryptoMarketPullback

The crypto market is currently experiencing a notable pullback, highlighting the volatility and sensitivity of digital assets to both macroeconomic and market-specific events. After a period of strong rallies and bullish momentum, Bitcoin and other major cryptocurrencies have retraced from their recent highs, reflecting a mix of profit-taking, short-term risk-off sentiment, and broader market uncertainty.

Pullbacks are a normal and healthy part of any financial market. In crypto, where price swings tend to be larger than traditional assets, these corrections can appear sh

The crypto market is currently experiencing a notable pullback, highlighting the volatility and sensitivity of digital assets to both macroeconomic and market-specific events. After a period of strong rallies and bullish momentum, Bitcoin and other major cryptocurrencies have retraced from their recent highs, reflecting a mix of profit-taking, short-term risk-off sentiment, and broader market uncertainty.

Pullbacks are a normal and healthy part of any financial market. In crypto, where price swings tend to be larger than traditional assets, these corrections can appear sh

BTC-0,88%

- Reward

- 14

- 15

- 2

- Share

DragonFlyOfficial :

:

🌟 Amazing insight! 🙌 Really loved how you shared this — your perspective is super clear and helpful! 🚀 Keep it up, looking forward to learning more from you! 😊View More

#TariffTensionsHitCryptoMarket

Global markets are once again under pressure as rising tariff tensions send shockwaves across risk assets, and the crypto market is feeling the impact clearly. Renewed trade disputes between major economies have increased uncertainty, pushing investors into a risk off mindset. As a result, volatility has returned to crypto, triggering pullbacks across Bitcoin and major altcoins.

Tariffs are not just political headlines. They directly affect global trade flows, supply chains, inflation expectations, and economic growth. When tariffs rise or new threats emerge, mar

Global markets are once again under pressure as rising tariff tensions send shockwaves across risk assets, and the crypto market is feeling the impact clearly. Renewed trade disputes between major economies have increased uncertainty, pushing investors into a risk off mindset. As a result, volatility has returned to crypto, triggering pullbacks across Bitcoin and major altcoins.

Tariffs are not just political headlines. They directly affect global trade flows, supply chains, inflation expectations, and economic growth. When tariffs rise or new threats emerge, mar

BTC-0,88%

- Reward

- 8

- 10

- Repost

- Share

DragonFlyOfficial :

:

🌟 Amazing insight! 🙌 Really loved how you shared this — your perspective is super clear and helpful! 🚀 Keep it up, looking forward to learning more from you! 😊View More

#GrowthPointsDrawRound16

Growth Points Draw Round 16 is gaining strong attention as users look to maximize engagement rewards through consistent activity and smart participation. This round highlights how loyalty systems and growth based incentives can create long term value for active community members.

Growth Points are designed to reward users who stay active, complete tasks, and contribute regularly. Instead of one time bonuses, this system focuses on sustainable participation. Each round allows users to convert effort into chances for rewards, which builds discipline and long term engagem

Growth Points Draw Round 16 is gaining strong attention as users look to maximize engagement rewards through consistent activity and smart participation. This round highlights how loyalty systems and growth based incentives can create long term value for active community members.

Growth Points are designed to reward users who stay active, complete tasks, and contribute regularly. Instead of one time bonuses, this system focuses on sustainable participation. Each round allows users to convert effort into chances for rewards, which builds discipline and long term engagem

- Reward

- 8

- 10

- Repost

- Share

Johan1963 :

:

Buy To Earn 💎View More

#SpotGoldHitsaNewHigh

Record Spot Gold Levels

• Spot gold has surpassed $4,800 per ounce for the first time in history, climbing to fresh all-time highs in global markets. This surge reflects extremely strong demand as investors seek safety amid uncertainty and market volatility.

• Just a few days earlier, gold had already risen above $4,700–$4,750 per ounce, breaking previous records and showing broad bullish momentum.

📈 What’s Driving the Rally

Safe-Haven Demand Intensifies — Rising geopolitical tensions, including trade conflicts and international political friction, are pushing investo

Record Spot Gold Levels

• Spot gold has surpassed $4,800 per ounce for the first time in history, climbing to fresh all-time highs in global markets. This surge reflects extremely strong demand as investors seek safety amid uncertainty and market volatility.

• Just a few days earlier, gold had already risen above $4,700–$4,750 per ounce, breaking previous records and showing broad bullish momentum.

📈 What’s Driving the Rally

Safe-Haven Demand Intensifies — Rising geopolitical tensions, including trade conflicts and international political friction, are pushing investo

- Reward

- 6

- 8

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎View More

#CLARITYBillDelayed

recent delay of the Digital Asset Market Clarity Act (commonly known as the CLARITY Act or #CLARITYBillDelayed) in the U.S. Senate is more than a temporary setback—it's a pivotal moment that exposes the entrenched resistance to true innovation in digital assets. As of mid-January 2026, the Senate Banking Committee postponed its markup session, originally set for January 15, after major industry pushback, including Coinbase CEO Brian Armstrong publicly withdrawing support. This postponement, with no firm new date and whispers of a shift to late January or beyond, leaves the

recent delay of the Digital Asset Market Clarity Act (commonly known as the CLARITY Act or #CLARITYBillDelayed) in the U.S. Senate is more than a temporary setback—it's a pivotal moment that exposes the entrenched resistance to true innovation in digital assets. As of mid-January 2026, the Senate Banking Committee postponed its markup session, originally set for January 15, after major industry pushback, including Coinbase CEO Brian Armstrong publicly withdrawing support. This postponement, with no firm new date and whispers of a shift to late January or beyond, leaves the

- Reward

- 8

- 5

- 1

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

#GateTradFi1gGoldGiveaway

The crypto market is constantly evolving, and Gate.io is taking trading excitement to the next level with the TradFi Gold Giveaway. Traders now have a unique chance to earn 1 gram of real gold every 10 minutes, simply by participating in TradFi trading. This event is designed not only to reward trading activity but also to make market engagement more fun and rewarding for the Gate community.

TradFi on Gate bridges the gap between traditional financial markets and the fast-moving world of crypto. It allows traders to leverage both conventional strategies and crypto tra

The crypto market is constantly evolving, and Gate.io is taking trading excitement to the next level with the TradFi Gold Giveaway. Traders now have a unique chance to earn 1 gram of real gold every 10 minutes, simply by participating in TradFi trading. This event is designed not only to reward trading activity but also to make market engagement more fun and rewarding for the Gate community.

TradFi on Gate bridges the gap between traditional financial markets and the fast-moving world of crypto. It allows traders to leverage both conventional strategies and crypto tra

- Reward

- 8

- 10

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

Trending Topics

View More61.93K Popularity

39.85K Popularity

24.25K Popularity

68.84K Popularity

347.84K Popularity

Pin